Petty Cash Register

You may already have heard the term petty cash, but you actually have not used it. And if ever you already have used it, you were not sure what it really meant. In your office, when there is a need for a change, such as when someone buys a box of goods, and the change is just less than a dollar, it would be too awkward to make fuss on such a small amount. So where do you get that small amount? You may also see petty cash log templates.

Or when you want to order some snacks in the office and you do not feel the need to do some check payments, where do you think you should get your payment? Or a package delivery arrived in your office, and the delivery guy ask for some local shipping charge. It is just some few dollars, but where do you get the amount anyway? You get them from the petty cash register. So what is a petty cash register?

Here, we discuss some concepts that surround the not so familiar but present petty cash register.

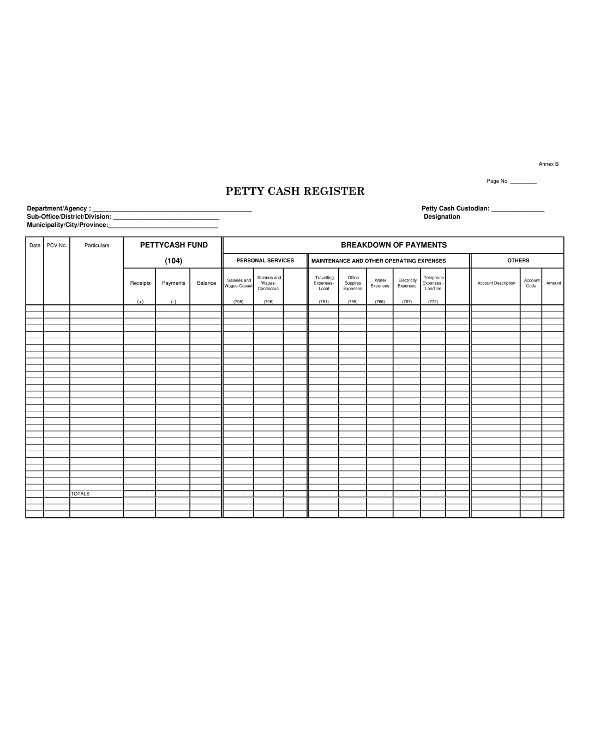

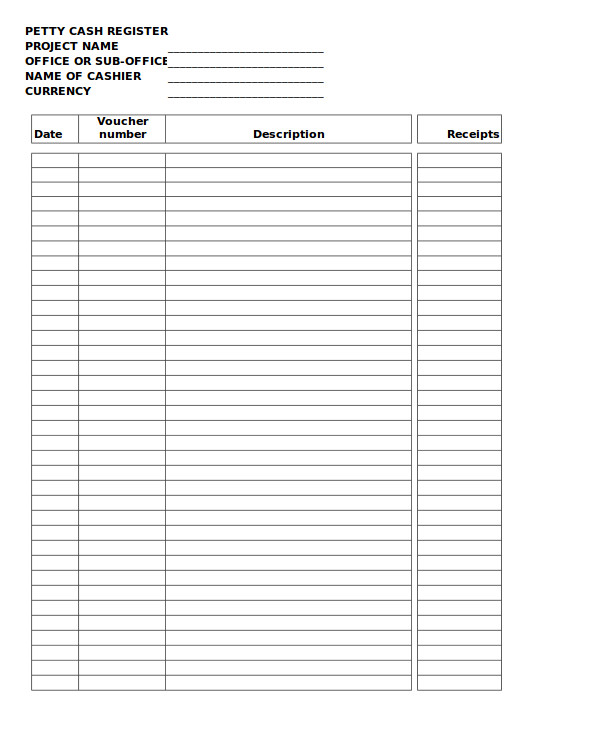

Petty Cash Register Example

Petty Cash Register Basic Example

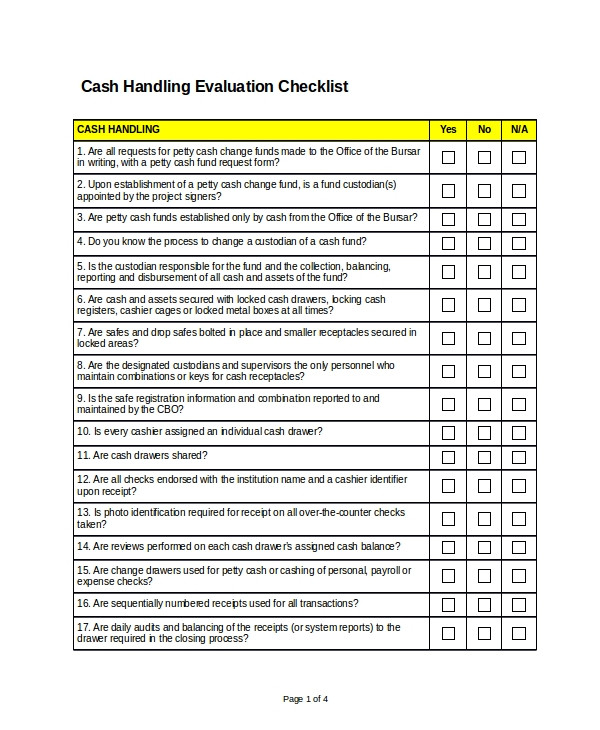

Petty Cash Evaluation Checklist Example

Cash Register FAQs

1. What is a petty cash?

It is an accessible store of money kept by an organization for expenditure on small items.

2. What is a register?

A register is a safe where you place small items, or small documents.

3. What is a petty cash register?

A petty cash register is where someone gets small amount of money for trivial expenses, such as a change or a tip you give to someone who delivered your package. You may also see check registers.

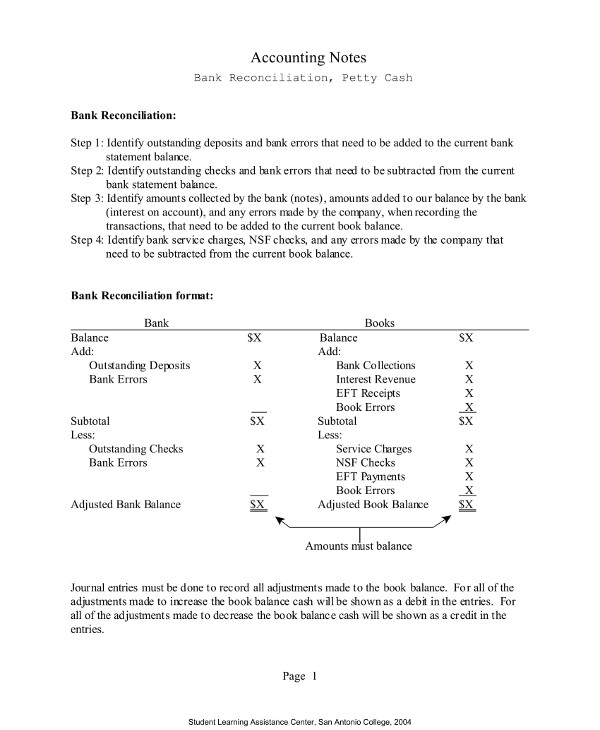

Imprest System

Imprest system is a kind of financial accounting system, and petty cash is a kind of imprest system in which there is a reserve amount to be used for small expenses. When spent, it will be replenished to maintain its fixed amount. You may also see checkbook register examples.

What Are the Uses of a Petty Cash?

The very purpose of a petty cash is to allow for the reimbursement or purchase of minor, small-dollar (less than $100), unanticipated business expenses, where the use of alternative means is neither feasible nor cost effective. These amounts may seem too small to be included in the accounting. Although they are too small for an accounting, the whole budget for these expenses should be accountable, at least on a regular basis. You may also see blank receipts.

Audit Controls

Because a petty cash is usually open to anyone, it can always lead to an abuse. For one, it does not require too much of an accounting. And because it is too small, no one really cares about its current status, except for the one in charge. A petty cash is like a coffer or a sugar in a jar. It is there for everybody’s consumption. And when it becomes empty, that is when people start complaining. You may also see log templates.

But it is always assumed that a petty cash calls for recording every time there is an expenditure.

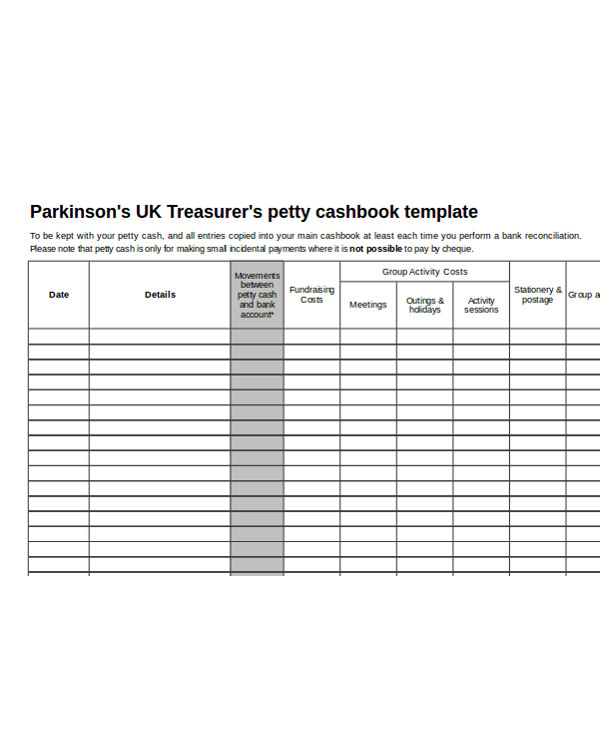

UK Petty Cashbook Example

Petty Cash Notes Example

Petty Cash Procedure

Different establishments have their own distinctive procedure in maintaining order for their petty cash funding. But here are basic ones on how it may be operated.

- Contact the petty cash in-charge. Verify if there is an available petty cash.

- Get a petty cash form.

- Fill out the request form for petty cash, indicate what is needed to be purchased, and how much is needed for the purchase.

- Let the administrator or the custodian review your request for approval. He will double-check your purpose for proposal and signs it if there is nothing questionable in the form. You may also see printable phone log examples.

- The petty cash in-charge (custodian) will give you the money as written in the request form. The custodian will also record all necessary information in the request of the money, how much was taken, who requested it, who gave the permission and the money, the exact time, date, the kind of purchase, etc.

- Make a report of the purchase, return the change, provide copy of the receipts of the purchase, etc., to the custodian. You may also advertisement flyer design.

- The custodian verifies the purchase. He will make a confirmation that the purchase has been made and that the money was coming from the petty cash register. Included in the documentation are the dates, names involved, items purchased. You may also see digital billboard examples

The important thing of petty cash register is documentation. Regardless of the amount withdrawn from the petty cash register, if it is not documented, that will always be considered a trespass.

Petty Cash and Cash Register Floats Example

Saqa Petty Cash Examples

Shortcuts Fusion Petty Cash Example

Custodian vs. Reconciler

In the world of petty cash register, there is one person that plays a big importance: the custodian. A custodian is the person responsible for keeping the petty cash register. The reconciler, on the other hand, we try to define in the following section:

Responsibilities of a Cash Petty Fund Custodian

1. Keep Petty Cash Safe

The custodian is responsible for making sure that petty cash funds are safe at all times and that it is attended by an authorized person (in case when he is not around). The register must be locked at all times. If number combinations are used, it is advised that only a few, at least for just two, individuals will be allowed to access the register. The standard is that only the custodian will know the pin or will have the key, and there may be one back-up person.

2. Separation of Duties

It should be discussed by the staff that the custodian is only a custodian and that the person in charge for double-checking the register is not the same person as the custodian. This is because the goal is not just to check the register but also to double-check the custodian. You may also see petty cash policy examples.

3. Reconciler’s Duty

The custodian is the custodian, while the reconciler is the reconciler. They have two different jobs, respectively speaking. The former is for making the register safe, the latter is for double-checking for errors. He will check if there are any unrecorded reimbursements. You may also see baby registry checklist examples.

4. Regular Accounting by the Reconciler

The reconciler must make sure that he will make a regular accounting of the balance available in the the petty cash. This will help avoid issues such as tracking undocumented reimbursements. To avoid such issues, the use of a petty cash reconciliation form is advised.

5. Regular Replenishment

Replenishment of the petty cash funds should occur on a timely basis (within 30 days) and should follow the procedures identified in Procedures for Replenishing Petty Cash Funds. You may also see simple checkbook register examples.

6. Separation of Expenses

Petty cash funds are for petty expenses and are not to be mingled and be confused with other funds.

7. Verify before Getting Petty Cash Funds

Every establishment or institution has its own terms for which the petty cash is to be used. Always see to it that your expenses are in line of your program. If not sure if the expenses to be used is part of the program or not, always ask, or check for guidelines. Are travel expenses allowed? Are expenses for food allowed? Are expenses for buying papers allowed? You can request your institution for the petty cash procedure. You may also see inventory examples.

How to Reconcile Petty Cash

It is important that there is a reconciliation of petty cash once in a while. A regular scheduling of reconciliation is standard. But many establishments adopt random scheduling of reconciliation. This is helpful when checking irregularities, such as undocumented expenses.

Undocumented expenses are the most difficult issue to settle since it is hard to trace its root problem. Unlike wrong kind expenses, but with a documentation, it can still be traced. Hence, it is important to always make a documentation every time there is an expense made from the petty cash. That is the use of a petty cash form or log sheet. You may also see work attendance register examples.

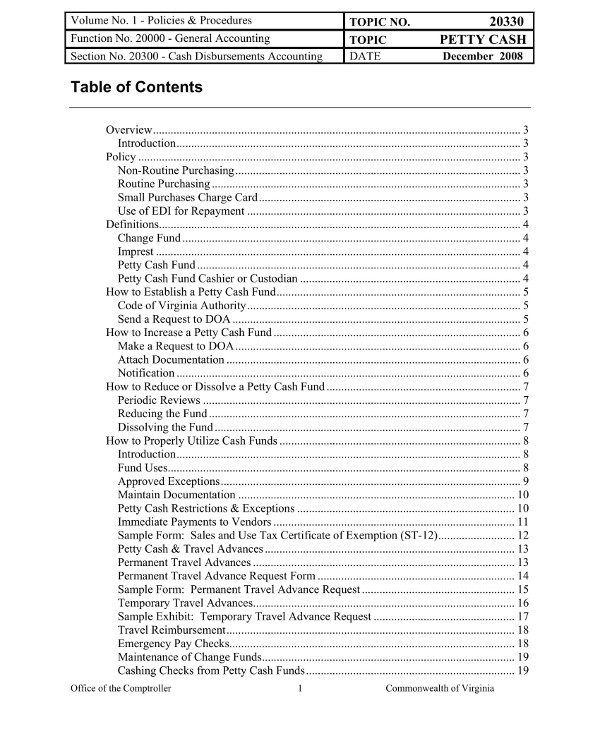

DOA Petty Cash Example

Fiscal Procedure Petty Cash Example

Purpose of a Petty Cash Reconciliation

The purpose of a petty cash reconciliation is to keep track on what is going on in the petty cash register. It is not just about checking about the irregularities that sometimes might happen in an accounting. Consider it a standard operating procedure in maintaining a petty cash documenting. One can always skip a petty cash reconciliation, but it is when there’s some anomalies that such procedure will always be needed. You may also see risk register examples.

To check anomalies, one can always start checking if there are any undocumented disbursements. This is done by matching the amount withdrawn from the register, to the actual purchase of items. If they match, including the change, the transportation fare, then there may be no problem in the accounting. If it is the other way around, if there are mismatches, if there are things not found in one document but is present in the other, if there are inconsistencies throughout, then that is where a petty cash reconciliation shines.

In another case, most custodians are not fully credible accountants. They are not accountants, actually. They are not bookkeepers. In short, documentation is not really their thing. So an incorrect recording of reimbursement from a custodian is not a far-off or a remote idea. It serves as an early warning device. You may also see check register templates.

Amajuba Petty Cash Example

Setting Up a Petty Cash

To set up a petty cash, you need to know an estimate of how much you (the people in the office) spend every day or monthly. Figure out what you usually spend for in day. What purchases or expenses do you usually have on a regular basis? Do you buy lunch in your office regularly? How frequently do you need to give change to your customers?

Next is to decide what kind of register to use. A cash register may look just like any register you see in a grocery store. The advantage is that there is a division of cash, for paper monies, and for coins. But any safety deposit box will do, as long as it can be locked. You may also see attendance sheet examples.

If you go for a cash register, there may be three types: the electronic cash register (ECR), computerized systems, and MPOS. But they may be too complicated for a simple task as just withdrawing a small amount of money. The other option is just a safety deposit box. This is less complicated although a bit expensive. But this will do the job of keeping the money safe, as well as making sure it is always locked, and not too easy to be carried around by anyone. And most of them are bullet and fireproof. But isn’t it an overkill?

Well, if you really want a simpler one, you can just get any deposit box of your choice. Just make sure it will really serve the purpose of a petty cash. If your company is not that big, and you only have a small amount to put in for the petty cash, why not?

Petty Cash vs. Cash on Hand

At some point, we may encounter how people interchange petty cash with the terms cash on hand. Are they the same? Technically speaking, petty cash and cash on hand are not that far off. While a petty cash is the specific cash that can be pulled out from the employers, that is when there’s a need for incidental small payments, cash on hand may not only include the petty cash but the cash that the company has that can be spent, which may not necessarily be incidental, such as for the petty cash expenses. So, they are almost the same one way or another, but there are nuances. One may interchange the meaning, but it should be noted that petty cash is more specific, the cash on hand is broader. You may also see business checklist examples.