13+ Money Laundering Examples

When criminals illegally obtain money from dubious and illegal origins they cannot use the money to the fullest extent. To ensure their safety and cover their tracks, criminals rely on money laundering operations to obfuscate the origin of their money.

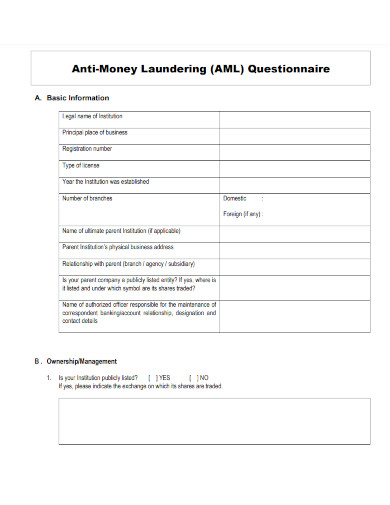

1. Anti-Money Laundering Questionnaire

bankcom.com.ph

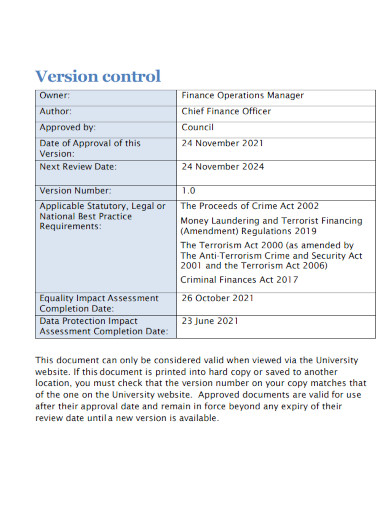

2. Anti Money Laundering Policy

bradford.ac.uk

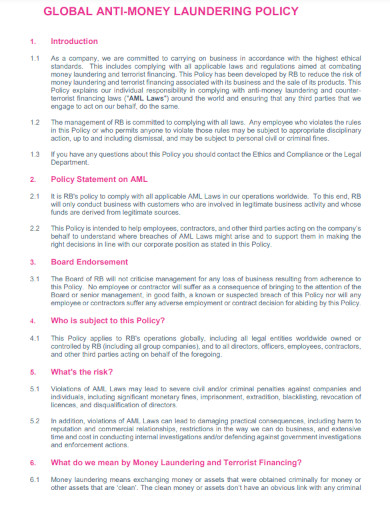

3. Global Anti-Money Laundering Policy

reckitt.com

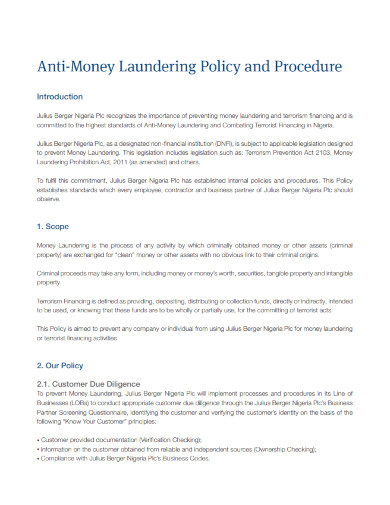

4. Anti-Money Laundering Procedure

julius-berger.com

5. Anti-Money Laundering Protocol

moderngov.merseytravel.gov.uk

6. Annual Anti-money Laundering Report

clc-uk.org

7. Anti-Money Laundering Policy Report

democraticservices.hounslow.gov.uk

8. Anti Money Laundering Form

westminster.gov.uk

9. Financial Crime and Anti-Money Laundering Policy

valeglazing.co.uk

10. Anti-Money Laundering Policy Statement

pennon-group.co.uk

11. Anti-Money Laundering Compliance Manual

assets.website-files.com

12. National Money Laundering Risk Assessment

home.treasury.gov

13. Anti-Terrorism and Anti-Money Laundering Policy

cordaid.org

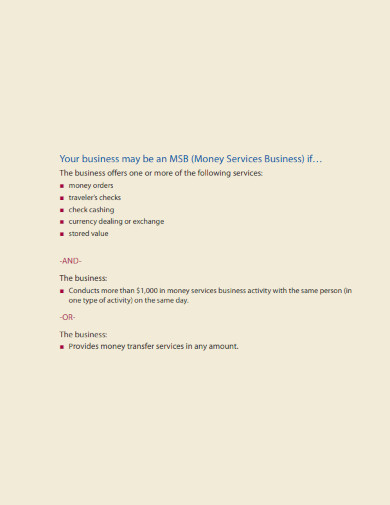

14. Money Laundering Prevention

fincen.gov

What Is Money Laundering

Money laundering is an illegal act that criminals do to convert the illegal origin of their money to a legal origin. Other times, people will use money laundering to avoid tax and illegally obtain tax deductions or tax exemptions.

How To Combat Money Laundering

Money laundering, in the context or theme of crimes, is a very prevalent illegal operation most illegal groups use to convert their money into legal tender. Because of this, money laundering operations reduce the economy of the country, which might impact the overall quality of life of all the people in the country.

Step 1: Improve One’s Communication with Banks

Banks can easily spot any weird or uncanny transactions. This means that one of the best ways to combat money laundering is to have open communication and conversation with banks. Doing this will allow you to be able to avail various services and consultations offered by banks.

Step 2: Learn More About Money Laundering

Money laundering is a criminal act that is very hard to nail down, as it tries its best to obfuscate itself as a legal action. This means that you will need to learn more about the concept of money laundering to help combat money laundering efforts.

Step 3: Learn or Discern Red Flags and the Early Signs of Money Laundering

Most money laundering operations will have an observable pattern of red flags and early signs. This means that you must learn all about the early warning signs and red flags of money laundering and how to discern them in everyday operations.

Step 4: Research the Ways One Can Launder Money

One of the best ways to combat money laundering is through learning the various ways criminal groups or illegal organizations launder money. Doing this will allow you to spot money laundering operations, which can lead to an early report.

FAQs

Why is money laundering dangerous?

People consider Money laundering as a criminal or illegal act, as money laundering is one of the most significant ways for criminals to obtain money from citizens and the presiding government. This will allow those criminals to use the monetary resources obtained from money laundering to invest in improving their illegal operations. Not only that but money laundering will also transfer a lot of the economic power to the criminals and upend the government’s hold on the economic power to fuel the economic growth of the country.

What is the most common way to launder money?

There are many ways for criminals to launder money away from the government and use it to funnel their illegal operations. One of the best ways is to use mules to act as the proxy of the illegal organization or group, mostly when it comes to transactions of products. Another way to launder money is through investing money in private properties and using shell corporations to convert the illegally obtained money to legal tender.

What are the signs of money laundering?

Money laundering is often characterized by a large number of transactions or transfers of money below 10 000 USD in a single day from different individuals. Not only that, but another sign of money laundering is various businesses reporting higher amounts of sales than what can be naturally observed in their day-to-day operations.

Money laundering is an illegal act that refers to the criminal activities of obscuring and converting illegally obtained monetary resources into legal tender. These criminal acts transcend cultures and countries and will include people of various ethnicity, ethnic groups, races, and subcultures. To ensure the safety of one’s community it is important to know and understand how to prevent money laundering efforts and other anti-money laundering laws like the AML act of 2020.