65+ Non Profit Organization Examples to Download

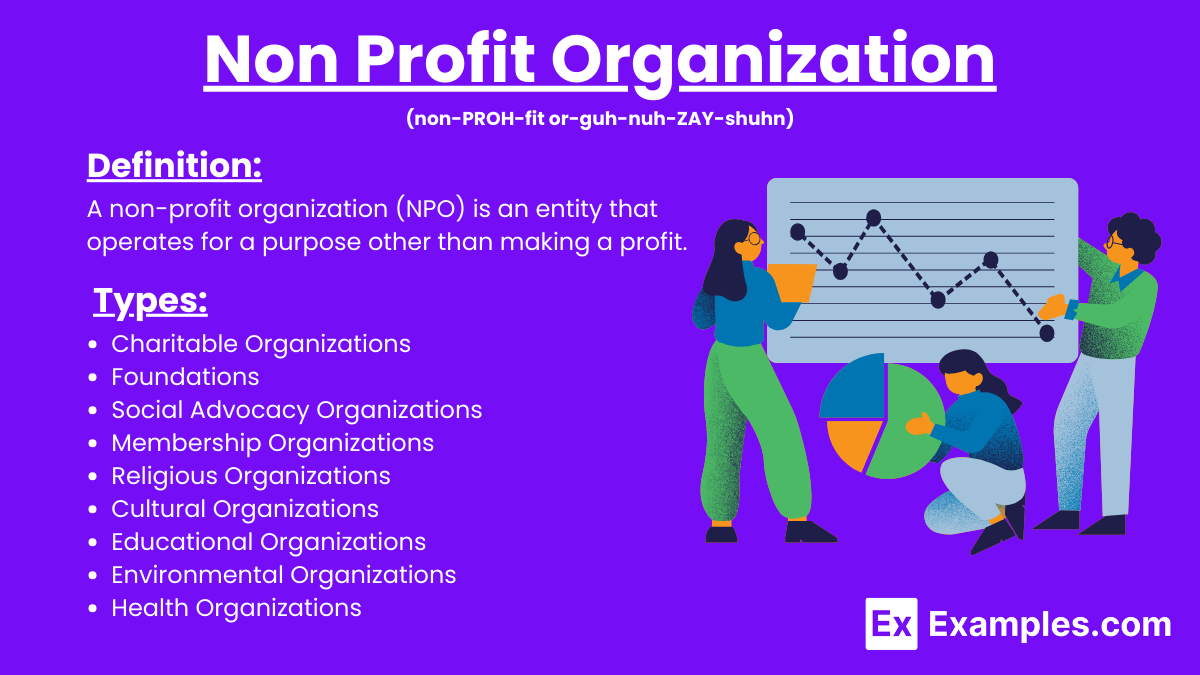

A non-profit organization (NPO) is an entity that operates for a purpose other than making a profit. Its primary goal is to serve the public interest or a specific community need, such as education, health, social services, or the arts. Any surplus revenues generated by the organization are reinvested into the organization to further its mission, rather than being distributed to shareholders or owners. When starting or funding a non-profit, creating a non-profit proposal is essential to outline the goals, strategies, and needs of the organization. A well-crafted non-profit cover letter accompanies the proposal, introducing the organization and its mission. Developing a comprehensive nonprofit business plan is crucial for detailing the operational, financial, and strategic aspects of the organization. Finally, a clear and inspiring non-profit mission statement communicates the core purpose and values of the organization to stakeholders and supporters.

What is Non Profit Organization?

Examples of Non Profit Organization

- Private foundation

- Otis Library

- Mitchell College

- Wikimedia Foundation

- Samaritan’s Purse

- Americares

- MAP International

- Compassion International

- Charity Navigator

- Council for Advancement

- Project On Government

- Independent Sector

- Crow Canyon Archaeological

- Endicott College

- Wildlands Restoration Volunteers

- Greater Chicago Food Depository

- Public Library of New London

- Mystic Seaport Museum

- National University

- Niantic Children’s Museum

- World Vision International

- Feeding America

- Feed The Children Inc

- US Fund for UNICEF

- University of Notre Dame

- BoardSource

- Candid

- New England Board of Higher Education

- Ronald McDonald House Charities

- Collings Foundation

- Children’s Hunger Fund

- AIDS Resource Foundation for Children

- The Garde Arts Center, Inc.

- Connecticut College

- Better Business Bureau

- Direct Relief

- Lutheran Services in America

- Step Up For Students

- YMCA

- Catholic Charities USA

- Habitat for Humanity

- Philanthropy Roundtable

- Action Without Borders

- Idealist

- VolunteerMatch

- Operation HOPE, Inc.

- Goodwill Industries

- The Chicago Mosaic School

- Tenafly Nature Center

- Red Cross

- Habitat for Humanity

- Doctors Without Borders

- World Wildlife Fund

- Feeding America

- Save the Children

- UNICEF

- Oxfam

- Goodwill Industries

- The Salvation Army

- Amnesty International

- Environmental Defense Fund

- Boys & Girls Clubs of America

- United Way

- St. Jude Children’s Research Hospital

Types of Non Profit Organization

1. Charitable Organizations

- Description: Focus on activities that benefit the public, such as relief of poverty, education, health care, and community development.

- Examples: Red Cross, Salvation Army, UNICEF.

2. Foundations

- Description: Provide funding and support to other non-profit organizations, individuals, or causes. They often have a large endowment.

- Examples: Bill & Melinda Gates Foundation, Ford Foundation.

3. Social Advocacy Organizations

- Description: Work to influence public policy and promote social change in areas such as human rights, environmental protection, and political reform.

- Examples: Amnesty International, Greenpeace, ACLU.

4. Membership Organizations

- Description: Serve the needs of their members, often providing services, networking opportunities, and advocacy.

- Examples: Professional associations, trade unions, chambers of commerce.

5. Religious Organizations

- Description: Focus on spiritual development, religious education, and community service based on their faith principles.

- Examples: Churches, synagogues, mosques, religious charities.

6. Cultural Organizations

- Description: Promote the arts, culture, and heritage through activities like museums, theaters, and cultural festivals.

- Examples: Museums, orchestras, cultural festivals.

7. Educational Organizations

- Description: Provide educational services, support, and scholarships. They range from schools and colleges to educational support groups.

- Examples: Private schools, universities, literacy programs.

8. Environmental Organizations

- Description: Focus on the protection and preservation of the environment through conservation efforts, advocacy, and education.

- Examples: World Wildlife Fund, Sierra Club, The Nature Conservancy.

9. Health Organizations

- Description: Provide health services, conduct medical research, and promote public health initiatives.

- Examples: American Cancer Society, Mayo Clinic, Médecins Sans Frontières (Doctors Without Borders).

10. Human Services Organizations

- Description: Offer social services to improve the well-being of individuals and communities, such as food banks, shelters, and family services.

- Examples: Habitat for Humanity, Feeding America, United Way.

11. International NGOs

- Description: Operate on a global scale to address issues such as poverty, disease, and disaster relief.

- Examples: CARE, Oxfam, World Vision.

Non Profit Organization Registration

Steps to Register a Non-Profit Organization

1. Define the Mission and Vision

- Description: Clearly articulate the mission and vision of your non-profit organization, including its purpose, goals, and target audience.

- Importance: Provides direction and helps in communicating the organization’s objectives to stakeholders.

2. Choose a Legal Structure

- Description: Decide on the legal structure of your non-profit, such as a corporation, trust, or association.

- Importance: Determines the legal framework and requirements for your organization.

3. Select a Name

- Description: Choose a unique and meaningful name for your non-profit.

- Importance: The name must be distinguishable from other registered entities and comply with state naming requirements.

4. Appoint a Board of Directors

- Description: Recruit a group of individuals to serve as the board of directors.

- Importance: The board is responsible for governance and strategic direction.

5. Draft Bylaws

- Description: Create bylaws that outline the rules and procedures for operating your non-profit.

- Importance: Bylaws provide a governance framework and help prevent and resolve internal disputes.

6. Incorporate Your Non-Profit

- Description: File articles of incorporation with the appropriate state agency, typically the Secretary of State.

- Requirements:

- Name of the organization

- Purpose of the organization

- Names and addresses of incorporators

- Information about the board of directors

- Importance: Incorporation provides legal recognition and limited liability protection.

7. Obtain an Employer Identification Number (EIN)

- Description: Apply for an EIN from the Internal Revenue Service (IRS).

- Importance: An EIN is required for tax filings, opening bank accounts, and hiring employees.

8. Apply for Tax-Exempt Status

- Description: Submit Form 1023 (or Form 1023-EZ for smaller organizations) to the IRS to apply for 501(c)(3) tax-exempt status.

- Importance: Tax-exempt status allows the organization to be exempt from federal income tax and makes donations tax-deductible for donors.

9. Register with State and Local Authorities

- Description: Comply with state and local registration requirements, which may include charitable solicitation registration.

- Importance: Ensures compliance with state and local laws, allowing the organization to solicit donations and operate legally.

10. Create Operating Procedures and Policies

- Description: Develop policies and procedures for day-to-day operations, including financial management, fundraising, and conflict of interest policies.

- Importance: Provides a clear framework for managing the organization effectively and ethically.

11. Open a Bank Account

- Description: Open a bank account in the name of the non-profit organization.

- Importance: Separates personal and organizational finances, essential for financial transparency and accountability.

12. Fundraising and Grant Applications

- Description: Develop a fundraising plan and start applying for grants.

- Importance: Secures the necessary funding to support the organization’s activities and programs.

13. Maintain Compliance

- Description: Ensure ongoing compliance with federal, state, and local regulations, including annual filings, tax returns, and renewals.

- Importance: Maintains the organization’s good standing and tax-exempt status.

Tax Issues for Nonprofits

- Tax-Exempt Status: Maintaining compliance with 501(c)(3) regulations.

- Unrelated Business Income Tax (UBIT): Properly identifying and reporting unrelated income.

- Employment Taxes: Correct classification and reporting of payroll taxes.

- Donor Contributions: Providing proper documentation for tax-deductible donations.

- State and Local Taxes: Navigating varying state and local tax laws.

- Lobbying and Political Activities: Adhering to limits on lobbying and avoiding political campaign activities.

- Reporting and Disclosure Requirements: Accurate filing of annual returns and maintaining transparency.

- Private Benefit and Inurement: Avoiding transactions that benefit insiders.

- Fundraising Activities: Complying with regulations for fundraising events and campaigns.

- Foreign Activities and Grants: Ensuring compliance with tax rules for international operations.

Importance of Non Profit Organization

Addressing Social Issues

Non-profits tackle a wide range of social issues, including poverty, education, health, and inequality.

Providing Public Services

They offer essential services such as healthcare, education, and disaster relief that may not be adequately provided by the government or private sector.

Advocacy and Awareness

Non-profits raise awareness about critical issues and advocate for policy changes to improve societal conditions.

Supporting Communities

They strengthen communities by providing support and resources to those in need, fostering community development and cohesion.

Promoting Volunteerism

Non-profits encourage volunteerism, allowing individuals to contribute their time and skills to meaningful causes.

Innovation and Problem-Solving

They often lead in innovative approaches to solving complex social problems, developing new models and strategies for addressing issues.

Cultural and Artistic Enrichment

Many non-profits preserve cultural heritage, promote the arts, and provide opportunities for cultural expression and education.

Economic Contributions

Non-profits contribute to the economy by creating jobs, stimulating local economies, and attracting funding and grants.

Environmental Protection

Environmental non-profits work to conserve natural resources, protect wildlife, and promote sustainable practices.

Enhancing Quality of Life

By addressing various needs and challenges, non-profits play a crucial role in improving the overall quality of life for individuals and communities.

Providing Research and Education

Many non-profits conduct research and offer educational programs that inform the public and drive progress in various fields.

Fostering Global Cooperation

International non-profits work across borders to address global issues, promoting peace, development, and humanitarian aid.

Advantages and Disadvantages of Non Profit Organization

| Advantages | Disadvantages |

|---|---|

| Public Trust and Support | Funding Instability |

| Non-profits often gain public trust and support due to their mission-driven focus and contributions to the community. | Reliance on donations, grants, and fundraising can lead to unpredictable and unstable funding. |

| Tax Exemptions | Regulatory Compliance |

| Eligible for tax exemptions on income, property, and sales, which allows more resources to be directed towards their mission. | Must adhere to complex regulations and compliance requirements to maintain tax-exempt status. |

| Volunteer Contributions | Resource Limitations |

| Attract volunteers who contribute their time and skills, reducing operational costs. | Limited financial resources can constrain operations and growth. |

| Social Impact | Operational Constraints |

| Create significant positive social impact by addressing critical societal needs and promoting social change. | May face bureaucratic hurdles and slower decision-making processes compared to for-profit businesses. |

| Grant Opportunities | Competition for Funds |

| Access to grants from government and private foundations, which are not available to for-profit businesses. | High competition for limited funding sources can make securing grants challenging. |

| Community Engagement | Limited Salaries |

| Foster community engagement and build strong community relationships through their work. | Often unable to offer competitive salaries, which can impact the ability to attract and retain skilled staff. |

| Donor and Member Benefits | Sustainability Challenges |

| Offer tax deductions to donors, encouraging philanthropy and increased donations. | Ongoing challenge of ensuring long-term sustainability and adapting to changing funding landscapes. |

| Focus on Mission Over Profit | Dependence on External Support |

| Prioritize social, cultural, or environmental missions over generating profit, aligning with values-driven goals. | Heavy dependence on external support can limit autonomy and influence decision-making. |

Uses of Non Profit Organization

- Social Welfare and Support: Non-profit organizations provide essential services to vulnerable and marginalized populations. They offer support such as food, shelter, healthcare, and counseling to those in need, addressing issues like poverty, homelessness, and mental health.

- Education and Literacy: NPOs play a significant role in improving education and literacy rates. They run schools, literacy programs, and educational workshops, providing resources and opportunities for underprivileged children and adults to gain knowledge and skills.

- Healthcare Services: Many non-profits focus on healthcare, providing medical services, health education, and preventive care. They operate clinics, hospitals, and mobile health units, often in underserved areas, improving access to essential healthcare services.

- Environmental Conservation: Environmental non-profits work to protect natural resources and promote sustainability. They engage in activities such as wildlife conservation, reforestation, pollution control, and advocacy for policies that address climate change and environmental degradation.

- Cultural Preservation: NPOs dedicated to culture and the arts help preserve cultural heritage, support artists, and promote artistic expression. They run museums, galleries, theaters, and cultural festivals, enriching communities and fostering cultural appreciation.

- Advocacy and Human Rights: Advocacy non-profits work to protect and promote human rights, social justice, and equality. They engage in lobbying, public education, and legal actions to address issues such as discrimination, civil liberties, and worker rights.

- Community Development: Non-profits contribute to community development by implementing programs that enhance local infrastructure, economic opportunities, and social cohesion. They work on projects like affordable housing, community centers, and small business support.

- Disaster Relief and Emergency Response: NPOs are often on the front lines during disasters, providing immediate relief and long-term recovery assistance. They offer emergency shelter, food, medical care, and support rebuilding efforts in communities affected by natural or man-made disasters.

How do non-profits generate revenue?

Non-profits generate revenue through donations, grants, memberships, fundraising events, and services.

What is the difference between a non-profit and a for-profit organization?

Non-profits focus on social, educational, or charitable missions, while for-profits aim to generate profit for owners and shareholders.

How can I start a non-profit organization?

To start a non-profit, draft a mission statement, create a board of directors, incorporate, and apply for tax-exempt status.

What are the benefits of having non-profit status?

Non-profit status offers tax exemptions, eligibility for grants, and increased credibility with donors and the public.

Can non-profits make a profit?

Non-profits can generate a surplus, but they must reinvest it into the organization’s mission rather than distributing it to members.

How are non-profits governed?

Non-profits are governed by a board of directors responsible for oversight, strategic planning, and ensuring the organization adheres to its mission.

What is a 501(c)(3) organization?

A 501(c)(3) organization is a tax-exempt non-profit in the U.S. that operates for charitable, educational, religious, or scientific purposes.

How do non-profits maintain tax-exempt status?

Non-profits maintain tax-exempt status by adhering to regulations, including filing annual returns and operating within their mission’s scope.

Can non-profits lobby or engage in political activities?

Non-profits can engage in limited lobbying but cannot participate in partisan political activities or endorse candidates.

What is the role of volunteers in non-profits?

Volunteers provide essential services, support operations, and help non-profits achieve their missions without financial compensation.