10+ Nonprofit Financial Report Examples to Download

Business always deals with money. But have you asked if nonprofit organizations do the same? If ever you are wondering, yes they do. They are entitled to seek assistance through donations and fundraising. Because of this, they handle their revenue just like any other businesses. All of these will be given out to selected beneficiaries. As money is substantial in any organization, handling finances is also part of the process. Nonprofit revenues are prepared through different methods. And if you are struggling to manage your net assets, consider developing a financial report. But before we define the procedure, let us look at the following samples that you can refer to.

10+ Nonprofit Financial Report Examples in PDF | MS Word

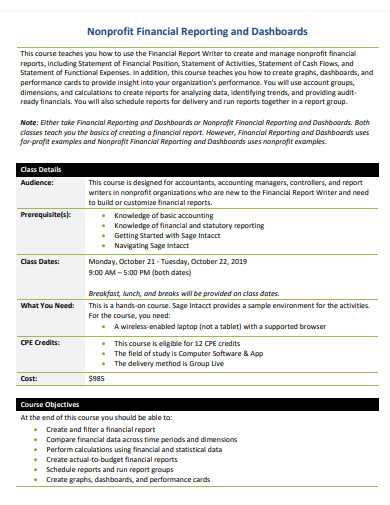

1. Nonprofit Financial Report

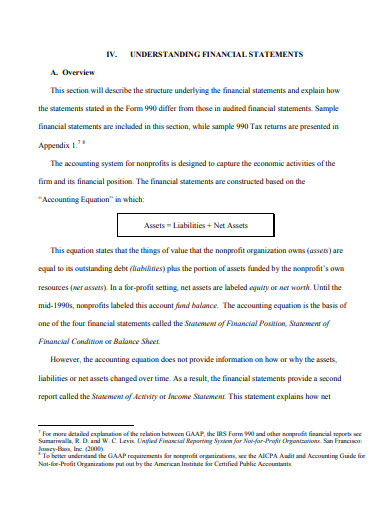

2. Sample Nonprofit Financial Report

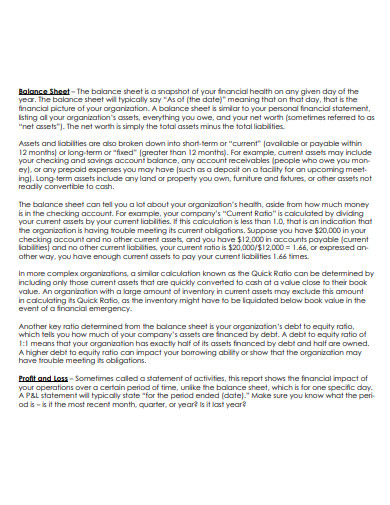

3. Nonprofit Financial Statement and Report

4. Nonprofit Audit Financial Report

5. Financial Reporting of Small Nonprofit Organizations

6. Accountable Report for Nonprofit Organizations

7. Nonprofit Financial Report Example

8. Basic Nonprofit Financial Report

9. Charity Nonprofit Financial Report

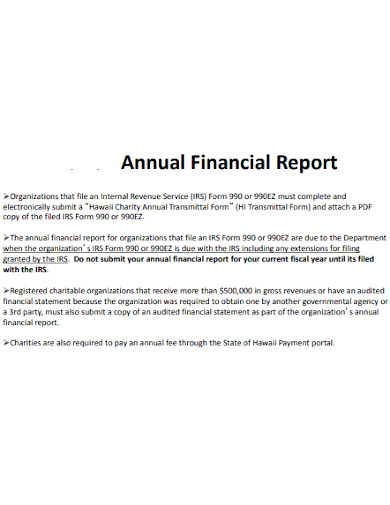

10. Charity Annual Financial Report

11. Printable Charity Financial Report

What is a Nonprofit Financial Report?

A non-profit financial report is a document that contains a summary of the operating expense, budget comparison, and functional expense that is prepared by a nonprofit organization. These organizations get their funding from donations and programs. With an enormous amount of money, a financial report would be a reliable material to secure the money that comes in and out of the organization. In general, this records the activities that rotate around. All the finances are well-kept, allowing the team to maintain transparency.

Importance of Transparency

According to the Insurance Information Institute, 25% out of the 3 million recorded issues were related to money theft. At this point, you probably wish this would not trigger far from what you think. In business, no one wants to experience money loss. So, to secure transparency and avoid breaches, it is essential to prepare a record that you can keep. Indeed, securing documents will enable you to track all the files from the past that may affect future transactions. Commercial companies and other organizations must consider the growth of awareness during this alarming period.

How To Make a Nonprofit Financial Report

Money is a crucial factor to discuss. But since you are in a nonprofit organization, money is more than that. Through donors and programs, you create a visual on how much money you will get. However, it needs to be recorded. Since financial reports can get all over the place, we list down the steps on how you can accurately go about it. Now, let’s get this process started.

1. Document all the Funds

For every nonprofit organization that is starting a new program, planning is the first procedure. Part of that is to secure that all the requirements are met. Here, you will keep the essential elements secure. Include the project schedules, financial statements, contributors, and of course, the funds. The budget speaks solely about what you should expect. Prepare all of this information to manage your report responsibly. If you are creating an annual report, prepare an outline on how much cash or check that the organization receives every month.

2. Construct the Financial Report

It is essential for reports to be clear and easy to understand. In this step, you will start constructing a table where you can separately fill out all the elements. Section each by putting proper column titles. For example, in one column, you can label it “labor funds”. In this area, you will simply list down the labor fees, wages, or year end salaries. Add as much section you need to. In this way, there will be a more precise classification of where the money goes. Aside from that, this will create transparency.

3. Add the Bigger Items

Since you have a structure of your table and title headings, it is now time to complete the list of all the items involved with the expenses alongside. For every non-profit organization, accuracy when adding the amount is essential. You can add them by category or priority. For example, you are calculating the depreciation. You can use accounting software that will help you quickly determine the depreciation. Now, input it in your report. You need to get the resources that you can to ease the process.

4. Do the Math

Finish it up by doing the necessary calculations to have an analysis report. Here, you will add all the expenses. Then, subtract it with the revenue. To avoid misunderstandings, you can change the colors of the primary numbers. Use red, blue, green or any highlights that will differentiate various elements.

5. Keep It Neat and Simple

Just like business reports, nonprofit financial statements must comply with professional standards. Here, you need to observe simplicity. Avoid adding visuals, such as images. But you are not limited to adding charts and diagrams. Other than that, your document must be neat at all times. Considering these aspects guarantees trust from your members.

FAQs

What are the components of a nonprofit annual report?

An annual report for nonprofit includes different components. Thin consists of the testimonials and honest feedback of accomplishments, a successful outcome, funds, budget, and acknowledgements of donors. All of these are necessary to complete a nonprofit annual report.

What are the primary parts of a yearly report?

Yearly reports include the introduction, income statement, balance sheet, cash flows, and conclusions. All of these secures the completion of your analysis. A missing section could be subject to a discrepancy. That is why all of these must be included in your document.

Why is an annual report necessary?

For many reasons, an annual report document is a credible material where companies collect information. An annual report is necessary because it opens various opportunities, such as alterations and adjustments within the work setting and performance. As this includes the mission statements, accomplishments, and budget, the organization is reminded of the purpose and the objectives that should be achieved.

Finances are always a daunting factor. As you calculate any loss, don’t forget to keep a record of accomplishments. That is why we provided a list of tips on how you can start making your nonprofit financial analysis. Now, create a bigger picture to change and rest by calculating your finances. Don’t forget to focus your investments into noteworthy factors. While you seek assistance from companies and other businesses, it is always important to keep a record for tracking. So, don’t wait any longer. Outline your finances accurately today.