5+ Project Finance Essentials Examples to Download

Project finance means funding in the creation of a project company that is legally independent. This sort of project is financed with limited or non-resource debts. Several sponsoring firms support such projects which may be based on anything like industrial or technical. The period of such investments is also very small as the projects are limited to a deadline.

5+ Project Finance Essentials Examples

1. Project Management Finance Essentials Example

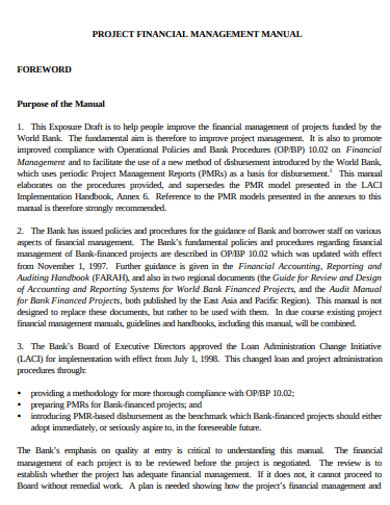

2. Project Finance Essentials for Social Sector Leaders

3. Natural Gas Project Finance Essential Example

4. Project Finance Course Outline Essential Example

5. Sample Project Finance Essential Example

6. MBA Project Finance Essentials Example

What are the Essential aspects of Project Financing?

Without a fund, many institutional and business projects can not be even planned that is why financing along with other requirements becomes necessary. The most important aspects of project financing are

- Lenders

- Sponsors

- Suppliers

- Contractors

- Customers

How Project Finance and Budget can be Managed?

Step 1: Understanding Stakeholders’ Needs

While designing a project you must think to look at what your stakeholders expect from the project. Fulfilling such expectations can direct you to several unpredictable paths that you might not have an idea on. That is why before acting on it plan your project actions as per the stakeholders’ needs assessment.

Step 2: Budget Realistically

While setting the budget of the project finance focus to gather responses from the stakeholders. It is better to study and have an eye on the external considerations and activities to control them for not impacting the resources, supplies, products, financing, etc. Thus you should plan for all the predictable and non-predictable circumstances to cope with different situations.

Step 3: Develop the Key Performance Indicators

Key performance indicators are one of the most important parts of project budget management. It helps you to keep a track of the expenses of the project, and the difference in the difference in the actual budget plan and tye expended amount. The following are some of the commonly used KPIs that are crucial in project budget management.

- The actual cost to keep a note of the capital spent on the project.

- Cost variance manages to estimate the cost spent has gone above or is below the set baseline.

- Earned value shows the budget decided on project activities to a particular time.

- The budgeted cost of work scheduled refers to the set cost for project activities.

- Return on investment is the level of profit derived out of the budget.

Step 4: Review and Re-forecast

Reviewing and re-forecasting is a work that can help to eliminate the mistakes and errors from the project and its management plan. So reviewing and re-forecasting is a way to reduce failure in projects. It can also give you an idea of the assets that remained unutilised in the project.

Step 5: Inform Everyone

One of the most important parts of managing the project budget or finance is to make your team members aware of the budget you are working on. An informed team can act out on the works fast and instantly without waiting for any sort of order or doubt.

What are the Characteristics of the Project Finance Essential?

- A project that is established separately.

- Tying the finance works and provisions with the management people.

- The projects are framed in a way to be easily communicated to the stakeholders.

- The project company functions with great ratios and equity and lenders who are limited to the recourse to the equity holders.

- Uses management tools to successfully implement project works in a controlled and effective way.

What are the Elements of Project Finance?

1. Capitally Intensive

Project finances might include great capitals for different national and international projects but it is very barely noticed.

2. Takes Numerous Member

A project often takes multiple people for its action and completion, that is why the chances of increasing the number of participants are common and understandable. Different project participants perform different responsibilities try to compile the project collectively.

3. Non-Recourse Financing

Project financing is always done with non-recourse funds or limited resources that the borrowers do not have personal liability to at the monetary default event. Even the project companies as limited liability and the lender’s recourse are often limited to project assets.

4. Off-Balancing Sheet

A project company is an independent and separate entity and all the finances and transactions of the project are kept apart separately in an off-balance sheet for a special purpose. This element is more preferable to the project sponsors as it doesn’t give a more negative impact on the sponsor’s balance sheet.

5. Finance Document

Project financing may go complex sometimes that is why documenting all the transactions and details is important. Such neatly and organised financing documents help in the smooth functioning of the project and project management.

6. Risk Management

Every project financing and other business plans are supposed to have and create some because of the more exposures to risk in deals. Risks are most of the time inherent in project financing that is why one needs to have a detailed plan for mitigating them by taking all the important aspects into considerations.

7. Project Financing

The project company is often a singe special purpose within a specific and small time frame. Such practices are held only to owe the responsible person capital and transactions by the sponsors. Sometimes the project ends on the, not of SPE transfer.

8. Project Cash Flow

Over cash flow applied in the project processing are often bound in a contractual obligation to debt services. Those overflows are used to boost loan amortisation that reduces risks.

9. Higher Costs

Project financing are often more expensive than any regular corporate finance. It asks for high financial requirement structures for its different works that give the costs to go high and liquidity goes low.