10+ Financial Proposal Examples to Download

Creating a strong financial proposal is essential for securing funding and getting your project off the ground. This document should clearly outline your project’s objectives, the amount required, and how the funds will be used to achieve your goals. A well-prepared financial proposal not only demonstrates your project’s potential but also shows your commitment to transparency and fiscal responsibility. Whether you’re approaching investors, financial institutions, or partners, your proposal is your first step towards turning your ideas into reality.

What is Financial Proposal?

Financial Proposal Examples Bundle

Financial Proposal Format

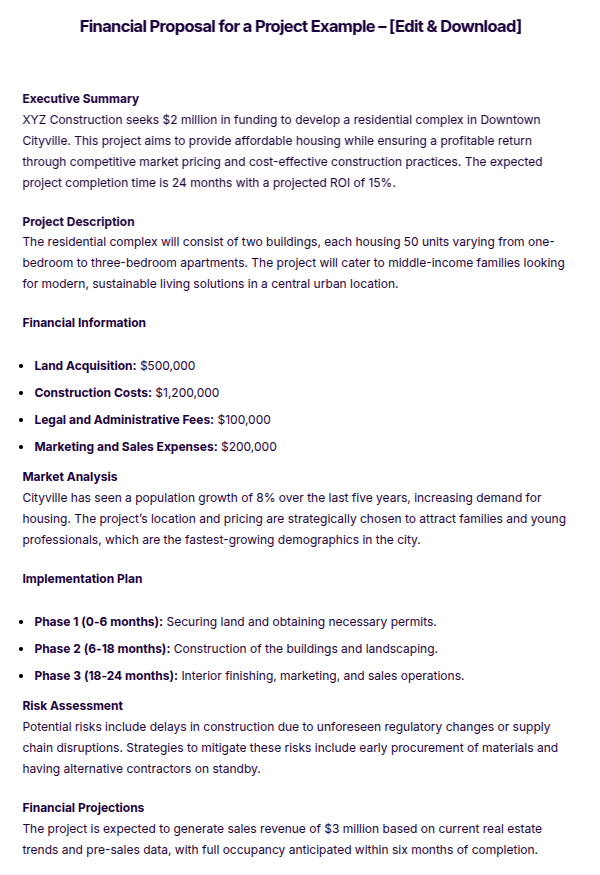

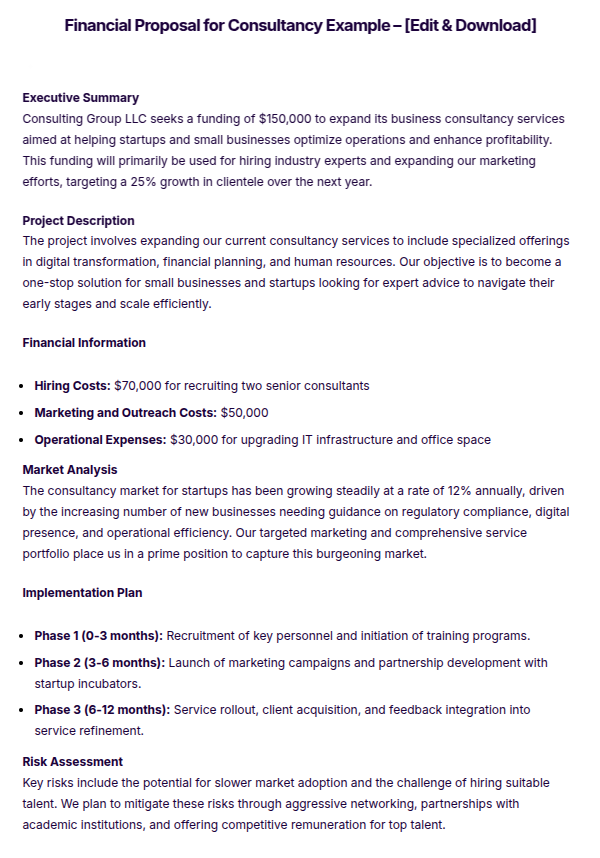

Executive Summary

Brief overview of the project or business. Key financial figures and funding request.

Project Description

Detailed explanation of the project. Objectives and expected outcomes.

Financial Information

Detailed budget breakdown. Cost analysis and funding sources.

Market Analysis

Insights into the current market. Competitive analysis and target audience.

Implementation Plan

Timeline of project milestones. Strategies for project management.

Risk Assessment

Potential risks and their solutions. Contingency plans.

Financial Projections

Future financial forecasts. Profit and loss projections.

Conclusion

Summary of the proposal’s strengths. Final appeal for funding support.

Appendices

Supporting documents and references. Additional detailed data.

Financial Proposal Example

Financial Proposal Examples

Financial Proposal for a Project

Financial Proposal for Consultancy

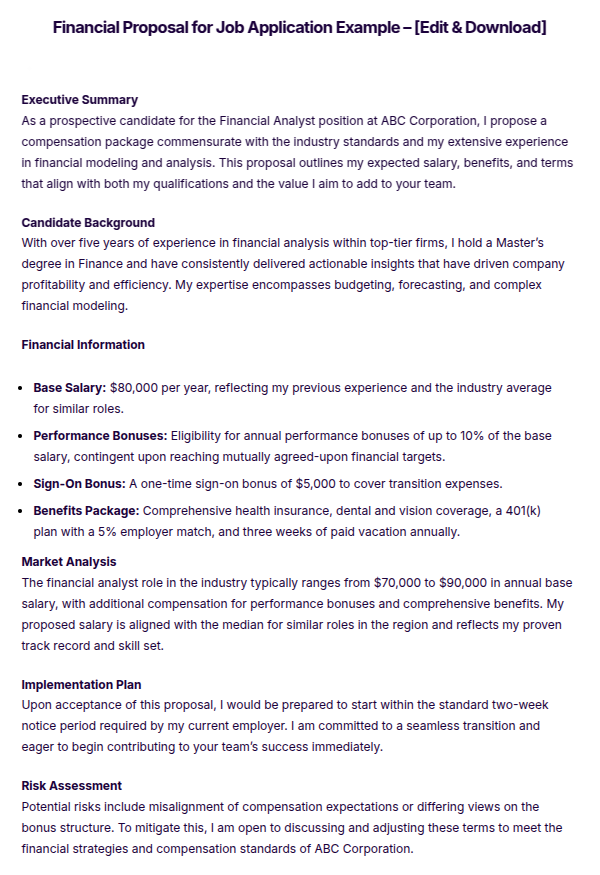

Financial Proposal for Job Application

More Examples on Financial Proposal

- Financial Proposal for Individual Consultant

- Financial Proposal for Tender

- Financial Proposal for Bidding

- Business Financial Proposal

- Unicef Financial Proposal

Financial Proposal Template

Financial Funding Proposal Template

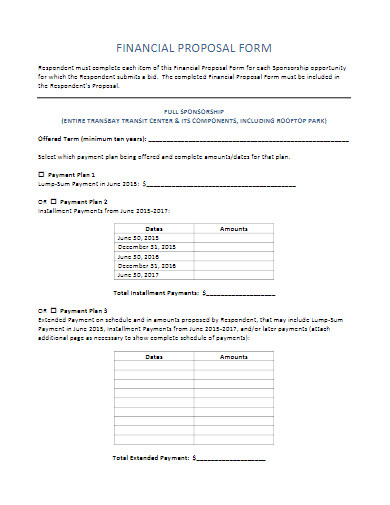

Financial Proposal Form

Financial Proposal Example

Financial Request for Proposal Template

Sample Financial Proposal Template

The Four Forecasting Methods

Financial forecasting is providing estimates or projections on the revenue and expenses of a company. Unlike financial plans or financial proposals, forecasting doesn’t elaborate on how a company can generate money and counterbalance its expenses. There are four ways to do such activity, including the straight-line method, moving average, simple linear regression, and multiple linear regression.

1. Straight-Line Method – The financial analysts combine the past financial documents in the company’s data inventory with the current trends to predict its future financial status.

2. Moving Average Method – The forecasters refer to a company’s current data patterns to predict its financial position in the future.

3. Simple Linear Regression – The forecaster uses a linear illustration of two variables, the predictor and the response, to explain their relationship and how they can predict the future of a company’s financial aspect.

4. Multiple Linear Regression – This type functions the same as the simple linear regression, but with more variables.

How To Create a Financial Proposal

Even though financial proposals are just mere guesses on a company’s finances, each of their elements plays an important role in the said business aspect’s success. It is because of that fact that you have to write them following the standards. If you’re not into proposal writing, especially about finances, let us guide you through our standardized outline below.

1. Give a Quick Run-Through

The first thing you have to do is to provide your audience with an overview of the proposal. Incorporate details about the business, specifically about how it generates its income, its usual expenditures, as well as its short-term goals and long-term goals.

2. Determine the Stakeholders

After giving out an overview of the proposal, make a list of all stakeholders. To give you a headstart, they consist of managers, accounting heads, and investors. You can also include the other people who helped in the creation of your document. In the list, make sure to write down the stakeholders’ roles and responsibilities.

3. Identify the Problem and Provide Resolution

Once you have introduced the stakeholders, start giving out the financial issues that the company is currently facing. The resolutions to these problems should follow right after. For example, if you wrote down that your company is low on sales, you can propose reducing its expenditures to even the weight of your financial resources.

4. Add a Timeframe

It will take some time for the resolutions to mitigate or eliminate the problems. To ensure that the stakeholders will not skip a process, and meet the deadlines, create a management timeline for them. It will guide them in performing the right activities while putting a little bit of pressure to improve their productiveness.

5. Present the Budget

The budget is one of the main components of a financial proposal. Therefore, there’s a need for you to prioritize it. Keep in mind to only set realistic amounts, whether your proposal’s purpose is to gather additional financial support or to get funds for your startup business.

6. Polish Your Document

After setting everything from the overview to the timeline, proceed by polishing your output. Given that it is for business purposes, you should free your document from unnecessary errors. For you to do so, double-check your grammar, spellings, and, most importantly, the numbers and figures.

7. Make a Summary

As per the standard documentation procedure of business documents, you should make a summary of every section of your proposal. It is necessary to give the audience the ability to quickly look back on the important details without reading the entire document again.

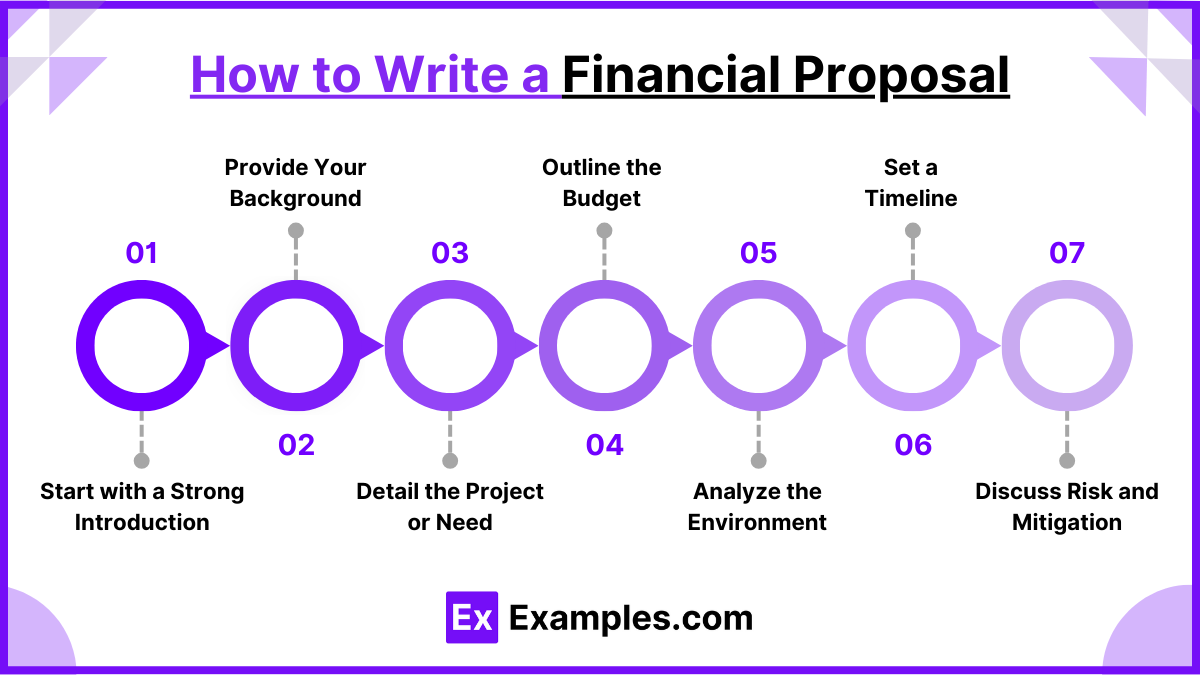

How to Write a Financial Proposal

Start with a Strong Introduction

Clearly state the purpose of the proposal and the specific financial needs. Explain the impact or benefit of the project succinctly.

Provide Your Background

Include relevant experience or organizational history that establishes credibility and supports your capability to manage the project successfully.

Detail the Project or Need

Clearly describe what the project involves, your goals, and how you intend to achieve them. Be precise about what the funding will accomplish.

Outline the Budget

Itemize the funding requirements. Break down costs in a clear format, showing how each portion of the funding will be allocated.

Analyze the Environment

If relevant, discuss the market, industry trends, or other external factors that justify the need for the project and the timing of the funding.

Set a Timeline

Specify when the project will start, major milestones, and the end date. This timeline should align with the budget and demonstrate efficient use of resources.

Discuss Risk and Mitigation

Identify potential challenges that could impact the project’s success and provide strategies that will be used to address these risks.

FAQs

Who reviews financial proposals?

Financial proposals are typically reviewed by stakeholders such as investors, grant committees, or bank loan officers, depending on the funding source.

How can a financial proposal impact a business?

A well-crafted proposal can attract investors, secure loans, and provide a roadmap for financial management.

What common mistakes should be avoided in financial proposals?

Avoid vagueness, lack of detail in the budget, unrealistic goals, and failing to address potential risks.

Why is a financial proposal important?

It’s essential for securing funding by demonstrating the viability and financial planning of a project.

How long should a financial proposal be?

A financial proposal should be concise yet detailed enough to cover all aspects, typically ranging from 5 to 20 pages depending on complexity.