6+ Mortgage Note Examples to Download

A mortgage, also known as mortgage loan or home loan, is a loan intended to purchase a property, usually a house. In a mortgage note templates, the borrower is allowed to lend a certain amount of money from a lending company (e.g. bank) and the property he/she purchases with the money serves as a collateral.

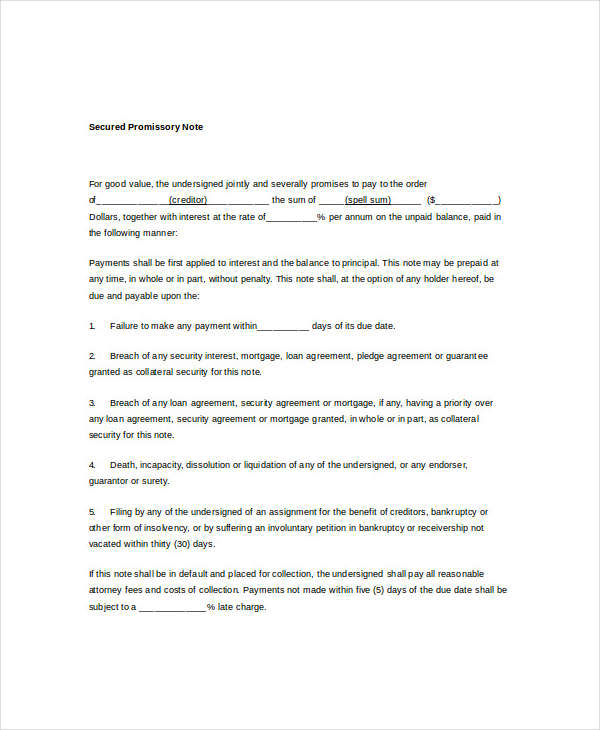

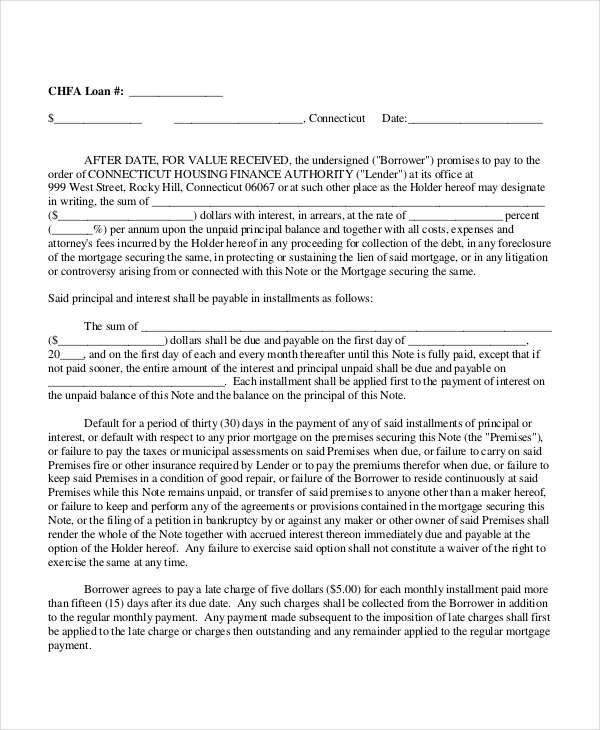

Promissory Mortgage

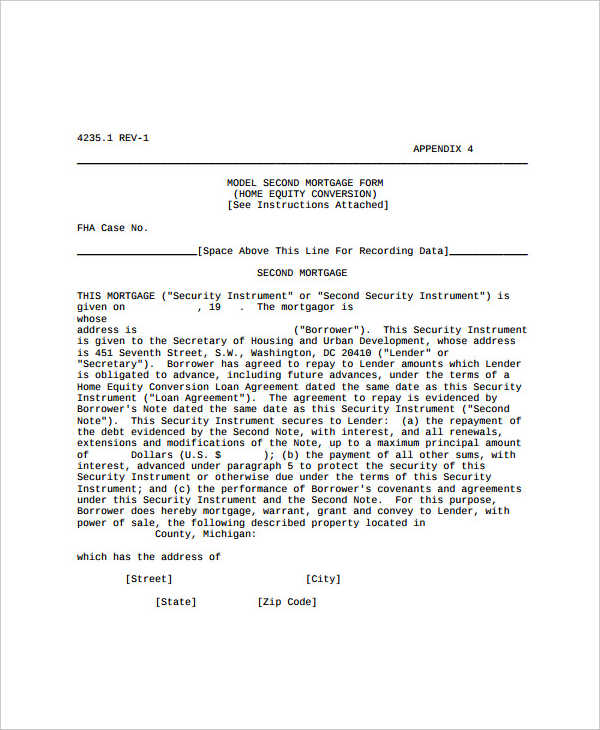

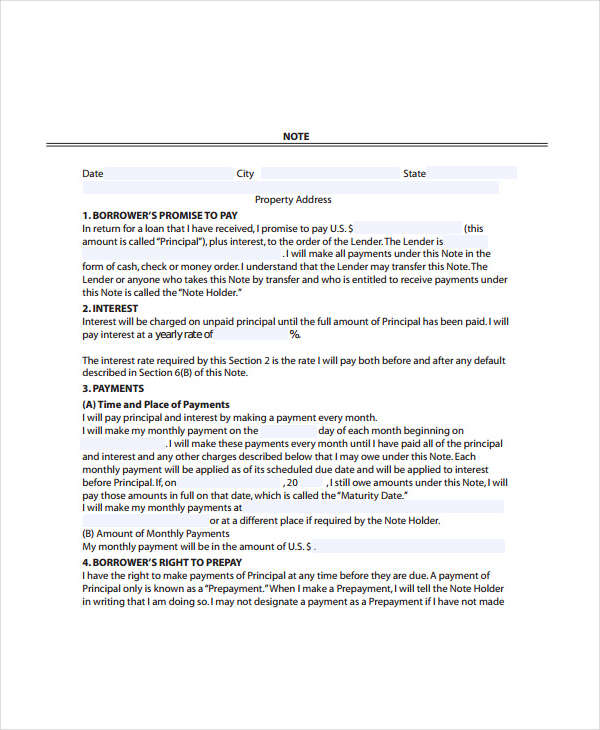

Second Note Example

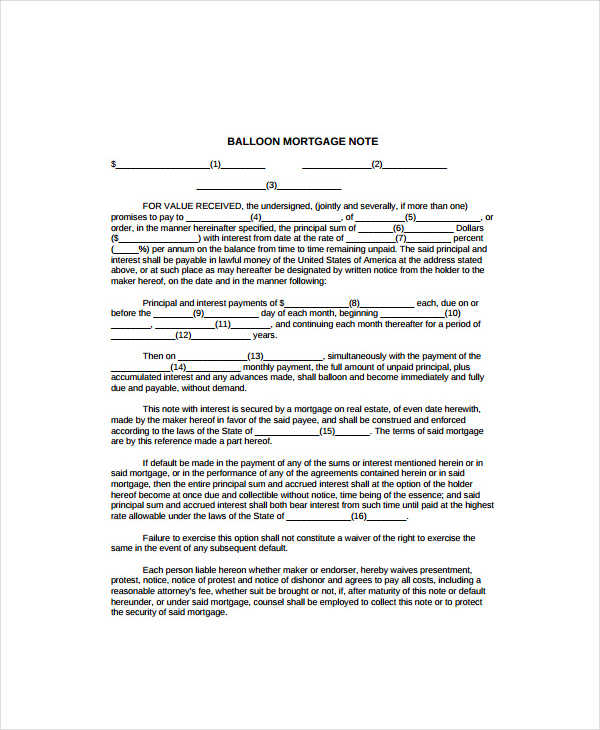

Balloon Mortgage Note

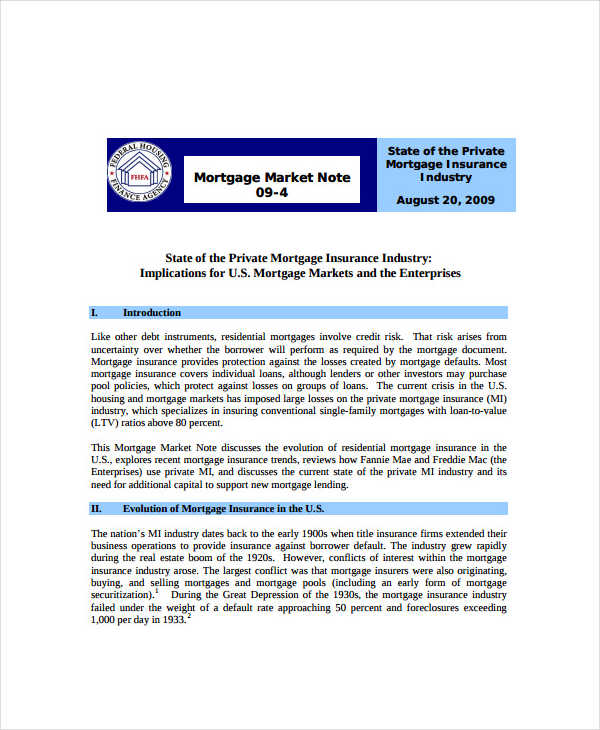

Private Mortgage Sample

Mortgage Loan Note

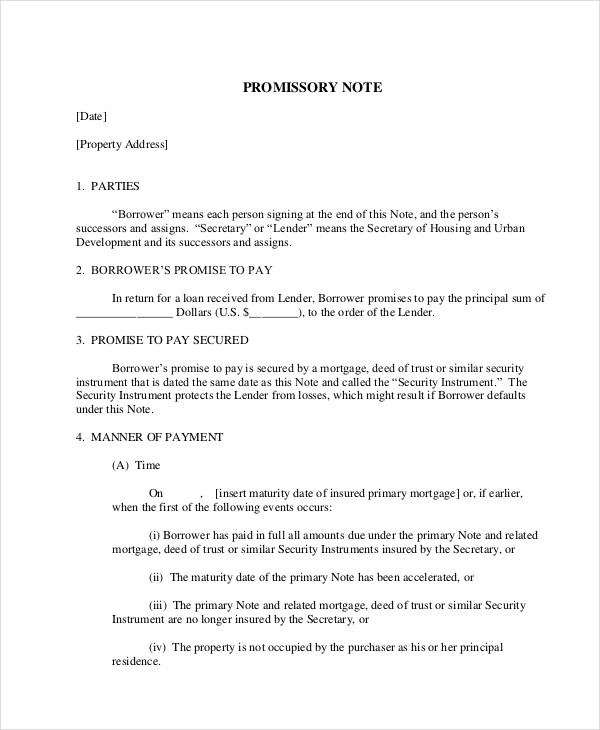

Mortgage Promissory Note

Free Mortgage Note

What Is a Mortgage Note?

In a mortgage note or a mortgage loan note, the borrower is required to pay back the amount during a certain period of time while following a set of terms and conditions found in a non-disclosure and confidentiality. If these conditions are not met by the borrower, or if he/she simply stops paying, the lending company may practice its right to claim the property in foreclosure. In this case, the lender may issue a briefing note to inform the borrower of the foreclosure.

How to Write a Mortgage Note

Writing a mortgage note does not have to be too complicated that the whole point or the idea is lost in context. The important thing to take notice of a mortgage note is the details that surround it. This includes the conditions. Here are steps to writing a mortgage note.

Step 1: State the Mortgage Note as the Headline

Like any other important documents that need to be taken into consideration, it is always best to add the title or the name of the document as the headline or at the top of the page. To make sure that anyone who may be reading the document will know what the contents are or would understand the contents. This is also to help identify who the parties that are involved in the mortgage loan.

Step 2: Specify the Loan Amount and Terms and Conditions

Just like making a non-disclosure agreement, in a mortgage note, you must also add in the loan amount as well the terms and conditions on the note. Information as important as loan payments, dates, number of payments and the due dates must be specified and should be as clear and concise as possible.

Step 3: Add the Collateral for the Loan

For any kind of mortgage deal, there must also be collateral to secure that the loan will be paid by those who are loaning. Adding some kind of collateral for the loan helps in maintaining a certain security or a promise that the people who are under the loan agreement will pay or may use what is being written as collateral as a form of payment.

Step 4: Close the Note with Signature Blocks for All Participants

Close the note with a signature block for all participants of the mortgage note. This will certify that the note is legal, has been signed and will take effect on the date it is signed. As well as the fact that it meets all the legal requirements for the mortgage to take into effect.

FAQs

What is the difference between a mortgage note and a promissory note

The terms mortgage notes and release notes are often used interchangeably, and sometimes used to mean the same thing. Mortgage notes and promissory notes, however, differ from each other, though not entirely. Both documents are, in most cases, issued upon processing a loan intended to purchase a new property or house.

What is the importance of a mortgage note?

A mortgage note in pdf serves to authorize the lending company of claiming the property being used as a collateral in the instance that the borrower fails to meet the set conditions, or fails to repay the loan during the set time frame. When this happens, the lending company may accelerate the debt which usually means the lender adjusts the due date at a sooner date or demands the borrower to pay the amount in full at a set date. The lender may also seize the property and sell it, considering the earnings as payment for the rest of the debt.

Why do you need a collateral for a mortgage loan note

The reason why you would need collateral when dealing with mortgage loans is because collateral helps borrowers take loans with lower interest rates and which also makes the loan less risky than without any collateral.

In a mortgage loan note, the borrower is required to pay back the amount during a certain period of time while following a set of conditions. If these conditions are not met by the borrower, or if he/she simply stops paying, the lending company may practice its right to claim the property in foreclosure. In this case, the lender may issue a briefing note to inform the borrower of the foreclosure.