18+ Payment Plan Examples to Download

Paying for debts and expenses in large amounts can be difficult. Those who lack financial stability have even less chances of accomplishing this, which can cause further problems like rising consumer debt. With the help of proper debt payment management, the necessity of a payment plan becomes utterly clear. In this article, you will not only learn about payment plans but also gain samples through our list, like the payment plan agreement template.

18+ Payment Plan Examples

1.Payment Plan Template

2. Free 30 60 90 Payment Plan Template

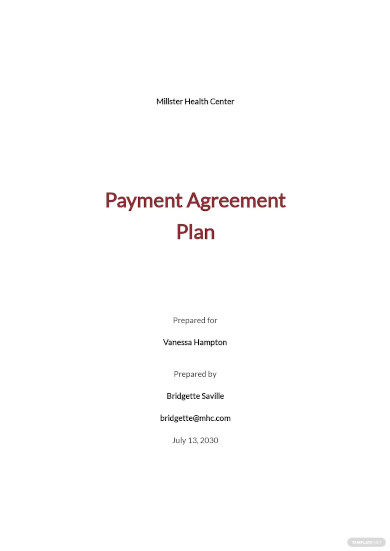

3. Payment Agreement Plan Template

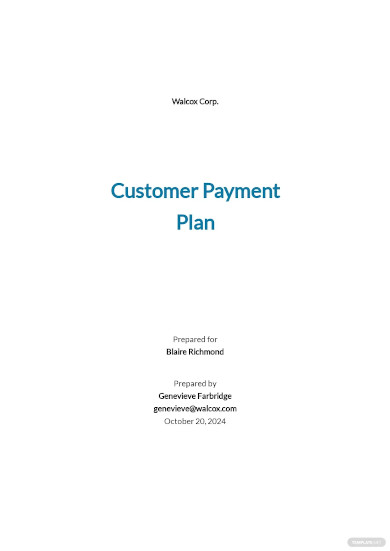

4. Customer Payment Plan Template

5. Payment Installment Plan Template

6. Rent Payment Plan Template

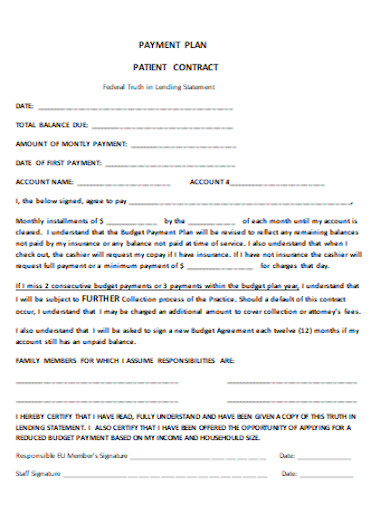

7. Patient Payment Plan Template

8. Monthly Payment Plan Template

9. Simple Payment Plan Template

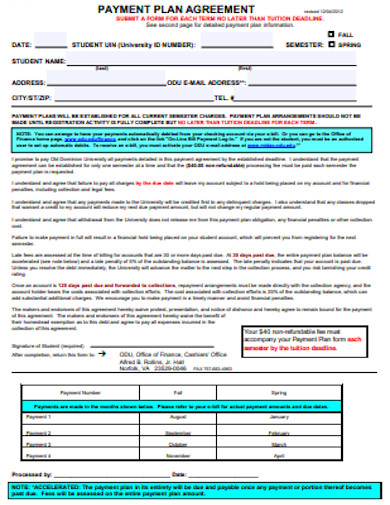

10. Payment Plan Agreement Example

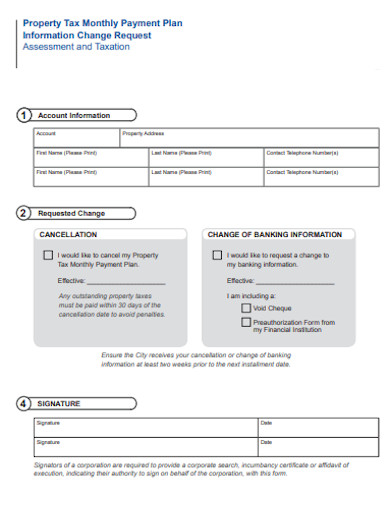

11. Property Tax Monthly Payment Plan

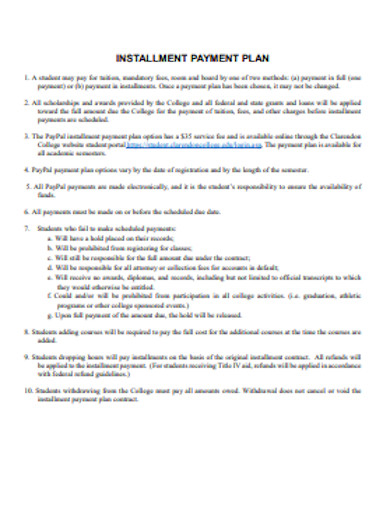

12. Installment Payment Plan Example

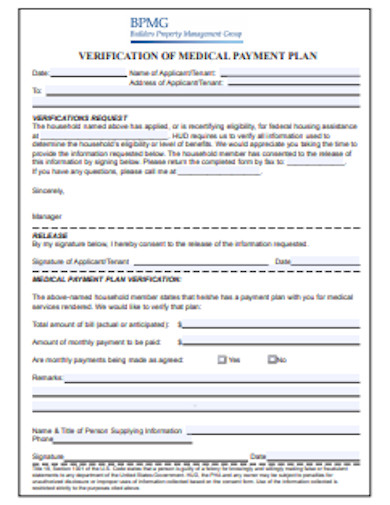

13. Medical Payment Plan Format

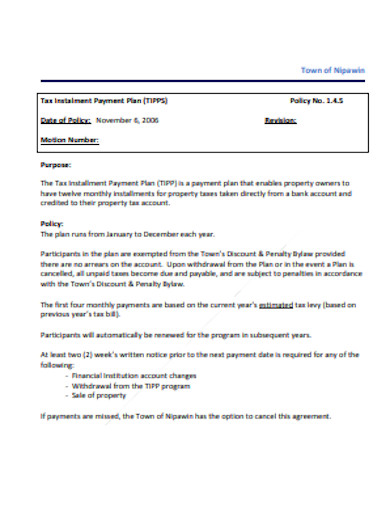

14. Tax Installment Payment Plan

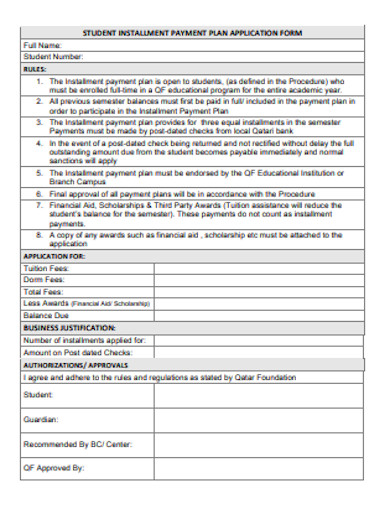

15. Student Installment Payment Plan

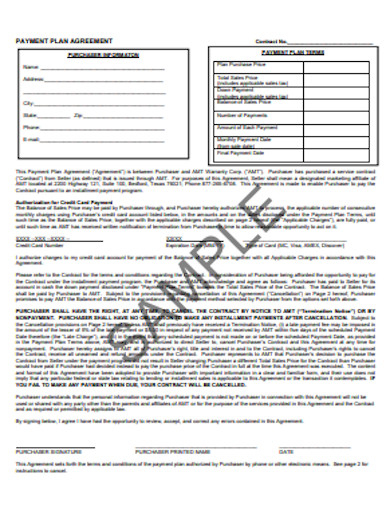

16. Payment Plan Agreement Format

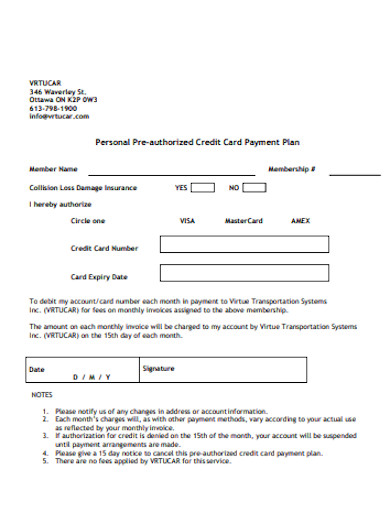

17. Personal Pre-authorized Credit Card Payment Plan

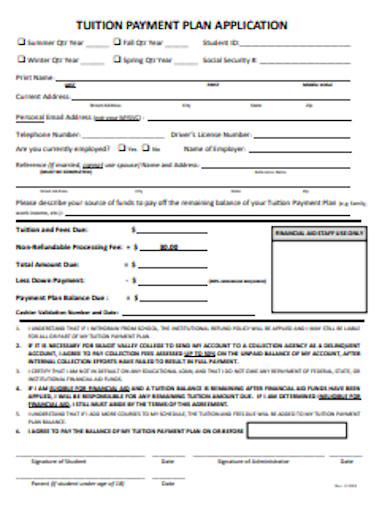

18. Tuition Payment Plan Application Format

19. Payment Plan Example

What Is a Payment Plan?

A payment plan is a document containing procedures that detail how a borrower or spender will pay for particular debts or expenses. For example, those making use of Amazon’s services will have their own Amazon payment plan. The billing process will proceed as originally agreed-upon over a set period. Similar processes take place for those with an Apple payment plan and an Ikea payment plan, among other examples. Buyers and debtors may be made to sign a payment plan contract to ensure that they will be held legally accountable for their responsibilities.

How to Set Up for a Payment Plan

A payment plan is a responsibility that you have to handle seriously. So before you acquire a payment plan template or a free payment plan form to use, it is best to take note of a few things. The following steps should be able to help you set up your own payment plan without too much hassle on your end:

Step 1: List Down Your Debts and Expenses

It is important that you list down all the bills and expenses that you receive or make on a regular basis. This will help you determine which debt or expense to prioritize in terms of payment, which debt needs your immediate attention, and which ones you can pay later.

Step 2: Classify Your Debts

You can classify your debts accordingly. It may be done according to their date of payment, the amount to be paid, or the value of debt. This is important because it can help you make a budget plan for your payment plan. This way, handling your debts becomes more manageable because now you have a guide in assessing them.

Step 3: Calculate Your Monthy Budget

You have to calculate your monthly budget to determine how much you will need to save for a payment plan. Compute how much you need for your daily expenses, monthly bills, and personal needs. This will help you control how much you spend, leaving you with extra money for your payment plan.

Step 4: Choose the Right Payment Plan

After assessing the different things that help you determine which payment plan is right for you, choose the payment plan that fits your budget. If you want to handle a monthly or an annual plan, then you should go for it since you have assessed the things that determine you can handle a payment plan.

FAQs

What are the different types of payment plan?

There’s the flexible payment plan, the monthly payment plan, and the annual payment plan.

What is a deferred payment plan?

A deferred payment plan is when a certain debt is paid beyond the scheduled date. This type of plan is arranged when an individual has insufficient funds. A deferred payment plan is usually done in a regular installment schedule to make sure that an individual can cover his or her payments.

What are the benefits of having a payment plan?

The first benefit you should know is that it provides an effective way of meeting payment deadlines. It can also help with establishing financial planning and security. And beyond maintaining an individual’s budget, it also lessens the worry of paying debts in large amounts.

Without a payment plan, many will have to go through the process of paying for debts and purchases without any form of guidance. As a result, many will also fail, or at least have a far more unpleasant time. Now that you’re better educated regarding the usefulness of a payment plan, what’s your next move going to be? Be sure to take what you’ve learned and put it to good use as soon as today!