55+ Partnership Business Examples to Download

A partnership business is a collaborative enterprise formed by two or more individuals who agree to share profits, losses, and responsibilities. It is essential to draft a comprehensive Business Partnership Proposal to outline the roles and expectations of each partner. This proposal forms the foundation for a solid Partnership Proposal, ensuring that all parties are aligned on the business goals. Additionally, a Business Partnership Agreement is crucial as it legally binds the partners, protecting their interests and providing a clear framework for resolving disputes.

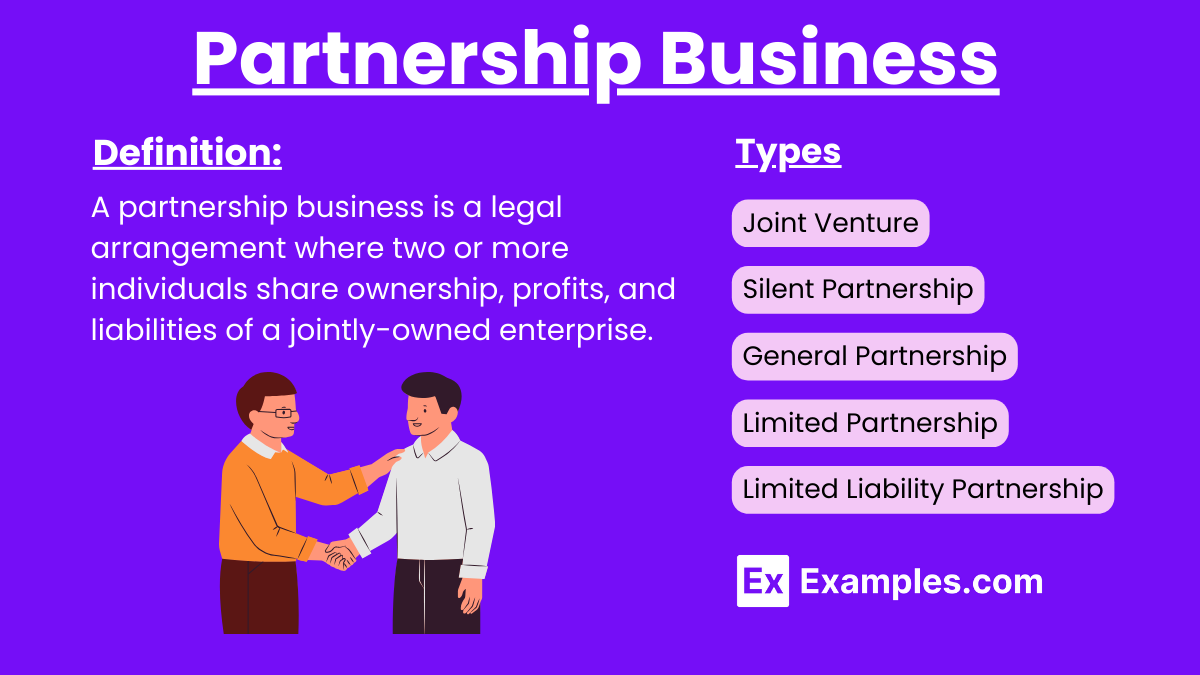

What is Partnership Business?

A partnership business is a legal arrangement where two or more individuals share ownership, responsibilities, and profits of a business. Partners collaborate to manage the enterprise and are jointly accountable for its success or failure.

Examples of Partnership Business

- Law Firms: Partners share clients, resources, and legal responsibilities.

- Medical Practices: Doctors collaborate to provide comprehensive patient care.

- Accounting Firms: Accountants pool expertise to offer diverse financial services.

- Marketing Agencies: Creative professionals join forces to deliver marketing solutions.

- Real Estate Agencies: Realtors work together to sell properties and share commissions.

- Consulting Firms: Consultants partner to offer specialized business advice.

- Restaurants: Chefs and business partners manage culinary and operational aspects.

- Retail Stores: Partners co-manage inventory, sales, and customer service.

- Tech Startups: Entrepreneurs collaborate on innovative technology solutions.

- Event Planning Companies: Planners coordinate to organize various events.

- Construction Companies: Builders and developers partner to complete projects.

- Fitness Centers: Trainers and business partners run gyms and fitness programs.

- Travel Agencies: Travel agents work together to offer vacation packages.

- Publishing Companies: Editors and writers collaborate on publishing ventures.

- Educational Tutoring Services: Educators team up to provide tutoring for students.

- Design Studios: Graphic designers and artists share resources and clients.

- Photography Studios: Photographers collaborate on various projects.

- Fashion Boutiques: Designers and retailers partner to offer fashion collections.

- Bakeries: Bakers and entrepreneurs co-manage bakery operations.

- Software Development Firms: Developers team up to create software applications.

- Web Development Agencies: Web designers and developers collaborate on projects.

- Cleaning Services: Partners co-manage residential and commercial cleaning services.

- Financial Advisory Firms: Financial advisors pool expertise for client investments.

- Landscaping Companies: Gardeners and landscapers partner to offer services.

- Architecture Firms: Architects collaborate on designing buildings.

- Interior Design Firms: Designers work together to create interior spaces.

- Car Dealerships: Partners co-manage the sale of vehicles.

- Logistics and Shipping Companies: Partners handle transportation and logistics.

- Health and Wellness Centers: Holistic health professionals offer wellness services.

- Beauty Salons: Hairstylists and beauticians partner to run salons.

- Music Production Studios: Musicians and producers collaborate on recordings.

- Film Production Companies: Filmmakers team up to produce movies.

- Art Galleries: Curators and artists partner to display and sell art.

- Catering Services: Chefs and event planners collaborate on catering events.

- Non-Profit Organizations: Partners work together to achieve charitable goals.

- Bed and Breakfasts: Hosts co-manage accommodations and services.

- Sports Training Facilities: Coaches and trainers partner to offer athletic training.

- Pet Services: Veterinarians and pet groomers collaborate on pet care.

- Green Energy Companies: Partners develop renewable energy solutions.

- Dental Practices: Dentists share office space and administrative duties.

- Veterinary Clinics: Veterinarians partner to provide animal care.

- Legal Aid Societies: Lawyers collaborate to offer pro bono services.

- Childcare Centers: Educators and caregivers co-manage childcare operations.

- Automotive Repair Shops: Mechanics partner to offer car repair services.

- Language Schools: Teachers collaborate to provide language instruction.

- Property Management Firms: Partners manage rental properties.

- HR Consulting Firms: HR professionals offer business consultancy services.

- Non-Governmental Organizations (NGOs): Partners work for social causes.

- Agricultural Farms: Farmers collaborate to manage agricultural operations.

- Hospitality Services: Partners co-manage hotels and hospitality businesses.

5 Types of Partnership Business

General Partnership: In this type, all partners share equal responsibility, liability, and management duties. Each partner is personally liable for the business’s debts and obligations.

Limited Partnership: This structure includes both general and limited partners. General partners manage the business and are fully liable, while limited partners contribute capital and have limited liability.

Limited Liability Partnership (LLP): In an LLP, all partners have limited liability, protecting their personal assets from business debts. This type is popular among professional services firms like law and accounting practices.

Joint Venture: A temporary partnership formed for a specific project or business venture. Partners share profits, losses, and control during the project but dissolve the partnership afterward.

Silent Partnership: A silent partner invests capital into the business but does not participate in day-to-day operations or management. They share in the profits and losses while remaining uninvolved in business decisions.

Partnership Business in India

1. Formation: A partnership can be formed through a verbal agreement or a written partnership deed. However, it is advisable to have a written agreement to avoid future disputes.

2. Registration: While registration of a partnership firm is not mandatory, it is beneficial. A registered firm can file a suit against third parties, whereas an unregistered firm cannot.

3. Partnership Deed: This legal document outlines the rights, duties, and responsibilities of the partners. It includes details such as profit-sharing ratios, capital contributions, and terms of partnership.

4. Number of Partners: A minimum of two partners is required, and the maximum number of partners allowed is 50.

5. Liability: Partners have unlimited liability, meaning their personal assets can be used to settle business debts.

6. Management: All partners share management responsibilities and decision-making authority unless otherwise specified in the partnership deed.

7. Profit and Loss Sharing: Profits and losses are shared among the partners as per the agreement mentioned in the partnership deed.

8. Taxation: Partnership firms are taxed as separate legal entities. The firm pays tax on its income, and partners pay tax on the share of profit received from the firm.

Partnership Business in the World

1. Formation: Partnerships are formed by an agreement between partners, which can be verbal or written. A written partnership agreement, or deed, is recommended to outline the terms and conditions clearly.

2. Types of Partnerships:

- General Partnership: All partners share equal responsibility and liability.

- Limited Partnership (LP): Includes general and limited partners. General partners manage the business and have unlimited liability, while limited partners contribute capital and have limited liability.

- Limited Liability Partnership (LLP): Provides limited liability protection to all partners, shielding their personal assets from business debts.

3. Shared Management: Partners share management responsibilities and decision-making authority, contributing their unique skills and expertise.

4. Profit and Loss Sharing: Profits and losses are typically shared according to the ratio agreed upon in the partnership agreement.

5. Unlimited Liability (General Partnership): Partners are personally liable for business debts and obligations, which can extend to their personal assets.

6. Mutual Agency: Each partner acts as an agent of the partnership Marketing, binding the firm through their actions and decisions.

Advantages of Partnership Business

- Combined Expertise: Partners bring diverse skills, knowledge, and experience to the business, enhancing decision-making and problem-solving capabilities.

- Shared Responsibility: Management and operational responsibilities are distributed among partners, reducing the burden on any single individual and improving efficiency.

- Easier Access to Capital: With multiple partners contributing financial resources, it is easier to raise the necessary capital for business operations and expansion.

- Simple Formation and Operation: Compared to corporations, partnership Proposals are relatively easy to establish and require fewer formalities and legal procedures.

Disadvantages of Partnership Business

- Unlimited Liability: In general partnerships, partners are personally liable for business debts and obligations, which means their personal assets can be used to settle business liabilities.

- Potential for Conflicts: Disagreements and conflicts between partners can arise over business decisions, profit-sharing, or management styles, potentially disrupting business operations.

- Shared Profits: Profits must be shared among partners, which can sometimes lead to disputes if contributions and efforts are perceived as unequal.

- Limited Control: Individual partners may have less control over the business compared to sole proprietorships, as decisions require consensus or majority agreement.

- Joint Liability: Each partner is liable for the actions of the other partners, which means that one partner’s misconduct or poor decisions can affect the entire partnership.

Tips for choosing the right Partnership Business

- Set Clear Goals: Make sure your business goals match your partner’s goals.

- Check Skills and Compatibility: Ensure your partner’s skills complement yours and that you work well together.

- Agree on Finances: Decide how much each partner will invest and how you’ll share profits.

- Create a Legal Agreement: Write a partnership agreement that covers all important details.

- Plan for the Future: Establish how you’ll handle disputes and discuss long-term plans for the business.

How are decisions made in a partnership?

Decisions are made collectively, with each partner having equal input unless otherwise specified in the agreement.

How is a partnership formed?

Partnerships are formed through verbal or written agreements between partners, preferably documented in a partnership deed.

What types of partnerships exist?

General partnerships, limited partnerships (LP), and limited liability partnerships (LLP) are the main types.

Do partnerships need to be registered?

Registration is not mandatory but recommended for legal benefits and the ability to sue third parties.

How are profits shared in a partnership?

Profits are shared according to the ratio specified in the partnership agreement.

What is unlimited liability in a partnership?

Partners are personally liable for business debts, risking their personal assets.

Can a partnership have more than 50 partners?

No, partnerships generally have a maximum limit of 50 partners.

How are disputes resolved in a partnership?

Disputes are resolved through mechanisms outlined in the partnership agreement, often involving mediation or arbitration.

What happens if a partner leaves the business?

The partnership may dissolve unless there is an agreement for continuation by remaining partners.

How are partnership taxes handled?

Partnerships are typically taxed as pass-through entities, with profits and losses reported on partners’ personal tax returns.