9+ Personal Care Agreement Examples to Download

Managing your finances is extremely important to your economic well-being. With the costs of everyday goods on the rise, controlling how funds flow through your account is essential for a number of reasons. But checking your balance online every now and then isn’t enough to keep you secured. Banks can only do so much for their clients, which is why it’s a wise idea to keep track of your personal transactions for further assurance.

One way to record your bank activities is through the use of a checkbook register. This can be useful when you want to make a withdrawal from your account, or need to write a check, for you to find out whether you have enough money in the account to cover it. So in this article, let’s take a closer look at how check registers are used along with how you can balance your checkbook correctly.

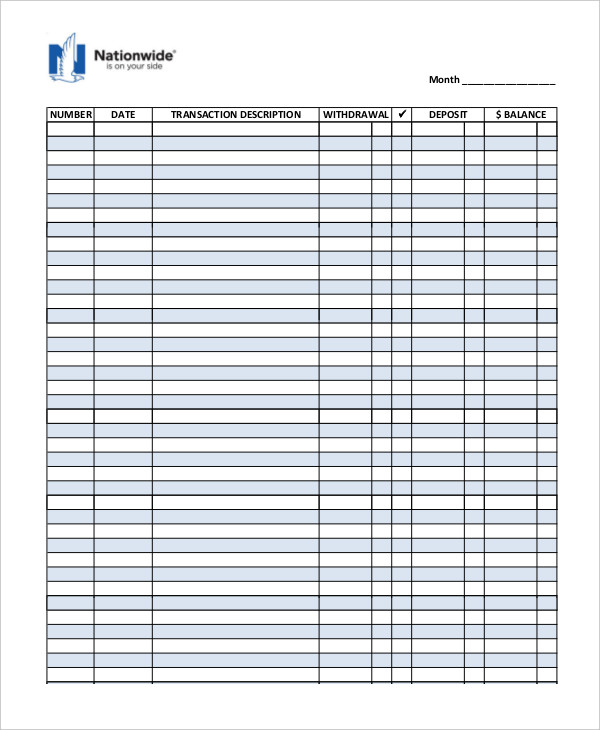

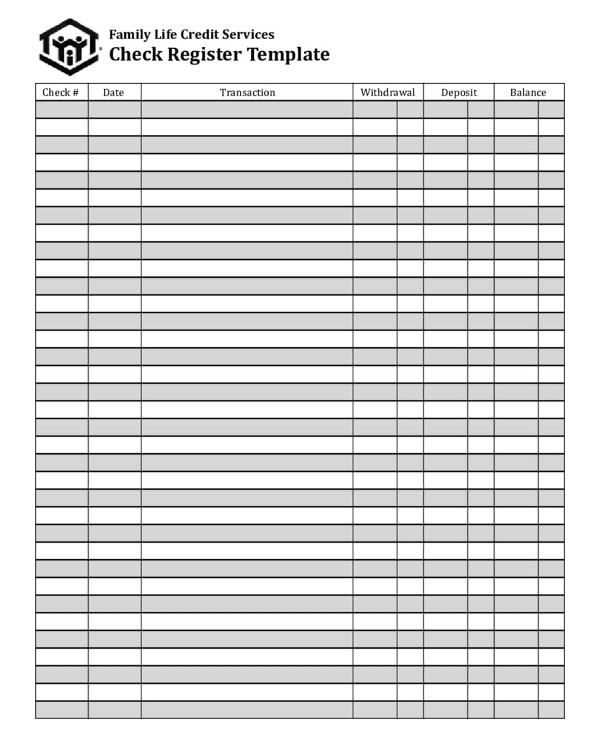

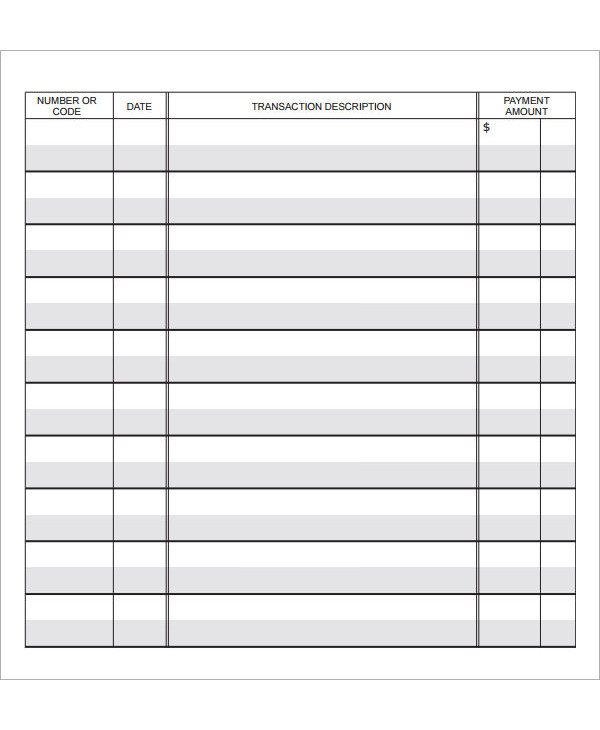

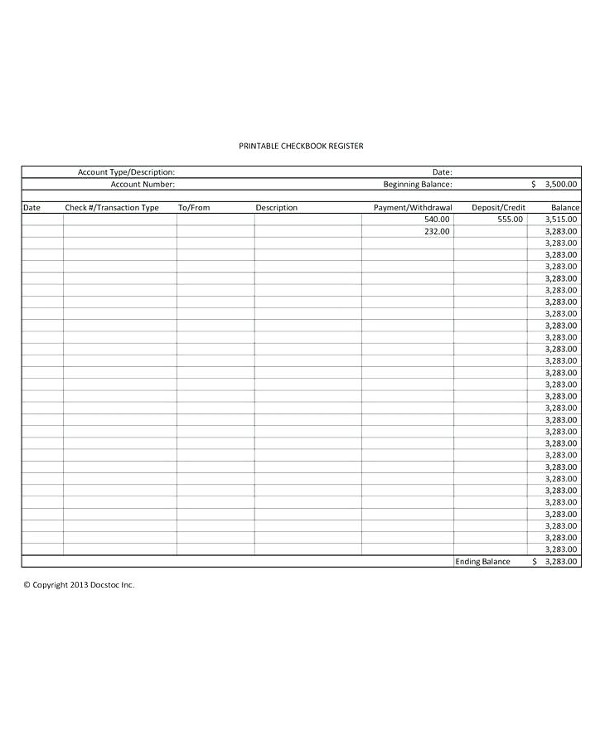

Checkbook Register for Personal Use Example

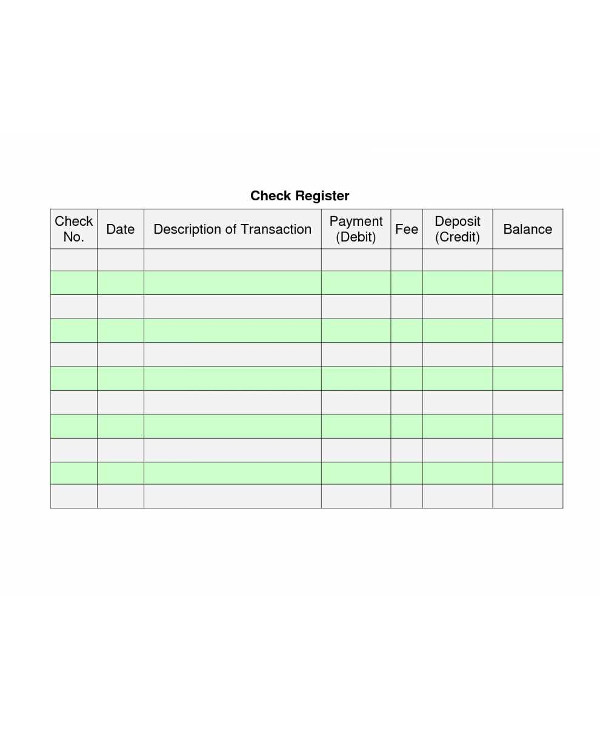

Downloadable Personal Checkbook Register Example

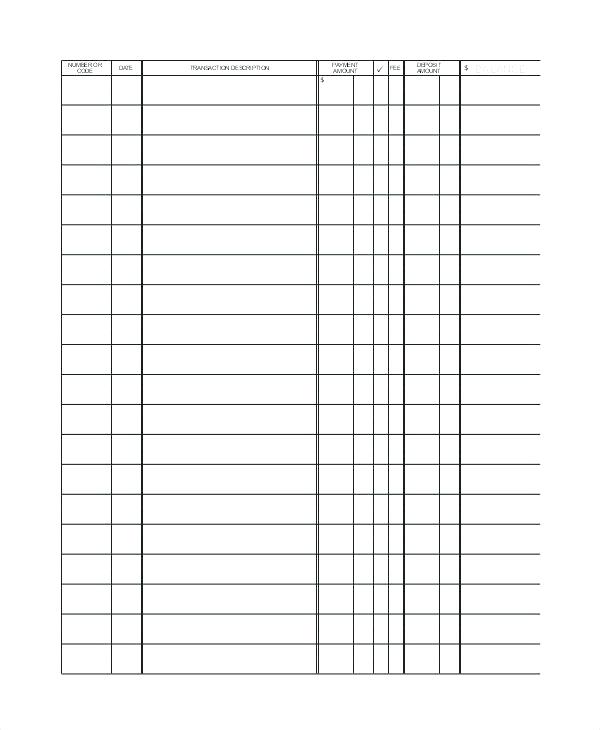

Print Personal Checkbook Register Example

What Is a Check Register?

A check register, which is also referred to as a cash disbursements journal, is a book used to document all of the cash payments, checks, and cash outlays during a particular accounting period. This allows you to view and continuously update your account balance, transactions that have yet to hit your account, as well as any withdrawals or deposits to your account. And for budget-conscious individuals, having a list of transactions in your bank account will let you know how much money you have available to spend. You may also see work attendance register examples.

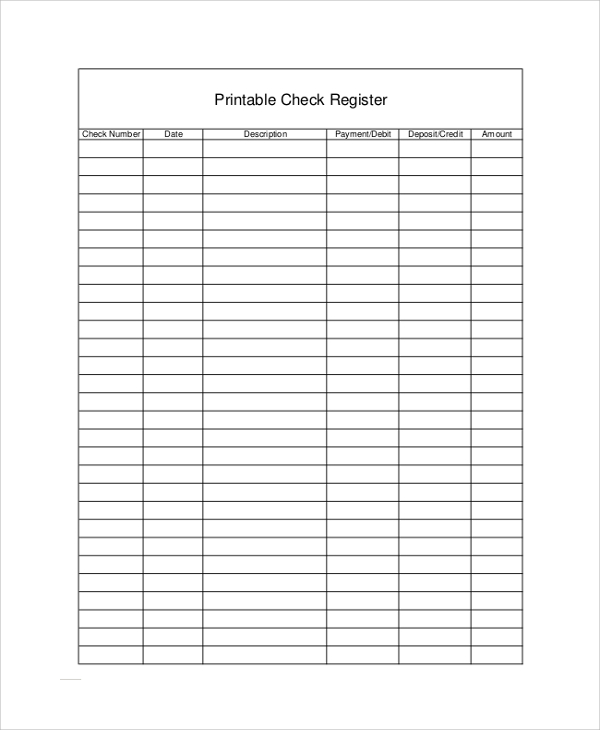

Check registers can come in many forms. You can use a blank paper, a mobile app, or even a spreadsheet template to keep your records in order. Homemade check registers are often preferable as opposed to electronic registers, as they allow users to customize their systems and track their personal accounts without having to purchase a new register whenever necessary. The list must be updated each time you spend or add money to your account. It’s also best to compare your check register with your bank records periodically to see whether they’re consistent or not. You may also see start-up business checklist examples.

As for check registers utilized in the field of business, these are typically used by bookkeepers to record transactions before they may be posted to the general ledger and other ledgers that are associated with the said transaction.

The accounts found in the register would usually depend on how the company functions. Say for instance, a retailer would have to deal with inventory payments, accounts payable, and salary expenses. On the contrary, the register of a manufacturer would likely consist of entries for raw material purchases and production costs. The journal should present an organized list of debited and credited accounts in each transaction, as well as its effect on the overall cash balance. You may also see attendance sheet examples.

1. The Purpose of Check Registers

Check registers can come in handy during various circumstances—be it for personal or business use.

For one, a check register can help you stay on top of activities in your account. Even if you’ve made it a habit to check your account balance online on a regular basis, you have to consider the possibility of this information being misleading at times. Just as much as you tend to occasionally forget about certain transactions, banks can make mistakes too. You may also see employee attendance form examples.

But with a check register, you can point out bank mistakes, avoid bounced checks, and report possible cases of identity theft. Suspicious activity in your bank account should be reported immediately to your bank for verification. Your bank can also assist you in resolving the problem to avoid further loss.

A check register can keep you updated on your current account balance as well. Knowing how much you can afford to spend at the moment, and whether you need to transfer money to your checking account to comply with the bank’s maintaining balance policies are also essential when managing your finances. Like for example, staying updated on these matters offers you a higher chance of avoiding overdrafts by transferring funds from your savings account to cover upcoming expenses. You may also see school receipt examples.

Always remember to update your register with every transaction made. When you write a check or use your debit card, make sure to record the transaction in your register immediately after. It’s a good idea to start saving your ATM and debit card receipts just in case. Also, consider getting a bank statement at least every month to review items that haven’t been reflected in your check register yet. This includes the fees that were paid to the bank, interest payments from the bank, and automatic or ACH transactions.

2. How to Get Check Registers

If your checkbook doesn’t come with a check register, you can easily get one from the internet or create one by yourself. There are many simple checkbook register templates found online that are made available for people to download and use freely. You can even order a new register from an online check printer or your bank for a reasonable price. But if you’re up for it, you can also choose to build a standard register in your favorite design or spreadsheet tool to avoid costs.

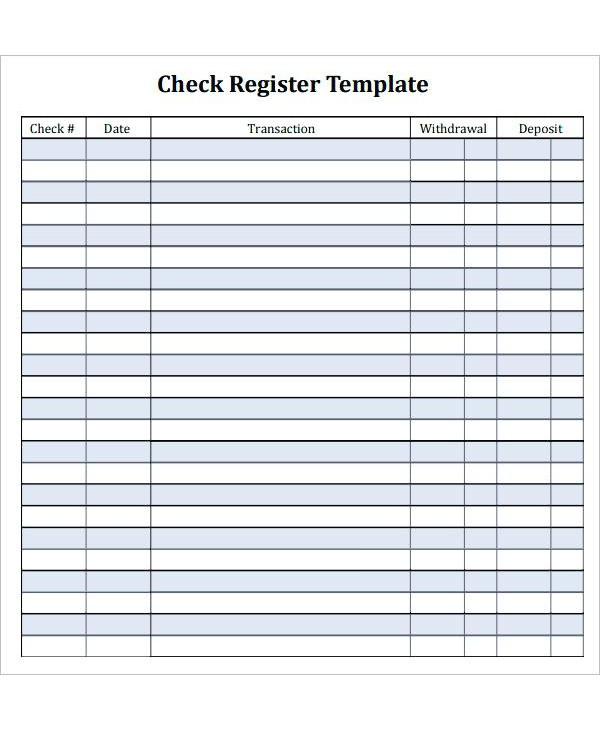

Personal Checkbook Register Example

Personal Checkbook Register List Example

Personal Checkbook Register Sheet Example

Personal Checkbook Register Template

7 Reasons to Start Balancing Your Checkbook

One of the best ways to get your finances in order is by balancing your checkbook. However, there’s nothing fun about balancing your checkbook regularly, especially when being forced to face your finances gives you nothing more than a headache. It can be a painful and frustrating process, one that involves nearly everyone’s worst enemy: math.

Fortunately, online banking and smartphone apps have made this dreadful task a lot easier for the average person to complete. So if you’re looking for a good reason to start balancing your checkbook, the following might be enough to convince you:

1. You can keep a close eye on your bank.

Balancing your checkbook each month can help you monitor your transactions and ensure that your balance matches your bank records. Banks are run by people, and as human as we are, we are bound to make mistakes sometimes. Since we’re usually given only 60 days to catch these banking errors, maintaining a regular schedule for balancing your account must be made a priority. You may also see petty cash log templates.

2. Overdraft fees tend to add up quickly.

Given how we’re already struggling to make ends meet, any extra charges caused by overdraft fees and bounced checks can burn an even bigger hole in our wallets. Returned checks can be costly, adding another $25 or more to your expenses for the month. But if you start balancing your checkbook as soon as possible, you’re less likely to incur low balance or overdraft fees.

3. Problem-solving is made easier.

There’s always a chance of a person encountering a banking problem at some point in their life. When this happens, not everyone seems to know where to start, especially if they haven’t balanced their checkbook recently. But to those who take the time to actually reconcile with their registers on a regular basis, you can simply review your transactions for the month and see what has caused the discrepancy. You may also see inventory checklist examples.

4. Even merchants make mistakes.

Like banks, companies commit mistakes as well, but they can’t always point it out before you do. To avoid paying $500 for a $100 item, you can take the initiative to balance your checkbook in order to verify that the amount charged for a particular product or service is exactly what you expected.

5. The opportunity for fraud is prevalent.

Cases of fraud has multiplied significantly in the past decade. While there are many ways for you to spend your money—between debit card transactions, online purchases, and ATM withdrawals—the opportunity for someone to hack into your account and steal your identity has also increased at an alarming rate. This is why it’s important for account holders to identify these fraudulent transactions by balancing their checkbooks. You may also see inventory list examples.

6. You can budget a lot better.

Many of us have developed a bad habit of spending money that we don’t have. This has left many of us drowning in a pool of debts for many months until we’re finally capable of paying them off. Thus, keeping a watchful eye on the transactions in your checking account is crucial in terms of budgeting. This provides you with enough insight to know exactly what your balance is for you to control your cash flow statements and reduce unnecessary expenses.

7. It can support your financial goals.

Many people find it difficult to save, despite having an income that’s more than enough to sustain their basic needs. Because of this, you have to make the most out of every money-saving opportunity available. Managing your checking account balance routinely can spare you from additional banking fees and prevent fraudulent transactions from taking over your account. Along with an impressive budgeting habit, you might be lucky enough to discover extra funds to add to your savings account, bringing you one step closer to accomplishing your financial goals.

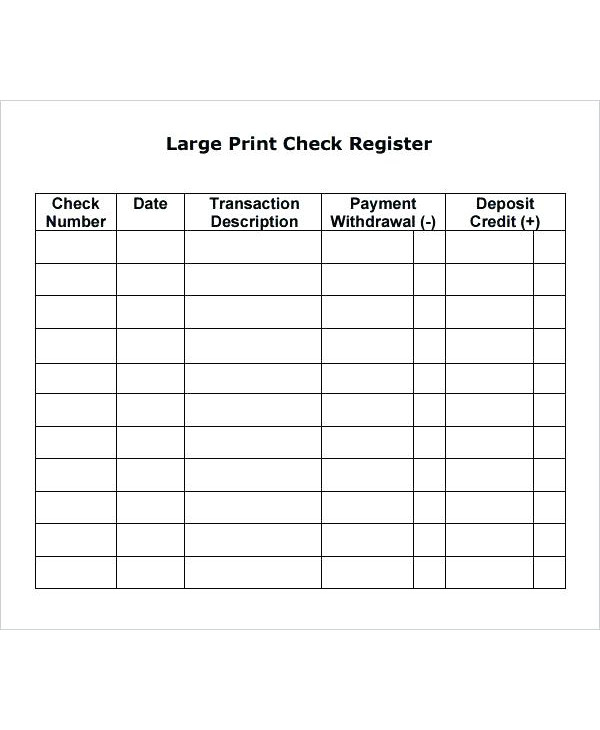

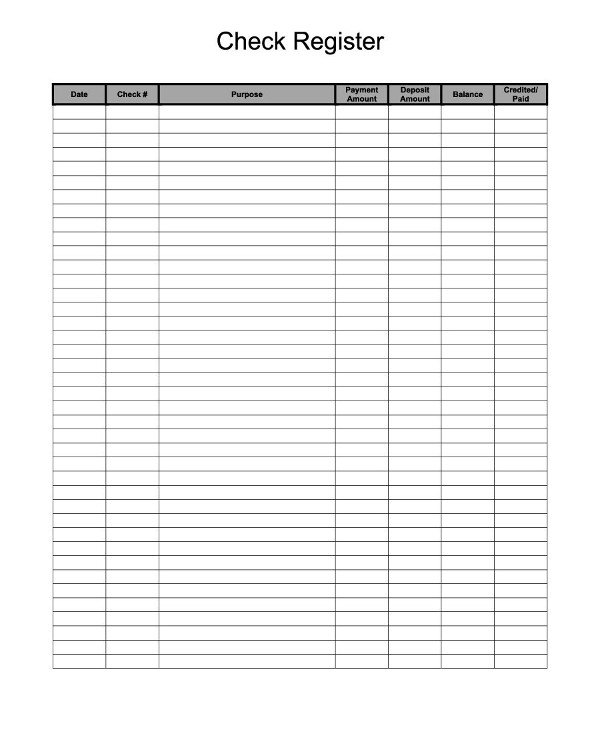

Printable Checkbook Register Example

Printable Personal Checkbook Register Example

Ready-to-Print Personal Checkbook Register Example

How to Make Checkbook Balancing Easier

If you’re having trouble balancing your check, here are a few tips that might help you get by:

1. Keep it up to date.

For every transaction made, you have to make sure it is recorded accurately on your checkbook. This includes your deposits, debit card purchases, and cash withdrawals. But if you write checks, consider a carbon-copy checkbook so you could secure a duplicate record for yourself. That way, you can easily verify the amount deducted from your account to see whether it is correct.

2. Record automatic bill payments and direct deposits.

It’s easy to forget about the payments emails that are deducted automatically from your account, since you don’t have to go through the hassle of visiting the bank to settle your dues. Direct deposits are another thing that people fail to take note of as well.

For this reason, it’s best to keep a separate list of these transactions to make them easier to monitor.

3. Set up your automatic checking account alerts.

Thanks to the advancements in technology, financial firms can now stay in touch with clients via email and SMS alerts. If they notice something questionable in your bank account, they could easily send you a text or email regarding the matter to keep you informed. You may also see baby registry checklist examples.

4. Switch to online banking.

With your busy work schedule, you probably don’t have the time to visit the bank to check your account. The good news is, most banks offer online banking to clients, allowing you to review your bank statement to make reconciling differences much easier. It’s also a convenient, safe, and less expensive option for people to use.

Though you may not take pleasure in recording every single transaction, nor is balancing your checkbook an amusing experience, but you’ll come to find that having a personal checkbook register in place can help you save money and prevent future headaches from arising. This way, you can effectively manage your finances for a better and brighter future. You may also see risk register examples.