26+ Printable Mileage Log Examples to Download

For those constantly transferring from location to another to get their job done on a daily basis, it’s not only the burden of having to be on your feet all day but also the expenses that come with having to drive a vehicle. This could range from the daily gas tank and the possibility of damages or accidents. If you want to get a reimbursement from your expenses, have a personal mileage log for business trips. This is a critical IRS requirement if you want to get your share of the refund and ease up on your tax burdens.

26+ Printable Mileage Log Examples

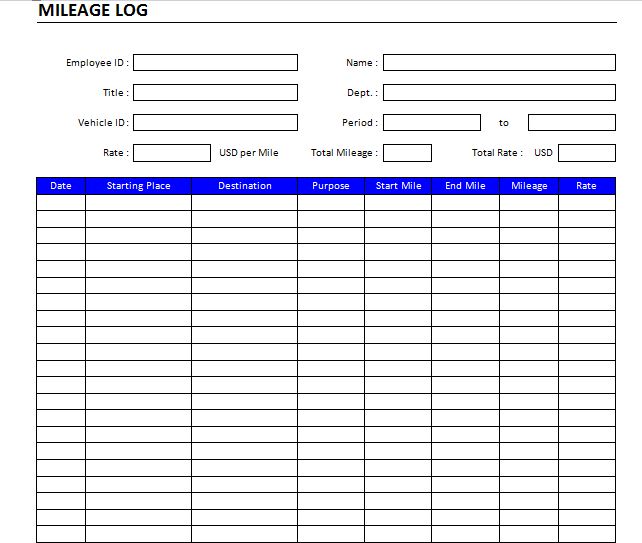

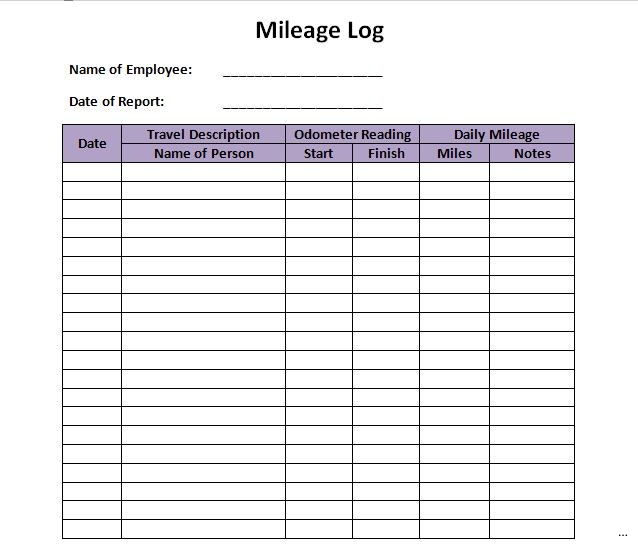

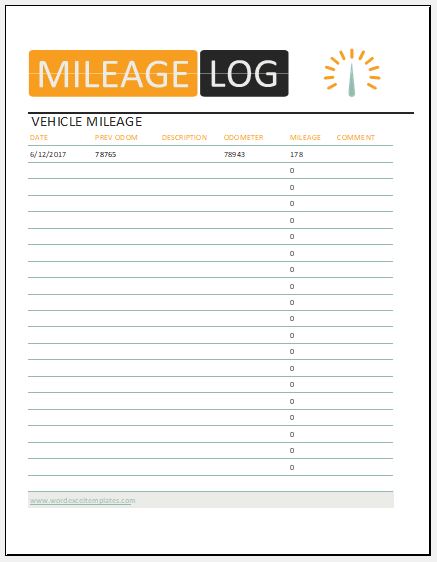

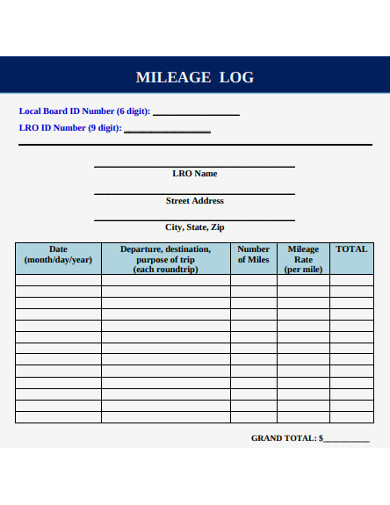

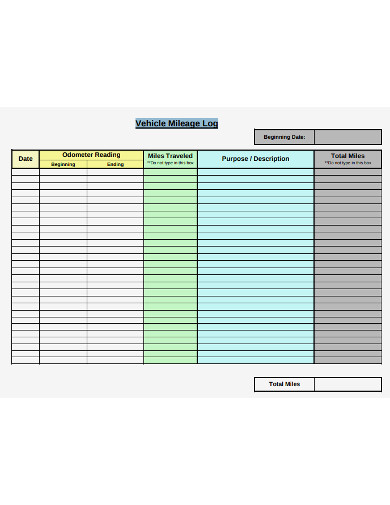

Vehicle Mileage Log Example

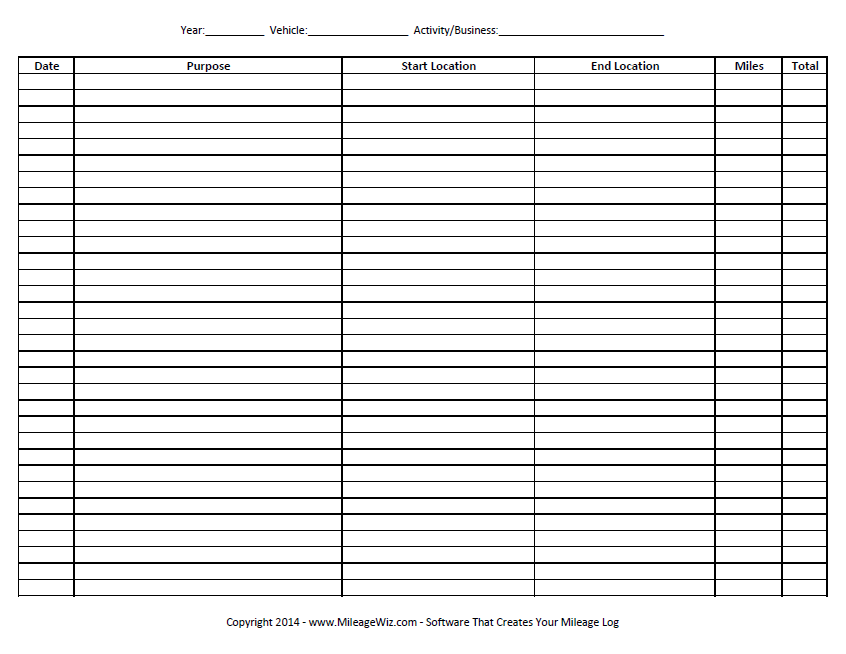

Basic Printable Mileage Log

Printable Mileage Log Example

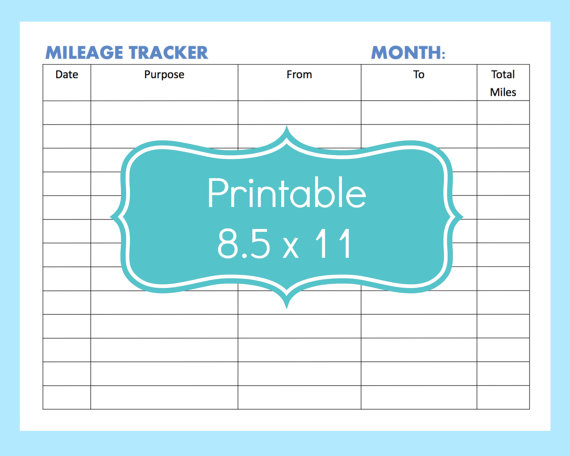

8.5 × 11 Printable Mileage Log Example

Bordered Mileage Log Example

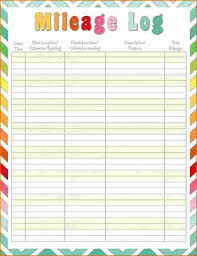

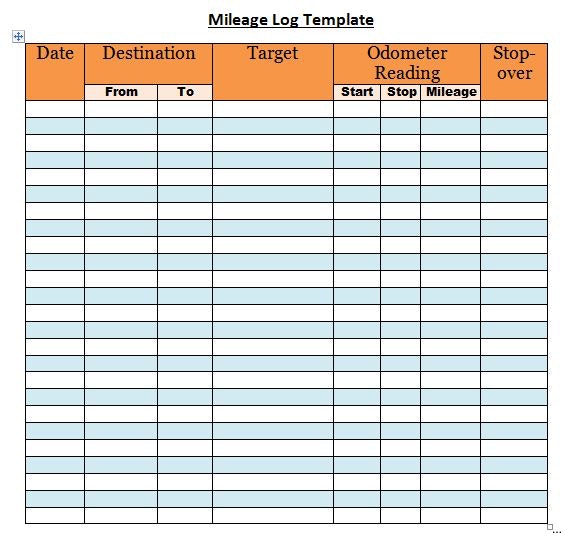

Colored Mileage Log Template

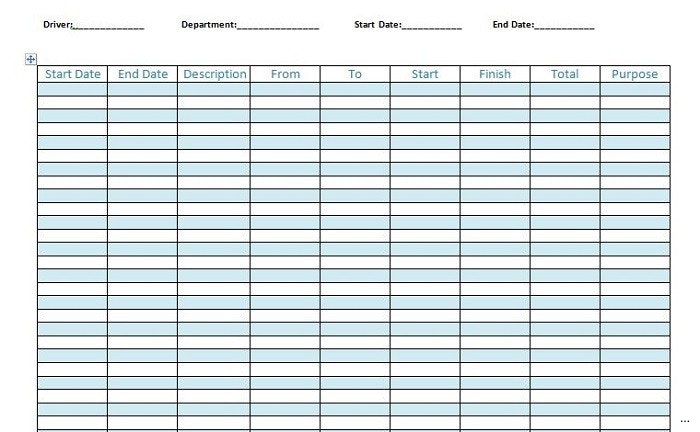

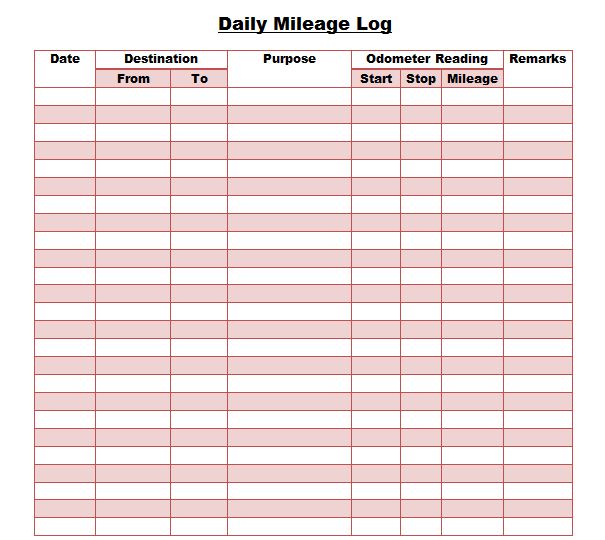

Daily Mileage Log

Mileage Log Journal

Mileage Log With Experimental Questions

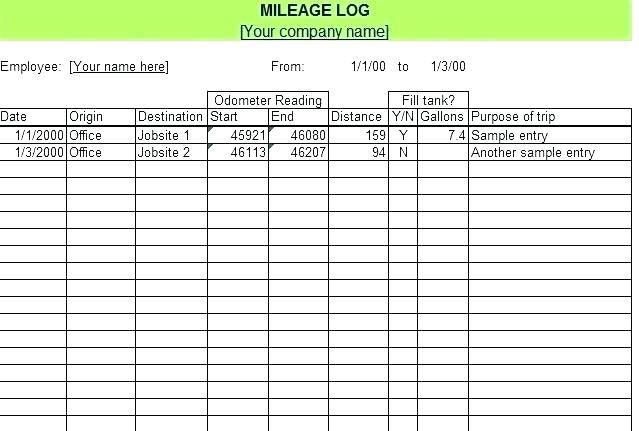

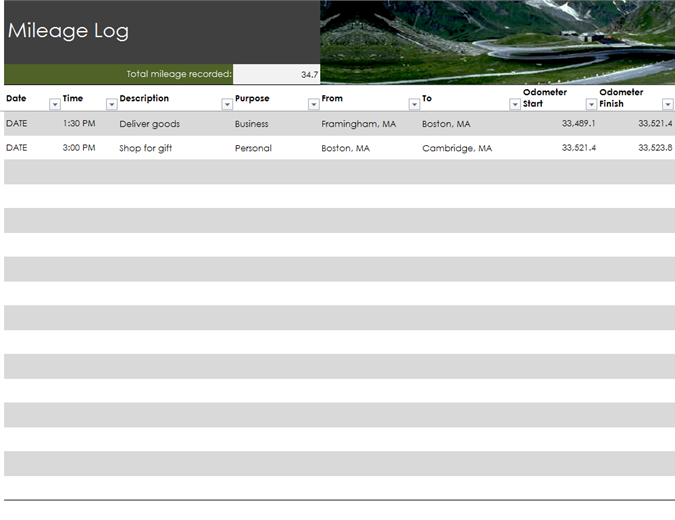

Excel Mileage Log Printable

Mileage Log Compliant Concept Template

Extensive Printable Mileage Log Example

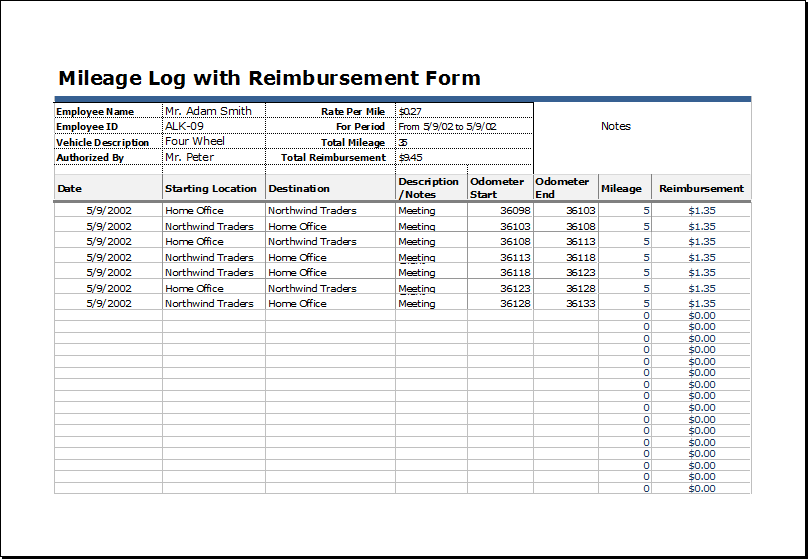

Mileage with Reimbursement Form Example

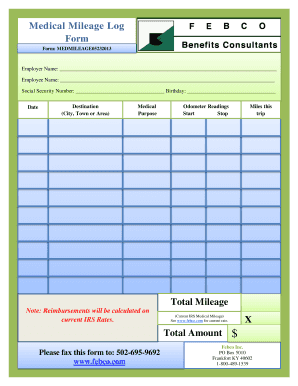

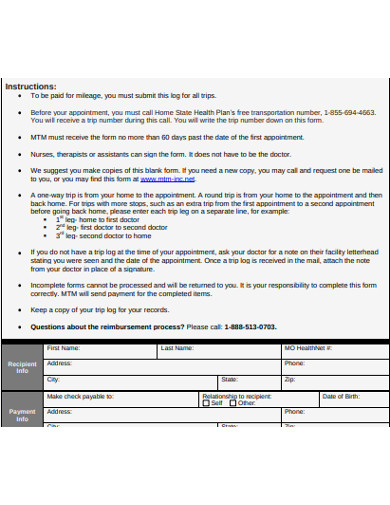

Medical Mileage Log Example

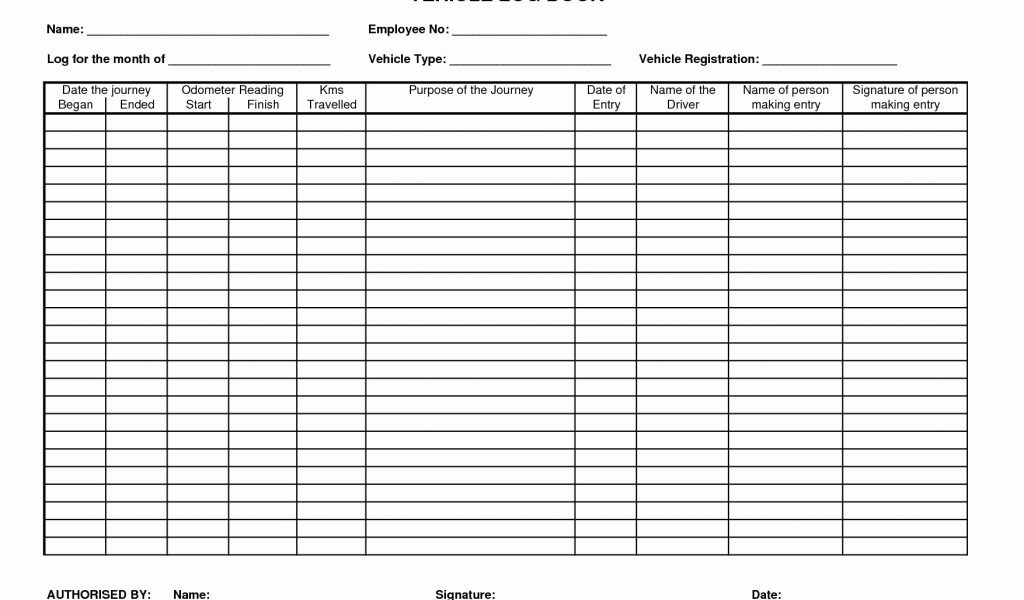

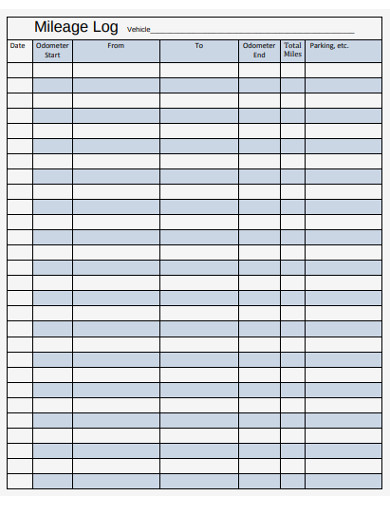

Vehicle Printable Mileage Example

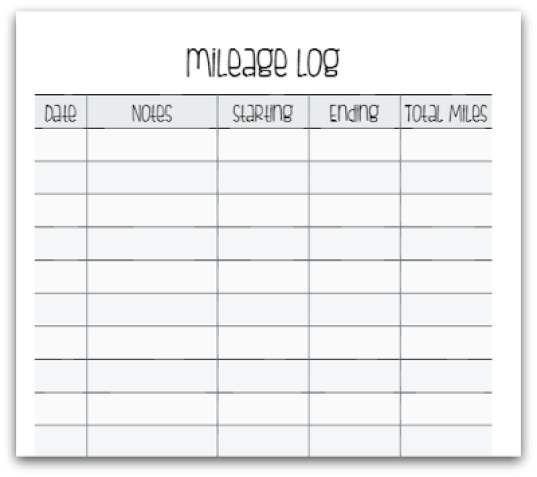

Simple Printable Mileage Log

Gas Mileage Log Printable Example

Monthly Mileage Log In Excel

Printable Mileage Log

Even the personal property tax you have paid for your car can be refundable.

Recap Sheet Example

Mileage Log Printable Spreadsheet Example

Cute Printable Mileage Log

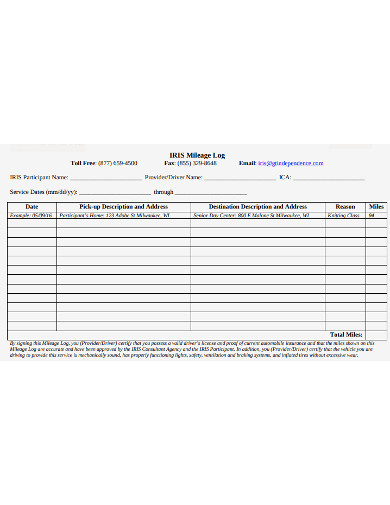

Mileage Log Example

Sample Mileage Log

Mileage Log in PDF

Basic Mileage Log

Vehicle Mileage Log

What Is a Mileage Log?

A printable mileage log refers to the document you use to keep track of the miles you have driven. This document can be used to file for at least a tax deduction or even a reimbursement. This means that every mile you spend driving to meet clients or to run errands for the company will be given back to you in cash, which will either be deducted from your taxes or reimbursed after your general application. Vehicle mileage logs work miracles, especially for self-employed business people. This is a program backed by the US’s International Revenue Service (IRS).

How to Make a Mileage Log

Diligently jotting down your miles on a monthly or weekly basis on a mileage log sheet may seem like nothing but might reap great results. Tracking mileage count is a considerable benefit for small business owners to take advantage of the tax deduction as they mostly operate on meager resources. If you’re entitled to getting your share of your travel burdens, it’s only right that you work on it.

To help you establish your own business mileage log, follow the steps below:

1. Ensure Your Reimbursement Eligibility

A mileage log sheet is only applicable to individuals who are eligible for the IRS’s mileage reimbursement program. If you don’t, drop your pen and do something else because mileage tracking can prove to be a lot of work. Self-employed individuals are among those that are mainly eligible for the program because they often use their own resources for business-related travels. This is also applicable to employees who travel a lot for work and continuously move from one place to another to accomplish their operations.

2. Track Only Business Travel Errands

It’s important to note that this only applies to mileage spent doing business-related transactions such as gathering production supplies, meeting with partners, delivering goods, and more. Your travel purposes should be on the column under your trip purposes. Check your daily work log for business appointment that you can record for this. Needless to say, you should not include your commute hours in going home and in arriving at work because that won’t be valid. Other impertinent reasons that do not relate to your work or business life would also deem your mileage log void.

3. Specify Time and Date

This is why it’s essential that you only undergo the mileage log tracking when you’re eligible, and it contributes to easing your tax amount—it can take a lot of effort. It’s necessary to fill in all specific time and dates on a mileage spreadsheet because it’s an IRS requirement. And this can be confusing, especially if you have multiple appointments in a single day. To make this easier, check your appointment schedule and see if you have meetings or errands outside your vicinity. Record in advance the date, and calculate the estimated time and the number of miles. This way, all you’re going to keep track of are your impromptu appointments and a few adjustments on those that are plotted on your timeline.

4. Update Regularly

You can’t effectively monitor and record your miles if you don’t do it regularly because you’ll most likely set it aside and forget everything all together. Update your mileage work log regularly. If you’re into the traditional written log system, you can collect all your travels one after the other for the day and take little notes of your mileage before putting them on your logbook all together. This is more efficient than recording your miles after every destination because you might commit some mistakes and record the wrong data. Taking notes along the way allows you to evaluate your record after everything and assess if there are any discrepancies before you put them in.

FAQ’s

What are the IRS’s requirements for your mileage log?

The IRS requires that your mileage log should have the following:

- the date of the journey

- the purpose of the journey

- the start-off point and the destination

- the total miles traveled

What is the standard mileage rate for 2020?

As of January 1, 2020, the standard mileage rate is 57.5 cents per mile.

What is the actual driving expenses method?

If you find mileage tracking too tedious, you can get your tax refund or reimbursement through the actual expenses method. Instead of counting your mileage, you’ll calculate your vehicle expenses instead, such as gasoline, oil, damage repair, and parking fees, among others and record them on an expenses sheet.

Keeping an updated record of your business trips might sound meticulous and, given the amount of the mileage rate, seemingly unnecessary. Still, it might help save up on your tax responsibility or get the refund you need for all your troubles. It’s a lot of work, but it can prove to be an advantage. If you want a reliable record-keeping tool that you can trust to help you, avail on of our mileage log templates today. They’re all ready-made with all the right requirements for your immediate use. Download now!

26+ Printable Mileage Log Examples to Download

For those constantly transferring from location to another to get their job done on a daily basis, it’s not only the burden of having to be on your feet all day but also the expenses that come with having to drive a vehicle. This could range from the daily gas tank and the possibility of damages or accidents. If you want to get a reimbursement from your expenses, have a personal mileage log for business trips. This is a critical IRS requirement if you want to get your share of the refund and ease up on your tax burdens.

26+ Printable Mileage Log Examples

Vehicle Mileage Log Example

Basic Printable Mileage Log

marevinho.com

Details

File Format

PDF

Size: 59 KB

Printable Mileage Log Example

templatelab.com

Details

File Format

PDF

Size: 61 KB

8.5 × 11 Printable Mileage Log Example

etsy.com

Details

File Format

PDF

Size: 33 KB

Bordered Mileage Log Example

thegimp.org

Details

File Format

PDF

Size: 15 KB

Colored Mileage Log Template

marevinho.com

Details

File Format

PDF

Size: 68 KB

Daily Mileage Log

templatelab.com

Details

File Format

PDF

Size: 57 KB

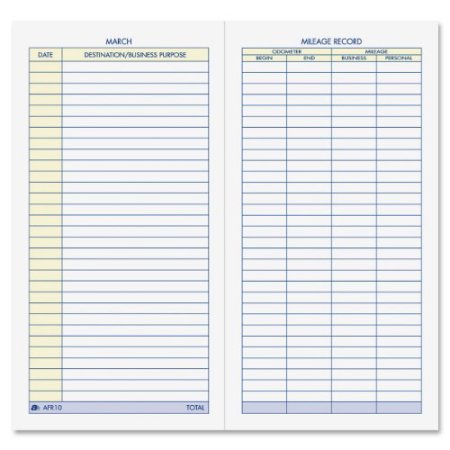

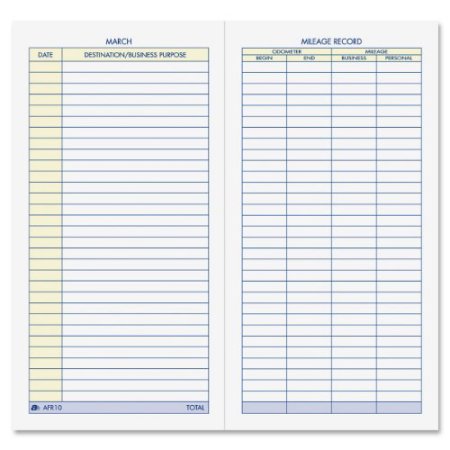

Mileage Log Journal

walmart.com

Details

File Format

PDF

Size: 36 KB

Mileage Log With Experimental Questions

marevinho.com

Details

File Format

PDF

Size: 50 KB

Excel Mileage Log Printable

kalnari.com

Details

File Format

PDF

Size: 56 KB

Mileage Log Compliant Concept Template

marevinho.com

Details

File Format

PDF

Size: 60 KB

Extensive Printable Mileage Log Example

popisgrzegorz.com

Details

File Format

PDF

Size: 94 KB

Mileage with Reimbursement Form Example

wordexceltemplates.com

Details

File Format

PDF

Size: 26 KB

Medical Mileage Log Example

businessmilagetracker.com

Details

File Format

PDF

Size: 11 KB

Vehicle Printable Mileage Example

wordexceltemplates.com

Details

File Format

PDF

Size: 35 KB

Simple Printable Mileage Log

crazybiker.net

Details

File Format

PDF

Size: 51 KB

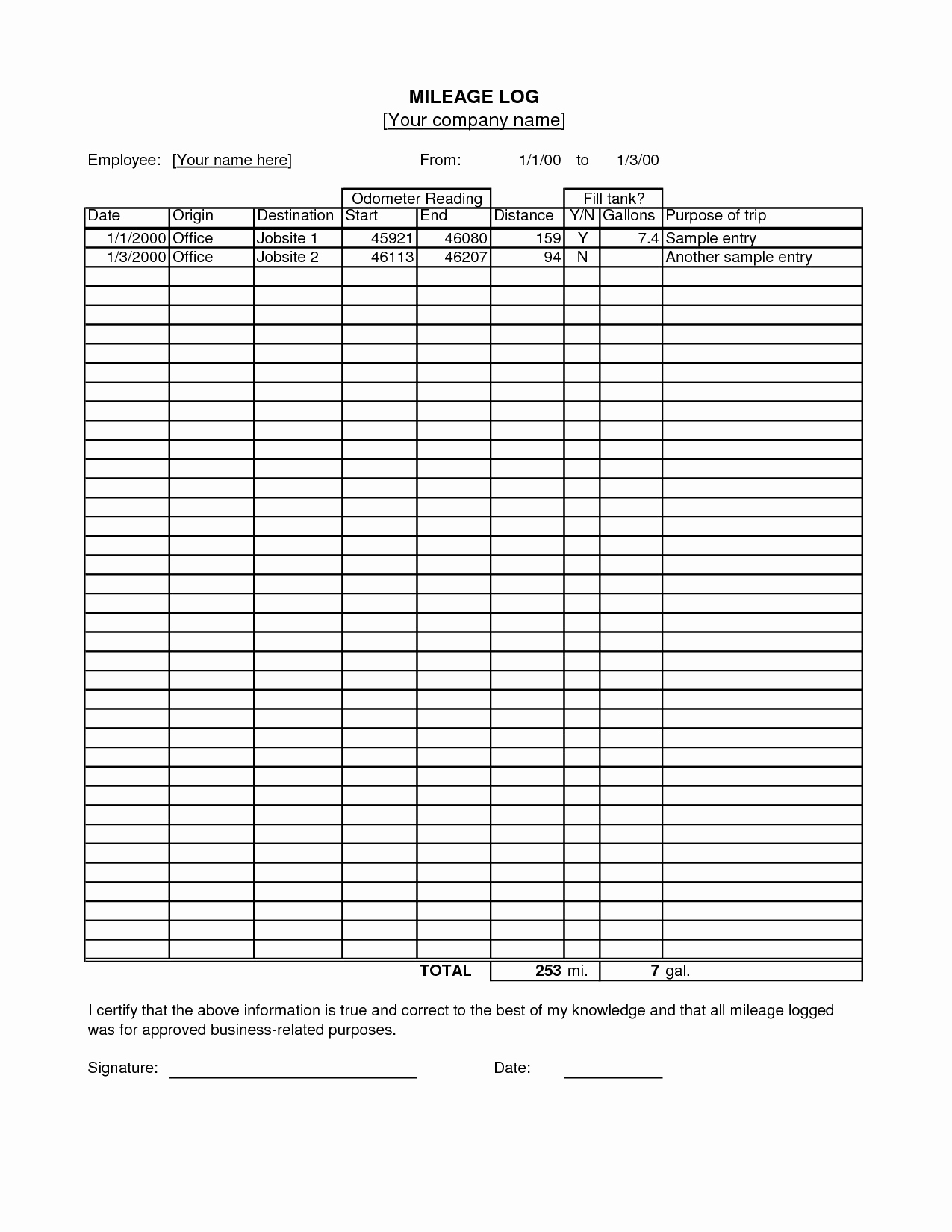

Gas Mileage Log Printable Example

eccos.us

Details

File Format

PDF

Size: 216 KB

Monthly Mileage Log In Excel

wordexceltemplates.com

Details

File Format

PDF

Size: 36.0

Printable Mileage Log

mileagewiz.com

Details

File Format

PDF

Size: 17 KB

Even the personal property tax you have paid for your car can be refundable.

Recap Sheet Example

daphnemaia.com

Details

File Format

PDF

Size: 25 KB

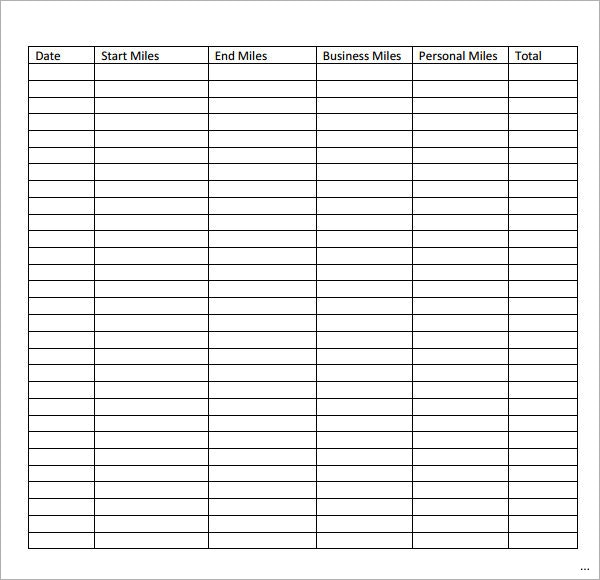

Mileage Log Printable Spreadsheet Example

templates.office.com

Details

File Format

PDF

Size: 112 KB

Cute Printable Mileage Log

getexceltemplates.com

Details

File Format

PDF

Size: 15 KB

Mileage Log Example

gtindependence.com

Details

File Format

PDF

Size: 22 KB

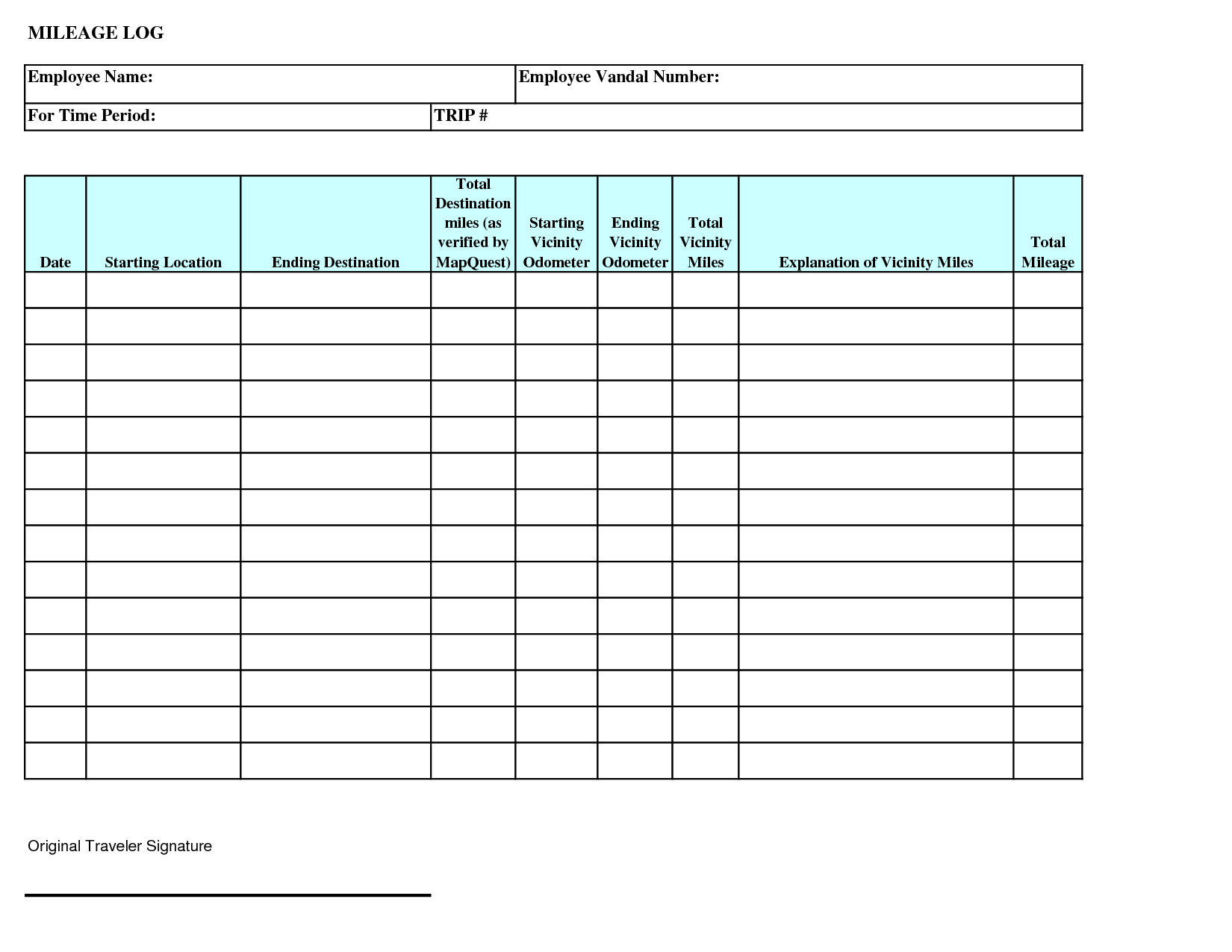

Sample Mileage Log

efsp.unitedway.org

Details

File Format

PDF

Size: 86 KB

Mileage Log in PDF

homestatehealth.com

Details

File Format

PDF

Size: 363 KB

Basic Mileage Log

obxcpa.com

Details

File Format

PDF

Size: 111 KB

Vehicle Mileage Log

mhaven.net

Details

File Format

PDF

Size: 8 KB

What Is a Mileage Log?

A printable mileage log refers to the document you use to keep track of the miles you have driven. This document can be used to file for at least a tax deduction or even a reimbursement. This means that every mile you spend driving to meet clients or to run errands for the company will be given back to you in cash, which will either be deducted from your taxes or reimbursed after your general application. Vehicle mileage logs work miracles, especially for self-employed business people. This is a program backed by the US’s International Revenue Service (IRS).

How to Make a Mileage Log

Diligently jotting down your miles on a monthly or weekly basis on a mileage log sheet may seem like nothing but might reap great results. Tracking mileage count is a considerable benefit for small business owners to take advantage of the tax deduction as they mostly operate on meager resources. If you’re entitled to getting your share of your travel burdens, it’s only right that you work on it.

To help you establish your own business mileage log, follow the steps below:

1. Ensure Your Reimbursement Eligibility

A mileage log sheet is only applicable to individuals who are eligible for the IRS’s mileage reimbursement program. If you don’t, drop your pen and do something else because mileage tracking can prove to be a lot of work. Self-employed individuals are among those that are mainly eligible for the program because they often use their own resources for business-related travels. This is also applicable to employees who travel a lot for work and continuously move from one place to another to accomplish their operations.

2. Track Only Business Travel Errands

It’s important to note that this only applies to mileage spent doing business-related transactions such as gathering production supplies, meeting with partners, delivering goods, and more. Your travel purposes should be on the column under your trip purposes. Check your daily work log for business appointment that you can record for this. Needless to say, you should not include your commute hours in going home and in arriving at work because that won’t be valid. Other impertinent reasons that do not relate to your work or business life would also deem your mileage log void.

3. Specify Time and Date

This is why it’s essential that you only undergo the mileage log tracking when you’re eligible, and it contributes to easing your tax amount—it can take a lot of effort. It’s necessary to fill in all specific time and dates on a mileage spreadsheet because it’s an IRS requirement. And this can be confusing, especially if you have multiple appointments in a single day. To make this easier, check your appointment schedule and see if you have meetings or errands outside your vicinity. Record in advance the date, and calculate the estimated time and the number of miles. This way, all you’re going to keep track of are your impromptu appointments and a few adjustments on those that are plotted on your timeline.

4. Update Regularly

You can’t effectively monitor and record your miles if you don’t do it regularly because you’ll most likely set it aside and forget everything all together. Update your mileage work log regularly. If you’re into the traditional written log system, you can collect all your travels one after the other for the day and take little notes of your mileage before putting them on your logbook all together. This is more efficient than recording your miles after every destination because you might commit some mistakes and record the wrong data. Taking notes along the way allows you to evaluate your record after everything and assess if there are any discrepancies before you put them in.

FAQ’s

What are the IRS’s requirements for your mileage log?

The IRS requires that your mileage log should have the following:

the date of the journey

the purpose of the journey

the start-off point and the destination

the total miles traveled

What is the standard mileage rate for 2020?

As of January 1, 2020, the standard mileage rate is 57.5 cents per mile.

What is the actual driving expenses method?

If you find mileage tracking too tedious, you can get your tax refund or reimbursement through the actual expenses method. Instead of counting your mileage, you’ll calculate your vehicle expenses instead, such as gasoline, oil, damage repair, and parking fees, among others and record them on an expenses sheet.

Keeping an updated record of your business trips might sound meticulous and, given the amount of the mileage rate, seemingly unnecessary. Still, it might help save up on your tax responsibility or get the refund you need for all your troubles. It’s a lot of work, but it can prove to be an advantage. If you want a reliable record-keeping tool that you can trust to help you, avail on of our mileage log templates today. They’re all ready-made with all the right requirements for your immediate use. Download now!