8+ Financial Planning Questionnaire Examples to Download

Money, despite its ability to give people the finer things in life, is a finite resource. While it is possible for everyone to have a lot of cash, it will lead to the stagnation and collapse of the economy. Instead, we reconcile with its finiteness and cultivate our resources through smarter financial and risk management. Every institution that uses money should be adept with proper financial management to sustain its growth and operations long-term. It is especially essential during the first few years of business. There isn’t just one way to manage your finances, but you can start by evaluating the business’s economic position through questionnaires.

Businesses spend money to produce and market products. They receive money in return from customers. A fraction of the profit goes into production and marketing. The institution maintains that cycle of buy-produce-sell. This cyclical sketch of money’s pathway in the business industry doesn’t represent the real and more complicated scenario in the industry. But, as in theory, things will fall apart if the company doesn’t strategize the flow of money. Financial management involves outlining, organizing, and overseeing the ins and outs of monetary resources of a business or organization. To exercise these responsibilities, financial managers produce reports and develop strategies for the business to achieve financial sustainability and longevity.

Good financial management is just one of the many requirements in keeping big or small businesses in tip-top shape. However, it doesn’t render the task any less significant in the day-to-day operations. For financial managers to execute their function well, they need questionnaires that will give them the information they need. The answers they get from questionnaires provide valuable insights and impressions in the financial practices of the business.

The Trouble with Unlimited Money

Things would seem easier if we didn’t run out of money ever. We won’t have to bother managing our finances because wealth will always be there. We can forget about budgeting or going through tall piles of financial records. We can employ more people in the company, which would result in higher productivity. Everyone would have so much money than they know what to do with. However, this fantasy is stacking its cards against the basics of economics. When we have more of the material, it loses its value.

Value of Scarcity

Limited availability increases the products’ value to be more than their mass-accessible counterparts. This idea partially explains why some luxury goods are priced in several thousands of dollars. For example, the coveted and rare Himalayan Birkin bag could set you back around $500,000. There are only a few of this bag on the market, and we can’t just walk into a Hermes store to get one. Purchase power is a privilege, and not everyone is given a chance. If the bag weren’t as exclusive, more people would be able to get one, and the bag’s value would decrease.

When More Means Less

With infinite money, we can get previously unattainable purchases. And so will everyone else. Businesses would have to increase the price until market equilibrium to supply such an uproar in demand; then, the supply and demand of items or services are balanced. Because people can pay more, prices would just keep skyrocketing. Meaning, a million dollars would have a value of $10.

Harmed work ethic is a by-product of this fantasy scenario. In theory, people work hard so they can earn more. If everyone had so much money, we wouldn’t have the same potent drive to give our best at work. Employees will provide low quality work performance. Maybe we won’t even work at all. Can you imagine being inside a tall building with the constitution of a deck of cards? Would you want to pay several thousands of dollars for spoiled food and muddy drinking water? Eventually, the quality of our goods and services diminishes. There will be low output and productivity. Dwindling supply and increasing demand will drive prices higher, and, eventually, supply and money will run out.

This economic nightmare is held back by controlling the amount of money in circulation. We can still earn and safeguard our finances with the restriction in place. We can’t hold on to every penny; we have to spend to earn revenue. We also can’t spend everything. Even things like investments contain varying degrees of risks that we need to study and calculate. Therefore, businesses need capable financial managers to prepare smart and effective financial management strategies and plans for the well-being of the enterprise.

Financial Management in Business

When you can oversee the cash flow in your business, you can strategically distribute these to different areas in the organization. You can hire more people, generate more products or services, expand your business, improve your marketing, and other options for business and revenue growth. You get to achieve more productivity for less. You can also look at the risks that you might encounter and do something to protect your business. How will you know if you are earning enough when you don’t do a proper accounting of your finances?

Make it a point to have a reliable team of financially-proficient individuals taking a close look at your company’s financial affairs. If you have several people in the administration who can drive the big business decisions, see to it that you have people with financial expertise in the circle. The decisions made from the top level of the organizational hierarchy will ripple into your business’s future. So, someone who understands economics and business finance has to be part of the decision-making body.

8+ Financial Management Questionnaire Examples & Templates

You can answer the following sample survey questionnaires to help you assess your business’s financial status. When you have an idea of your economic position, you can make the necessary decisions to achieve the organization’s goals and objectives.

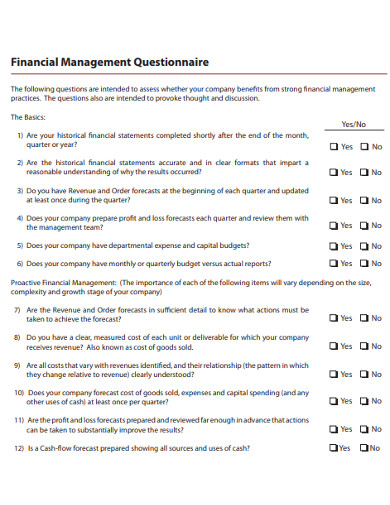

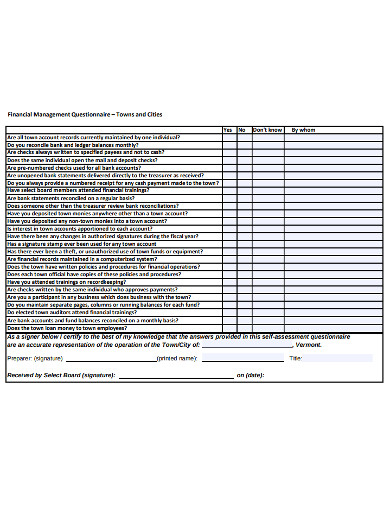

1. Sample Financial Management Questionnaire Example

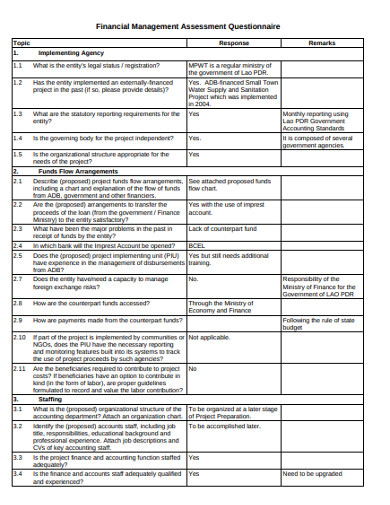

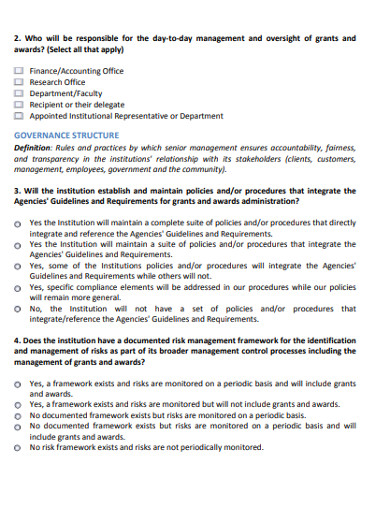

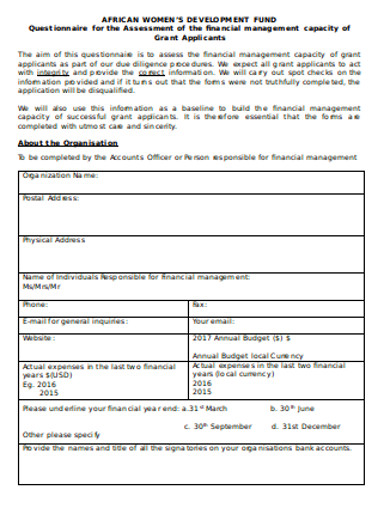

2. Financial Management Assessment Questionnaire Example

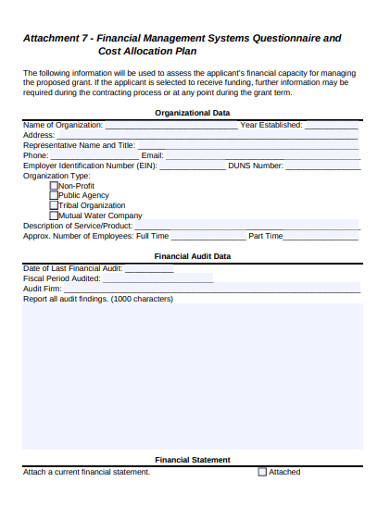

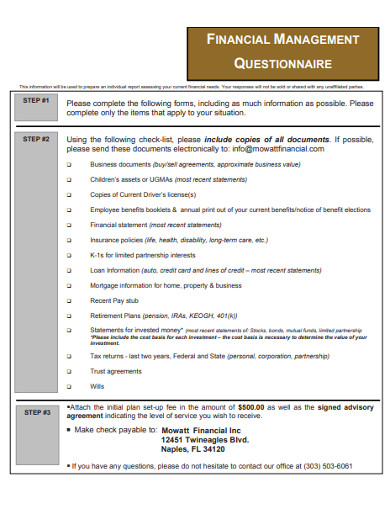

3. Financial Management System Questionnaire Example

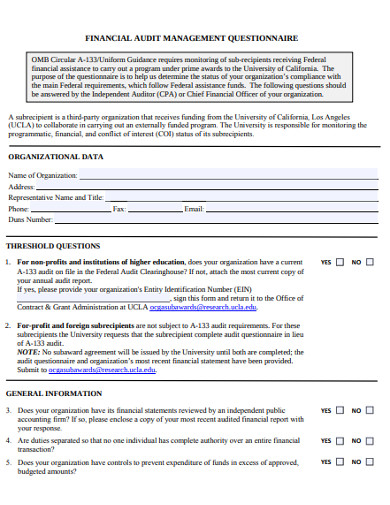

4. Financial Management Audit Questionnaire Example

5. Basic Financial Management Questionnaire Example

6. Financial Management Risk Assessment Questionnaire Example

7. Standard Financial Management Questionnaire Example

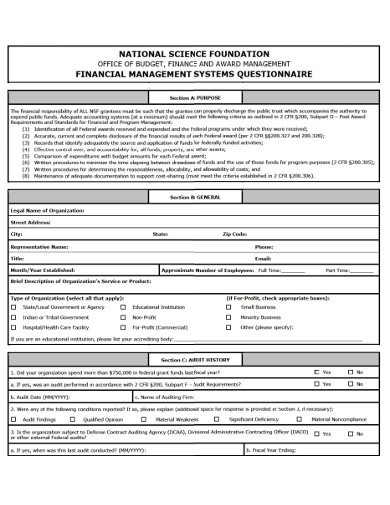

8. Financial Science Foundation Management Questionnaire

9. Financial Development Management Questionnaire Example

Evaluating Finances with Questionnaires

Financial managers closely monitor finances so that they can prepare and propose proactive measures to safekeep the company’s financial health. Therefore, questionnaires that supplement the tasks should also be able to assess the business’s financial position, risks, and areas for improvement. The survey form should contain sections pertaining to the following:

1. Review of Priorities

To evaluate the financial practices of the institution, financial managers would need to review the capacity of the management to consider the business’s financial interests when making decisions. This section of the questionnaire assesses the priorities of the management if these are in line with the company’s objectives. The word from the top of the company reverberate in the financial practices of the company.

2. Reassessment of Process

Financial managers also have to evaluate how the company manages its finances. How the company allocates funds for different purposes can also be reviewed. Expenses in other areas in the company can be cut down and redirect the extra resource to areas that need the fund. Financial managers can propose revisions on how the organization currently handles its finances. When the resource allocation is optimized, the company can maximize its resources.

3. Reporting of Data

How does the company’s finance department record and organize the transaction files? There should be timely and updated reports of financial statements and comprehensive data from previous years. When financial managers look through the old data and compare these with the current financial data, they will have reason to modify and correct practices to favor financial growth. Evaluations of previous measures to grow the company will also help in finding out what works and what doesn’t.

4. Re-examination of Control

The company’s financial control is all the approaches and processes that the company institutes to sufficiently safeguard financial health. The financial managers can review how effective these controls are for the company’s goals and objectives. When there is an error in the procedures, the manager can propose corrections. The procedures can also function as a measure to prevent errors in the practices.

The finiteness of money requires strategic planning by individuals and organizations to optimize the available resources. Financial management has its importance in any business venture to maximize the gains and minimize losses. By diligently working and monitoring your finances, you can be sure that not one of your hard-earned penny goes to waste. It’s just good business to be able to account for your resources down to the last digit.