14+ Payment Receipt Examples

Receipts prove the existence or occurrence of a specific business receipt transaction. In most cases, issuance of a receipt means that the service provider recognizes the fact that the client has already paid for the goods or services rendered during the transaction or deal.

Different areas have different rules or laws on the use and issuance of Receipts’ example. Still, it cannot be denied that a receipt is a formal business document widely used by businesses in different areas. It is thus important for a business owner to know the laws that pertain to the usage of receipts in their area.

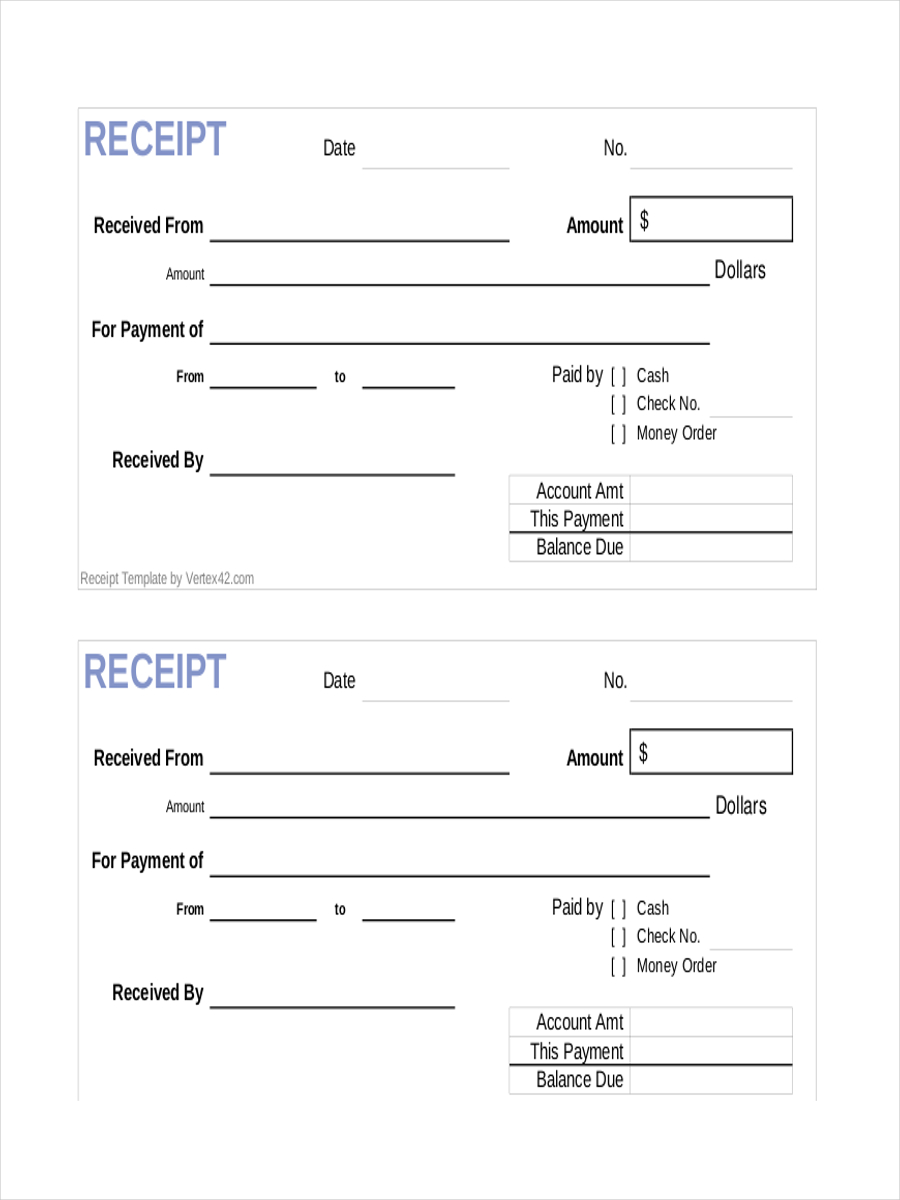

Payment Receipt Example

Payment Receipt Book Template

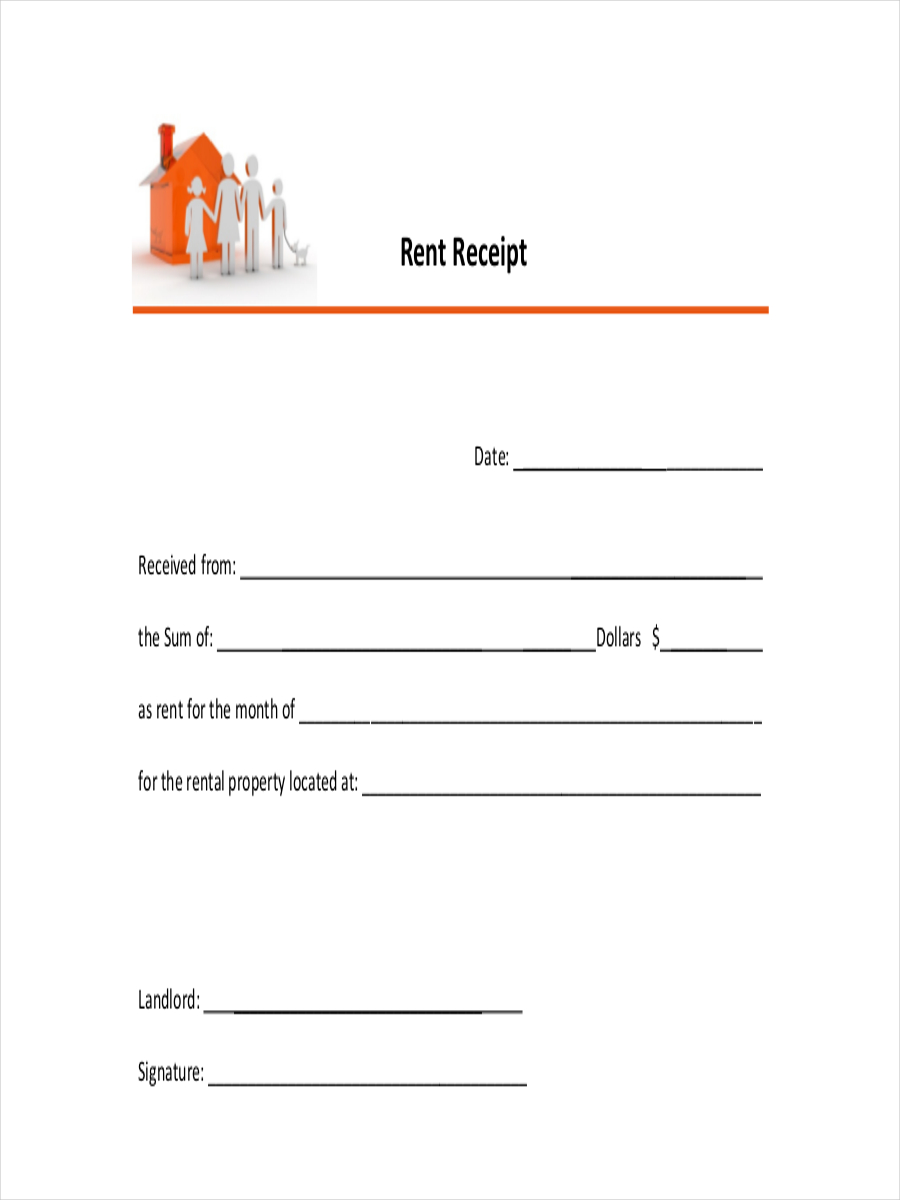

Rent Payment Receipt Template

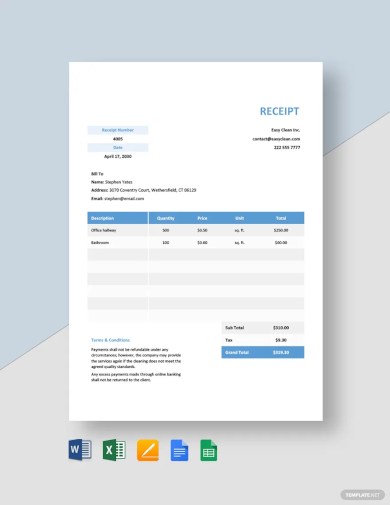

Cleaning Payment Receipt Template

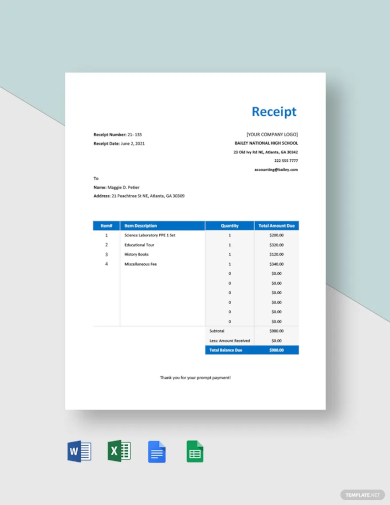

School Payment Receipt Template

Rent Payment Receipt

What Is a Payment Receipt?

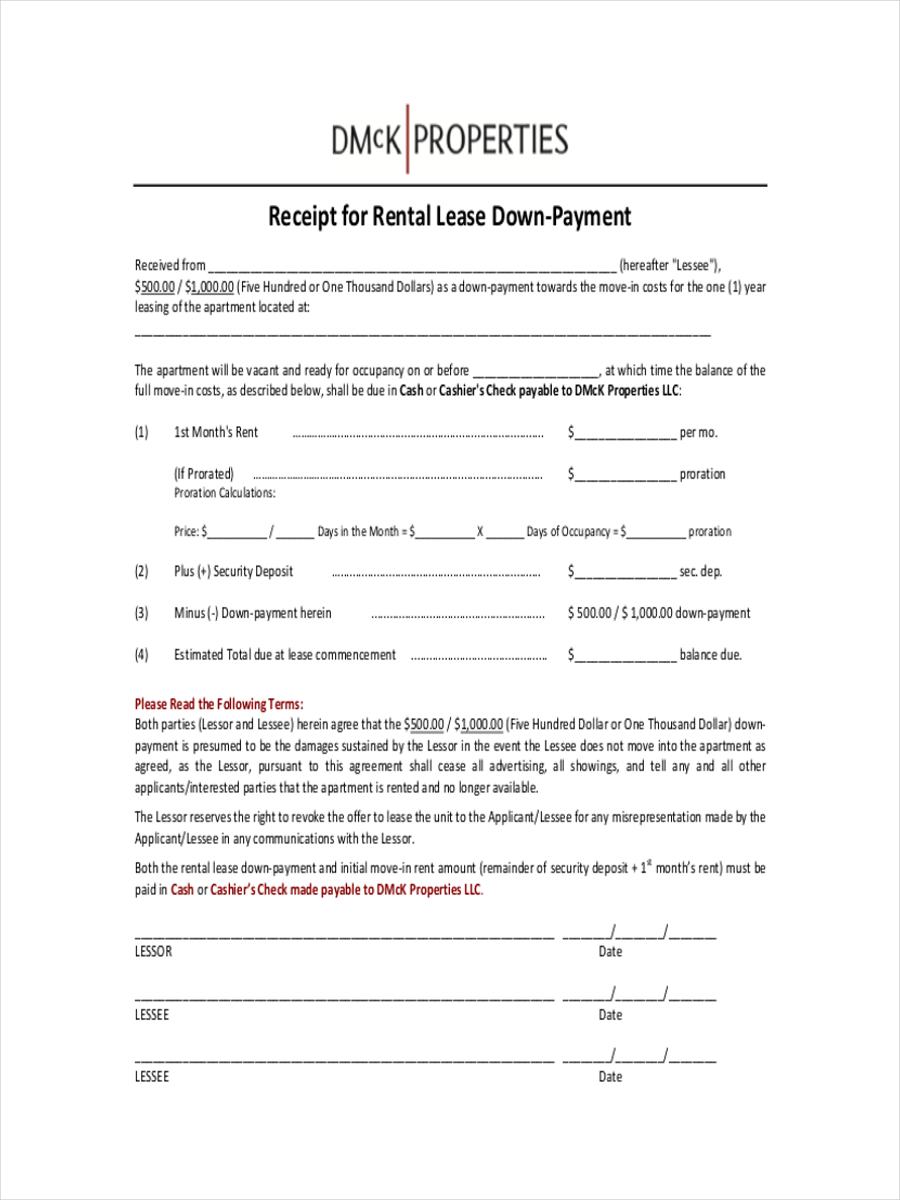

A payment receipt is a kind of receipt which serves to verify that a payment has been made by a certain party like an exchange for receiving goods or services.

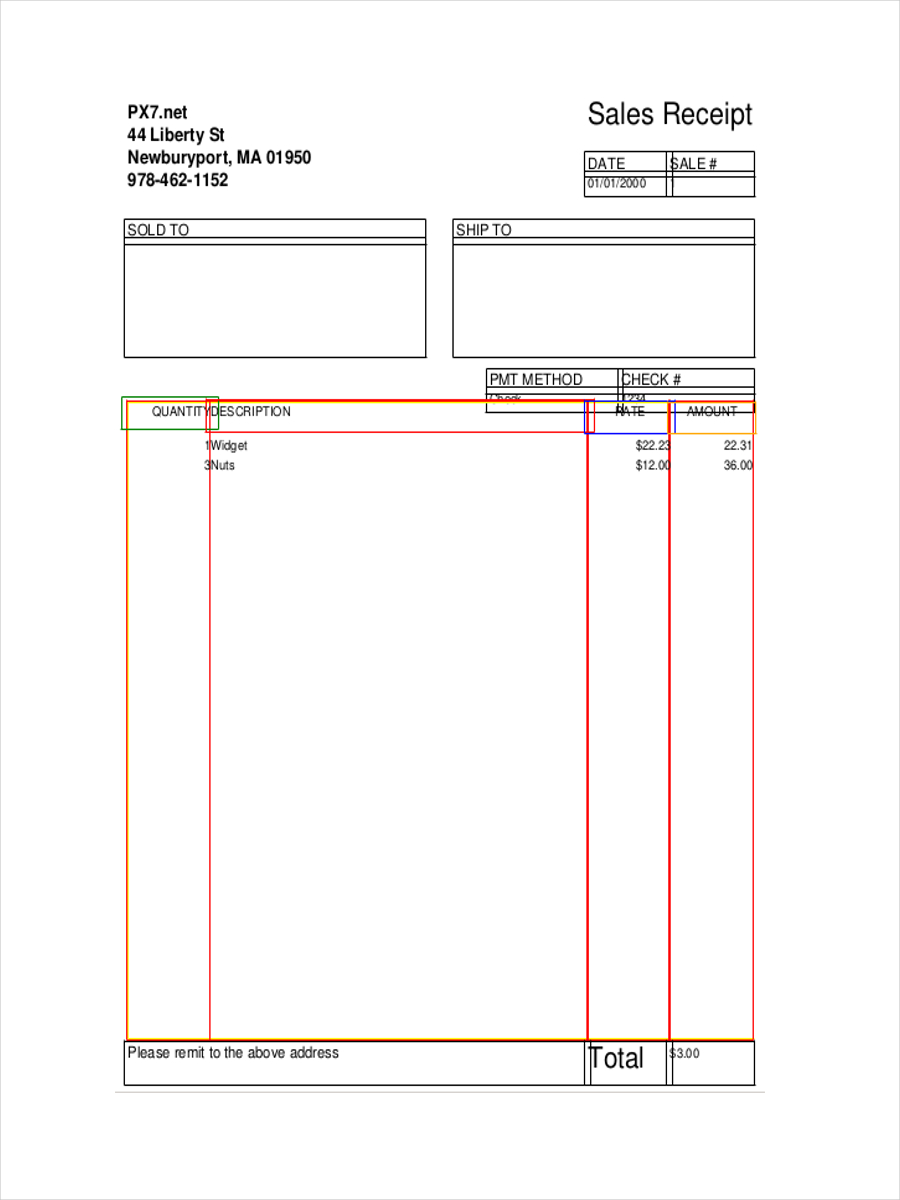

Such instances can occur at any place, like a convenience store, for example. Payment receipts can also be used by businesses when dealing with other businesses, to prove that both parties have successfully done their part in the transaction. In such transactions between business parties, payment receipts may include a more detailed description of the goods and services rendered.

Cash Payment Receipt

Receipt for Sales Payment

Down Payment Receipt

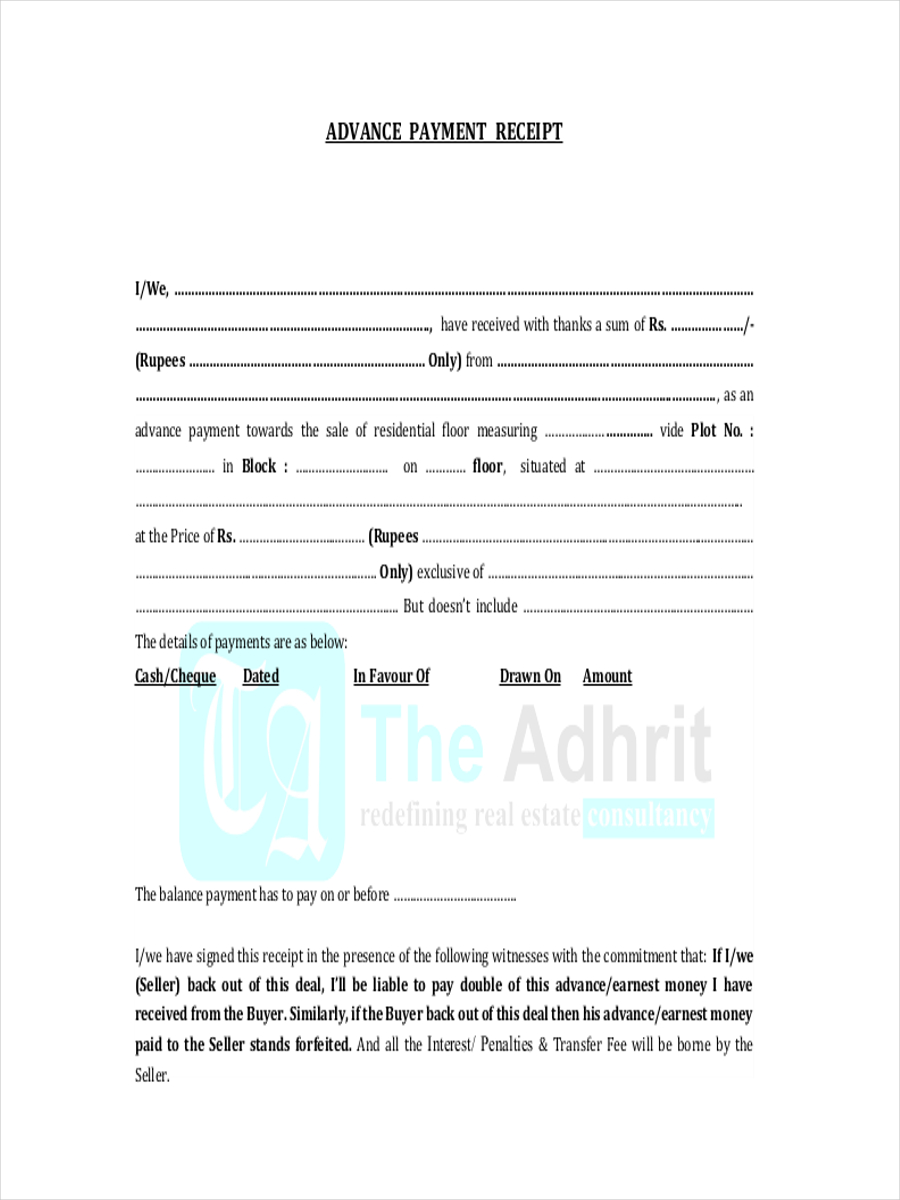

Advance Payment Receipt

Benefits of a Payment Receipt

Like other types of receipts, payment receipts (or receipts, in general) provide several benefits to its users. Here are some of such benefits:

- Evidence for reimbursements, or warranties: When you spend on company operation, you’ll need payment receipts to request for reimbursement. Service warranties can also be availed if payment receipts are shown to the service provider. Such receipts will also allow a customer to return or exchange goods that might be defective.

- Contract or agreement of both parties: If the conditions are violated by any of the parties involved, this will be evidence they can present in the court of law.

- Support of accounting records: These will prove that a reasonable amount was asked in exchange for the goods and services rendered. These will complete accounting records and will simplify the process of tracking the finances of a business.

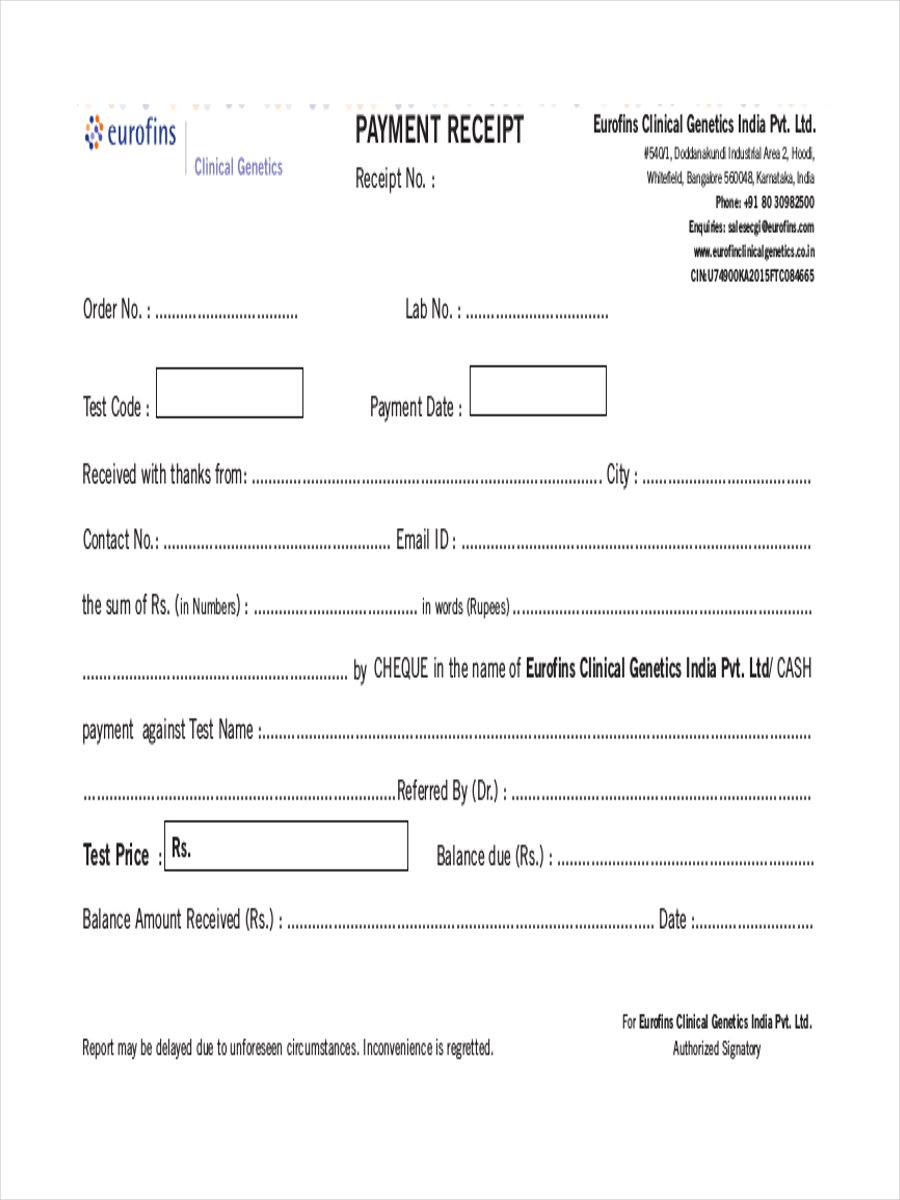

Sample Payment Receipt

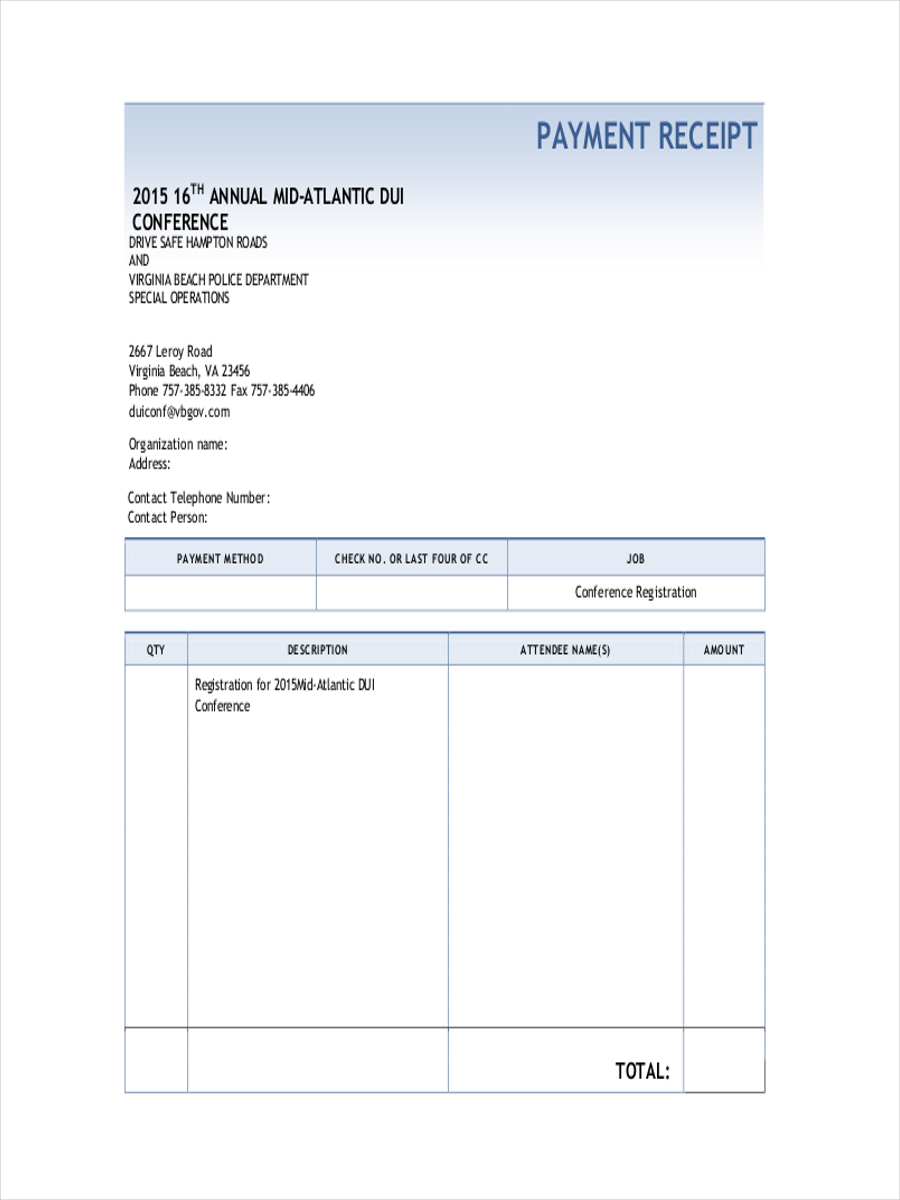

Receipt for Conference Payment

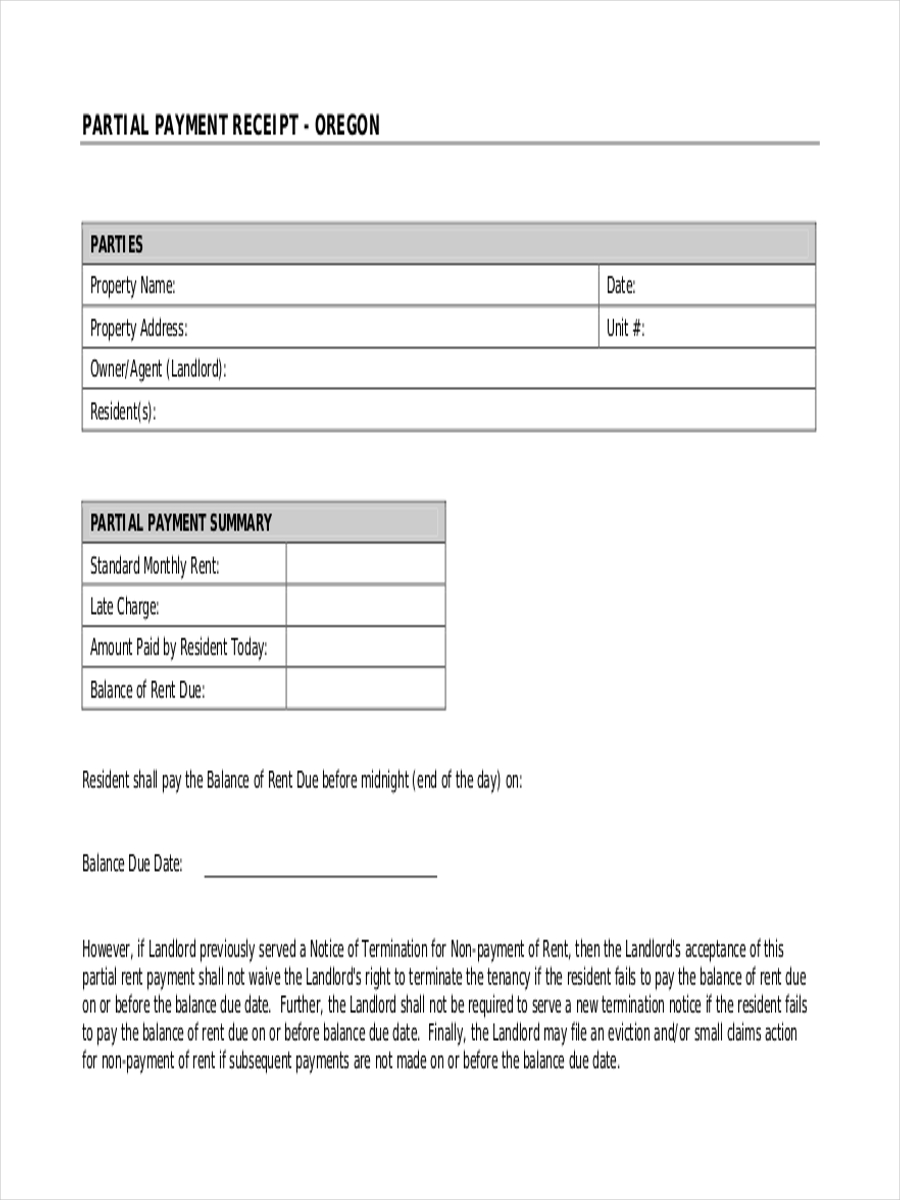

Receipt for Partial Payment

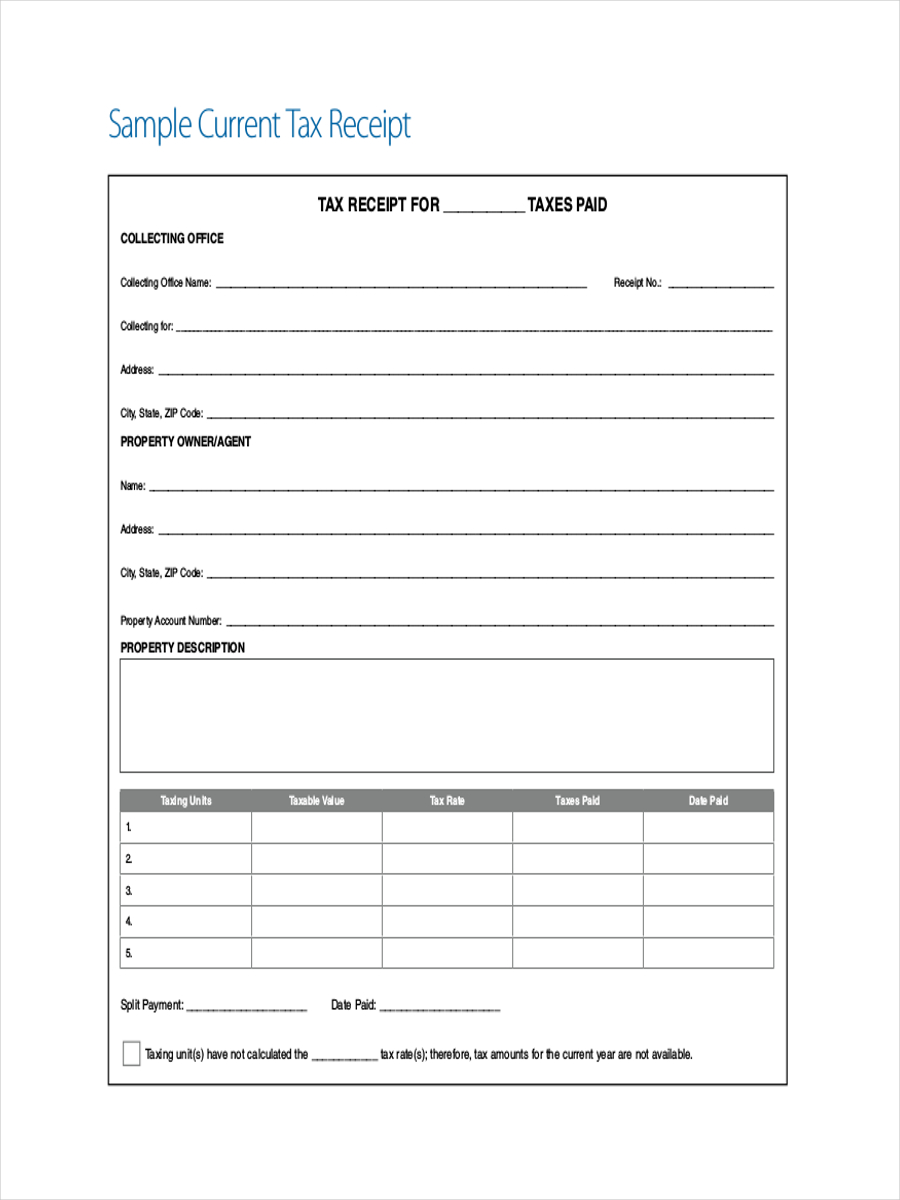

Tax Payment Receipt

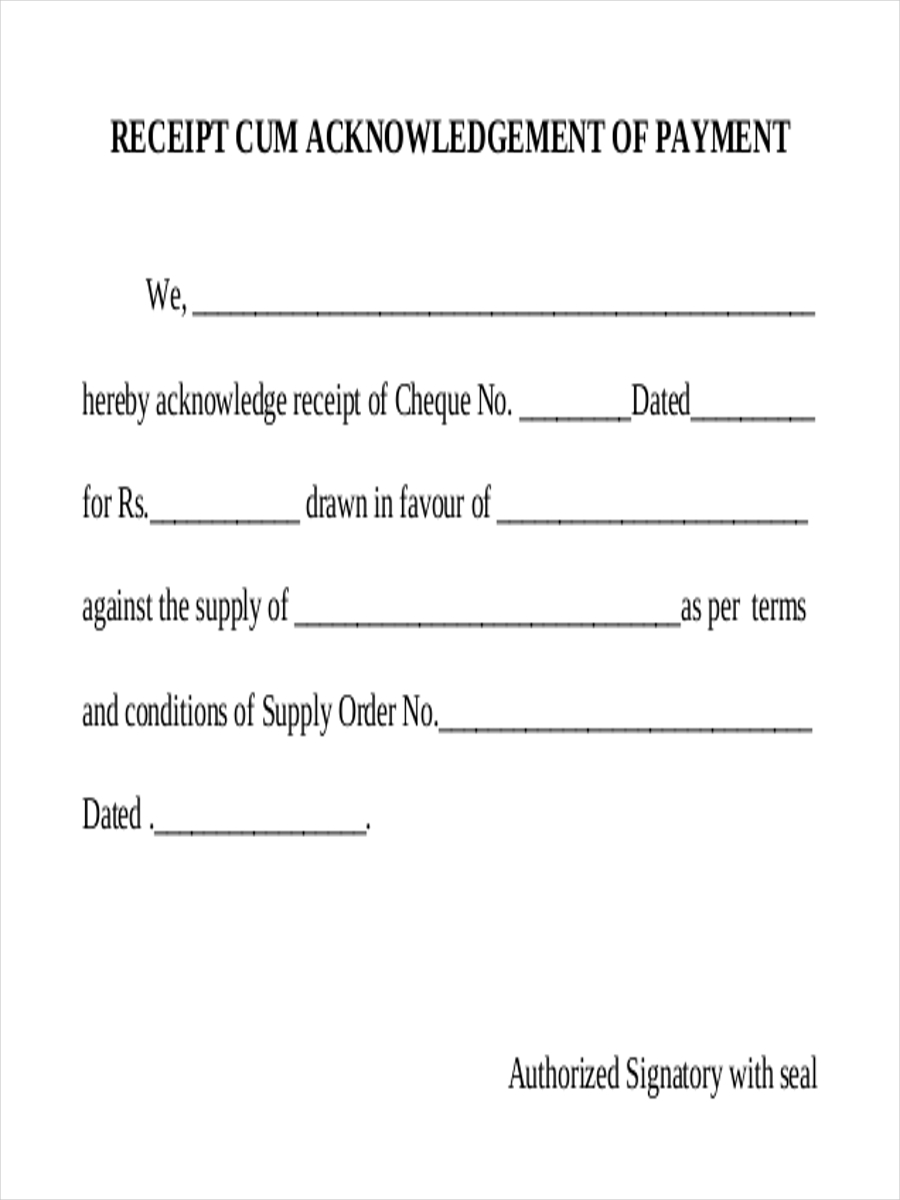

Acknowledgement Receipt of Payment

Making a Payment Receipt

Making a pyament receipt can be a tough job to do. Here are a few things you need to keep in mind while making one on your own:

- Know the type of receipt to create. Once you’ve done this, you can write the type on the heading of your receipt (e.g. payment receipt).

- Identify the template to use, or create your template. Receipt templates are available online. But if you’re planning to create your template, there are receipt examples included in this post for your reference.

- Input the information. You can either print a blank receipt and complete it by hand, or complete it on your computer. Do what you prefer the most.

- Fill your receipt with the necessary details of the transaction. Whatever method you choose in filling up, you need to carefully write all the details.

- Let the customer sign the receipt on the space indicated. You can also choose to affix your signature.

- Keep a backup copy. Remember, you give one to your customer, and keep another for your records.

Payment receipts or receipts of payment are receipts that resemble other receipts in many ways. An individual, especially for a business owner needs to know the basics of writing a receipt.

General FAQs

1. What is a Payment Receipt?

A payment receipt is a document that is given to a customer as proof of payment, whether half or full for the products/services rendered. It is mostly given to the buyer rather than for a whole business. It lets the buyer be sure that their payment was received by the seller.

2. What is the purpose of using a Receipt?

The purpose of using a receipt is to provide information to customers/donors about the payment that has been made. It documents purchases and assists internal accounts to keep a check on the expenses and income of a company. Both nonprofits and for-profit entities use receipts as it is documented proof of payment.

3. What are the basic components of a Receipt?

A basic receipt has the following details that need to be included in it:

- The name and address of the business/individual receiving the payment

- Details of the person making the payment

- The date and receipt number

- The amount paid

- Mention the reasons for payment

- Payment method, etc.

4. What is the difference between an Invoice and a Receipt?

An invoice is a request for the payment to be made, whereas a receipt is documented proof of payment that has been made successfully. An invoice is issued before the amount is paid, while a receipt is given to the buyer after he/she makes the payment.

5. When should Receipts be issued?

A receipt is a written confirmation that the product/value of something has been paid by one party to another. In addition, receipts are also issued in business-to-business(B2B) dealings, stock market transactions, etc. These kinds of receipts are received by consumers from vendors and service providers, regardless of the industry they work for.