19+ Pay Stub Sheet Examples to Download

As an employer or business owner, it is important that you keep an account of all your employees’ salary or pay. Doing this will ensures that there are records and transparency with how much they receive. Thus, it is important to use an effective document that will help you list down all the information regarding an employee’s paycheck.

A pay stub sheet is a document that itemizes how much an employee receives as his or her salary. Since essential information such as taxes, voluntary deductions, etc. are all listed on the sheet it helps employees know and understand how much is his or her base pay and how much he or she gets to take home.

Elements of a Pay Stub Sheet

Listed below are the essential elements that should be included on a pay stub sheet or a payslip:

1. Gross Pay: The gross pay is the amount employees are paid within a certain period of time without the tax deductions. In the most basic sense, this is the base pay, but not the amount they get to take home during payday.

2. Net Pay: On the contrary, the net pay is the amount employees take home. This is the total amount after taxes and other deductions have been made that they will receive.

3. Federal Withholding: Federal withholding refers to the taxes an employer is legally required to withhold from their employees’ wages or salaries. The amount withheld by the employer form each employee is then paid to the Federal Government to fund programs, projects, etc. You may also see training sheet examples.

4. Social Security: An Employment Tax as part of the Federal Insurance Contributions Act (FICA) provides benefits to retirees, disabled, and children of the deceased. Both the employer and the employee pay a certain amount depending on the wage or salary bracket. However, should the limit be reached, deductions will automatically stop.

5. Medicare: Still part of the FICA, Medicare Tax is a legal requirement for both the employee and employer. Both are required to pay a flat rate of 1.45 percent withheld on all wages or salary brackets, totaling 2.9 percent. This tax is used to pay hospital and medical care costs.

6. State Withholding: Although some states do not have withholding taxes, some do. Unlike a Federal Withholding, this does not have or follow a certain standard. Some follow withholding tables, others have flat rates, and some are just a percentage of the Federal Tax.

7. Local Taxes: In addition to Federal and State taxes, there is also a local tax. According to Investopedia, a local tax is levied by a local authority such as a state, county or municipality.You may also see monthly sheet examples.

8. Voluntary Deductions: Should an employee personally opt to deduct payment for health benefits, life insurance, disability insurance, etc. this automatically becomes a voluntary deduction. However, this can only be done when there is a signed authorization by an employee.

9. Involuntary Deductions: On the other hand, involuntary deductions are binded by law and mandated by courts or government agencies. Employers may automatically deduct child support, for example, on an employee’s wage.

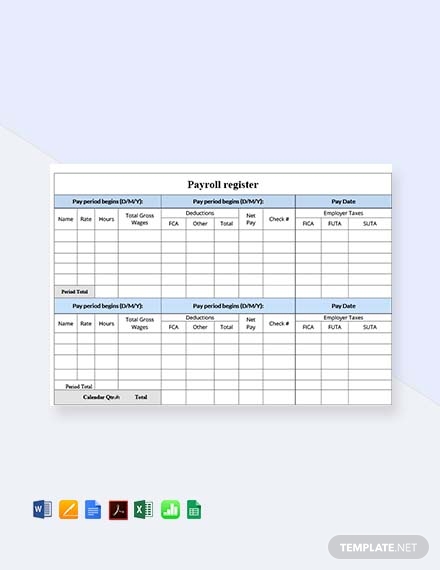

19+ Pay Stub Sheet Templates

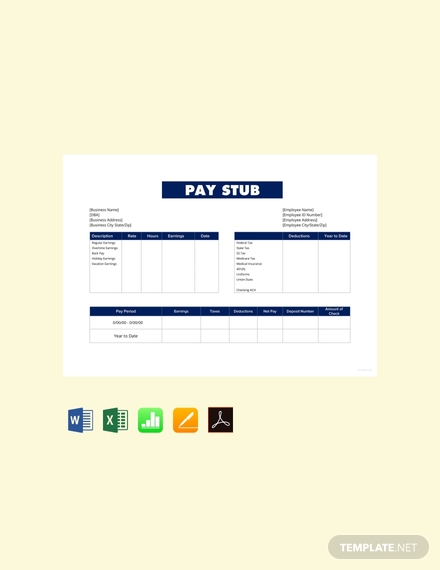

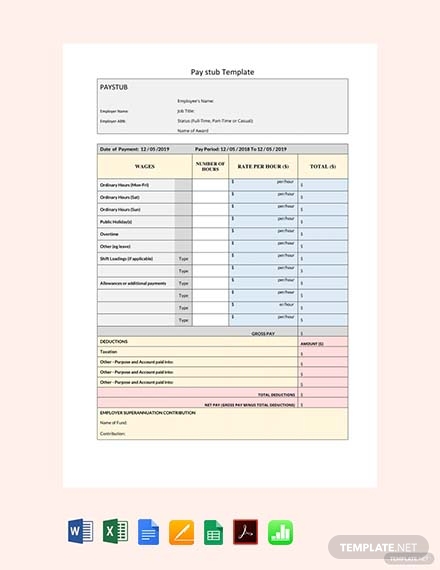

Pay Stub Sheet

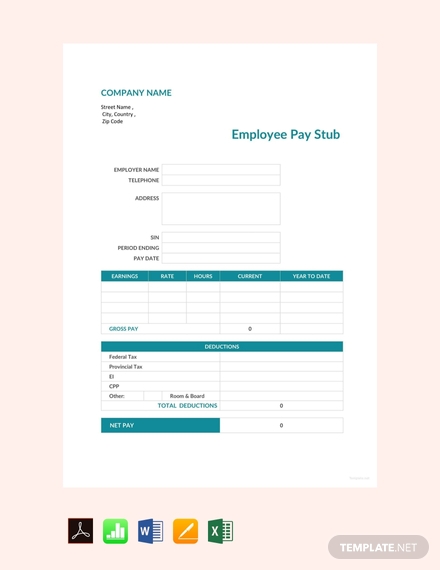

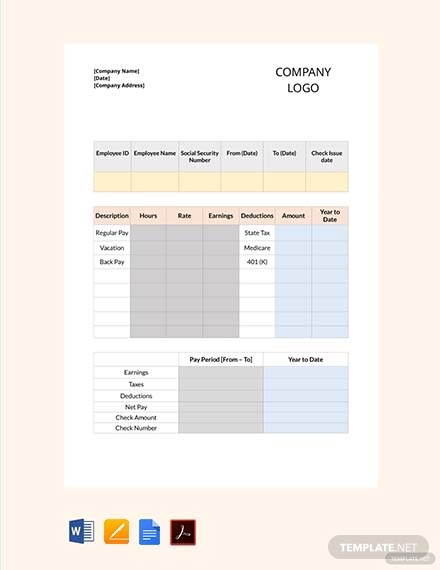

Employee Pay Stub Sheet

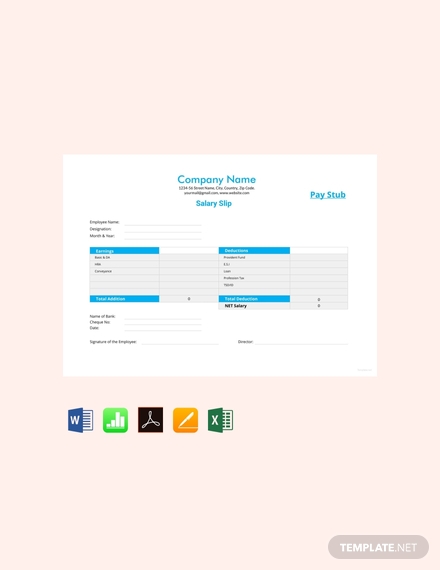

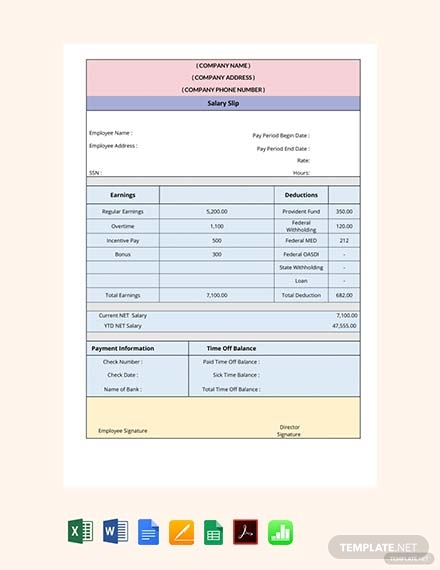

Salary Slip Pay Stub Sheet

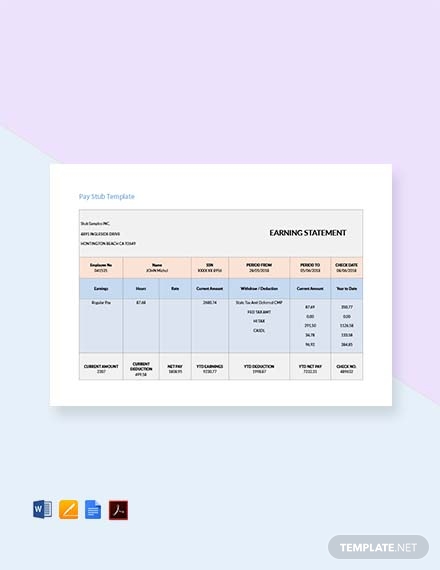

Earning Statement Pay Stub Sheet

Corporate Pay Stub Sheet

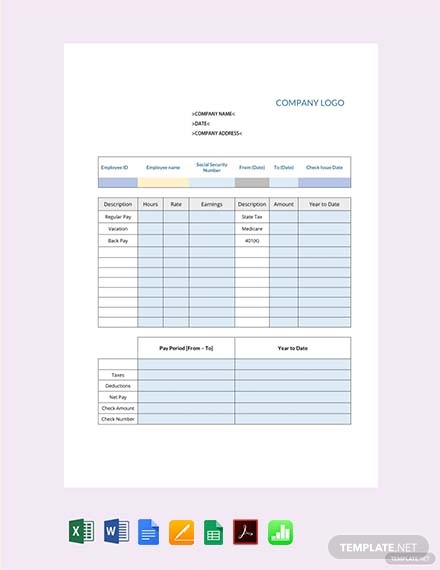

Company Salary Pay Stub Sheet

ePay Stub Sheet

Business Pay Stub Sheet

Employee Pay Stub Sheet Template

Canadian Check Pay Stub Sheet

Hourly Wage Pay Stub Sheet

Pay Check Pay Stub Sheet

Corporate Pay Stub Sheet Template

Simple Pay Stub Sheet

Bonus Pay Stub Sheet

Organization Pay Stub Sheet

Real Estate Pay Stub Sheet

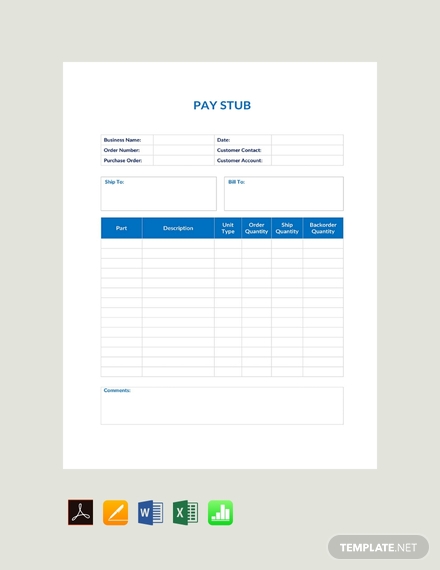

Packing Pay Stub Sheet

Incentives Pay Stub Sheet

Basic Pay Stub Template

Types Of Pay Stub Papers

Here are the types of papers you can use for a pay stub:

1. Software-compatible stubs or forms: To maintain a digital organization system for all the paychecks, using this type of paper is the most ideal. This is specially designed to be compatible to an electronic payroll software, and will allow you to keep a copy in the system and give physical copies to the employess. Since this is typically perforated, you can separate the check portion from the receipt or pay overview.

2. Business checks: Business checks are papers designed to avoid illegal duplication and fraud. Check-21 compliance, a VOID pantograph behind the endorsement section, an anti-splice backer, patterned backgrounds, watermarks and more are all incorporated to this paper to meet the security requirements of major financial institutions. You may also see activity sheet examples.

3. Standard printer paper: If you want to be cost-effective using a standard printer paper is the best option for you. Ultimately, this paper will allow you to incorporate more of the company’s design since it does not have constraints like that of a perforated paper, preprinted lines, etc. However, you will need to create your own format or you can use editable pay stub templates online.

Pay Stub Sheet FAQs

Here are answers to some questions about pay stub sheets:

Essentially, what is a pay stub sheet for?

Essentially a pay stub sheet is a salary slip meant to help employees understand their net pay; it also serves as a record of their pay. Both the employee and the employer can see the information in the sheet, it can help settle discrepancies and issues that may arise since it is transparent and accurate.

Are employers required to give a pay stub sheet to employees?

According to the Fair Labor Standards Act (FLSA), employers are not required to provide employees with pay stub sheets; however, employers are required to keep accurate records of the number of hours employees have worked and how much they are paid. However, some states require employers to do so, and it is important to just comply.