15+ Pay Stub Examples to Download

Salary is an essential component that every employer should give to their employees. It is how they can pay and compensate for the hard work each employee has done for the benefit of a company. Most companies deposit the salary straight to the employees’ bank account because it is a convenient way of giving a salary. But even if they make a direct deposit to the employees’ bank account, they still need to provide a document that contains the details of the employees’ salary. That said document would be a pay stub. In this article, you will learn all about a pay stub, its significance, and the steps and guidelines in crafting an excellent pay stub.

15+ Pay Stub Examples

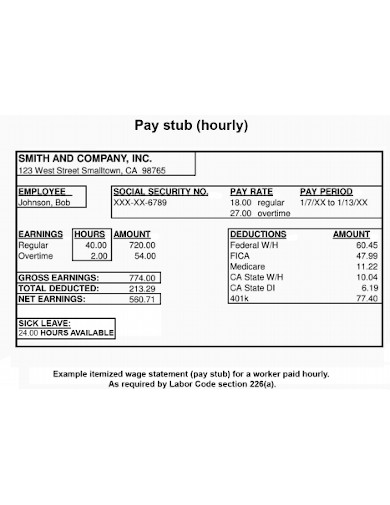

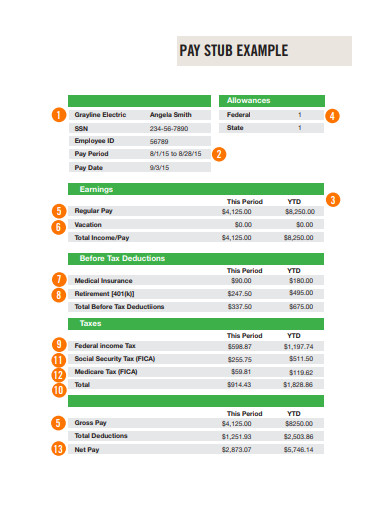

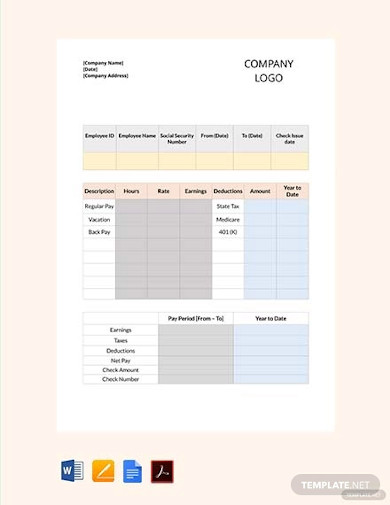

1. Employee Pay Stub Example

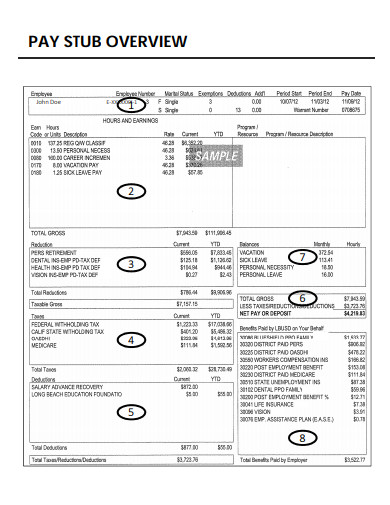

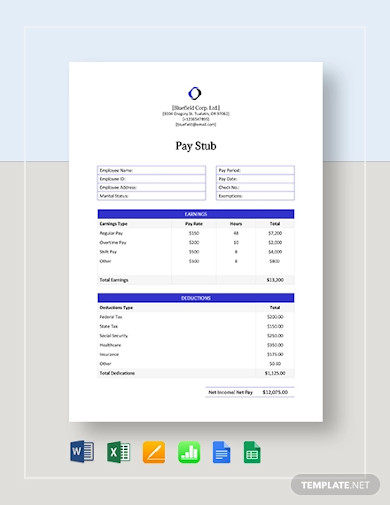

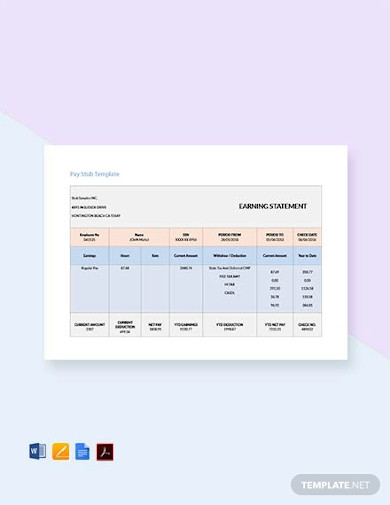

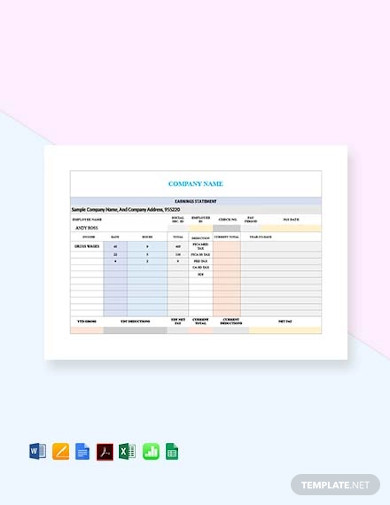

2. Sample Pay Stub

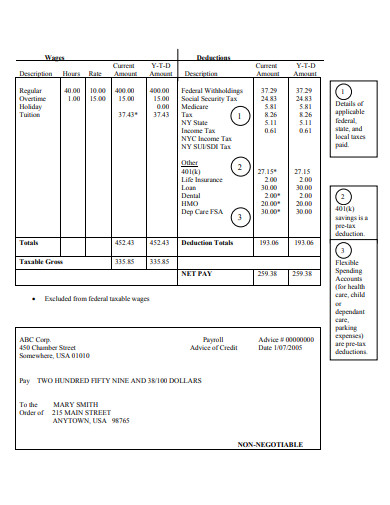

3. Basic Pay Stub Template

4. Company Salary Pay Stub Template

5. Bonus Pay Stub Example

6. Pay Check Pay Stub

7. Organisation Pay Stub

8. Corporate Pay Stub

9. Company Salary Pay Stub Example

10. Corporate Business Pay Stub

11. Pay Stub Example

12. Sample Employee Pay Stub Example

13. Hourly Pay Stub

14. Epay Stub Example

15. Incentives Pay Stub

16. Paycheck Stub E-mail Authorization

What Is a Pay Stub?

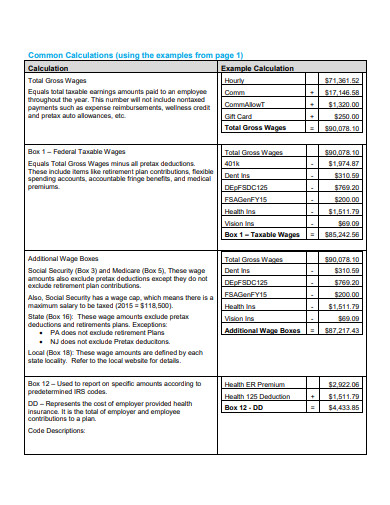

A pay stub is a document that contains the complete details of an employees’ salary. It includes the breakdown of the total pay an employee receives, such as the tax deductions, late deductions, overtime pays, and extra holiday pays. These details come from the company payroll, which also contains the list of employees that receives a monthly salary. An employer has to provide a pay stub to every employee because they deserve to know as to why they receive a particular amount of salary. It acts as proof of why certain deductions or additional wages have to be made. Before, pay stubs were attached to paychecks, but now most pay stubs are sent through emails to save the use of ink and paper.

Significance of a Pay Stub

A pay stub plays an essential role in providing the precise details of the salary of an employee. It serves as an employee pay statement that helps an employee keep track of their monthly salary, the taxes they pay, and the additional wages they receive. This document should be void of any errors since most workers rely on their paychecks. An article from The Guardian revealed that 80% of american workers rely on their paychecks.

Employees also need a pay stub because it acts as a proof of income for various activities such as loan applications and filling out their child’s scholarship form. A pay stub is also used to settle employee pay discrepancies. As you can see, a pay stub is significant to both employers and employees’. So it is important that with each time an employee receives his salary, there should always be a pay stub.

How To Create a Pay Stub

You have to be attentive in creating a pay stub for a company since it needs to have the complete details. There are also stub templates and paycheck pay stubs that are available online, but if you want to create your own salary pay stub, you will find the steps and guidelines in this section that will help you craft an excellent pay stub.

1. Include the Company Logo

In your pay stub template, you should include the logo of your company. It signifies that the company makes the document, and it also makes a pay stub look professional. You must add the company logo because if an employee uses a pay stub as proof of income, the organization or establishment can immediately determine which company the employee is working for.

2. Add the Employee Information

You must incorporate the employee information, such as name, address, id number, and tax number. You can also include additional information such as the pay period and the pay date. These are the elements that a pay stub should have so that an employee will know that he or she has received the correct pay stub.

3. Don’t Forget the Pay Details

The most important part of a pay stub is the breakdown of an employees’ pay. You should be descriptive and precise as you include such pay details. It is also important that each deduction and additional wages should be computed correctly so that the salary pay stub will not contain any errors. You must keep an employees’ salary details void of any mistakes because it can lead an employee to be confused as to why he received a particular amount of pay.

4. Use Appropriate Colors

Although most pay stubs are plainly black and white, it doesn’t mean that your company pays stub also has to be. You can incorporate colors in your pay stub as long as it is appropriate and professional to look at. You can use the color that signifies the company so that your pay stub doesn’t look dull and boring. Even though pay stubs are professional documents, you can always change the way they look by adding a splash of color.

FAQs

Are a pay stub and a payslip the same?

Yes, pay stubs and payslips are very similar to each other that they are almost the same. They contain the same pay details of an employee. The only difference is that before, pay stubs were attached to paychecks, and employees received payslips after they receive their salary.

Can I include a company letterhead on my pay stub?

Yes, you can include a company letterhead on your pay stub. Letterheads signify the reliability of a company, and it would also make your pay stub look more professional. So, it is a good thing to include a company letterhead on your pay stub.

Can I make my own pay stub format?

Yes, you can make your own pay stub format as long as the format you create is appropriate. Most pay stub formats are the layout of a table since it allocates pay details accordingly. Also, keep in mind that your format should be easy to read and comprehend so that an employee can immediately determine the details of his pay stub.

As you can see, a pay stub is an essential tool in keeping an employee updated on his salary details. They have the right to know how a company compensates them since they work hard and give their best to their jobs. A pay stub is how they can determine the deductions and additional pays they receive, so it is important to include a pay stub every pay period. If your company has no pay stubs or needs to improve their pay stubs, you can make use of the sample documents in this article if it is up to your liking. It already has the format and precise details, so all you need to do is download them into your computer.