18+ Oligopoly Examples to Download

Oligopoly is a market structure characterized by a small number of large firms dominating the industry, unlike perfect competition where many firms exist. These firms have significant market power, influencing prices and output levels. They often engage in strategic decision-making, considering the actions of their competitors. Barriers to entry are high, making it difficult for new firms to enter the market. Oligopolistic industries include automotive, telecommunications, and airline sectors, where a few key players control the majority of the market share.

What Is an Oligopoly?

An oligopoly is a market structure characterized by a few large firms that dominate the industry, influencing prices and market outcomes. These firms have significant market power and engage in strategic decision-making, considering competitors’ actions, with high barriers to entry for new firms.

Oligopoly Examples

- Automotive Industry: Dominated by major players like Toyota, Ford, and Volkswagen, with high barriers to entry and significant market power.

- Telecommunications: Companies like AT&T, Verizon, and T-Mobile control the market, offering similar services with limited competition and high entry costs.

- Airlines: Major airlines such as American, Delta, and United Airlines dominate, with significant control over pricing and limited new entrants.

- Energy Sector: Firms like ExxonMobil, BP, and Chevron have substantial influence over oil prices and production levels, restricting market entry.

- Soft Drinks: Coca-Cola and PepsiCo lead the industry, with significant brand loyalty and marketing power, limiting competition from new entrants.

- Supermarkets: Chains like Walmart, Kroger, and Costco dominate, using economies of scale and extensive distribution networks to control the market.

- Pharmaceuticals: Companies such as Pfizer, Johnson & Johnson, and Merck control drug pricing and innovation, with high research and development costs.

- Media and Entertainment: Firms like Disney, Warner Bros, and Comcast dominate, controlling content creation and distribution, with high entry barriers.

- Technology: Giants like Apple, Microsoft, and Google lead, with substantial market influence and continuous innovation, creating high entry costs.

- Banking: Major banks like JPMorgan Chase, Bank of America, and Wells Fargo dominate, controlling significant market shares and financial services.

- Mobile Phone Service Providers: Companies like AT&T, Verizon, and Sprint dominate the market, offering similar services with high entry barriers.

- Internet Service Providers: Comcast, AT&T, and Spectrum control a large share of the market, providing broadband services with limited competition.

- Tobacco Industry: Dominated by firms like Philip Morris, British American Tobacco, and Imperial Brands, with significant control over pricing and advertising.

- Steel Industry: Companies like ArcelorMittal, Nippon Steel, and US Steel lead, controlling production and prices with significant market power.

- Chemical Industry: Firms such as BASF, DowDuPont, and Sinopec dominate, with high entry barriers due to extensive research and development.

- Fast Food Chains: McDonald’s, Burger King, and Wendy’s control a significant market share, using brand loyalty and extensive marketing strategies.

- Credit Card Companies: Visa, MasterCard, and American Express dominate, with significant control over transaction fees and network services.

- Beer Industry: Dominated by Anheuser-Busch InBev, SABMiller, and Heineken, with substantial control over production, distribution, and branding.

- Semiconductor Industry: Firms like Intel, Samsung, and TSMC lead, controlling a large share of the market with high technological entry barriers.

Types of Oligopoly

- Pure Oligopoly: Firms produce identical or homogeneous products, such as in the steel industry, where competition is based on price and output.

- Differentiated Oligopoly: Firms produce similar but not identical products, like in the automotive industry, where branding and features play crucial roles.

- Collusive Oligopoly: Firms cooperate, often forming cartels, to control prices and output, maximizing collective profits as seen in OPEC’s oil production agreements.

- Non-Collusive Oligopoly: Firms compete independently without explicit agreements, leading to strategic decision-making and competitive behaviors, like in the airline industry.

- Open Oligopoly: New firms can enter the market relatively easily, but a few dominant players still maintain significant control, such as in the tech industry.

- Closed Oligopoly: Entry barriers are high, preventing new firms from entering the market, as seen in the telecommunications industry.

- Partial Oligopoly: One firm holds a dominant position, with smaller firms following its lead, as seen in the microprocessor industry with Intel.

- Full Oligopoly: Firms have equal market share and influence, resulting in balanced competition, often seen in the tobacco industry.

- Syndicated Oligopoly: Firms coordinate their marketing and sales efforts, often pooling resources to increase market influence, such as in agricultural cooperatives.

- Competitive Oligopoly: Firms engage in intense competition, frequently changing prices and strategies based on target market analysis to gain market share, as seen in the retail supermarket sector.

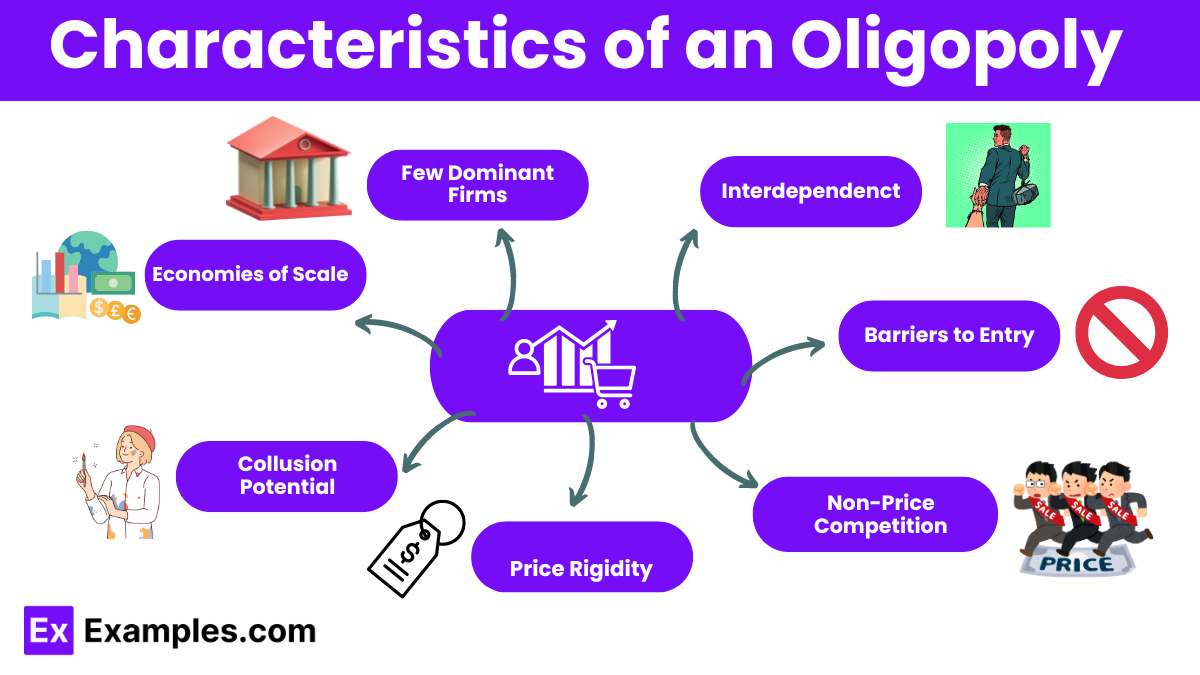

Characteristics of an Oligopoly

- Few Dominant Firms: A small number of large firms dominate the market, each holding significant market share.

- Interdependence: Firms are interdependent; the actions of one firm significantly impact the others, leading to strategic decision-making.

- Barriers to Entry: High barriers to entry, such as significant capital requirements and regulatory hurdles, prevent new firms from easily entering the market.

- Non-Price Competition: Firms often compete using advertising, product differentiation, and customer service rather than price changes.

- Price Rigidity: Prices tend to be stable over time as firms, with a strong market orientation, avoid price wars that can erode profits.

- Collusion Potential: Firms may collude, either formally or informally, to set prices or output levels to maximize collective profits.

- Economies of Scale: Large firms benefit from economies of scale, reducing average costs as production increases.

Oligopoly Market Structure

Oligopoly market structure is characterized by a few dominant firms controlling the industry, leading to significant market power and strategic decision-making. Unlike a command economy, where the government dictates production and prices, oligopolistic firms independently influence market outcomes, often engaging in non-price competition and maintaining stable prices to avoid profit-eroding price wars.

Oligopoly in Economics

- Market Concentration: A few large firms dominate the industry, each holding significant market share, guided by extensive market research to inform their strategies.

- Interdependent Decisions: Firms make strategic decisions based on competitors’ actions, leading to careful consideration of market moves.

- Collusion Potential: Firms may engage in collusion, either explicitly or tacitly, to set prices or output levels and maximize joint profits.

- Product Differentiation: While some oligopolies offer homogeneous products, others differentiate their offerings to capture niche markets and create customer loyalty

- Price Stability: Prices remain stable over time as firms avoid price wars to protect profits, maintaining a balanced competitive environment.

Industries With Potential Oligopolies

- Automotive Industry: Dominated by major global players like Toyota, Ford, and Volkswagen, leveraging extensive market research to maintain competitive edges.

- Telecommunications: Controlled by a few key firms such as AT&T, Verizon, and T-Mobile, offering similar services with high entry barriers.

- Airlines: Major airlines like American, Delta, and United Airlines dominate, significantly influencing pricing and route structures.

- Energy Sector: Companies such as ExxonMobil, BP, and Chevron exert considerable control over oil production and prices.

- Pharmaceuticals: Firms like Pfizer, Johnson & Johnson, and Merck dominate, with high R&D costs preventing easy market entry.

- Technology: Giants such as Apple, Microsoft, and Google lead in a market economy, maintaining substantial market power through continuous innovation and brand loyalty..

Oligopoly functions in business

- Strategic Pricing: Firms set prices based on competitors’ actions, avoiding price wars to maintain stable profits.

- Market Control: Dominant firms influence market conditions, including supply and demand, due to their significant market share.

- Non-Price Competition: Companies compete through advertising, product differentiation, and customer service rather than price cuts, aiming to increase customer loyalty and reduce reliance on unearned income.

- Collusion Potential: Firms may engage in collusive behavior, both formally and informally, to set prices and output levels.

- Innovation and R&D: Large firms invest heavily in research and development to innovate and maintain competitive advantages.

Why do Businesses Form Oligopolies?

- Market Power: Businesses form oligopolies to gain significant market power, allowing them to influence prices and control market conditions.

- Economies of Scale: Large firms benefit from economies of scale, reducing production costs and increasing profitability.

- High Barriers to Entry: Establishing an oligopoly creates high entry barriers, preventing new competitors from easily entering the market.

- Stable Profits: Oligopolies help firms maintain stable profits by reducing the likelihood of destructive price wars.

- Collaboration Opportunities: Firms in oligopolies can collaborate, formally or informally, to set prices and output levels, maximizing collective profits.

Effects of Oligopolies on Markets

- Reduced Competition: Oligopolies limit competition, leading to higher prices and reduced choices for consumers.

- Price Rigidity: Prices tend to remain stable due to mutual interdependence among firms.

- Collusion: Firms may collude to set prices or output levels, undermining market efficiency.

- High Barriers to Entry: New firms find it difficult to enter the market, maintaining the dominance of existing firms.

- Innovation and Investment: Oligopolies may invest in R&D, but innovation can be stifled by lack of competition.

Oligopoly vs Monopoly

| Aspect | Oligopoly | Monopoly |

|---|---|---|

| Number of Firms | Few dominant firms | Single firm controls the market |

| Price Setting | Limited price-setting power, potential for collusion | Price maker, sets prices without competition |

| Barriers to Entry | High barriers to entry, but not insurmountable | Extremely high barriers, often insurmountable |

| Product Differentiation | Products can be similar or differentiated | No close substitutes for the product |

| Market Power | Significant market power, but interdependent decisions | Absolute market power, full control over market supply |

How does an oligopoly affect prices?

Prices are often stable due to firms’ interdependence.

What are examples of oligopolies?

Examples include the automobile, airline, and telecommunications industries.

How do firms in an oligopoly compete?

Firms compete through non-price competition like advertising and product differentiation.

What is collusion in an oligopoly?

Collusion is when firms agree to set prices or output levels.

Why are barriers to entry high in oligopolies?

Barriers include high startup costs and established brand loyalty.

How does an oligopoly impact consumer choice?

Consumer choice can be limited due to fewer firms in the market.

What is price rigidity?

Price rigidity is when prices remain stable despite changes in demand or cost.

Can oligopolies lead to innovation?

Yes, firms may invest in R&D to gain a competitive edge.

What is the kinked demand curve theory?

It’s a theory that explains price stability in oligopolies.

How do governments regulate oligopolies?

Governments may use antitrust laws to prevent anti-competitive practices.