18+ Payment Schedule Examples to Download

Whether you are an average wage earner or a business entity, you are bound to encounter purchase transactions that you cannot settle all at once. One-time payment can also be impractical for different reasons. Sometimes, the price is too steep for the average person. Or the amount is not easy to lug around in a wallet. Institutions have broken down big purchases into installment payments because barring these people from buying seems like a bad business practice. Not all businesses can afford to wait for the upper class to buy, considering that this group makes up just shy of a quarter of American households. By offering pay-later options with a convenient payment schedule, businesses do not miss out on the larger fraction of US consumers.

Payment schedules come in a sheet that indicates dues and due dates. For a private individual, a simple Excel document can help keep track of his or her recurring or frequent payables. The document is a helpful reminder so as not to miss due dates and not incur extra charges for late payments. There are also payment plans that offer discounts for early payment.

For businesses, payment schedules are included in the purchase package. Once the customer avails of a product or service, you can talk about the modes of payment that he or she can take. A payment schedule can be a simple table of how much and when to pay that is included in a product brochure or pamphlet. It can also be a document where businesses can record the payments made by the customer. It helps stores keep track of the customer’s payments. When the person misses a payment date, the store or company can give the person a call for follow-up. In this way, installment payments are like using a promissory note. There is an agreement for the customer to pay for the product or service during the given period.

When businesses give customers options on payment, they are more likely to purchase or subscribe to the products and services. Unlike one-time payments, installments are a pay-later alternative that encourages the customers to pursue the purchase with a small deposit. The creditee regularly pays a fraction of the total price on recurring intervals until the purchase is paid in full. To protect the business, the creditor and the creditee agree on a payment schedule. As an added benefit, the store earns through interest fees on top of the original price.

Making Use of Payment Schedule

Installment payment schemes are not a new idea. They are usually the go-to option for a lot of customers who do not want to shell out a lot of money in one transaction. Payment of purchase or amortization of loans can be made weekly, monthly, quarterly, or annually. Customers, borrowers, and businesses can use payment schedules to keep track of the payments made. There are different industries and sectors that provide installment payment options to availing persons. People transacting with these industries can, therefore, use payment schedules to responsibly monitor their dues.

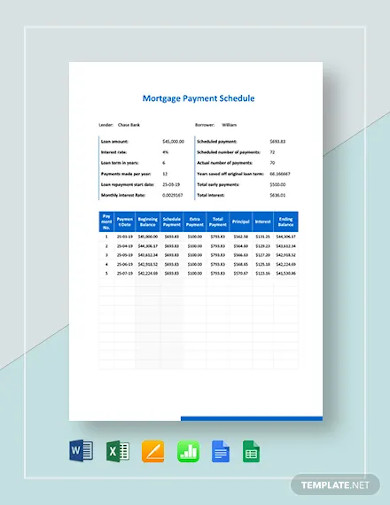

Houses and Mortgages

Owning a home is still a part of the American dream for most. However, the price rise in real estate keeps this dream as a distant milestone for the average wage earner. Whether buying a condo in the big city or a house in the suburbs, the average person would not want to shell out thousands of dollars in just one transaction. Instead, the person applies for mortgage loans for the purchase or renovation of his or her property. The borrower pays the creditor regularly through the agreed payment schedule. In cases where the borrower completely fails to comply with the schedule, the lender can evict the borrower from the residential property.

Tuition Fees and Student Loans

One of the ways that people prepare for the day they will start to settle down is to get a good higher education. A college degree or higher seems to give people a better advantage in their careers. However, the cost of tertiary education, with other commodities in the US, has been soaring. College is becoming pricier that students are plunged in student loan debt. A lot of millennials have to choose which among settling student debt, saving for retirement, stocking emergency fund, and paying to live comfortably, can they afford to set aside for now. To make repayment of student loans manageable, institutions offer installment plans and amortization options to the graduates. Penalties from not paying student debts religiously depend on where the loan was made.

Retail Stores and Installment Plans

Installment payment options are also the rage in retail marketing. Instead of paying the full price upfront, people have the option to pay a smaller amount for a specific amount of time for that new smartphone or electronic device. The store and the customers agree beforehand on a payment schedule. The customer takes home the product that day then pays for the total price of the product with the interest fee during the agreed dates. Stores can also choose to waive interest fees to motivate purchase. This way, everyone wins. The store also gets new customers or woos current patrons to keep coming back.

Managing Your Finances

Payment can be done one-time, multiple, recurring, or custom. Installment payment of loans and purchases are helpful for both the client and the business. They let people pursue desired transactions and let businesses regularly generate revenue.

An individual’s payment schedule is different from his or her budget plan. Both financial management tools let the person map out expenses and monitor where his or her hard-earned money goes. While budget plans help optimize and manage the totality of a person’s finances, payment schedule plans are a timetable of payables. The latter reminds the person when is the next date of payment and how much should be paid.

Businesses can choose to add or waive interest fees from installment purchases. They can use a payment schedule to show the clients how much should be paid and when. This is useful for purchases with corresponding interest. The table can show the raw price plus interest for clarity and transparency. Should the payment plan be flexible and dependent on changing things like a person’s income over time, the payment schedule can also show much should be paid in the event of changes.

Setting up a payment schedule is not as simple as marking dates on a calendar. The business has to prepare realistic payment plans. The plans have to appeal to customers as well as help sustain the business. The company or store have to gain information on the customers’ financial situation. The financial situation includes the customer’s capacity to pay the amortization, their transaction history in the store, and their credit history. Understanding the person’s financial situation before the business approves the loan is important. It helps you provide a payment plan that fits the customer. At the same time, you are less likely to lose money.

18+ Payment Schedule Examples

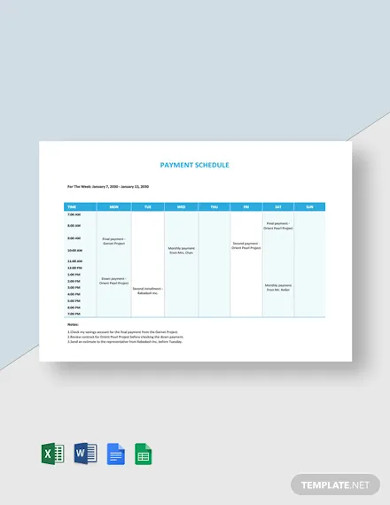

Organize your finances with up-to-date payment schedules. Peope can create one for themselves to manage their dues. Companies can also set up the fitting payment schedule for clients. You can include payment schedules in the forms that the customers fill in during transaction. You can also create a simple but handy guide for them to help them keep track of when they are scheduled to pay their dues. You can download and edit the following blank templates using familiar word processors.

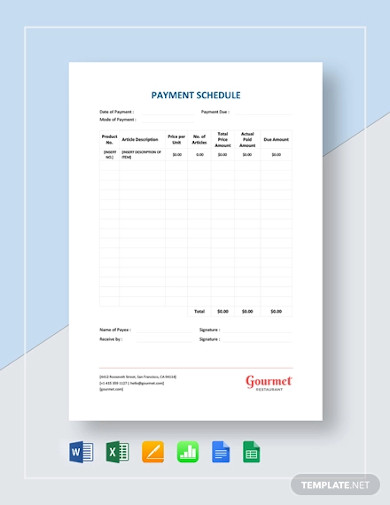

1. Payment Schedule Template

template.net

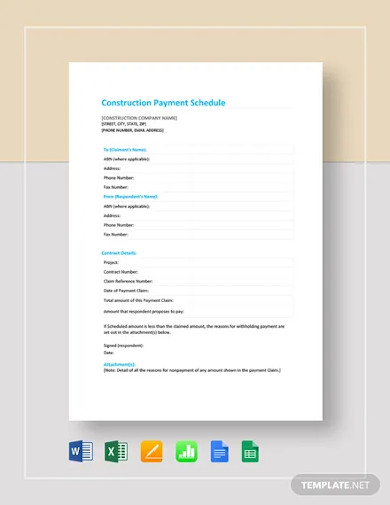

2. Construction Payment Schedule Template

3. Mortgage Payment Schedule Template

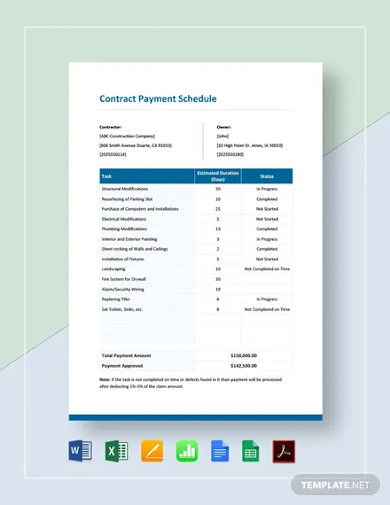

4. Contract Payment Schedule Template

5. Freelance Payment Schedule Template

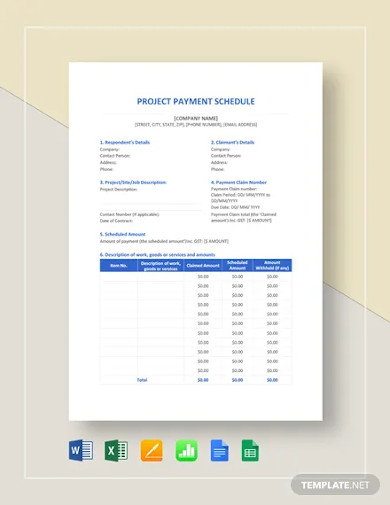

6. Project Payment Schedule Template

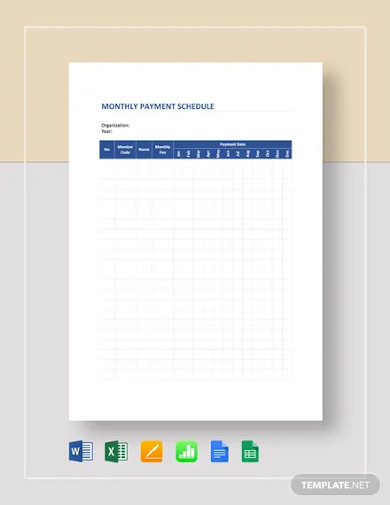

7. Monthly Payment Schedule Template

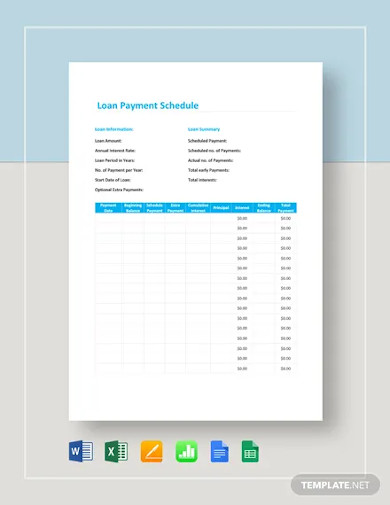

8. Loan Payment Schedule Template

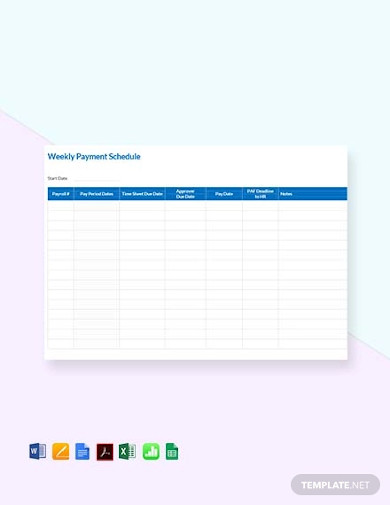

9. Free Weekly Payment Schedule Template

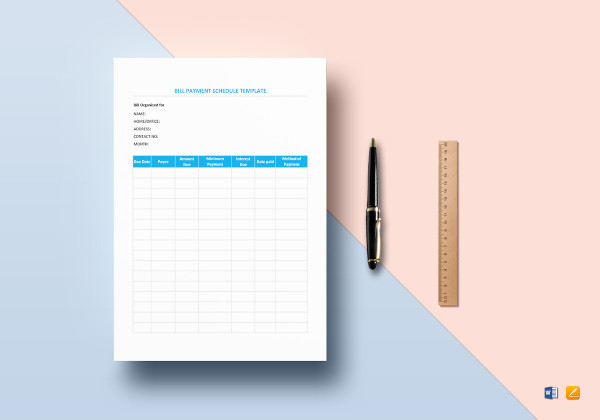

10. Bill Payment Schedule Template

11. Payment Schedule Example

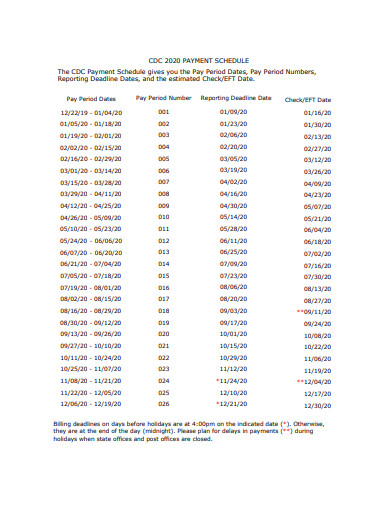

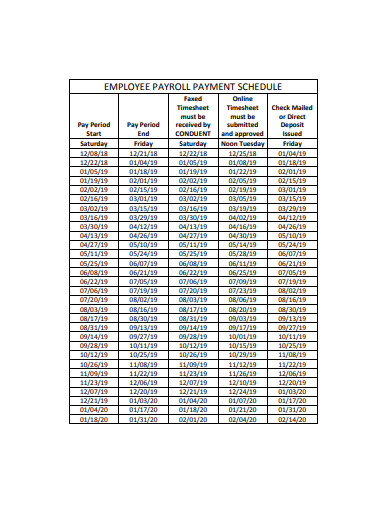

12. Employee Payroll Payment Schedule

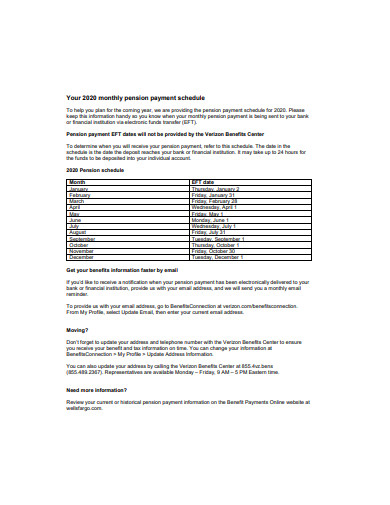

13. Monthly Pension Payment Schedule

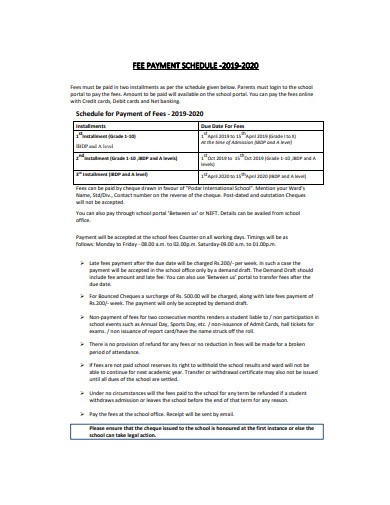

14. Fee Payment Schedule

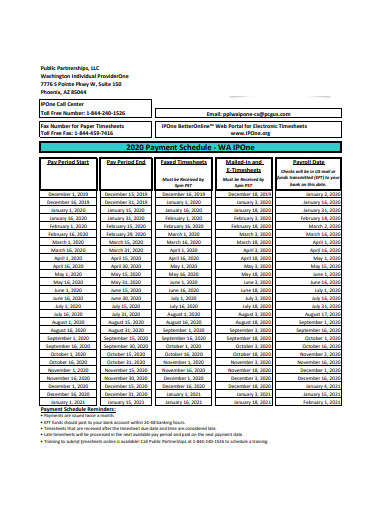

15. Payment Schedule Format

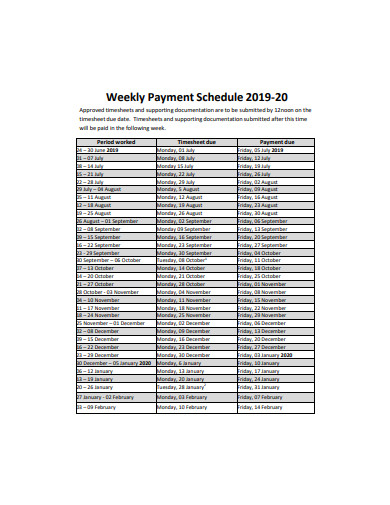

16. Weekly Payment Schedule

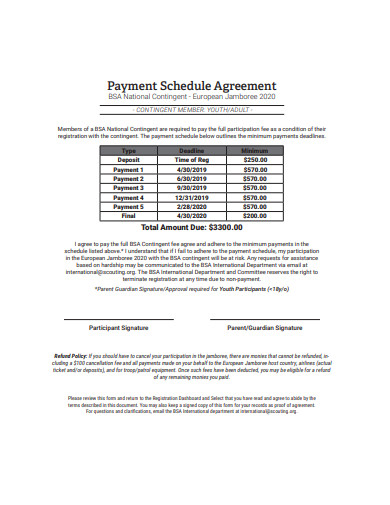

17. Payment Schedule Agreement

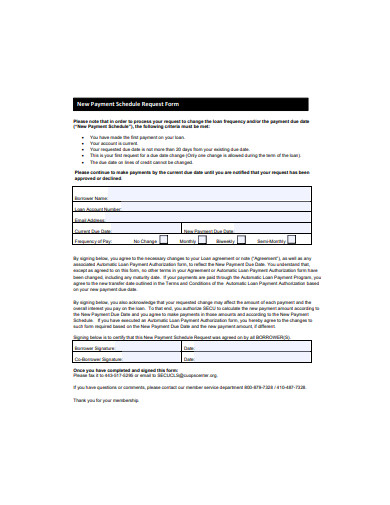

18. New Payment Schedule Request Form

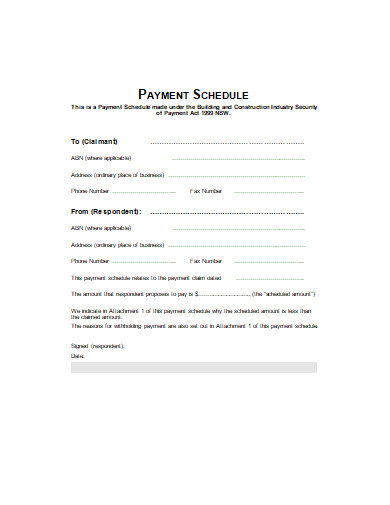

19. Payment Schedule in DOC

Using A Payment Schedule

Payment schedule helps one manage his or her finances. It also protects businesses, as well as gain and retain customers through the various bill payment options. Companies can monitor if the customers are keeping their end of the agreement. Having a payment schedule sheet with you is not the end of the story. Put the template you downloaded to meaningful use with the following tips.

1. Set Realistic Goal

Payment schedule is not the place to imagine what could be. If you have an existing subscription, list down all the figures down to the last dime. You should also keep receipts of payment for future reference. For institutions, do an assessment of the person’s financial situation. Can they make the steady payment? How long can they actually pay for the time? You and your clients should reach an understanding on how the results of the assessment matter in choosing payment plans. Realistic payment options are easier for the clients to pay, too.

2. Be Transparent

Business should be honest and transparent in reporting the amount to be paid, instead of indicating just the how much and the when. Add columns for the total price of the item, the installment payment amount, the interest rate, and the total payables. The last one can vary depending on how long the client pays for the item. This helps understanding of the payment terms. Normally, you would want clients to pay then and there. Installment payments are just an option if this is not possible.

3. Institute Reward System

Businesses should also provide incentives for paying early than the due date. Incentives can be points, freebies, or discounts on the amount to be paid. At the same time, add weight on late payments. The goal is to motivate the clients to pay ahead and not skip due dates. The processing time of the payment may take time, so clients should pay earlier. Always excusing the clients from late payments without corresponding fines will not be sustainable for your company.

4. Schedule Routine Review

Regularly review your payment schedule. You should have specific days dedicated to organizing your finances. You can invest on software and programs that will automate the review process and create a report for you. You can also do things yourself using word processors or printable sheets. Remember to do this well before the due date so that you will have ample time to settle unpaid balances and inconsistencies. As much as it is ideal that you pay every due, there will be times that this is not possible. Consider your top priorities and pay them first.

The benefits of pay-later options come with the responsibility to religiously review, monitor, and settle the unpaid balances. This goes to both the client and the institution. By setting up a payment schedule according to your needs, you can get ahead of due dates and deadlines. Businesses can avoid losing money. And customers can save money when payments are on time. Paying on time is also beneficial for a person’s credit score, and lets the person borrow cash with less difficulty should a need arise.