10+ Financial Planning Questionnaire Examples to Download

By helping people manage their assets and liabilities and actively reach their financial goals, financial planners can save people from questionable decisions and regrettable, uncalculated risks. Some people attempt to do the planning themselves. While that isn’t a bad thing, sometimes what they’re doing is usually just budget planning. Financial planners assist people in making the right moves towards financial freedom.

As financial planners, we help people handle their finances, achieve their financial goals, or both. We look through the client’s finance files, their assets and liabilities, talk with them to gauge their stage of life and work with them on how they can make their life goals a reality. But all our hard work would be put to waste when the financial roadmap we prepared does not fit our clients’ specific needs and aspirations. The financial plan is only as good as the information available to the planner from financial planning questionnaires. Refining this plan involves revisiting the questionnaires for a make-over.

Areas For Financial SOS

In a world where money is the medium by which we acquire personal assets and purchase necessities, it makes sense that we should be strategic in distributing it. For some people who watch idly as their money flies out of their wallets, financial troubles seem to be their wake up call to wise up with their finances. Others just try to set a budget cap with their expenses and forget about investments and setting up funds in the bank. These cases are an SOS scenario for financial planners. Financial planners can specialize in different areas of financial help. Among these are:

Retirement planning: People wouldn’t want to work forever. And even if they want to, their body won’t allow them. Old age would limit some of the body’s functions, that we may need to vacate our spots for newer members of the workforce. That is why people should have a retirement plan early on. They would need the money for sustenance and as a safety net once the salary stops coming. It can spell trouble when people don’t realize this or think about this in the last five years of their career.

Estate planning: We can’t take our homes with us when we die. It would be hard to sell the place we grew up in to strangers, too. There are too many memories in every hallway, nook, and cranny of the home that we can’t give up easily. Therefore, people opt to leave their houses to their trusted people, often their family members. Because estates can be a hard matter to deal with—complex assets, debts, and tax benefits, on our own, we need a specific estate plan that considers the complexities of the property and inheriting it.

Event and party planning: The joys of parties and galas don’t reflect the challenges in event planning to make them run smoothly. Aside from the logistics, supply chain management, and operations that we stress about, the finance department of any party can be a nightmare when we can’t manage it well. The horrors of overbudgeting and mismanaged finances can be saved by expert event financial planners.

Funeral planning: At a time of grief, the family members of the deceased shouldn’t be stressed about funeral arrangements and memorial service plans on top of the emotional experience. Funeral planning can be stressful on emotional, logistical, and financial levels. Therefore, funeral planners are a necessary help for laying the deceased to rest and letting the family have time to mourn the loss.

Wedding planner: The day of the wedding is a happy occasion and a stark contrast to all the stress of the planning months prior. Financial planners save people from the excessive pressure of wanting their special day to be perfect. Financial planners can help the couple with wedding planning by setting realistic budget expectations and working with the given budget. The financial planner is able to do this because he or she isn’t emotionally invested in the event, so he or she can give more eagle-eye inputs for the occasion.

10+ Financial Planning Questionnaire Examples & Templates

Browse through the following free samples of financial planning questionnaires below.

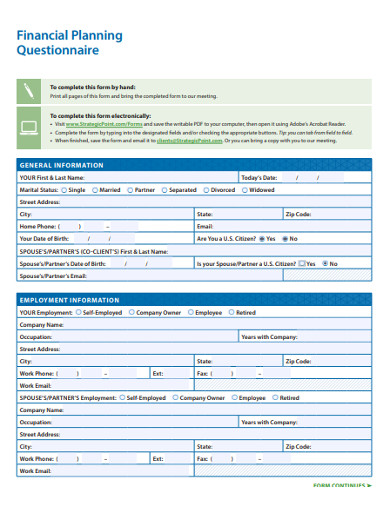

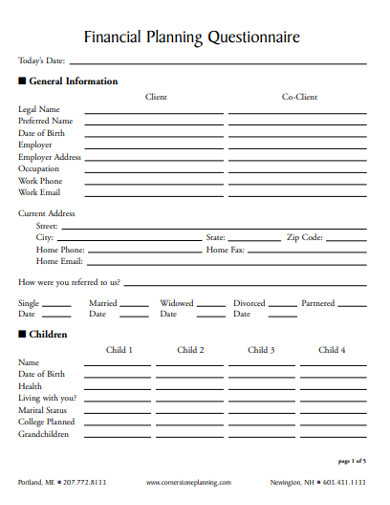

1. Sample Financial Planning Questionnaire Example

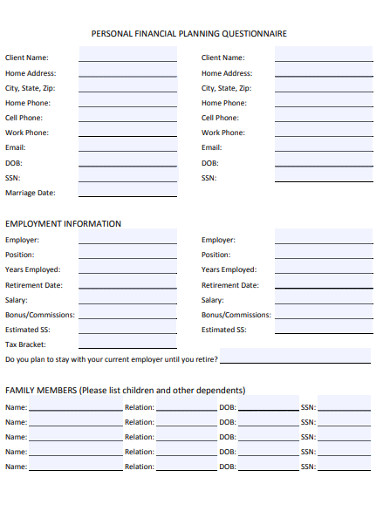

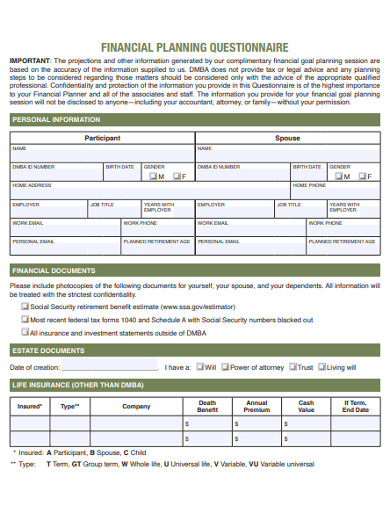

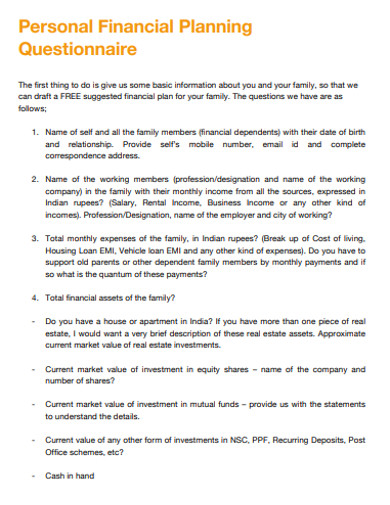

2. Personal Financial Planning Questionnaire Example

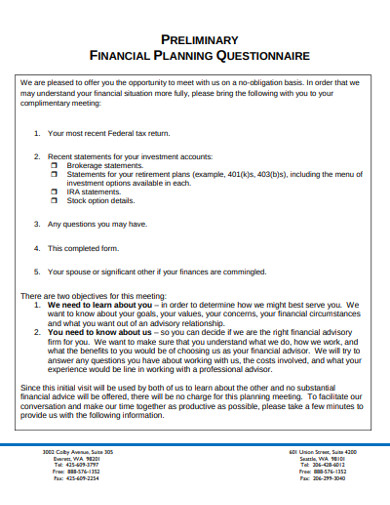

3. Preliminary Financial Planning Questionnaire Example

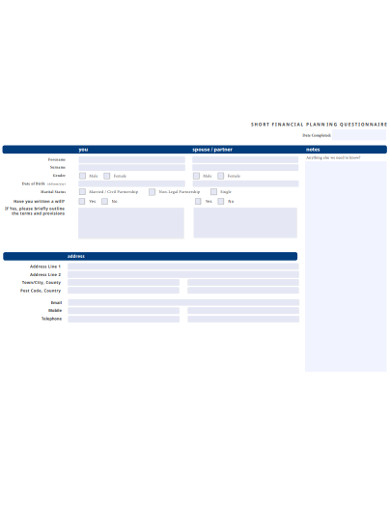

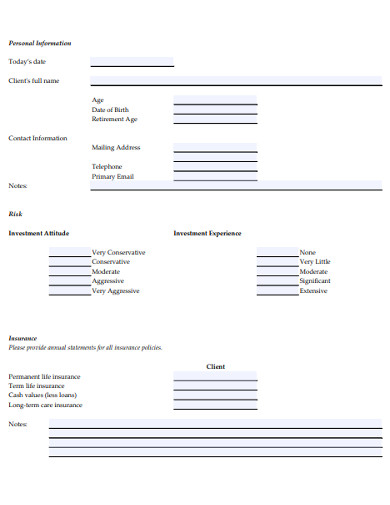

4. Short Financial planning Questionnaire Example

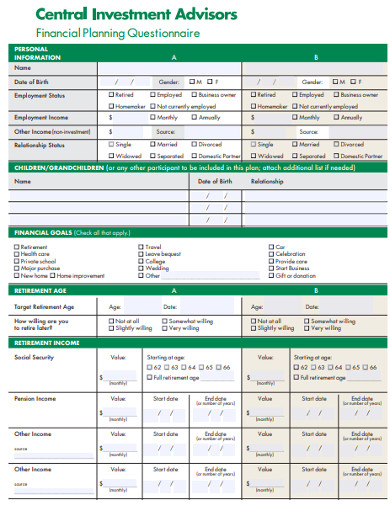

5. Financial Investment Planning Questionnaire Example

6. Simple Financial Planning Questionnaire Example

7. Basic Financial Planning Questionnaire Example

8. Financial Adviser Planning Questionnaire Example

9. Confidential Financial Planning Questionnaire Example

10. Formal Personal Financial Planning Questionnaire Example

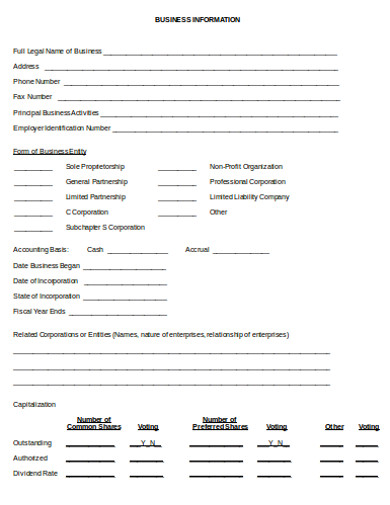

11. Business Financial Data Planning Questionnaire Example

Reviewing Your Questionnaire

Go over your questionnaire. And if you don’t have one yet, you should already start with yours. You can follow the following tips and start from scratch. Or you can browse through hundreds of planning questionnaires available online. What are the things you should remember to begin planning your clients’ financial future?

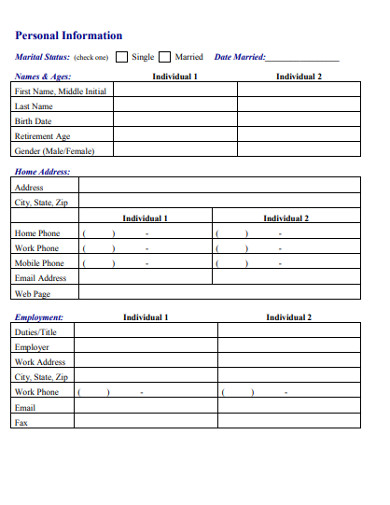

1. Personal Information

This information can be 1-2 pages long. It contains the data of a person’s identity, including his or her name, birth date, address, contact information, and family details. You will need these so that you can tailor a plan for your client. It can also help you start a discussion organically. Maybe they’re still young and haven’t had a retirement plan. Or, they have but the old plan isn’t a perfect fit for their growing family. You can also talk about saving for the kids’ education with college plans.

2. Assets and Liabilities

The person’s assets, like their savings, stocks, home, car, and jewelry, measure a person’s wealth or net worth. The possessions can be used for things like emergency expenses or making purchases. Liabilities, on the other hand, are the person’s financial obligations or responsibility, like loans, mortgages, and accounts payable. These need to be accounted for when calculating the real value of assets. This information should be declared so that you can consider them in the plan. Recognizing and protecting their assets are an important point in financial planning.

3. Financial Goals and Plans

To create a personalized financial plan for your clients, you have to know what they want in the next years. You have to understand their priorities and goals. Sometimes, it’s because they want to achieve this particular goal that’s why they sought your service. This is how you can help them, therefore you should know their financial goals. The questions in your questionnaire should be able to illustrate your clients’ vision and plans. When you see their goals as how they picture these you can better formulate a plan to achieve these. You can also perform a reality check when their goals are too idealistic for their current financial situation.

4. A Space For Changes

Although this isn’t a page in the document, you should remember that in a few years, people’s lives can change dramatically. That is why as a financial planner you should consider the dynamic nature of an individual’s life. They might have different plans for next year. They might have shifted in priorities. There might be huge, altering financial events, like a lottery win. Always make room for these changes, because nothing in a person’s financial life is static.

Planning for the future is a basic life skill for everyone. However, not everyone can have the needed foresight when they needed it. Because people can have different plans, aspirations, and circumstances, financial planning is not a one-size-fits-all industry. Although there will be models and theories that would apply to most people, one’s future roadmap will always be as unique as much as a person’s individuality