10+ Financial Questionnaire Examples to Download

For most people, financial freedom is the light at the end of their 9-to-5 tunnel. Who wouldn’t want to retire early and enjoy the rest of what they have worked for? The goal is there, but not everyone has the financial literacy of achieving it. Some of us are living from paycheck to paycheck, with a few to zero dollars in savings. People are burying themselves in more debt just to pay the previous debt that their income could no longer cover. As financial advisors, we are responsible for helping our clients get out of and avoid this nightmarish financial quicksand.

Financial planners ask their clients to disclose their personal and financial information on financial questionnaires in good faith. Financial questionnaires contain the client’s personal information that identifies the client’s demographic group. The client also declares his or her financial goals and aspirations, like saving up for retirement or the kids’ college education. He or she should also disclose his or her financial assets, such as those in mutual funds, bonds, and stocks.

There is also a statement on liabilities, such as loans and debts that the person, and his or her spouse, have incurred. Additional information, like insurance, valid will, and trust, are included in the questionnaire. By keeping an account of the clients’ assets and liabilities, the advisors can tailor personalized financial plans that keep the clients on the right track to financial independence and peaceful retirement.

Where Memory Recall Fails

As financial planners, we tend to have more than five clients. Even five is a handful already. We might not be able to remember all the nitty-gritty details about the person’s personal and financial information that will help us map out a decade or more of their purchasing, savings, and investment decisions. Worse case, we might even confuse one person’s data with another and offer erroneous advice. Instead of relying on just a notebook and our faulty memory recall, it is wiser to keep documents about their information that we can always refer to when we plan for their future. Aside from the reliability of the data which we based our suggestions on, possessing the files will also create the impression that we take our job and our clients seriously.

10+ Financial Questionnaire Examples & Templates

The right kind of questions yields the right answers. Therefore, it is indispensable that we optimize our questionnaires with the information gaps that we need filled-in. Gather the correct and complete data necessary for personalized financial planning with the following PDF files of financial questionnaires.

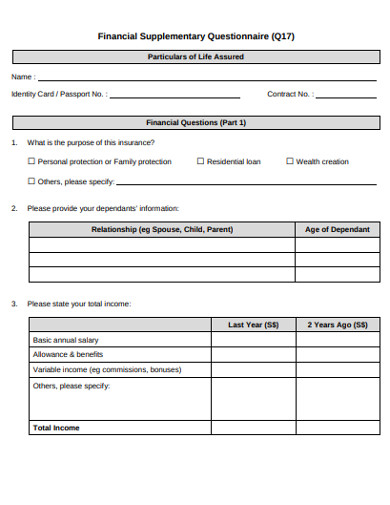

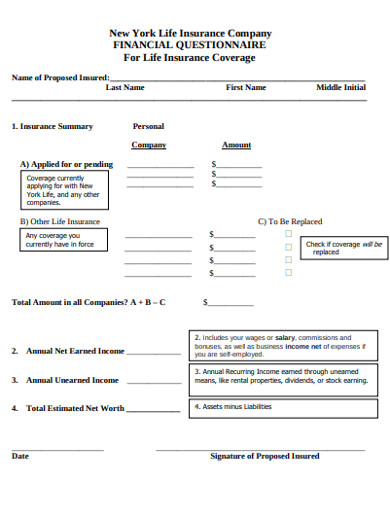

1. Financial Supplementary Questionnaire Example

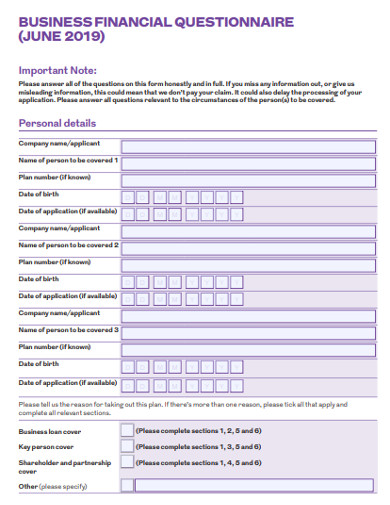

2. Business Financial Questionnaire Example

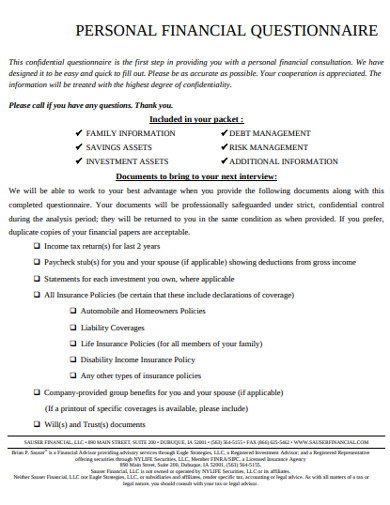

3. Personal Financial Questionnaire Example

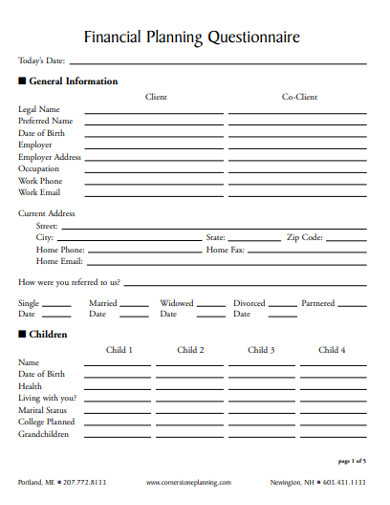

4. Financial Planning Questionnaire Example

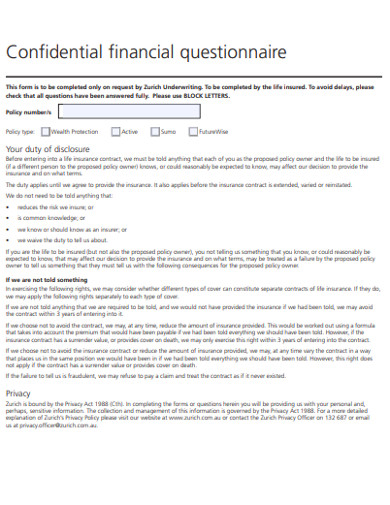

5. Confidential Financial Questionnaire Example

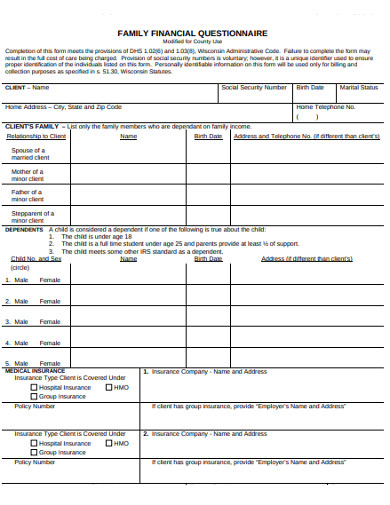

6. Family Financial Questionnaire Example

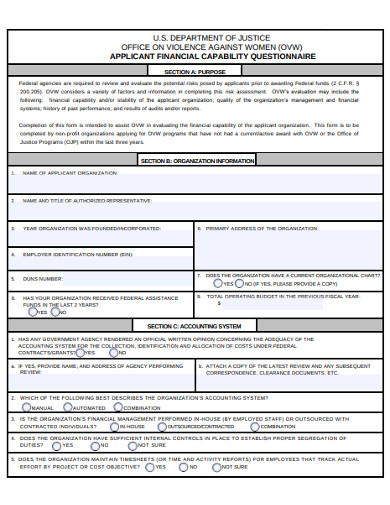

7. Applicant Financial Capability Questionnaire Example

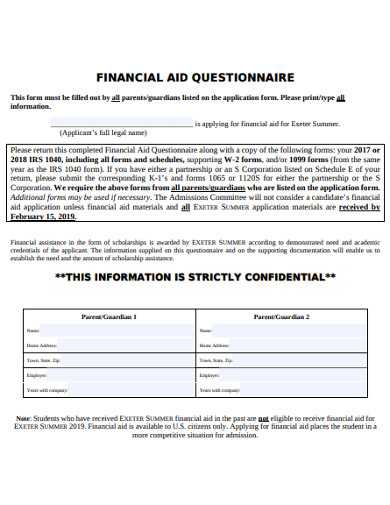

8. Financial Aid Questionnaire Example

9. Company Financial Questionnaire Example

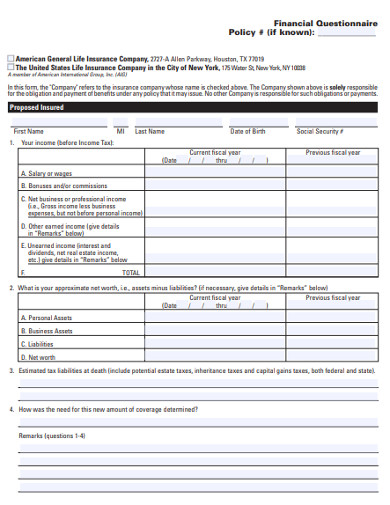

10. Financial Questionnaire Policy Example

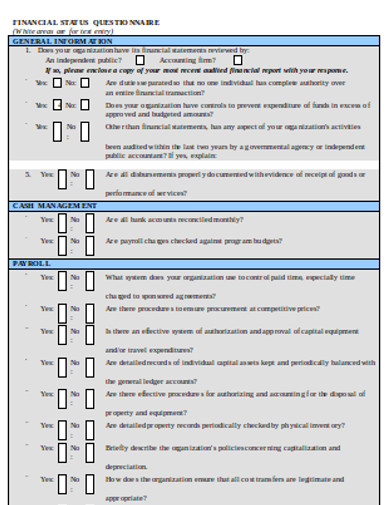

11. Financial Status Questionnaire Example

How to Revamp Your Questionnaire

The following tips on how to upgrade your financial questionnaires aren’t as necessary as the information that the document contains, but these changes will do you good in clients’ impression of your capability and professionalism. Be a stand out among the rest of financial advisors and create a positive impact to your clients by adding these enhancements to your financial planning essentials.

1. Create A Cover Page

This might as well be the first thing that greets your client when he or she opens the folder containing the questionnaires. Print the title of the document in a big and bold font. If you are affiliated with a finance company, indicate the name of the business on the page. Add your name, as well as your client’s. You can either print his or her name, or leave the space blank. You can also opt to add a logo to your document to add a sense of formality with flair.

2. Mind the Paper Quality

Certain documents exude a certain air of professionalism more than others. Often, it’s the paper used that makes such a huge difference. Better paper quality means that the paper is thicker, brighter, and smoother. Go for paper type around 22-24 lb in weight. High paper brightness means there is better color reproduction of images and text. When you have the option, choose the paper with around 75 percent hardwood and 25 percent softwood fiber composition. Aside from you looking sharp during consultations, the practical benefit of using premium paper is that the documents printed on it would be durable.

3. Use Neat and Readable Fonts

Create a pleasant experience for your clients as they fill out several pages of the financial document. The font size and type matter in the readability and overall atmosphere of the file. Opt for sans serif font types that abandon those little extra strokes on letters as in Times New Roman letters, since san serif fonts look smoother and cleaner. The fonts like Calibri, Cambria, and Helvetica work well with these traits. The right font styles are produced well on screen and on print, even when the text has a small font size.

4. Vary Text Color and Shade

Your clients will be filling out pages and pages of the document. You can make this task less monotonous for them when you add color variety to the document. This means that instead of printing everything in standard black, you assign different cool color shades to the headings and subheadings of the page. Keep these chosen colors uniform throughout the file. You can apply this when you are using tables in the document. This variety makes your document interesting and easier to navigate, also.

Financial illiteracy can be attributed to a knowledge gap in the education system. And it has sent a lot of people’s finances into a downward spiral. Financial advising and planning is like throwing in a life raft or a long stick to pull someone out of his or her financial quicksand. Sometimes, everyone needs a little pull and tug when they feel hopelessly trapped from a series of debts and questionable money management. Help people sort out their finances and oversee their financial well being with a stand-out professional questionnaire tucked with your financial management essentials.