25+ Non Current Assets Examples

Non-current assets, also known as long-term assets, are resources a company holds for more than a year and uses in its operations to generate revenue. These include property, plant, equipment, and intangible assets like patents. In contrast, current assets are short-term resources expected to be converted into cash or used up within a year, such as inventory and accounts receivable. Both types of assets, along with liabilities and Inventory Assets (debts and obligations), are critical components of a company’s balance sheet, which provides a snapshot of its financial health at a given point in time.

What are Non Current Assets?

Non-current assets are long-term resources that a company uses in its operations and expects to hold for more than a year, such as property, equipment, and patents. Unlike liquid assets, which are easily converted to cash, non-current assets are part of a company’s broader asset allocation strategy to support long-term growth and stability.

Formula:

How to calculate Non-current assets

To calculate non-current assets, sum up all the long-term assets a company holds. Here’s a step-by-step guide:

- Property, Plant, and Equipment (PPE): Add the value of land, buildings, machinery, and equipment.

- Intangible Assets: Include patents, trademarks, copyrights, and goodwill.

- Long-term Investments: Sum up investments in stocks, bonds, or other securities intended to be held for more than a year.

- Other Long-term Assets: Include items like deferred tax assets, long-term receivables, and any other non-current assets not classified above.

Example Calculation:

Suppose a company has the following items:

- Property, Plant, and Equipment: $200,000

- Intangible Assets: $50,000

- Long-term Investments: $100,000

- Other Long-term Assets: $25,000

Calculation:

Non-Current Assets=200,000+50,000+100,000+25,000 = 375,000

The company’s total non-current assets would be $375,000.

Examples of Noncurrent Assets

- Property: Real estate owned by the company, including land and buildings used for operations or investment.

- Plant: Factories and production facilities where goods are manufactured.

- Equipment: Machinery and tools used in the production process or for providing services.

- Vehicles: Company-owned cars, trucks, and other transportation used for business purposes.

- Furniture: Desks, chairs, and other office furnishings.

- Fixtures: Permanent installations such as lighting and plumbing.

- Computers: Hardware used for business operations.

- Software: Purchased software programs used for business processes.

- Patents: Exclusive rights granted for inventions, allowing the company to produce or sell a product.

- Trademarks: Registered signs, designs, or expressions identifying products or services.

- Copyrights: Legal rights to creative works such as literature, music, and art.

- Franchise Agreements: Rights acquired to operate under a franchisor’s business model and brand.

- Goodwill: Intangible asset arising from the acquisition of one company by another, representing the value of the acquired company’s reputation and customer relationships.

- Long-term Investments: Investments in stocks, bonds, or other securities intended to be held for more than a year.

- Land Improvements: Enhancements to land such as landscaping, fencing, and parking lots.

- Leasehold Improvements: Alterations made to leased property to meet the needs of the business.

- Mineral Rights: Rights to extract minerals from the land.

- Timberland: Land used for growing and harvesting timber.

- Oil and Gas Reserves: Rights to extract oil and gas.

- Art Collections: Valuable works of art owned by the company for display or investment.

- Licenses: Permits acquired to conduct certain types of business or use certain technologies.

- Development Costs: Costs associated with developing new products or services.

- Biological Assets: Livestock or crops that are used in agricultural production.

- Shipping Containers: Containers used for transporting goods over long distances.

- Infrastructure: Long-term physical structures such as bridges, roads, and utilities that support the company’s operations.

Types of Noncurrent Assets

Tangible Assets: Property (land and buildings), plant (factories), equipment (machinery and tools), vehicles (cars and trucks), furniture and fixtures (office furnishings and installations), computers and hardware (IT assets).

Intangible Assets: Patents (legal rights for inventions), trademarks (registered signs/designs), copyrights (rights to creative works), franchise agreements (rights to operate under a franchisor’s model), goodwill (intangible asset from acquisitions), licenses (permits for business activities or technology use).

Financial Assets: Long-term investments (stocks, bonds, securities held for over a year), securities (financial instruments intended for long-term holding).

Natural Resources: Mineral rights (rights to extract minerals), timberland (land for growing/harvesting timber), oil and gas reserves (rights to extract oil and gas).

Development and Capital Projects: Construction in progress (costs of new buildings/facilities), development costs (expenses for new products/services).

Agricultural Assets: Biological assets (livestock or crops used in agricultural production).

Specialized Assets: Art collections (valuable art for display/investment), infrastructure (long-term structures like bridges, roads, utilities).

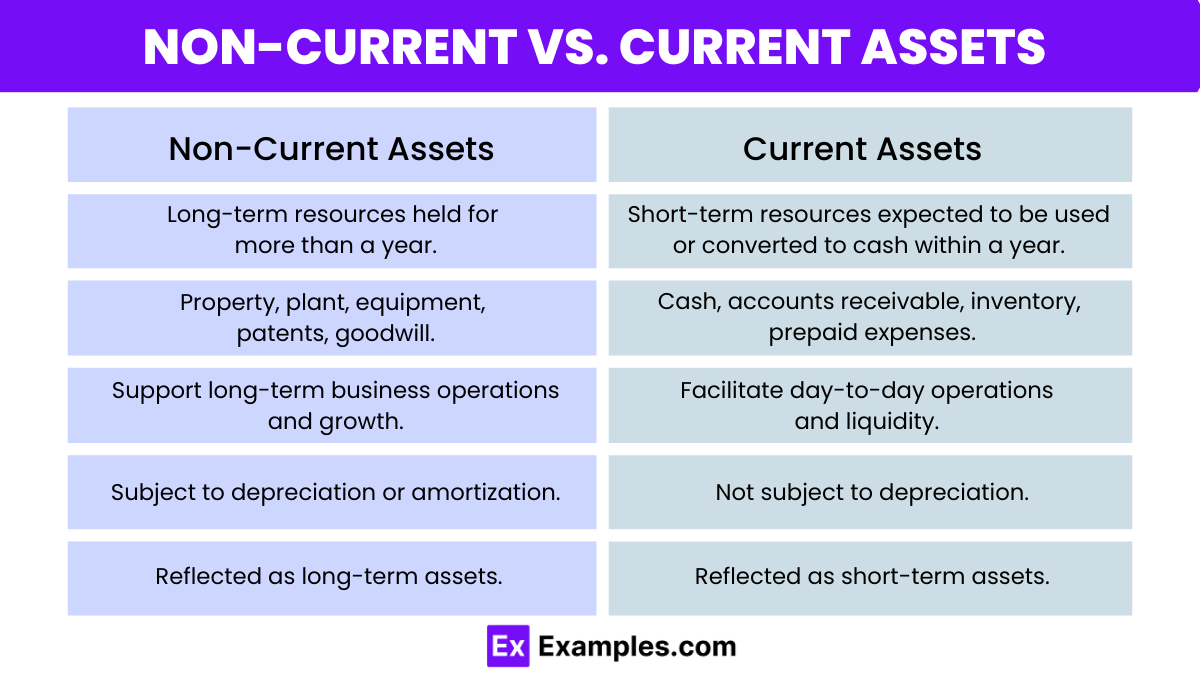

Non-Current vs. Current Assets

| Aspect | Non-Current Assets | Current Assets |

|---|---|---|

| Definition | Long-term resources held for more than a year | Short-term resources expected to be used or converted to cash within a year |

| Examples | Property, plant, equipment, patents, goodwill | Cash, accounts receivable, inventory, prepaid expenses |

| Purpose | Support long-term business operations and growth | Facilitate day-to-day operations and liquidity |

| Liquidity | Low (not easily converted to cash) | High (easily convertible to cash) |

| Depreciation/Amortization | Subject to depreciation or amortization | Not subject to depreciation |

| Balance Sheet Impact | Reflected as long-term assets | Reflected as short-term assets |

What are non-current assets?

Non-current assets are long-term resources held for over a year, including property, equipment, and intangible assets.

How do non-current assets differ from current assets?

Non-current assets are held long-term, while current assets are expected to be converted to cash within a year.

What are examples of non-current assets?

Examples include property, plant, equipment, patents, and goodwill.

Why are non-current assets important?

They support long-term business operations and growth, providing stability and potential revenue.

Can non-current assets be liquidated?

Yes, but typically non-current assets are less liquid compared to current assets.

How are non-current assets recorded on the balance sheet?

They are listed under long-term assets on the balance sheet.

Do non-current assets depreciate?

Yes, tangible non-current assets like equipment and buildings depreciate over time.

What is amortization of non-current assets?

Amortization refers to the gradual expensing of intangible non-current assets like patents.

How do non-current assets impact financial health?

They indicate long-term investment and stability, crucial for sustaining business operations.

Can non-current assets include investments?

Yes, long-term investments in stocks or bonds are considered non-current assets.