10+ Proforma Examples to Download

In the world of business, almost every move you make requires a document or requires it to be documented. These documents are called pro forma. It is a Latin phrase that means “for the sake of form” in English. Its function depends on what kind of document you are trying to produce. Let’s take financial statements as examples. A pro forma financial statement acts as a dummy to project the cash flow of a company. Like a bona fide company financial statement, it also takes into account the income statements, balance sheets, and more. You can learn more about the variations of such documents by checking out our article and examples below.

10+ Proforma Examples

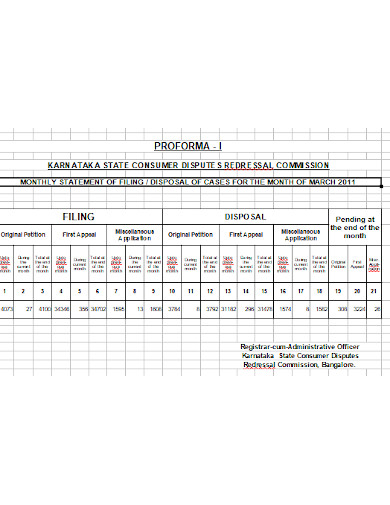

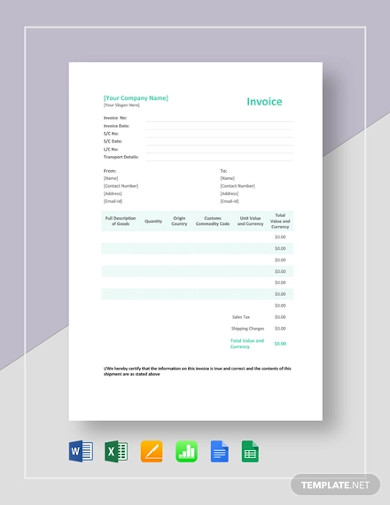

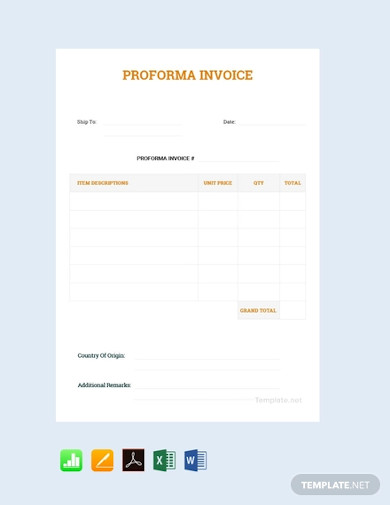

1. Simple Proforma Invoice

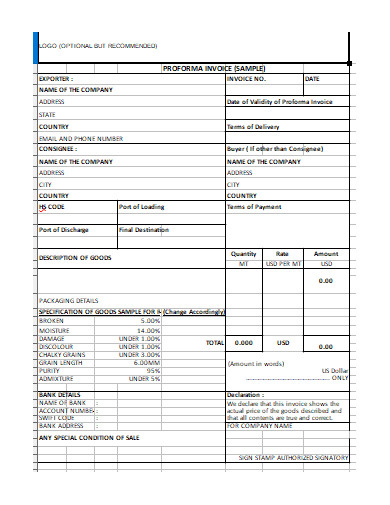

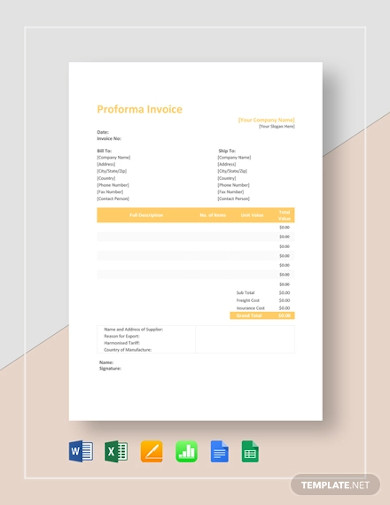

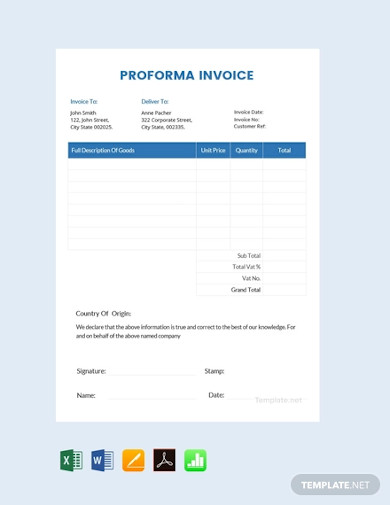

2. Proforma Invoice

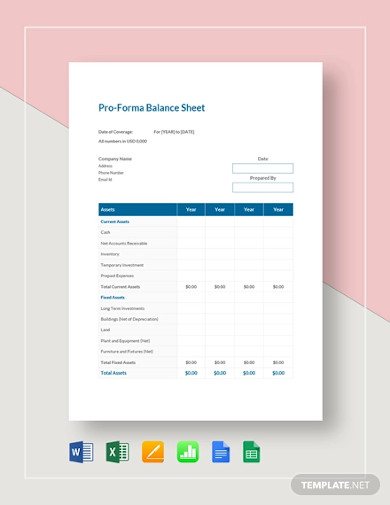

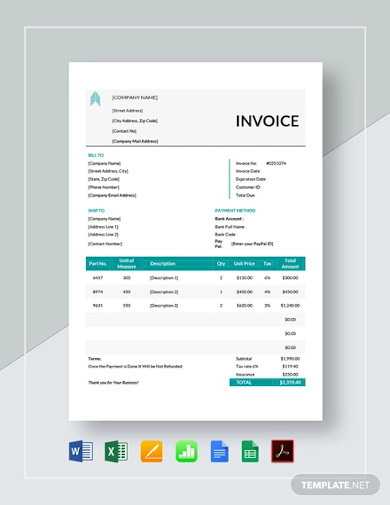

3. Proforma Balance Sheet

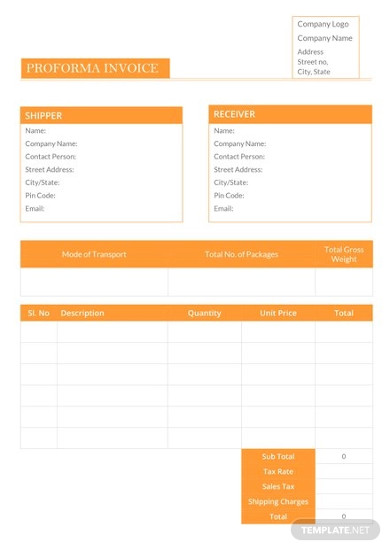

4. Sample Proforma Invoice

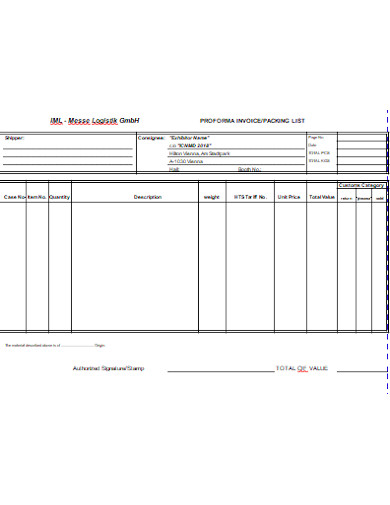

5. Proforma Invoice Example

6. Printable Proforma Invoice

7. Basic Proforma Invoice

8. Business Proforma

9. Company Proforma

10. Sample Proforma

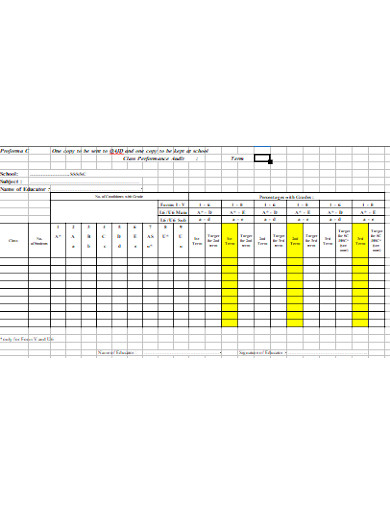

11. Proforma Example

What Is a Pro Forma?

Any document that presents assumptions, forecasts, or presentations of informal information representing a formal document is considered a pro forma. The Corporate Finance Institute (CFI) states that any form of pro forma documents functions like letters of intent (LOI). They explained that the said documents help professionals express their interests in making business transactions and disclosing their respective intentions or result projections. Common pro forma documents take the forms of invoices, job applications, resumes, receipts, and quotations. The use of pro forma is common in real estate and construction industries.

Types of Pro Forma in Financial Accounting

Pro Forma financial statements are other forms of financial reports that organizations issue to present financial assumptions with past accounting and financial statement analysis results as their basis. These documents have three general types, including pro forma income statement, pro forma balance sheet, and pro forma cash flow statement.

Pro Forma Income Statement – This type of pro forma has three functions. First, it projects sales revenue. Second, it ensures that the financial reports follow the Generally Accepted Accounting Principles (GAAP). Lastly, it also predicts the outcome of acquisitions.

Pro Forma Balance Sheet – This type of pro forma presents the projections on the balances of assets, liabilities, and equity.

Pro Forma Cash Flow Statement – This pro forma discusses the cash inflows and outflows of a company, such as investments.

How To Create a Pro Forma

Creating a pro forma depends on what kind of financial document you are trying to make. Even though it’s not considered an official document, you still have to treat it as one. By far, pro forma income statements are the most complicated. To walk you through in making one, take heed on our ready-made outline below.

1. Check Current Income Statement

The first thing you have to do is to request access to your company’s data inventory and check on your past and latest income statement.Take note of the items that are prone to changes such as the sales and expenditures’ figures.

2. Make Sales and COGS Forecast

Start composing your pro forma by projecting your company’s overall sales and costs of goods sold (COGS). Do your estimates by comparing the past and current annual sales reports. The same process goes into finding out the COGS.

3. Calculate Total Revenue or Gross Profit

After making up the details on your sales and COGS forecast, calculate your total revenue or gross profit. To do this, you just have to find the difference between your sales figures and COGS.

4. Totalize Expenditures

Just like the second step, you will make a forecast, only this time, on the expenditures. Using the past and the latest business expense reports, create a list of items that you think are necessary for your business operations, including the cost of each item. Once you have them all in place, find the total amount.

5. Compute Profit Without the Tax

Now that you have your total revenue and expenditure all figured out, you have to find out what your gross profit is. Do this by subtracting the total expenditure from your gross profit.

6. List Tax Figures

When creating a pro forma income statement, you must not forget about the taxes. Aside from your data inventory, you might have to look at your area’s taxation policies. Once your much-needed pieces of information are in your hands, create a list that details the taxes.

7. Work Out Profit With the Tax

The last step in creating a pro forma income statement is calculating how much your company’s profit is even with the tax. Simply subtract the total tax from your profit.

FAQs:

Who uses pro forma?

Accountants, management consultants, and entrepreneurs are the usual professionals who produce pro forma documents. Accountants use these documents for financial analysis. On the other hand, management consultants utilize pro forma documents as tools that set the decision criteria in studying and acquiring financial assets. Meanwhile, entrepreneurs use these documents to attract potential investors or to appeal to other funding sources.

What are the different types of accounting that uses pro forma?

The two types of accounting that use pro forma are the financial and managerial accounting. The pro forma documents in financial accounting act as financial reports to attract prospective investors or compute company earnings. On the contrary, the pro forma documents in managerial accounting serve as internal financial statements.

Why do we need to make pro forma documents?

Producing a pro forma document is one way of testing out certain circumstances that can possibly happen in the future. Needless to say, it paves the creation of a business plan, financial forecast, or engagement with potential investors, grantmakers, or other sources of funds.

Former United States president Abraham Lincoln once said, “The best way to predict the future is to create it.” These wise words perfectly summarize the very function of a pro forma document. Because of such a document, many businesses have prepared themselves, not for the worst to come, but for all circumstances. The preparation allows corporate entities to increase the chances of success in whatever document they are trying to create and for whatever purposes. Since it is a sort of a testing tool for documents, we can conclude that these types of documents play vital roles in the overall success of organizations.