15+ Payslip Examples to Download

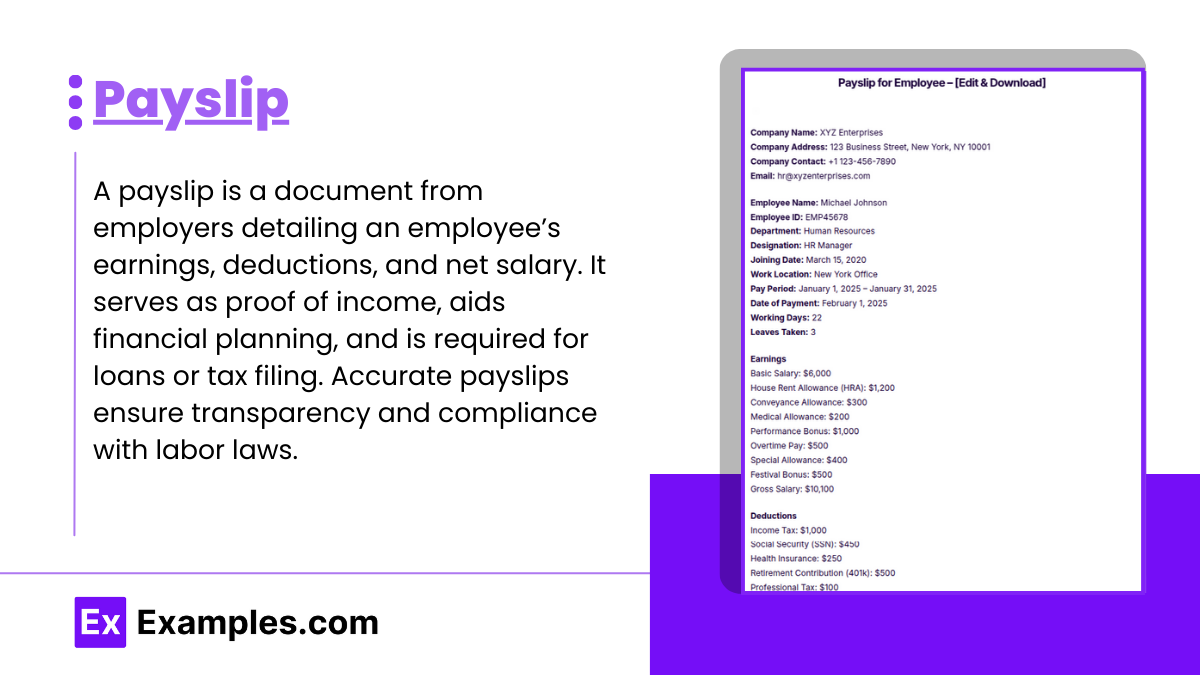

A payslip is a crucial document provided by employers to employees, detailing their earnings, deductions, and net salary for a specific period. It serves as proof of income, helps in financial planning, and is often required for loan applications or tax filing. A standard payslip includes information such as gross salary, tax deductions, insurance contributions, and any bonuses or overtime pay. Understanding your payslip ensures you are aware of your earnings and deductions, helping you manage your finances better. Employers must issue accurate payslips to maintain transparency and compliance with labor laws

What is Payslip?

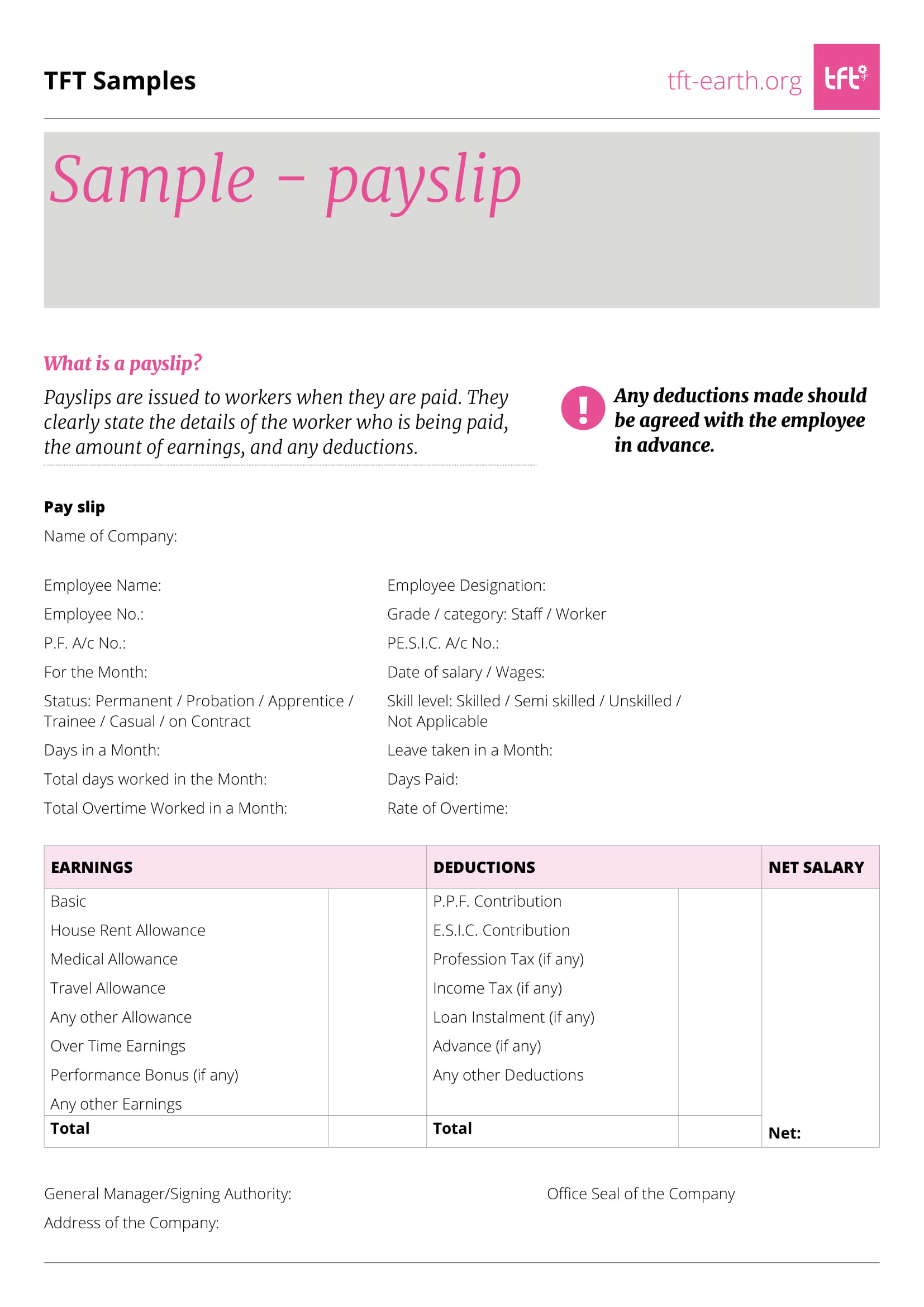

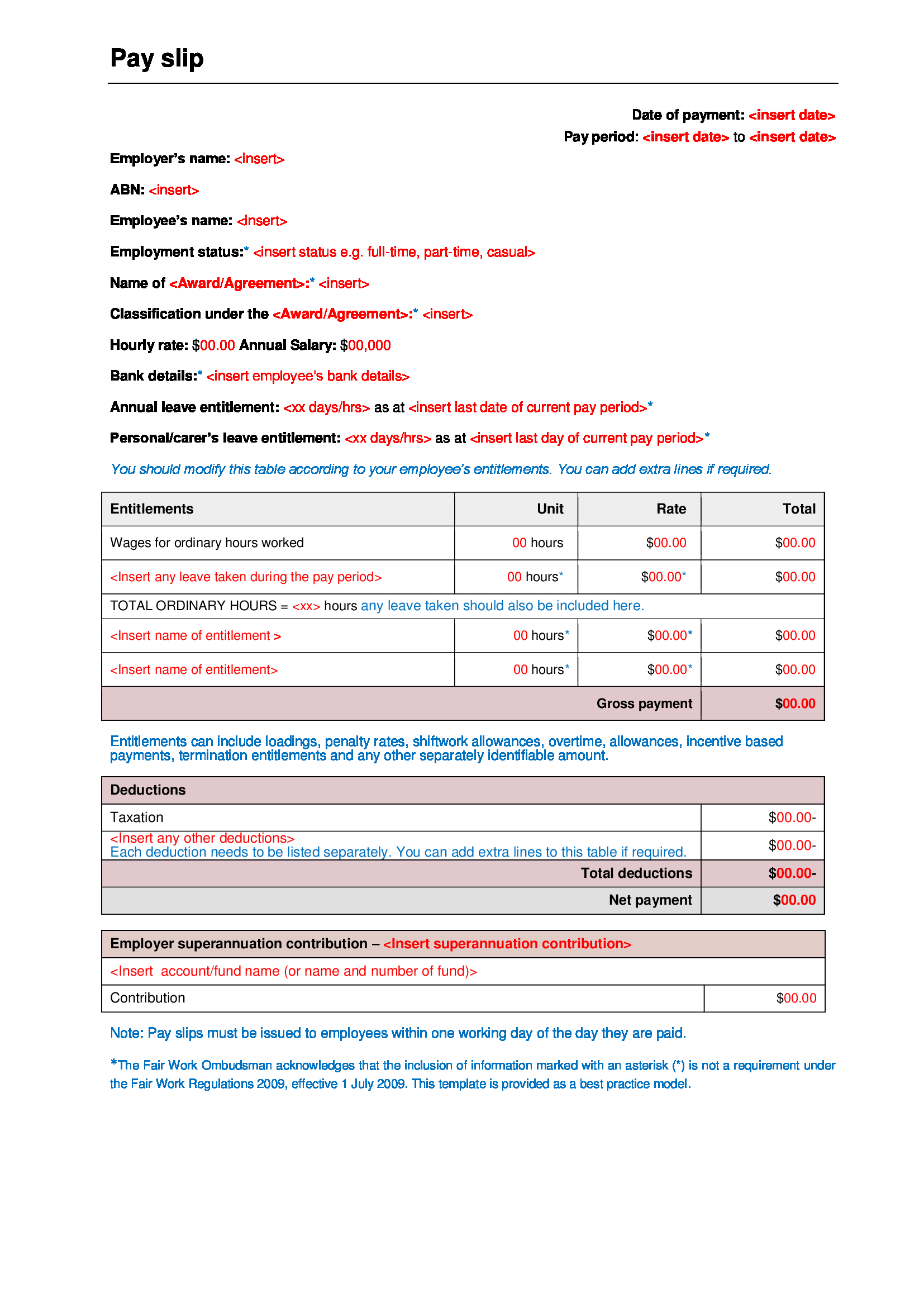

Payslip Format

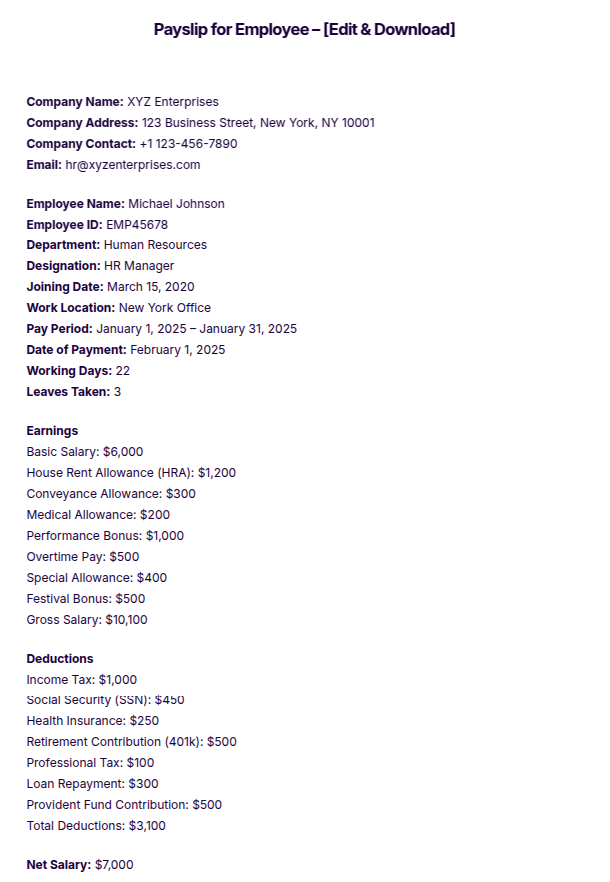

Employee Details

Includes the employee’s name, ID, department, and designation.

Employer Information

Contains the company name, address, and contact details.

Pay Period

Specifies the start and end date of the salary cycle.

Earnings

Shows basic salary, bonuses, overtime, and other allowances.

Deductions

Lists tax, insurance, retirement contributions, and other deductions.

Net Salary

Displays the final amount the employee receives after deductions.

Additional Information

May include leave balances, payment method, and employer notes.

Payslip Example

Company Name: ABC Corporation

Employee Name: John Doe

Employee ID: 12345

Department: Finance

Designation: Senior Accountant

Pay Period: January 1, 2025 – January 31, 2025

Earnings

Basic Salary: $5,000

Bonus: $500

Overtime Pay: $200

Total Earnings: $5,700

Deductions

Tax: $700

Health Insurance: $150

Retirement Contribution: $300

Total Deductions: $1,150

Net Salary: $4,550

Payment Method: Direct Bank Transfer

Bank Account: ****5678

Date of Payment: February 1, 2025

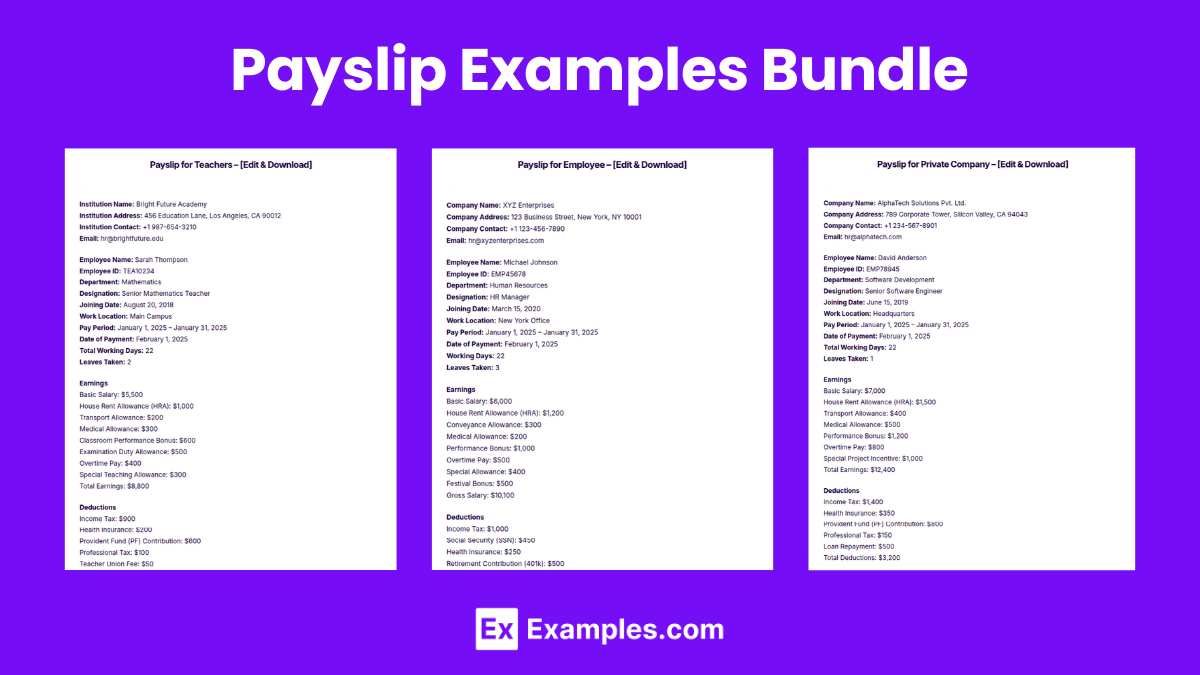

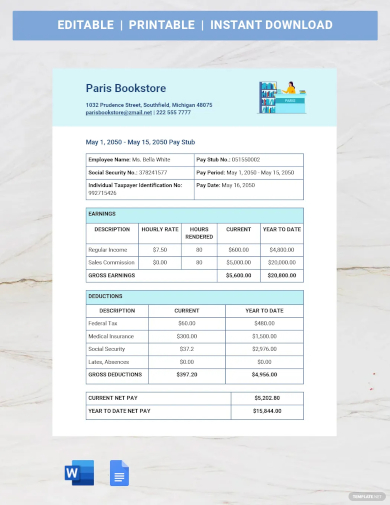

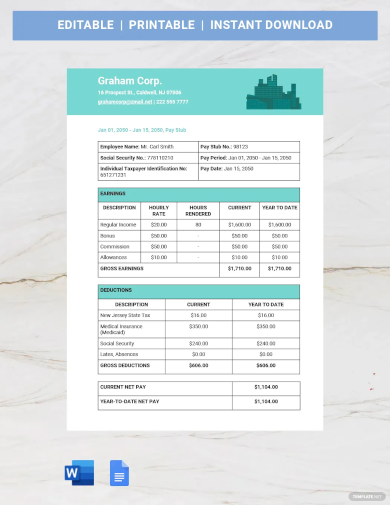

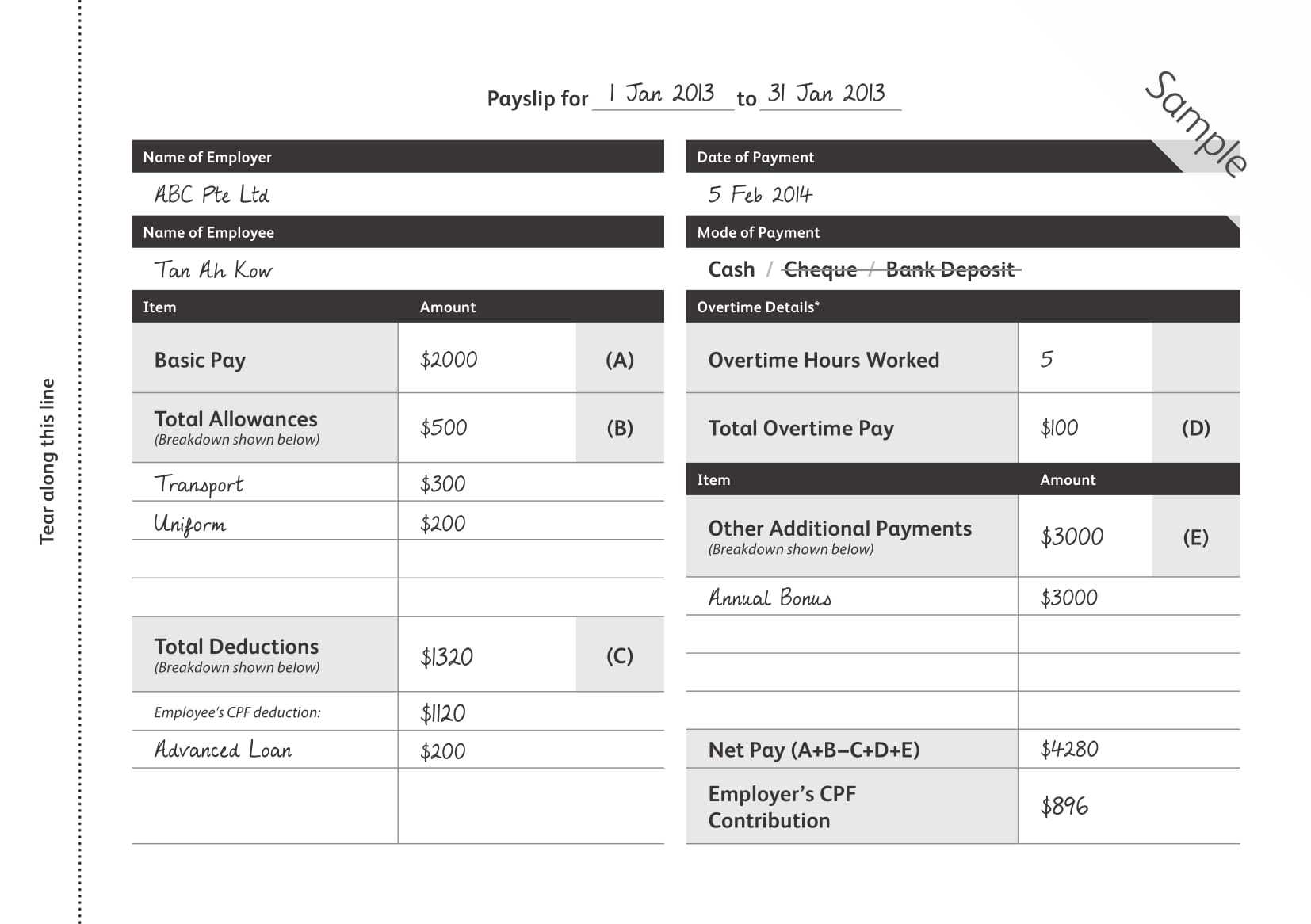

Payslip Examples

Payslip for Employee

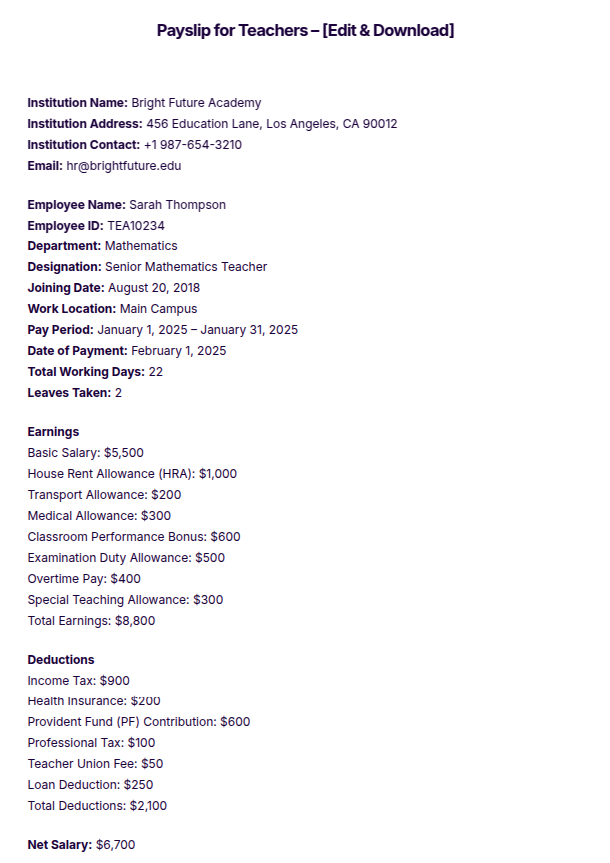

Payslip for Teachers

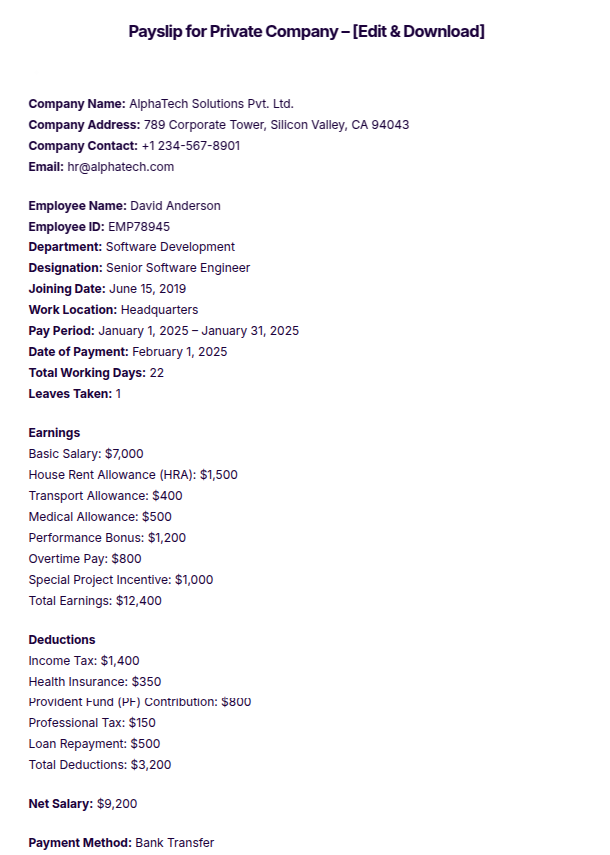

Payslip for Private Company

More Examples on Payslip

- Payslip for Government Employees

- Payslip for the Month

- Salary Sacrifice Payslip

- Ghris Payslip

- Umbrella Company Payslip

Payslip Template

Salary Payslip Template

Basic Payslip Template

Self Employed Payslip Template

Payslip Templates Example

Basic Payslip Example

Payslip Format Example

Payslip Template Example

Difference Between Payslip and Salary Statement

| Feature | Payslip | Salary Statement |

|---|---|---|

| Definition | A document given to an employee showing earnings, deductions, and net salary for a specific pay period. | A detailed summary of an employee’s salary over a longer duration, usually covering multiple months or a year. |

| Time Period | Covers a single payroll cycle (e.g., monthly or weekly). | Covers a broader period (e.g., quarterly, biannually, or annually). |

| Details Included | Basic salary, allowances, deductions (tax, insurance, etc.), and net pay. | Total earnings, total deductions, tax contributions, and bonuses over a period. |

| Issued By | Employer or payroll department. | Employer, HR department, or financial division. |

| Purpose | To inform employees about their salary breakdown for a specific period. | To provide a full salary record for financial planning, tax filing, or loan applications. |

| Usage | Used for verifying salary deposits, tax deductions, and loan applications. | Used for tax filing, financial audits, and employee salary history verification. |

| Format | A one-page document issued for each pay period. | A detailed report covering multiple salary cycles. |

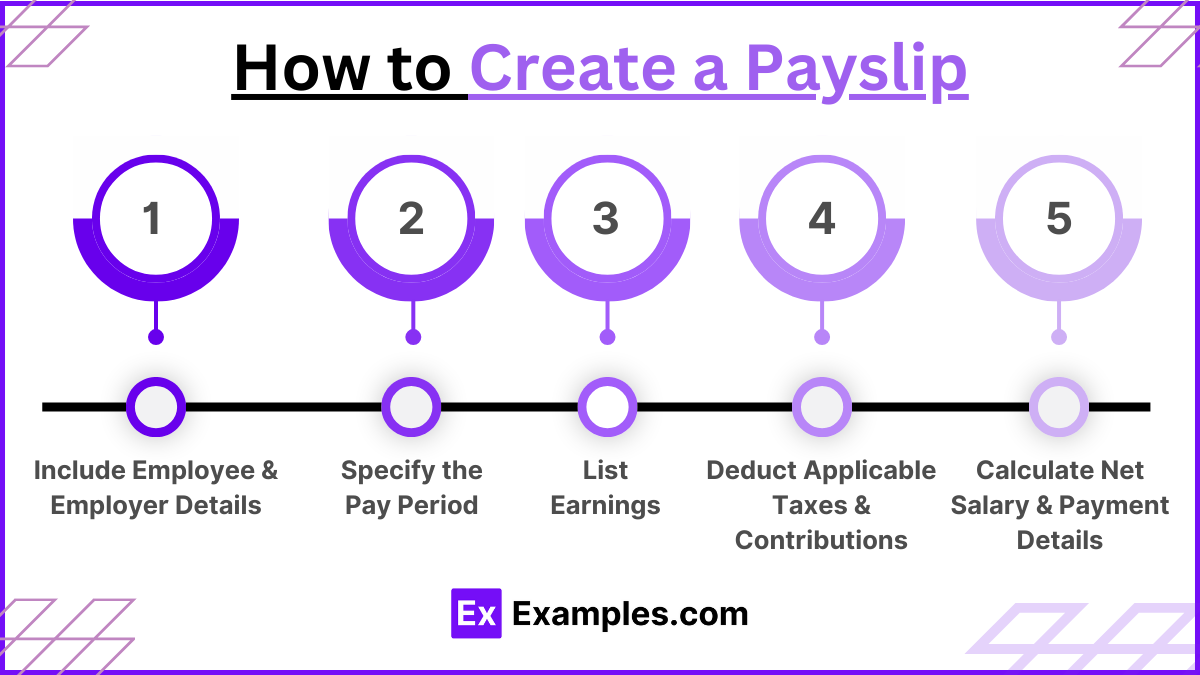

How to Create a Payslip

- Include Employee & Employer Details – Add the company name, address, employee name, ID, department, and designation.

- Specify the Pay Period – Mention the salary cycle (e.g., monthly, biweekly) and the payment date.

- List Earnings – Include the basic salary, allowances (HRA, medical, transport), bonuses, and overtime pay.

- Deduct Applicable Taxes & Contributions – Subtract income tax, provident fund, health insurance, and other deductions.

- Calculate Net Salary & Payment Details – Show the final salary after deductions and mention the payment method (bank transfer, cheque, cash).

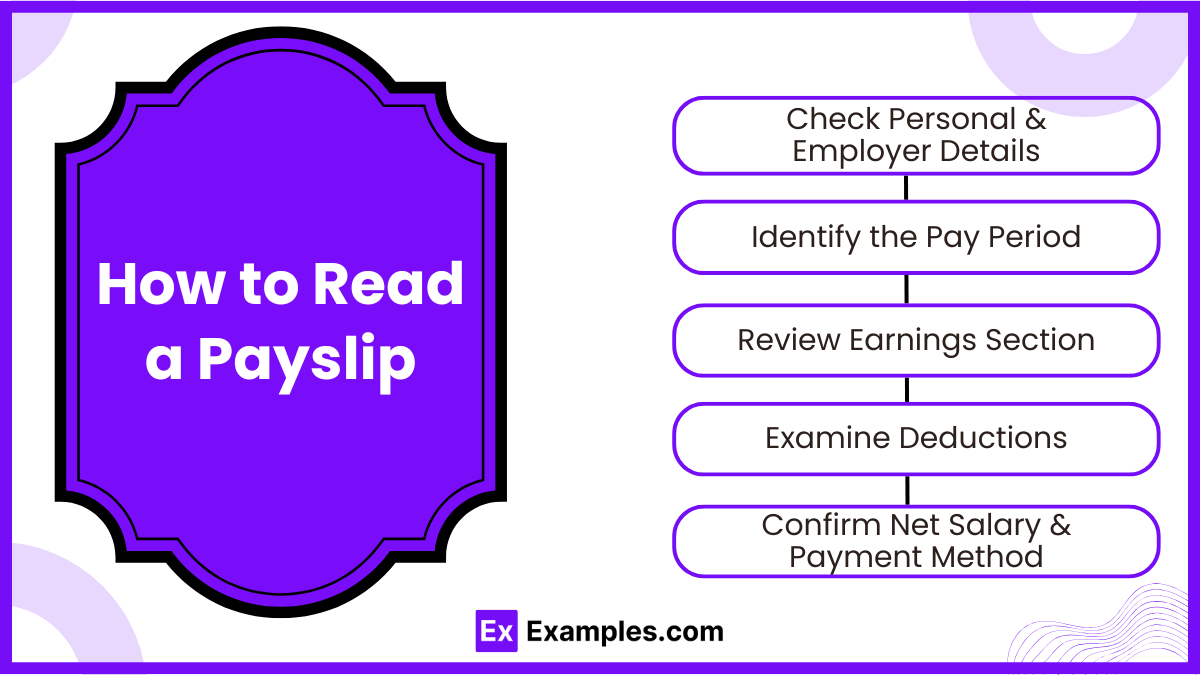

How to Read a Payslip

- Check Personal & Employer Details – Ensure your name, employee ID, department, and employer information are correct.

- Identify the Pay Period – Look at the salary cycle dates to confirm the period for which you are being paid.

- Review Earnings Section – Check your basic salary, allowances, overtime, and bonuses to verify your total income.

- Examine Deductions – Look at tax deductions, insurance contributions, pension, and any other withholdings.

- Confirm Net Salary & Payment Method – Ensure the final amount received after deductions matches the bank transfer or payment made.

Tips for Creating a Payslip

- Use a Standard Format – Ensure the payslip includes essential details like employee name, pay period, earnings, and deductions.

- Clearly Separate Earnings & Deductions – List basic salary, allowances, and bonuses separately from tax and other deductions for clarity.

- Ensure Accuracy – Double-check salary calculations, tax deductions, and contributions to avoid errors.

- Include Payment Details – Mention the net salary amount and payment method (bank transfer, cheque, or cash).

- Keep It Legally Compliant – Follow labor laws and tax regulations to ensure the payslip meets legal requirements.

FAQs

Why is a payslip important?

A payslip helps employees track their salary, deductions, and benefits. It is required for loan applications, tax filing, and verifying employment details. Employers use it for transparency and compliance with labor laws.

What information is included in a payslip?

A payslip includes employee details, earnings (basic salary, allowances, bonuses), deductions (tax, insurance, pension), net salary, and payment method. Some payslips also show leave balances and employer contributions.

How can I get my payslip?

Employees receive their payslip via email, HR portals, or printed copies. Some companies provide digital access through payroll systems. If unavailable, request it from your HR or payroll department.

Can I use my payslip for a loan application?

Yes, banks and financial institutions require payslips as proof of income when processing loans or credit applications. It helps verify financial stability and salary consistency.

What should I do if my payslip has errors?

Report errors to your HR or payroll department immediately. Incorrect deductions, missing earnings, or tax miscalculations should be corrected promptly to ensure accurate salary payments and tax compliance.