Financial Risk Management Plan

Risks are always present in many business operations. That is why the use of risk managements are essential especially if you are going to identify revenue leakage. Of all the types of risk that your business might face, the financial risk has the most impact on your cash flows and other business aspects. All you have to do is to anticipate this risks with a quality financial management plan at hand.

The financial risk management techniques must be able to guard all the business assets starting from your own money down to the funds of the company. Uncontrolled expenses might cause your business to fall out. Sometimes, the huge amount of budget will not even matter especially to the fact that there will be always a danger facing the damaged financial balance. This will only exist if a business do not even have a concrete business financial plan.

4+ Financial Risk Management Plan Examples

1. Financial Risk Management Mitigation Plan

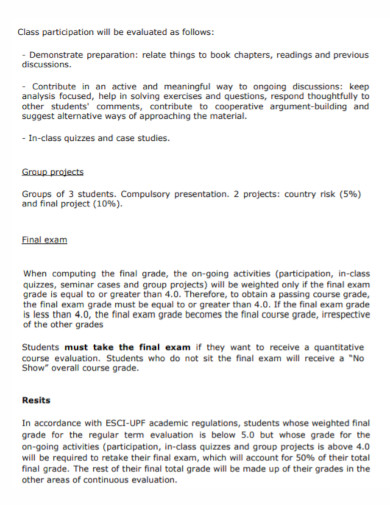

2. Financial University Risk Management Plan

3. Teaching Plan for Financial Risk Management

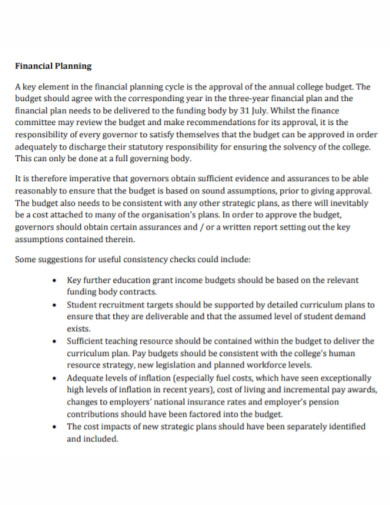

4. Standard Financial Risk Management Plan

5. Financial Risk Agricultural Management Plan

Financial Risk Management Definition

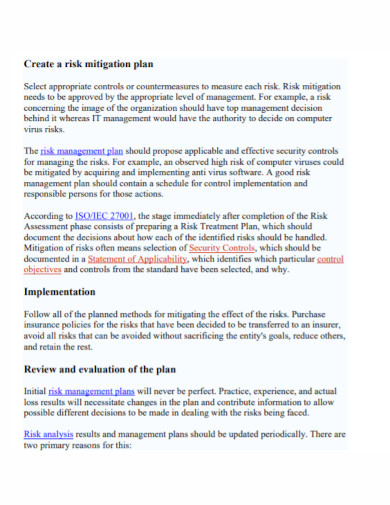

A financial risk management is a sort of process that enables you to understand and manage all the financial risks that your business has. It is not just about finding ways on how to eliminate risks, but it is also about understanding what risks you are willing to take, what risks you would rather avoid, and how you are going to develop a strategic plan based on those given risks.

The key for having an effective financial risk management is to take an action plan. This composed of procedures, practices, and even policies that your business will use. The plan itself will make it clear what a business can do and cannot do, what decisions needs to be escalated, and who has the responsibility in case any other risk will arise.

Financial Risk Management Strategies

Before you are going to plan out for financial risk management strategies, you need to acknowledge first the types of risks.

1. Identify the Risks

You must know what you are up to especially if you are holding a business. The assets you have in the company are not immune to human errors. You should be able to identify the types of risks firsts. These may be a credit, liquidity, foreign investment, market, operational, etc. Aside from that, external hazards also exist. Unfortunately, you cannot be able to control these situations nor predict it.

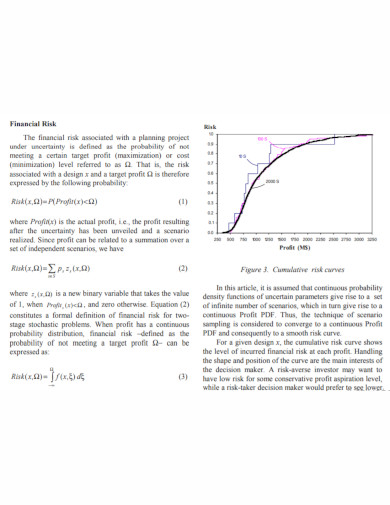

2. Measure the Financial Risk

Make sure that you are able to quantify each of the liability in your list. These rely mostly on statistical models, so you have to seek help to professionals or in a specific tool in calculating the numbers.

3. Learn more about investments

Financial risk management plan should always take the idea of investments. Take time to learn more about the idea of investment market. Read more into websites, blogs, articles to be familiar with the concept of investment.

4. Turn to Insurance Policies

This is one of the essential point in creating a well-structured financial risk management plan. Insurances have already become a must in the society nowadays. However, you should also include health insurance. Do some research and find the best form of insurance to sign into.

5. Build an Emergency Fund

It is always important to take some precautions and have in mind to never hurt anybody. Emergency funds are life-savers to some of the financial risks that you might experience,

6. Invest in your Skills

Commit to your professional career as possible. Most people will always think that whenever you become irrelevant in the workplace, you will be easily replaced. Avoid being too complacent and start accepting the challenges that you know will help in enhancing your skill.

7. Diversify your Income Sources

You income source might also suffer from financial crisis, but there is a small likelihood that it will happen. Financial diversification has been one of the reliable financial risk management strategies. It will always be with you whenever a risk will turn into a reality.

FAQs

What are the different types of risks in business finance?

The types of risks include operational risk, foreign exchange risk, credit risk, and reputational risk.

How do you implement financial risk control?

Some of the stages that implements financial risk control involves identifying risk exposures, quantifying the exposure, and making a decision.

Who manages financial risk?

On behalf of the company, it is always the financial risk manager who is responsible for managing the risk and make recommendations for an action plan.

Financial risk management has always been an avenue that practices protecting the economic value of a specific firm. They make use of financial tools or instruments to manage ones exposure to the various risks such as the operational risk, foreign exchange risk, credit and reputational risk. You just have to make use of the given financial risk management strategies that will help you handling your business.