13+ Pro Forma Invoice Examples

In a buy-sell transaction, every process must be documented to protect the ownership rights of the seller to be passed on to the buyer for the goods being purchased. Most of the time, the transaction starts by the buyer asking for a quotation from the seller. You may also see payment invoice examples.

The seller then provides the pertinent papers, and the buyer confirms the order. Before shipping the goods, there are other papers needed to be issued by the buyer to the seller such as pro forma invoice and sales invoice. These invoices detail and repeat the order of the buyer to confirm if they have received the correct order as this will affect the package that they are going to ship to the buyer and request payment from the buyer, respectively.

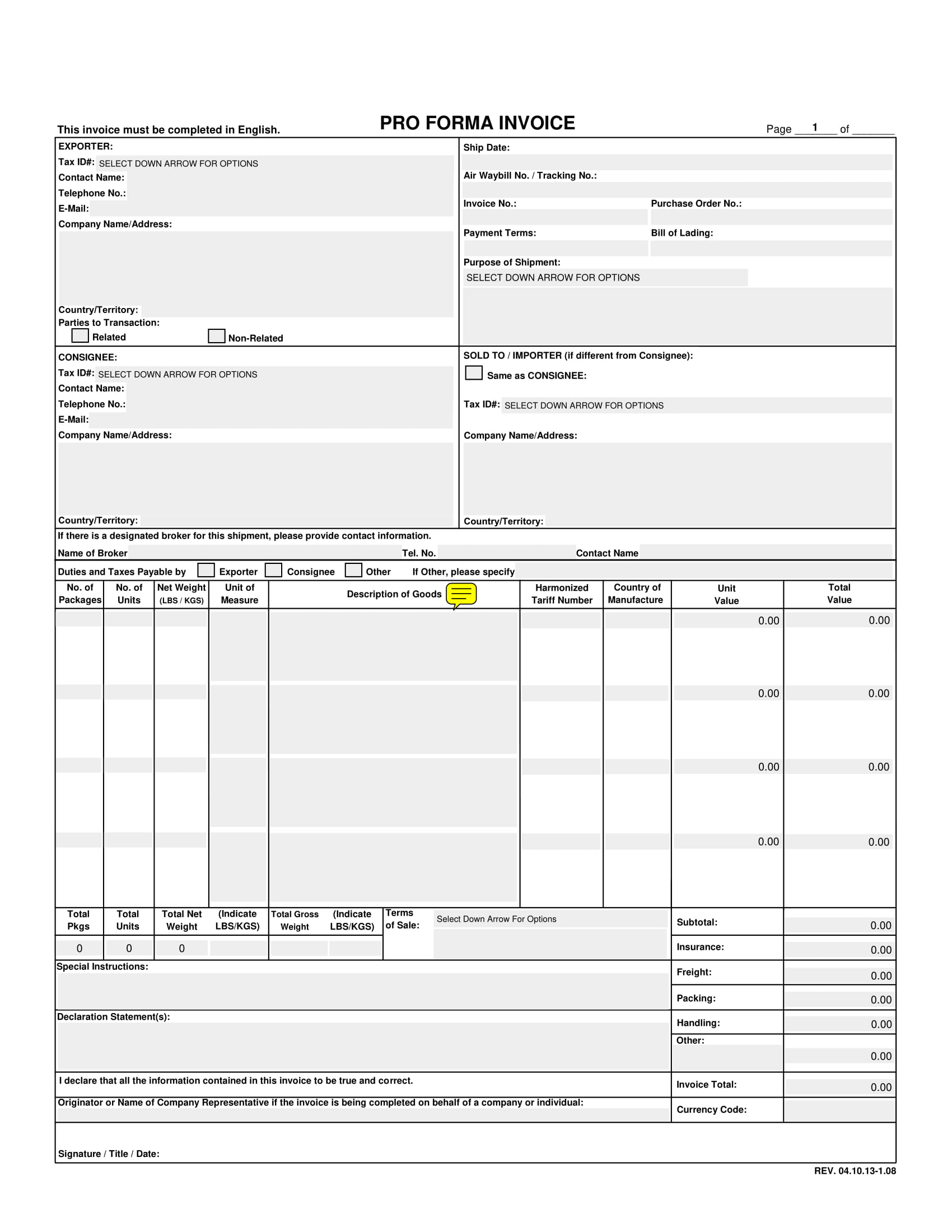

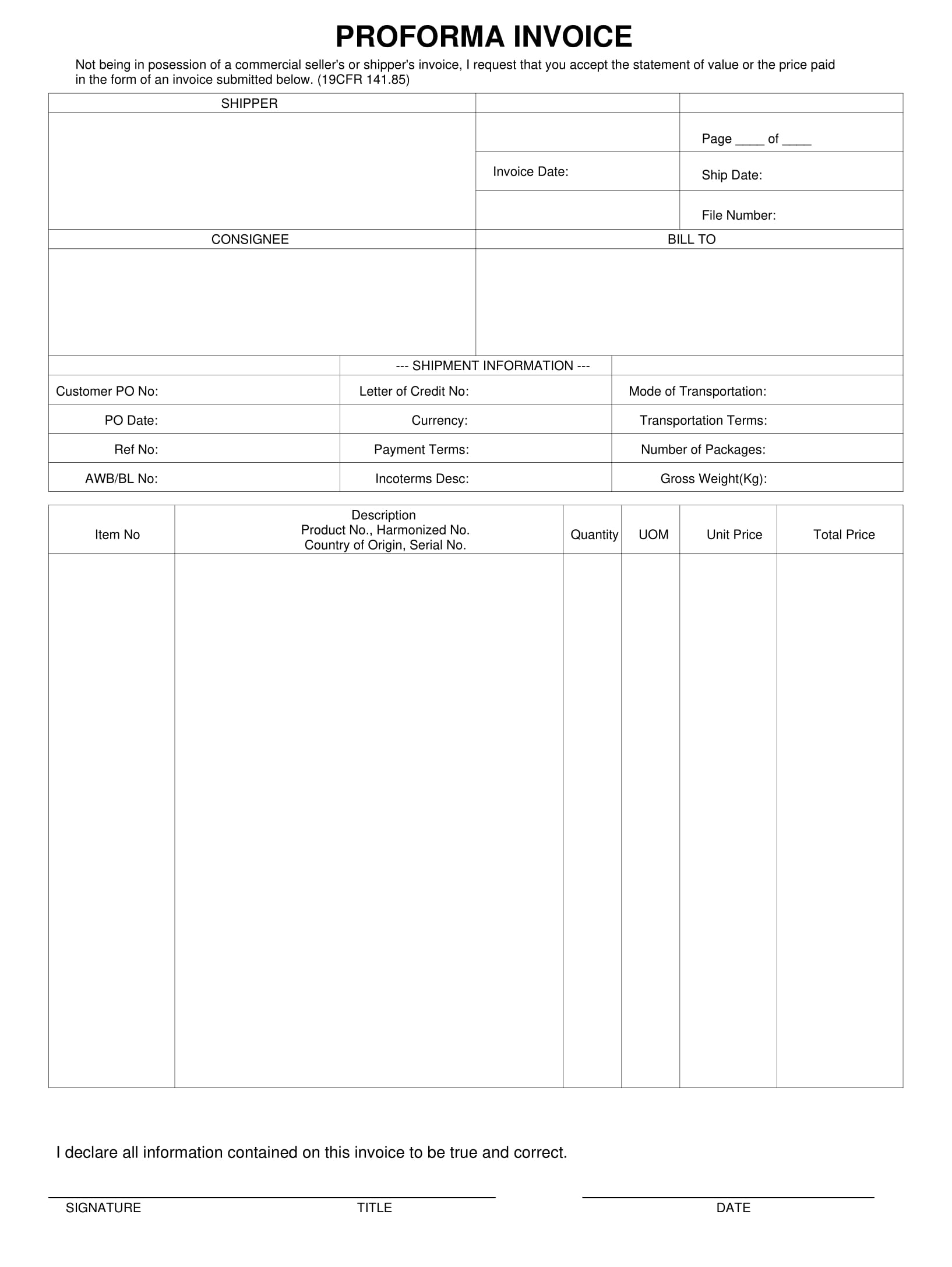

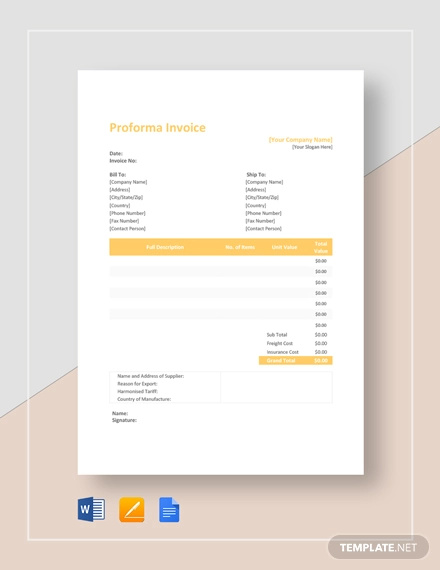

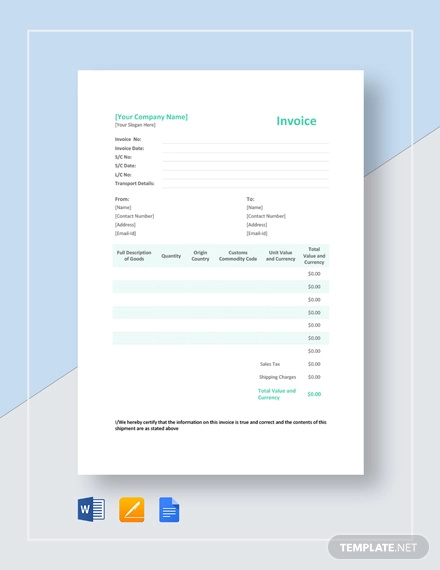

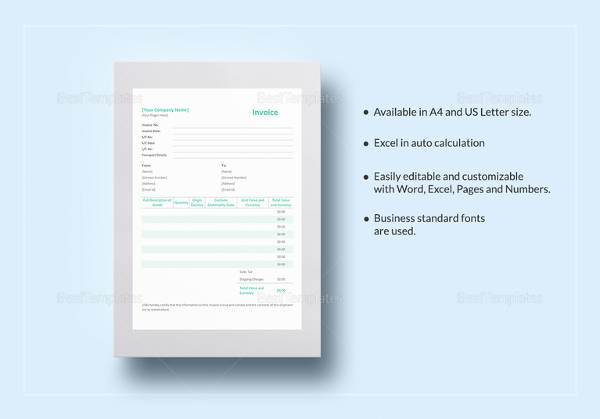

Proforma Invoice Example

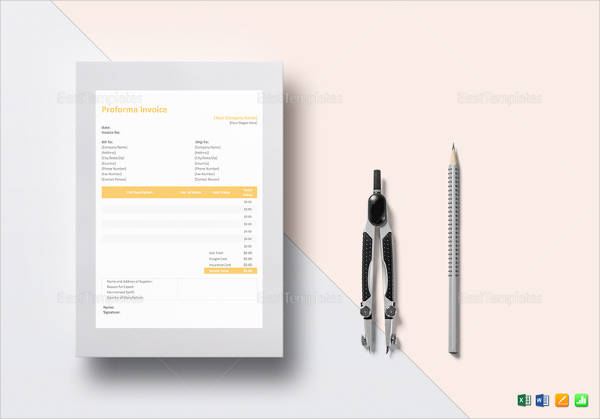

Simple Proforma Invoice Example

To explain further, sales and pro forma invoice is somewhat similar in a way that they present the items ordered by the buyer but differs in a way that the price and quantity listed in a pro forma invoice may change while those in a sales invoice will not change and is the final amount. Another difference is that a sales invoice demands payment from the buyer while a pro forma invoice does not. More of pro forma invoice discussions can be found on the succeeding sections.

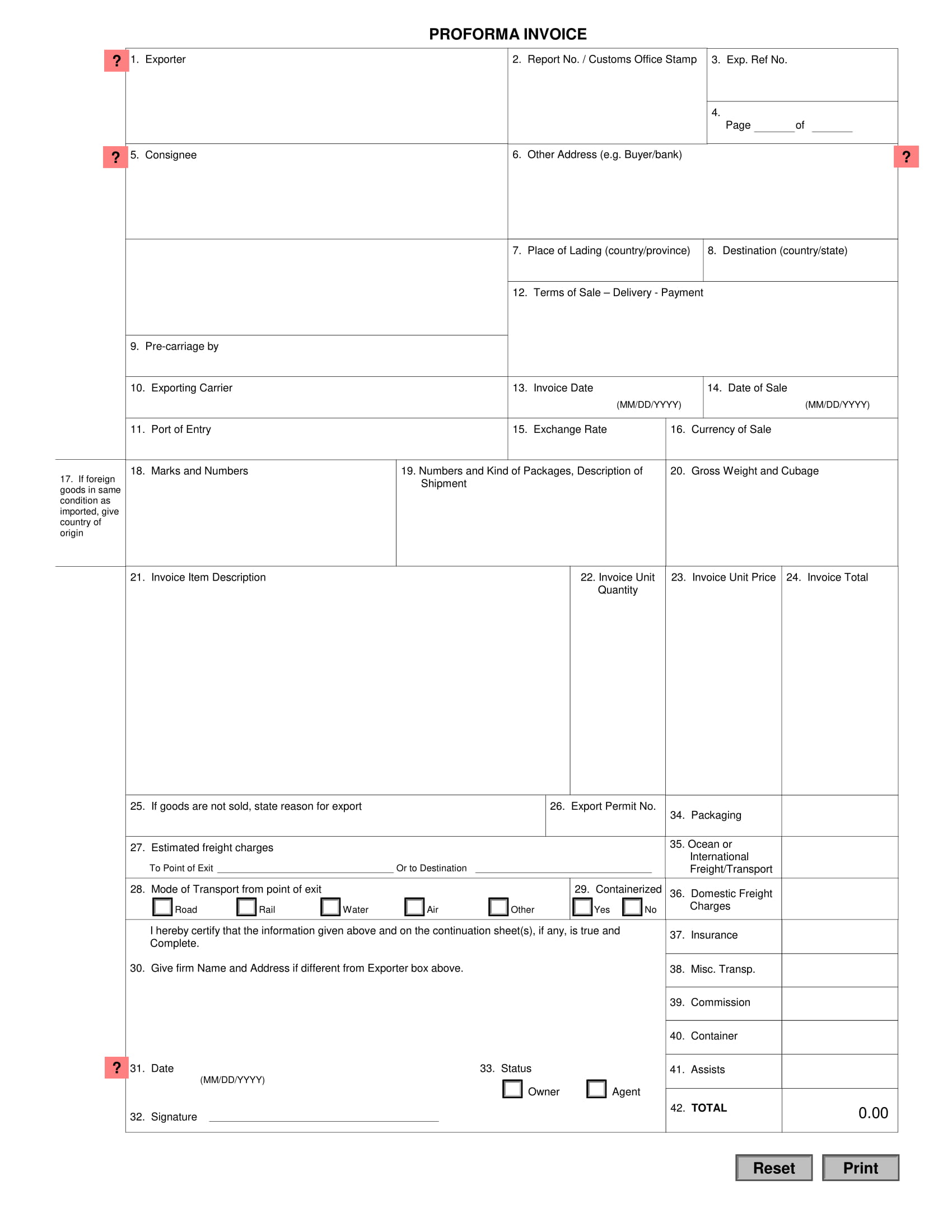

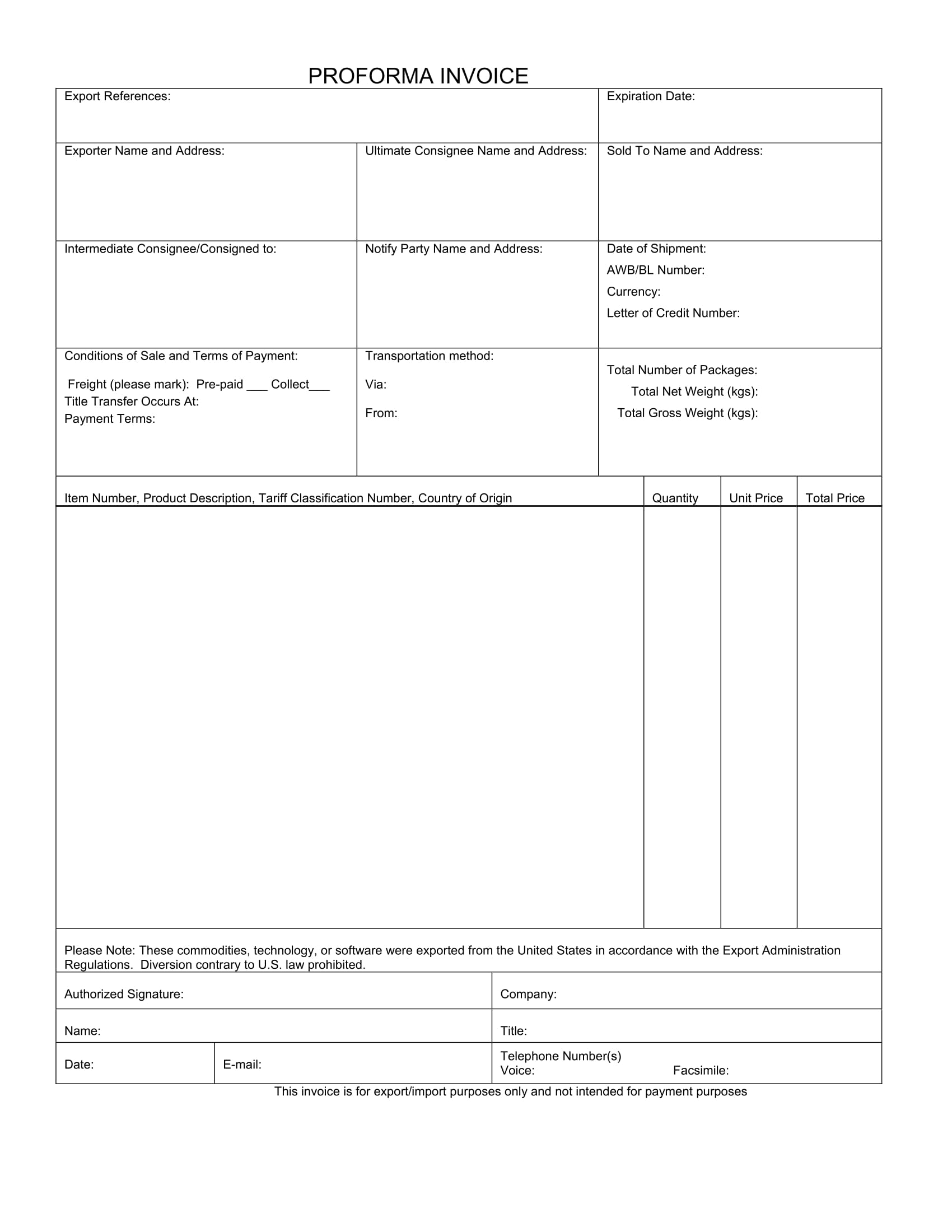

For now, you may check the next section for some examples of pro forma invoice examples and templates.

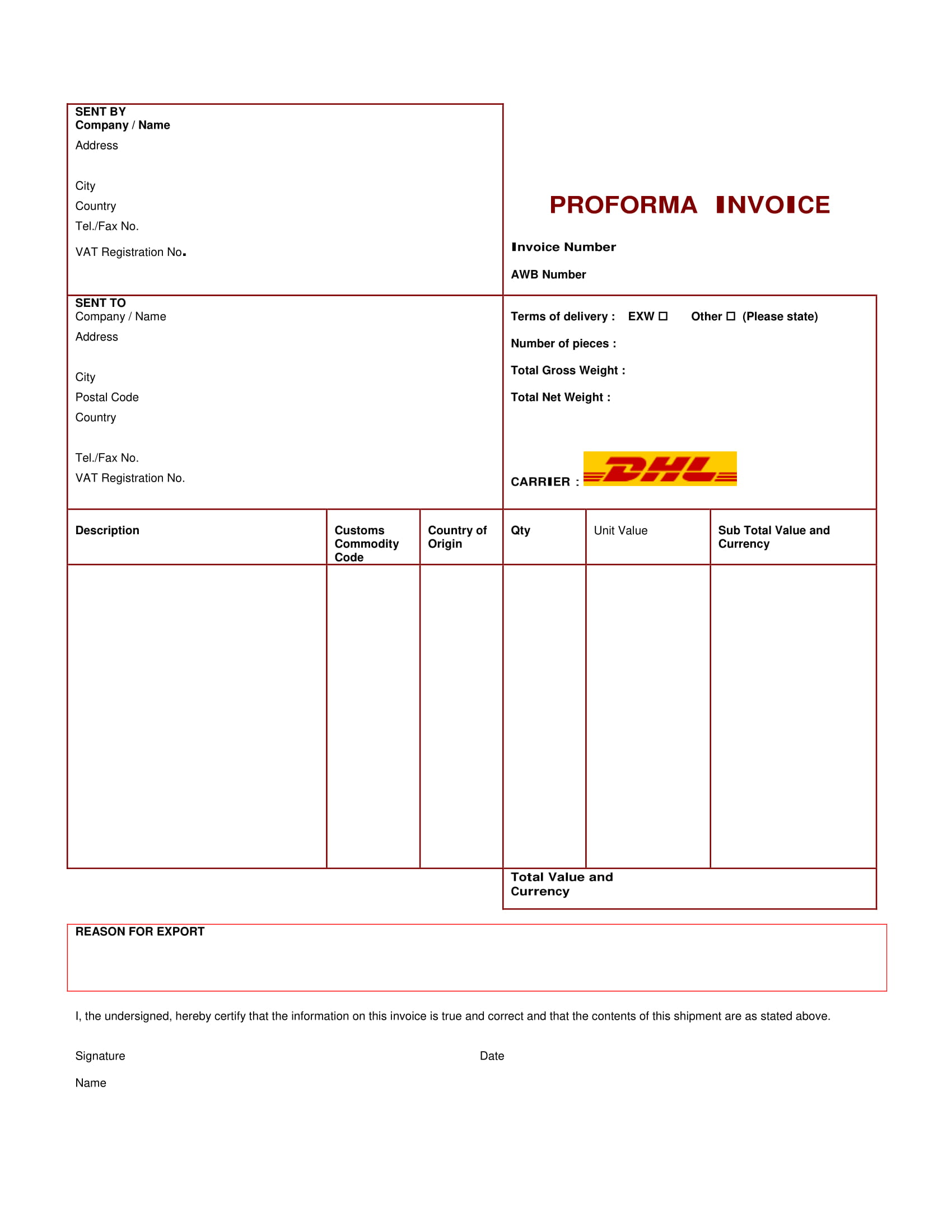

Proforma Invoice Sample

Simple Proforma Invoice

Classic Pro Forma Invoice Example

Pro Forma Invoice Definition

A proforma invoice, an estimated invoice, is considered a pre-advice document or a preliminary bill of sale that is sent by a seller to a buyer in advance of a shipment or delivery of goods and is often used for customs purposes on imports. You may also like service invoice examples.

It serves as a guide to action on what the expectations are on an export sale and sets the stage for the sale negotiation process. It states a commitment on part of the seller to deliver the products or services as notified to the buyer for a specific price, hence, not a true simple invoice.

It contains details with regard to the quantity of goods, the amount, and other important information such as weight and transportation charges. Unlike a sales invoice, it does not demand or request for payment. In effect, this is not a receivable of the seller and, conversely, not a payable of the buyer. You may also check out tax invoice examples.

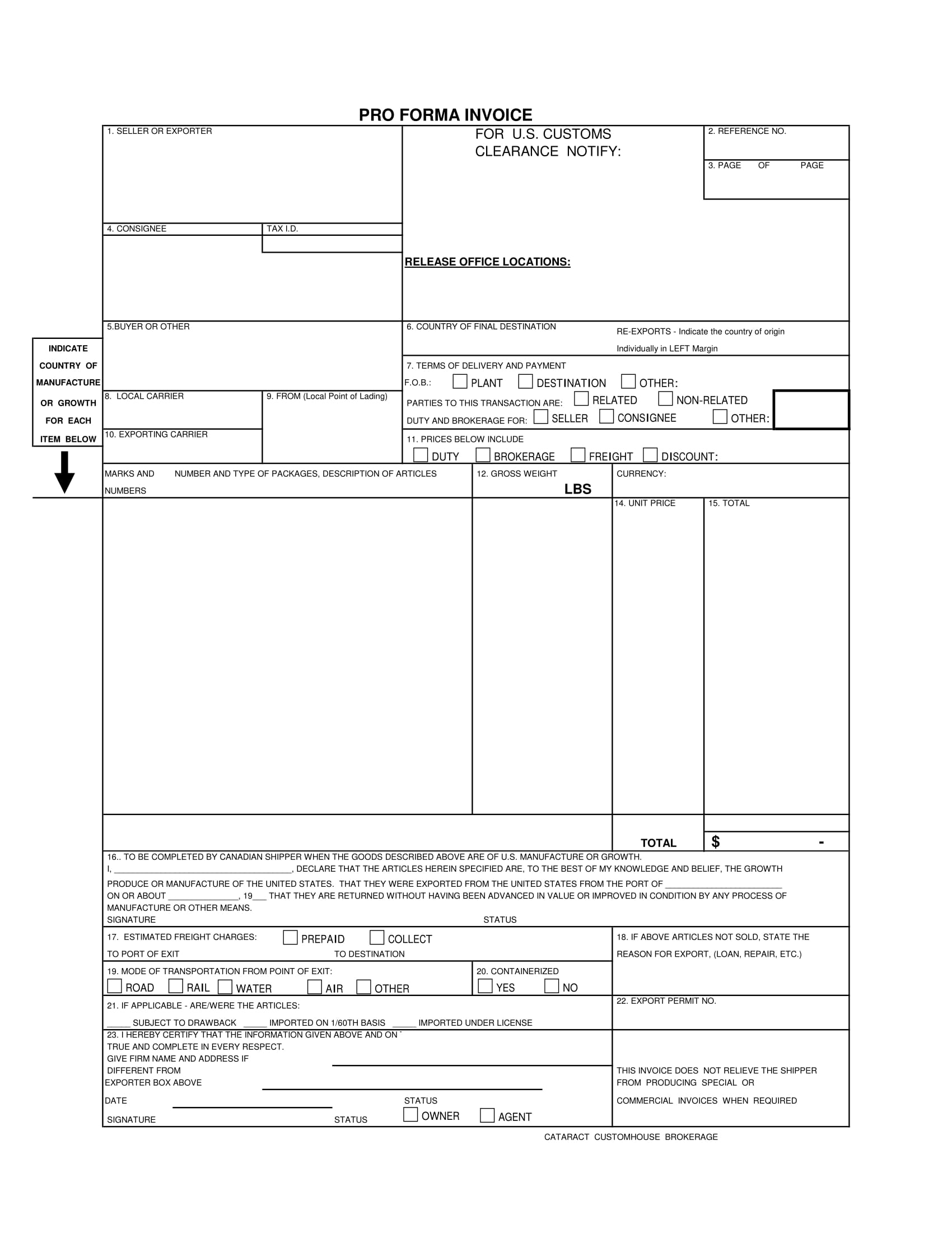

Elegant Pro Forma Invoice Example

Generic Pro Forma Invoice Example

Professional Pro Forma Invoice Example

Simple Pro Forma Invoice Example

Components of a Pro Forma Invoice

Before you ship or deliver the goods ordered by the buyer or transfer the ownership rights of the goods, a pro forma invoice will set the stage which serves as a negotiating tool between the buyer and the seller and a blueprint for the whole transaction process. You may also see contractor invoice examples.

You must see to it that your pro forma invoice must detail the important and necessary information albeit it is still subject to change for these information will be used on many other export forms that you will be creating later on.

Below are the components of a pro forma invoice that you must consider when you create your own invoice.

1. Quantity

In your pro forma invoice, you must reiterate the quantity of goods that the buyer orders. Some simple invoices would never bother to include quantity as they are subject to change, and sometimes, at this stage, the buyer has not yet established the quantity of the goods he or she needs. However, when the buyer already specifies the number of items he or she would like to order, you must include this is the pro forma invoice.

2. Price

Make sure that the price you place in your pro forma invoice is accurate. Do not forget to include the cost of transportation, insurance costs, duties, and taxes for these are the additional expense that may be incurred in shipping the goods apart from the cost of the goods itself. Additionally, you may include an expiration date for the general invoice especially when your prices are subject to change.

3. Description

Also include a clear, comprehensive, and detailed description of the goods with related information such as the product classification, the weight, and the dimension. The measurements, dimensions, and weights must be included in the pro forma invoice for these will allow the buyer to calculate the delivery costs especially when they are the ones to shoulder the cost of the delivery. You may also like purchase invoice examples.

4. Terms of Sale

The terms of sale refers to the price quotation for a specific product, states the price for the product as a specified delivery location, sets the time of shipment, and specifies payment terms. Furthermore, the responsibilities of the buyer and the seller should be in detail as they relate to the things included or not in the price quotation and the ownership of goods that passes from the seller to the buyer. You may also check out travel invoice examples.

5. Freight Terms

The owner of the goods in transit must also be agreed upon as well as the party in charge of the freight costs. Determining the owner of the goods in transit is important in case of accidents that might happen with the goods that are still in transit.

FOB destination, FOB shipping point, freight prepaid, and freight collect are the common freight terms that you may encounter. For FOB destination, the owner of the goods in transit is the seller while in FOB shipping point, the owner of the goods in transit is the buyer. For freight prepaid, the shipping cost is shouldered by the seller while in freight collect, the shipping cost is shouldered by the buyer. You might be interested in blank invoice examples.

6. Payment Terms

The seller must also specify the payment terms for the goods that will be delivered. Buyers might need a pro forma invoice when they need to open a letter of credit with a bank, arrange for financing, and apply for an import license. Hence, you must fully discuss the terms of payment in your pro forma invoice.

7. Delivery Details

The delivery detail is also an important information needed to be included in your pro forma invoice as it will state where will the goods be delivered and when will the goods arrived at the location for if you leave this detail blank, it may be a start of the conflict between the parties in your transaction with regard to the delivery terms as well as the cost of the order. You may also see what is a non-trade invoice?

So make sure that the delivery details are included in the invoice to prevents conflicts and confusions.

8. Export Controls

Last but not the least is the details for the export control. The necessity of creating a pro forma invoice is dependent on whether or not you can actually do business with this potential customer.

US export regulations identify certain organizations and individuals with whom you can’t do business with and control the type of information and products that can be transported to certain people from a specific country even without first getting an export license. Before proceeding with a potential customer, you must check on these requirements. You may also like catering invoice examples.

Purposes and Advantages of a Pro Forma Invoice

- It helps minimize the errors in the shipping and delivery of goods.

- It outlines all relevant information pertaining to the export transaction.

- It helps streamline the sales process.

- It is ideal when the details of the sales invoice are not yet available.

- It is not used to demand payments.

- It is sometimes used in business entities for their internal purchasing approval process.

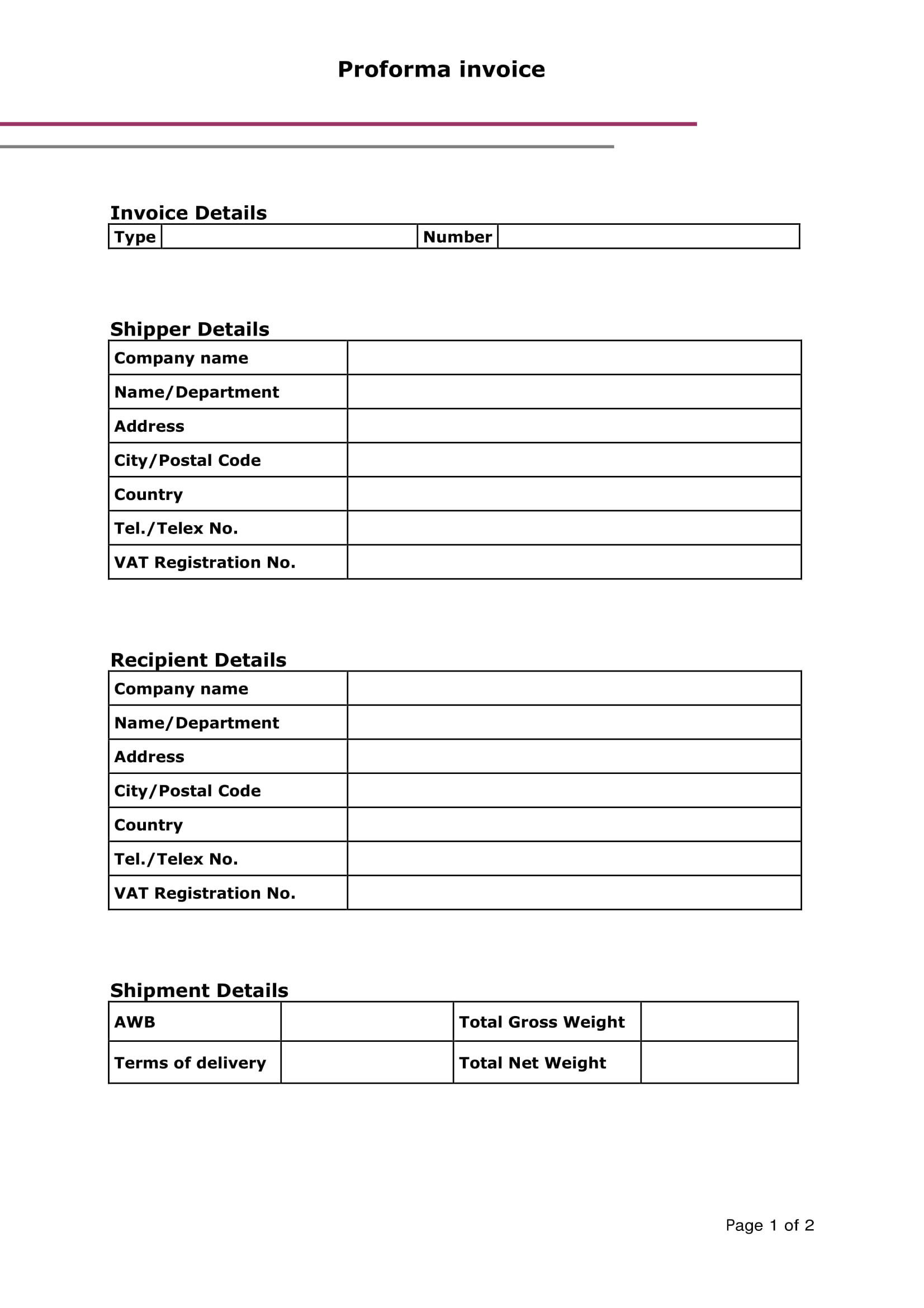

Sophisticated Pro Forma Invoice Example

Standard Pro Forma Invoice Example

Difference between a Pro forma Invoice and a Sales Invoice

A pro forma invoice and a sales invoice are somewhat similar prima facie. However, when you take a good look at both of the invoices and you trace their issuance, there are very huge differences that you will notice.

As been previously explained, a pro forma invoice differs from a sales invoice in the nature of their content. For pro forma invoice, the details of the good such as the price or quantity may be changed, while in sales invoice, they are permanent and they are the final amount to be paid by the buyer. You may also see auto repair invoice examples.

Pro forma invoice does not demand or request payment from the buyer, while in sales invoice, it requests the payment from the buyer.

The issuance of pro form invoice does not affect the financial statements of the buyer and the seller, while the issuance of sales invoice would mean that the seller must record accounts receivable and the buyer accounts payable.

On the timing of the issuance, a pro forma invoice is issued before the sales take place, while a sales invoice is issued after the sales takes place.

Knowing these differences would help you easily distinguish a pro forma invoice from a sales invoice.

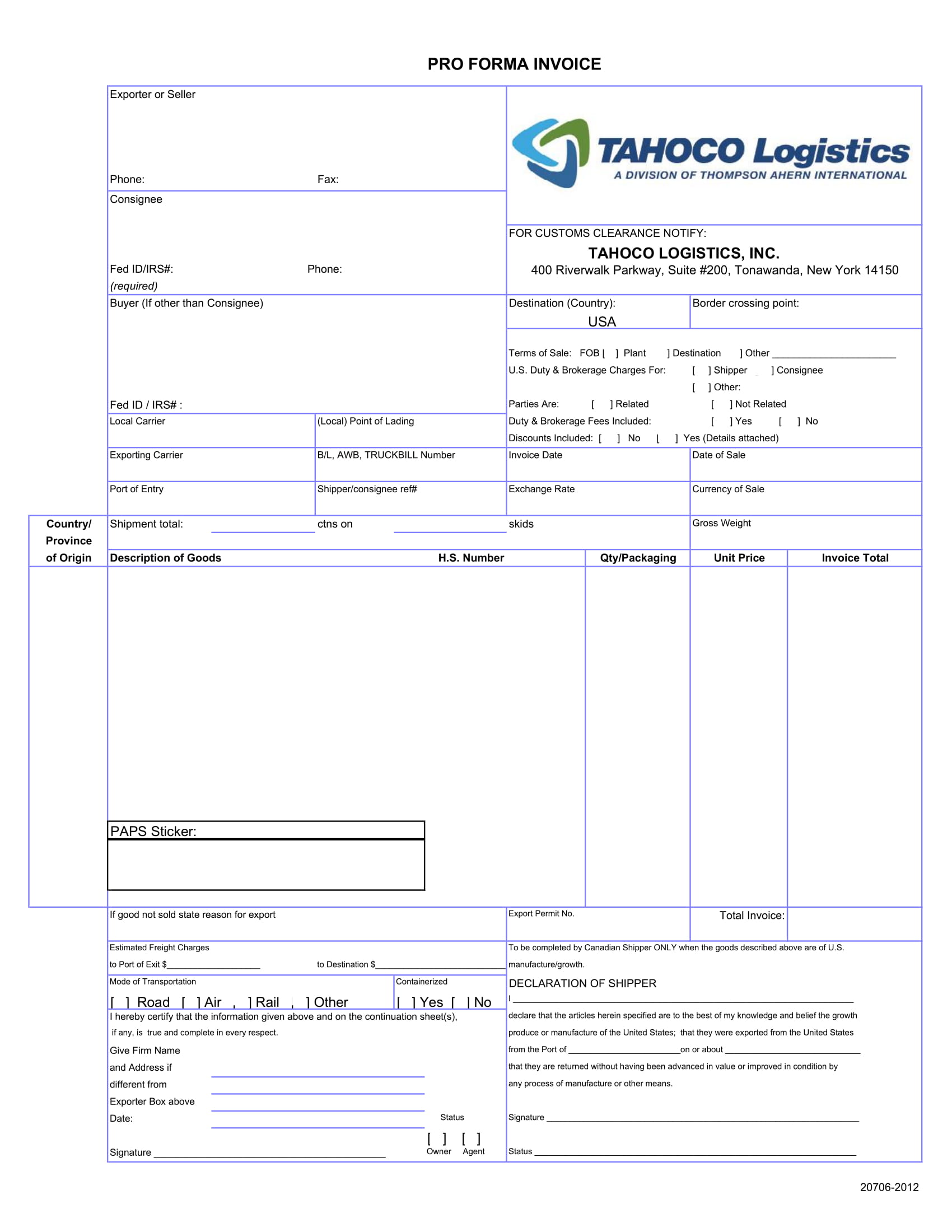

TAHOCO Pro Forma Invoice Example

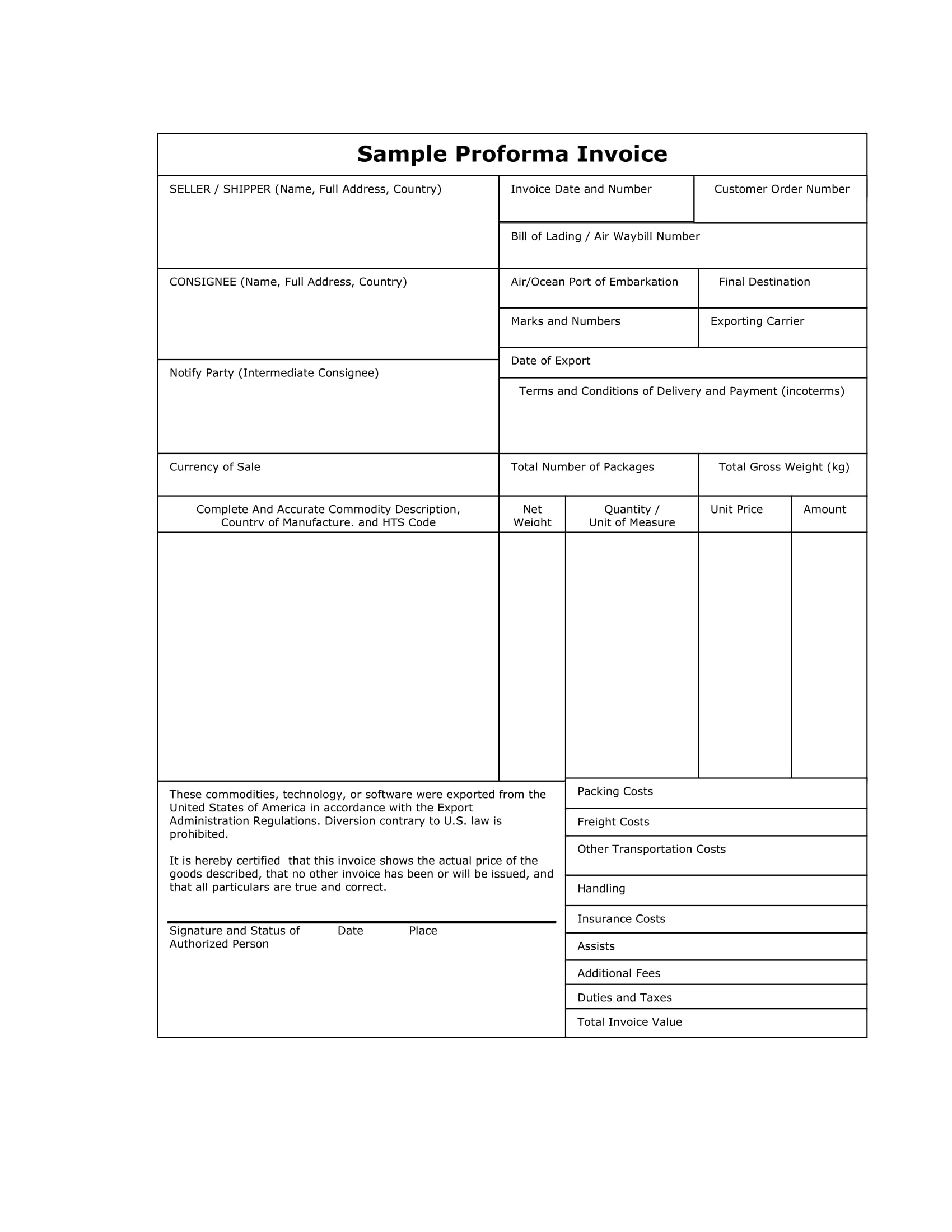

Comprehensive Pro Forma Invoice Example

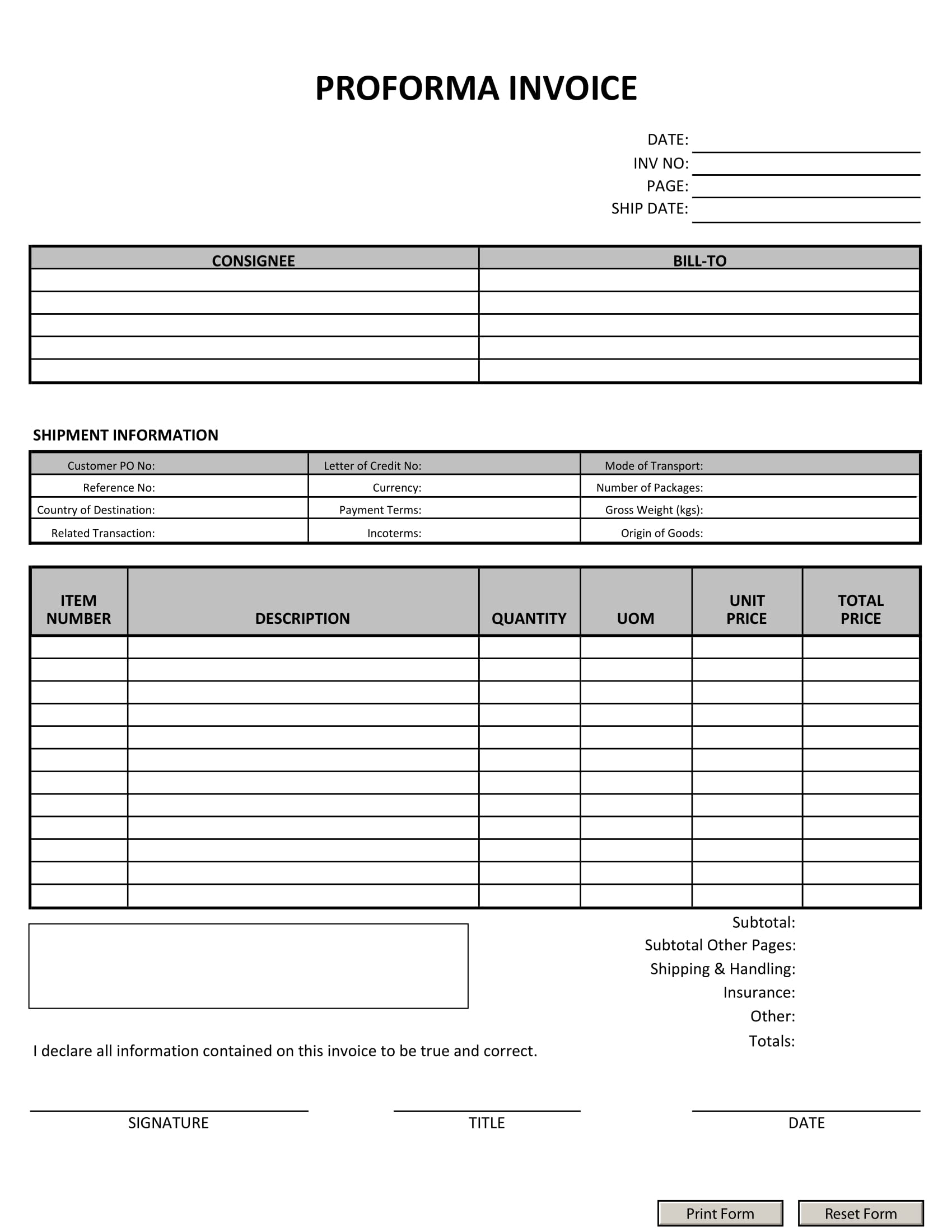

Concise Pro Forma Invoice Example

Recap

Pro forma invoice, just like any other invoice, is needed to complete a sales transaction. Pro forma invoice, or estimated invoice, is sent by the buyer to the seller in advance in a delivery of goods. Although it notes the quantity of the goods, the price, and other important information related to the goods, it contains temporary information, meaning the information is still subject to change. You may also see self employed invoice examples.

There are six components in a pro forma invoice which are as follows: quantity, price, description, terms of sale, payment terms, delivery details, and export control. These components comprise a complete and understandable pro forma invoice which is needed to have a smooth flow of the sales transaction. You may also like free invoice examples.

General Pro forma invoice is important as it helps minimize the errors in the shipping and delivery of goods, it outlines all relevant information pertaining to the export transaction, it helps streamline the sales process, it is ideal when the details of the sales invoice are not yet available, it is not used to demand payments, and it is sometimes used in business entities for their internal purchasing approval process.

Lastly, the examples and templates presented above can surely help you with regard to pro forma invoice; hence, you must check them all out!