5+ Receipt Voucher Examples to Download

A receipt voucher is a documented acknowledgment confirming a transaction where cash or goods have been received. It can be issued as a cash receipt, simple receipt, or payment receipt, depending on the context and the type of transaction. Receipt vouchers are commonly used by businesses, financial institutions, and individuals to record the details of a financial transaction. Typically, they include essential information such as the date, amount received, names of the payer and receiver, and a brief description of the transaction. These vouchers support accurate financial records, ensure transparency, and simplify audits or references by serving as verifiable proof of payment.

What is a Receipt Voucher?

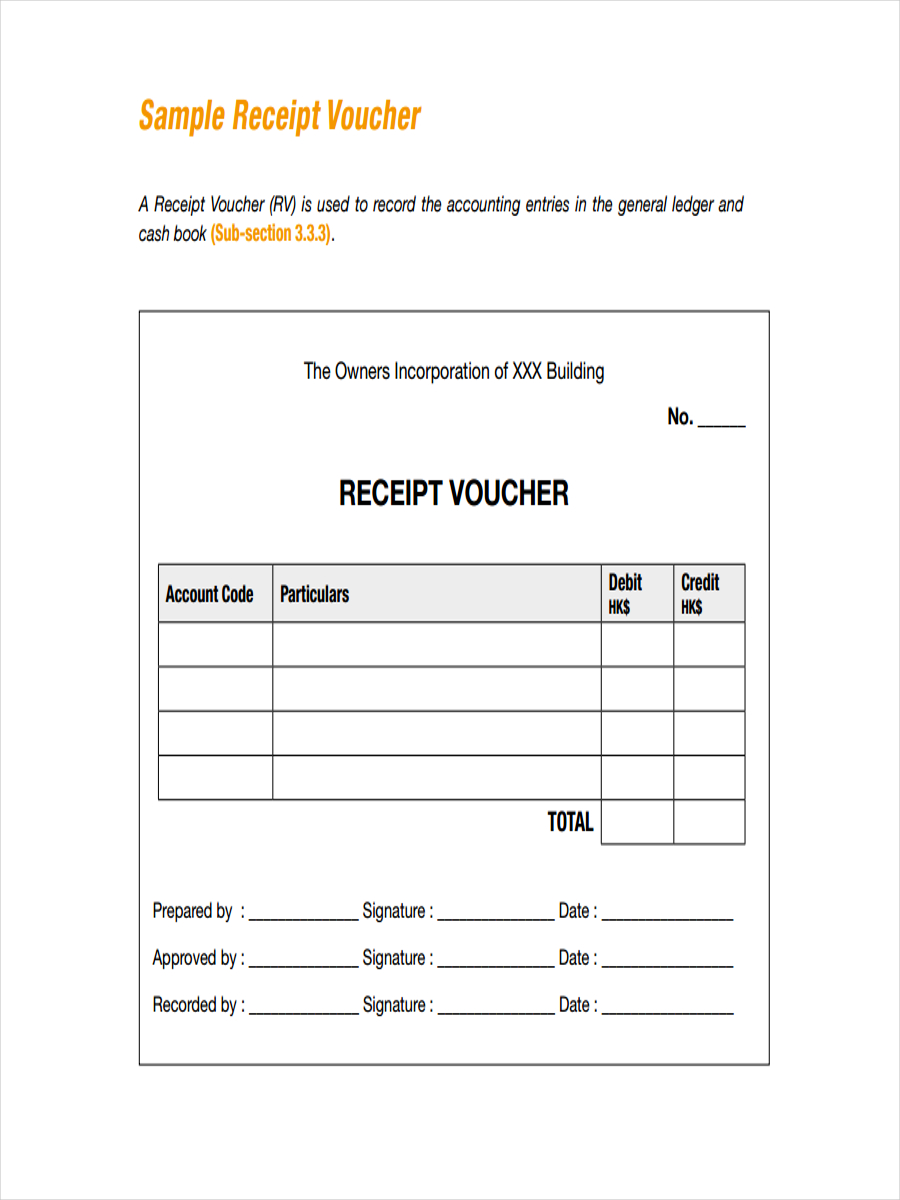

Receipt Voucher Format

Voucher Details

Voucher Number: [Unique Number]

Date: [DD/MM/YYYY]

Payer Information

- Received From: [Name of the Payer or Customer]

- Address: [Address of the Payer, optional]

- Contact: [Phone or Email of the Payer, optional]

Payment Information

- Payment Method: [Cash, Cheque, Bank Transfer, etc.]

- Cheque/Transaction Number: [Number, if applicable]

- Bank Name: [Bank, if payment by cheque or transfer]

Amount Received

- Currency: [Currency, e.g., USD]

- Total Amount: $[Exact Amount Received]

Purpose of Payment

[Brief Description of Purpose, e.g., “Payment for Invoice #12345” or “Consulting Fees”]

Description of Transaction

[Further details about the transaction if needed, e.g., services provided or product details]

Authorized Recipient Details

- Name of Authorized Recipient: [Name]

- Signature: [Space for Signature]

- Date of Receipt: [Date]

Additional Notes

[Any special instructions or remarks]

Receipt Voucher Example

Voucher Details

- Voucher Number: 1023

- Date: 11/14/2024

Payer Information

- Received From: John Doe

- Address: 123 Main Street, Springfield, IL

Payment Information

- Payment Method: Bank Transfer

- Transaction Number: 7859301

- Bank Name: First National Bank

Amount Received

- Currency: USD

- Total Amount: $1,500.00

Purpose of Payment

- Payment for Invoice #56789 (Consulting Services)

Description of Transaction

- Consulting services provided for business development strategies during October 2024.

Authorized Recipient Details

- Name of Authorized Recipient: Sarah Johnson

- Signature: _____________________

- Date of Receipt: 11/14/2024

Additional Notes

- Payment includes all taxes and service charges.

Credit Receipt Voucher Example

Voucher Details

Voucher Number: CRV-2045

Date: 11/14/2024

Customer Information

Customer Name: Michael Lee

Address: 789 Oak Avenue, Springfield, IL

Contact: mlee@example.com

Transaction Details

Credit Amount: $850.00

Purpose of Credit: Return of goods (Order #78956)

Description of Goods/Services:

Product Return – Office Chairs (5 units)

Reason for Credit: Customer returned goods due to damage during shipping.

Credit Method

Credit Account: Customer Account with XYZ Office Supplies

Transaction Reference Number: REF-112233

Authorized By

Authorized Person: Emily Davis

Signature: ____________________

Date of Authorization: 11/14/2024

Additional Notes

Credit will be applied to the customer’s next purchase.

Customer notified of the credit adjustment via email.

Sales Receipt Voucher Example

Voucher Details

Voucher Number: 2054

Date: 11/14/2024

Customer Information

Customer Name: Jane Smith

Address: 456 Elm Street, Springfield, IL

Contact: janesmith@example.com

Sales Details

Invoice Number: INV-7834

Description of Goods/Services:

Product A: 5 units @ $50 each, Total: $250

Product B: 10 units @ $30 each, Total: $300

Product C: 2 units @ $100 each, Total: $200

Payment Information

Total Amount: $750

Payment Method: Credit Card

Transaction Number: 9823746

Bank Name: Springfield Bank

Purpose of Sale

Sale of office equipment and supplies.

Received By

Name of Authorized Recipient: Robert Green

Signature: _____________________

Date of Receipt: 11/14/2024

Additional Notes

Payment completed in full. No outstanding balance.

Receipt Voucher for Advance Payment

Voucher Details

Voucher Number: 2024-AP-109

Date: 11/14/2024

Payer Information

Received From: ABC Constructions Ltd.

Address: 456 Elm Street, Springfield, IL

Contact: contact@abcconstructions.com

Payment Information

Payment Method: Bank Transfer

Transaction Number: 8429137

Bank Name: Global Finance Bank

Amount Received

Currency: USD

Total Amount (Advance Payment): $10,000.00

Purpose of Payment

Advance Payment for Construction Project at Maple Avenue (Project ID: MAPLE-2024)

Description of Transaction

Initial advance payment for the construction project per agreement terms. Total project value is $50,000. Balance due upon project milestones completion.

Authorized Recipient Details

Name of Authorized Recipient: Michael Stewart

Signature: _____________________

Date of Receipt: 11/14/2024

Additional Notes

The advance payment is non-refundable and will be deducted from the final project invoice. Any adjustments or additional charges will be detailed in subsequent invoices.

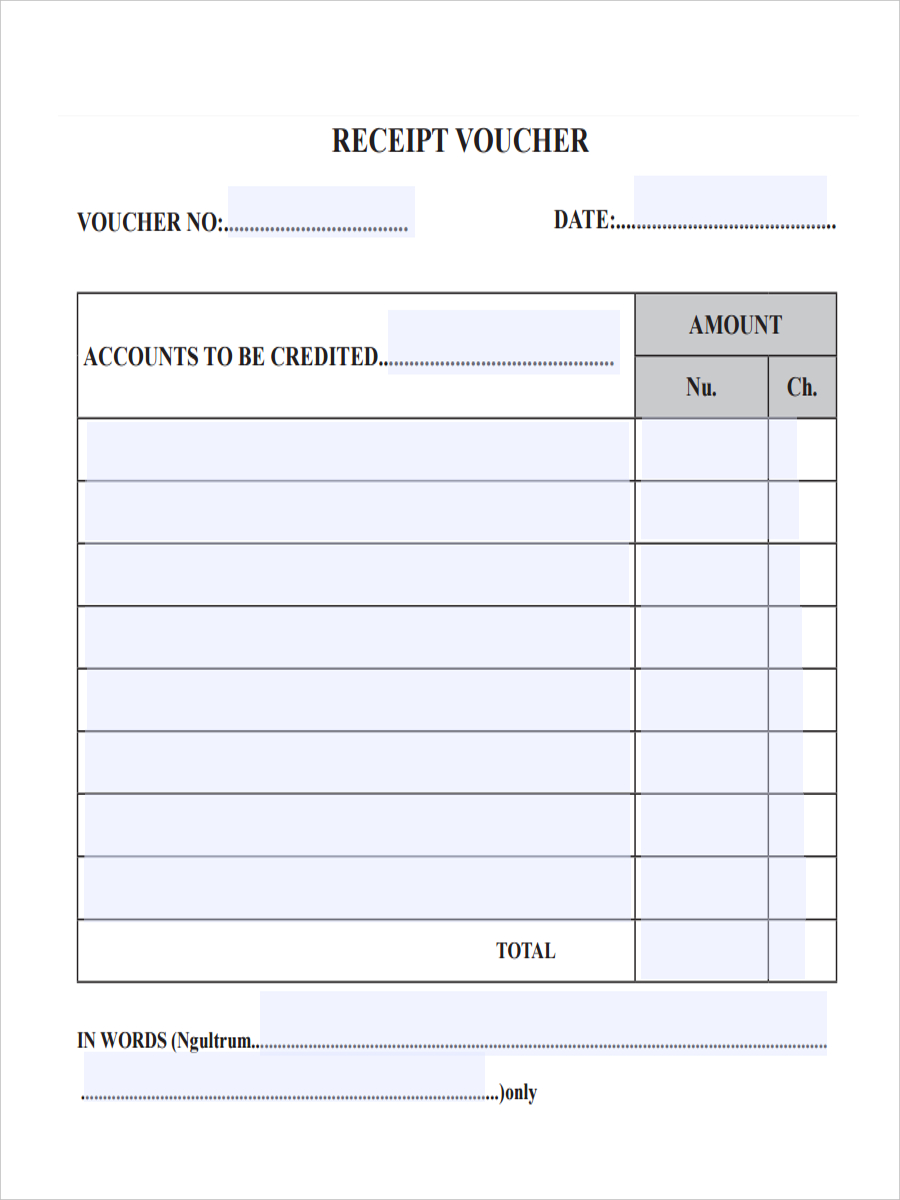

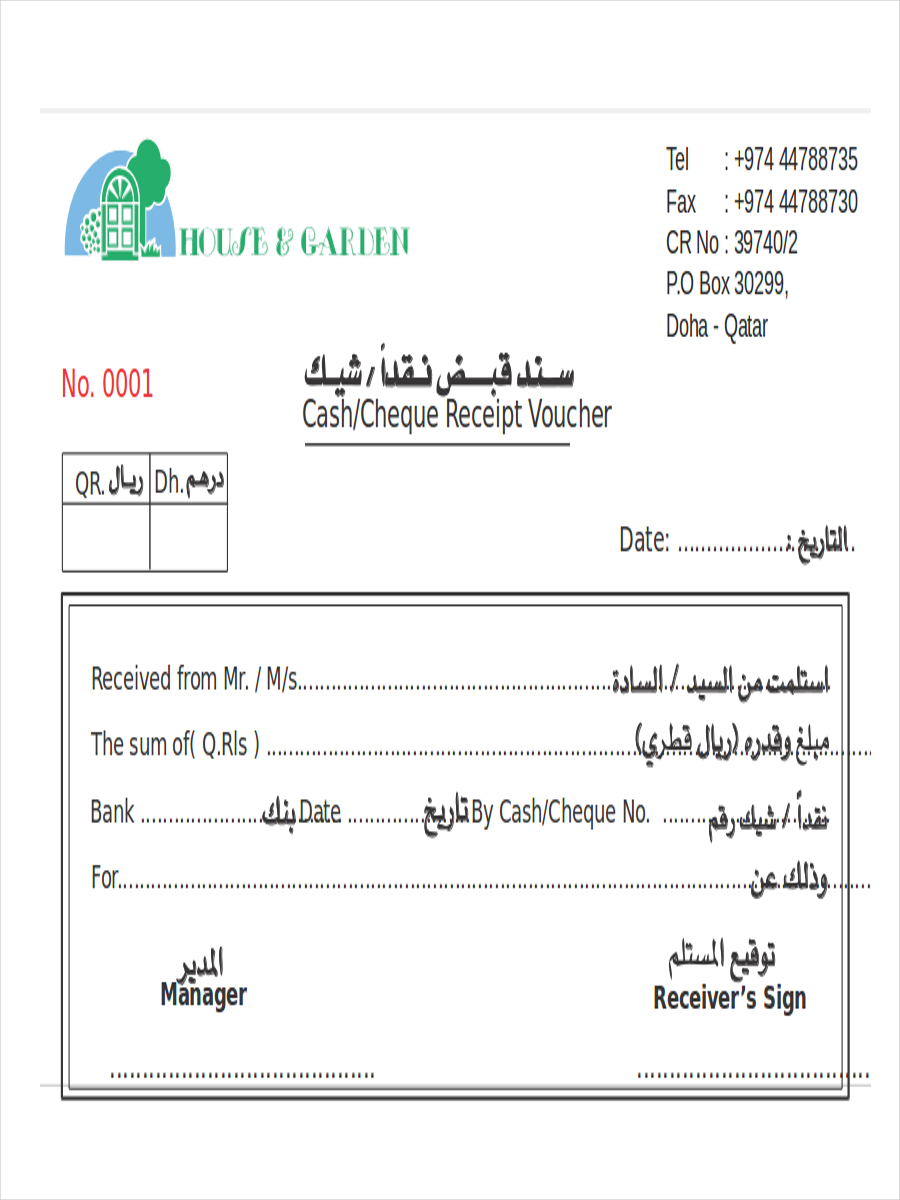

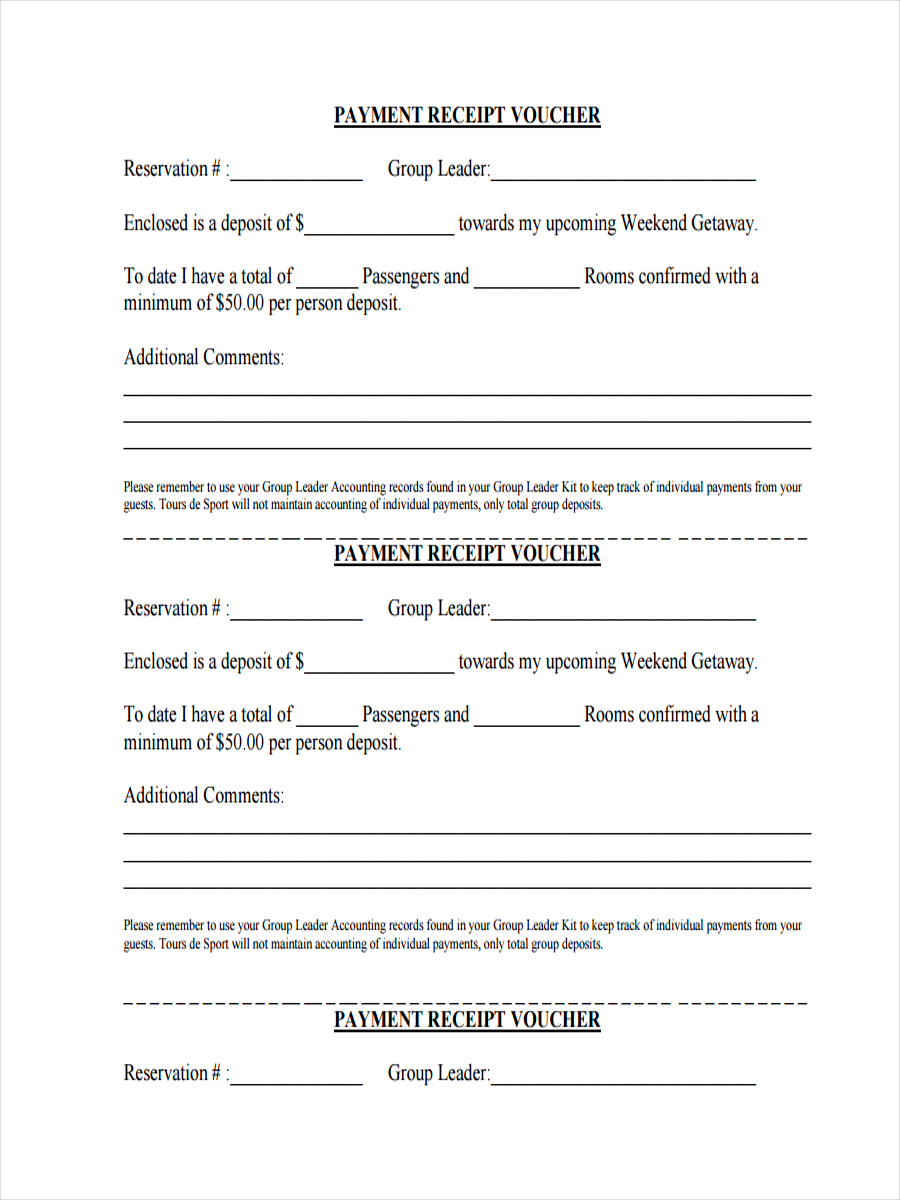

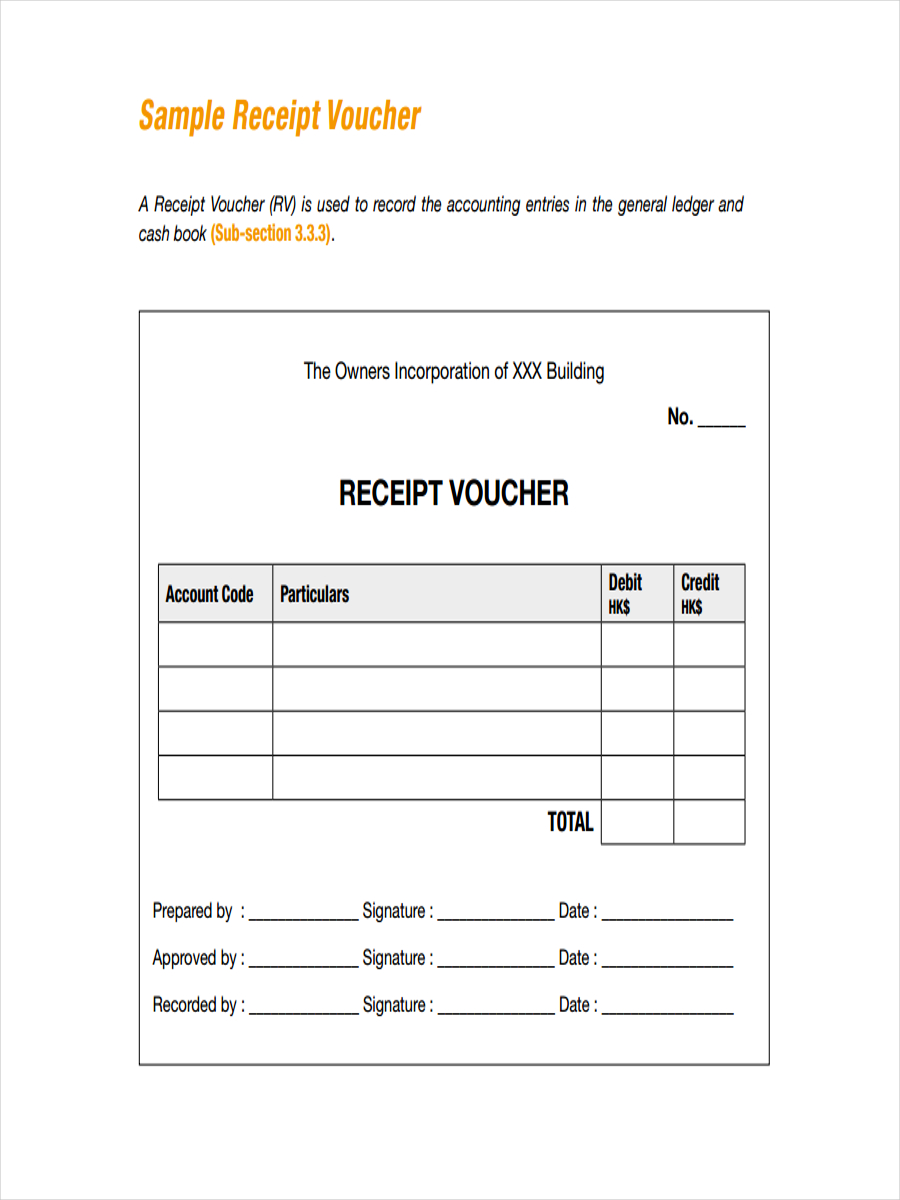

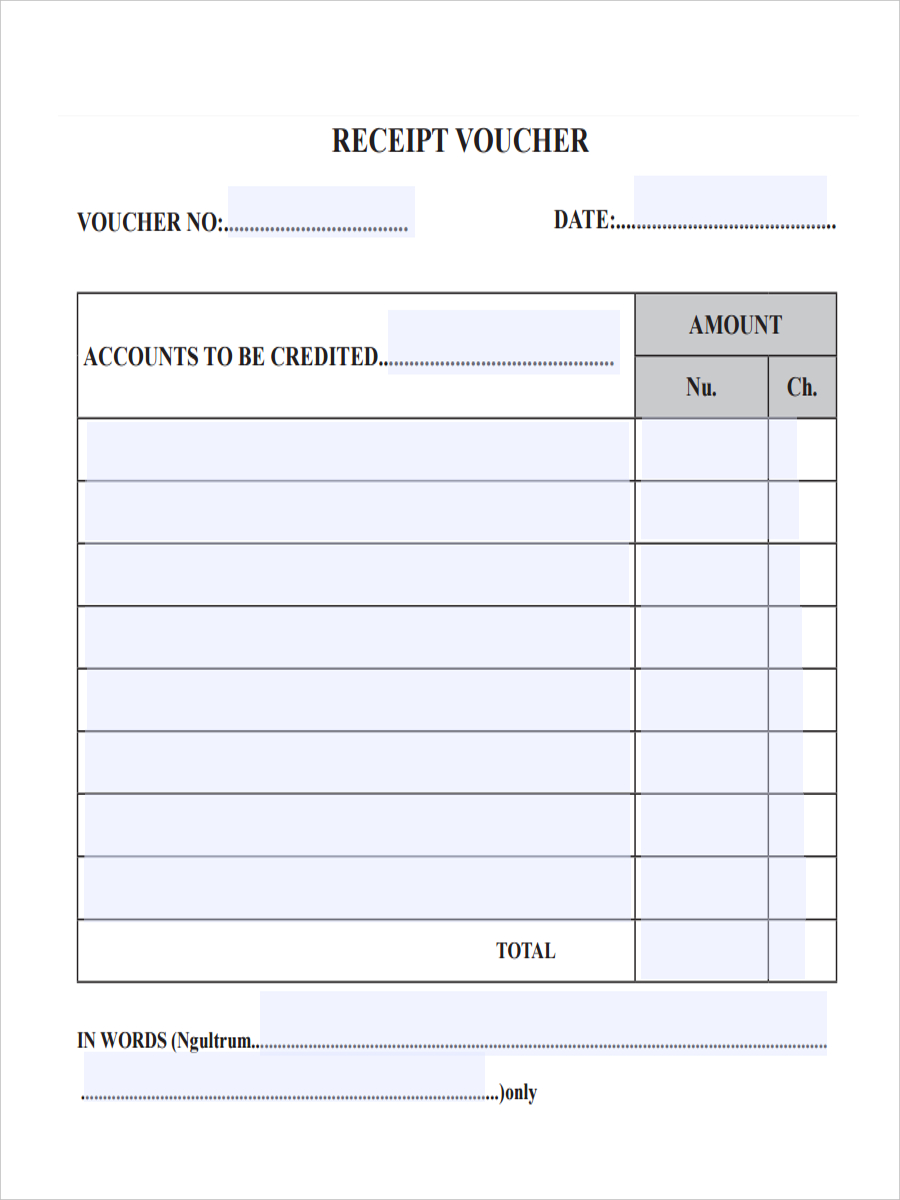

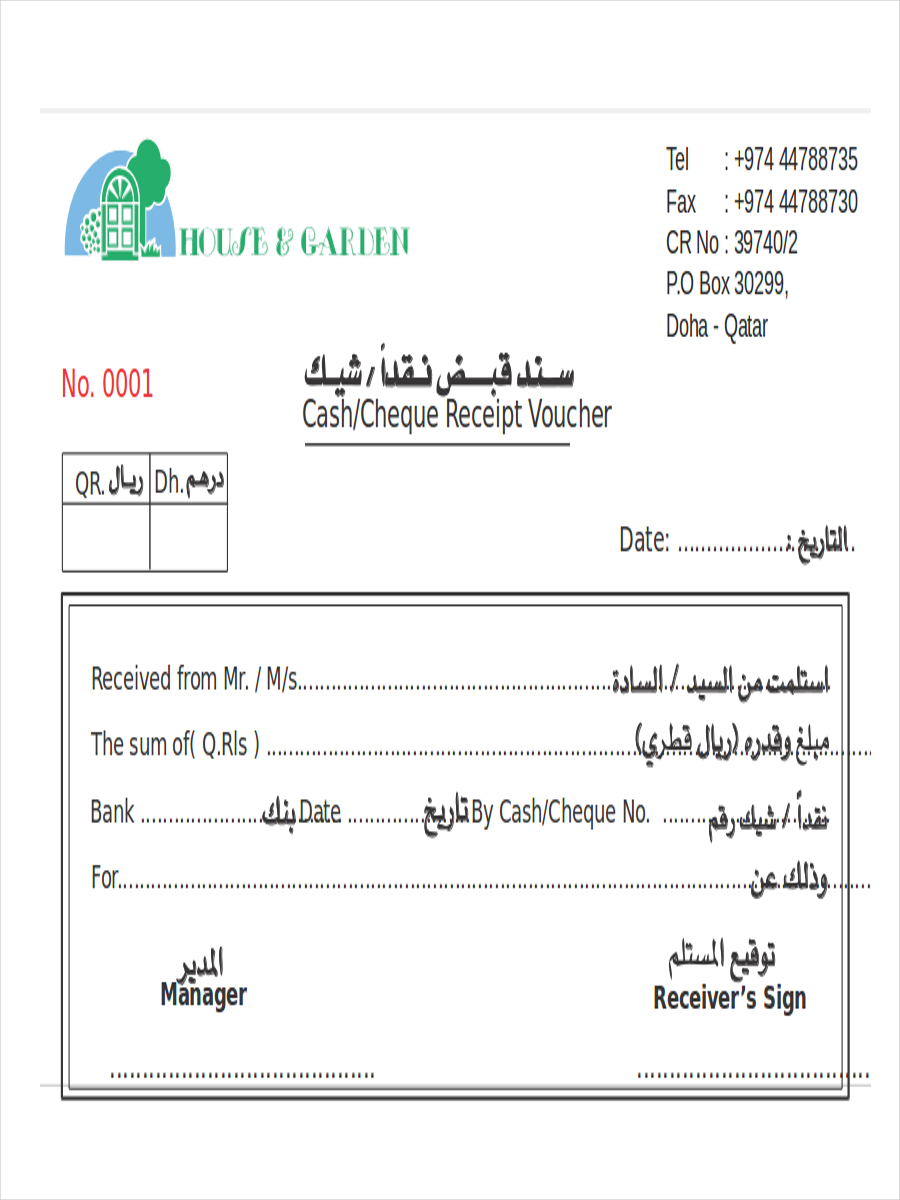

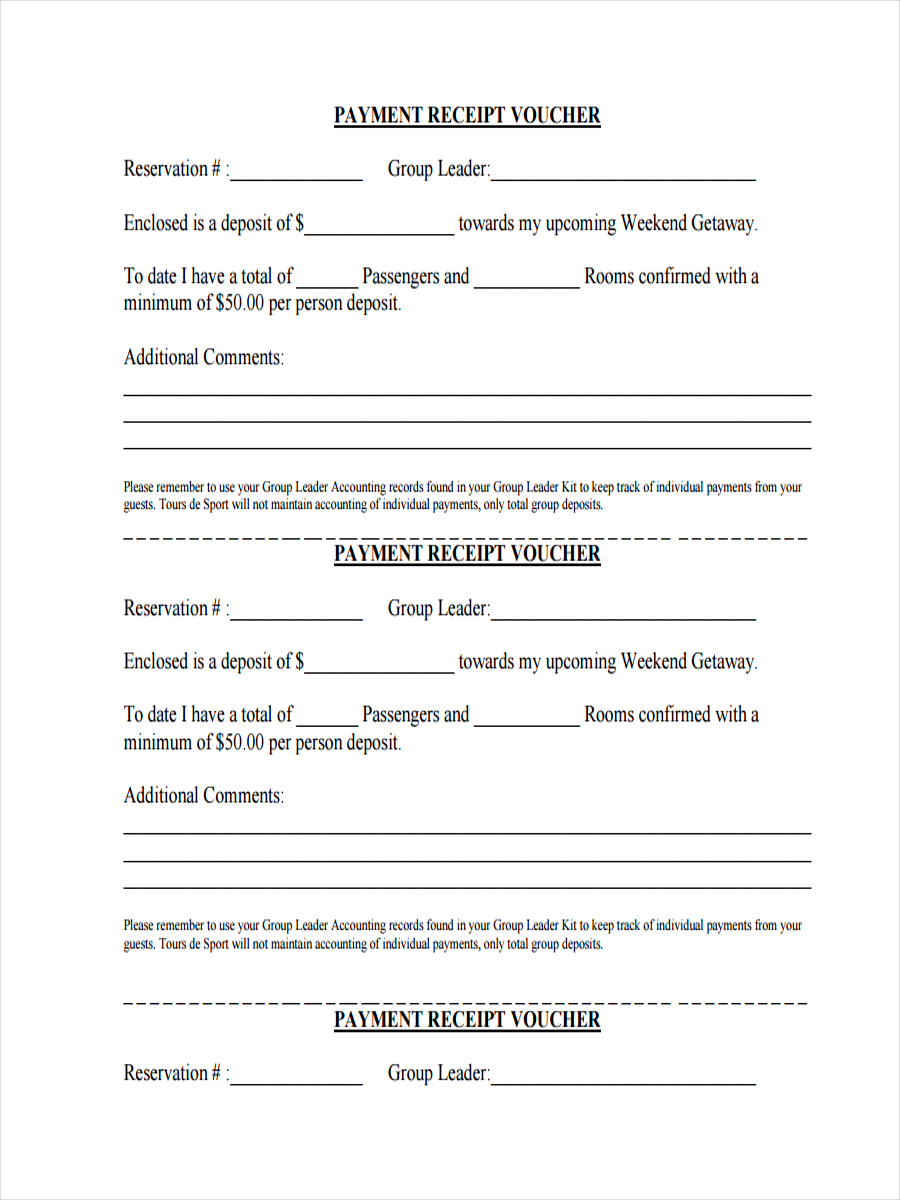

Receipt Voucher Samples & Templates in PDF

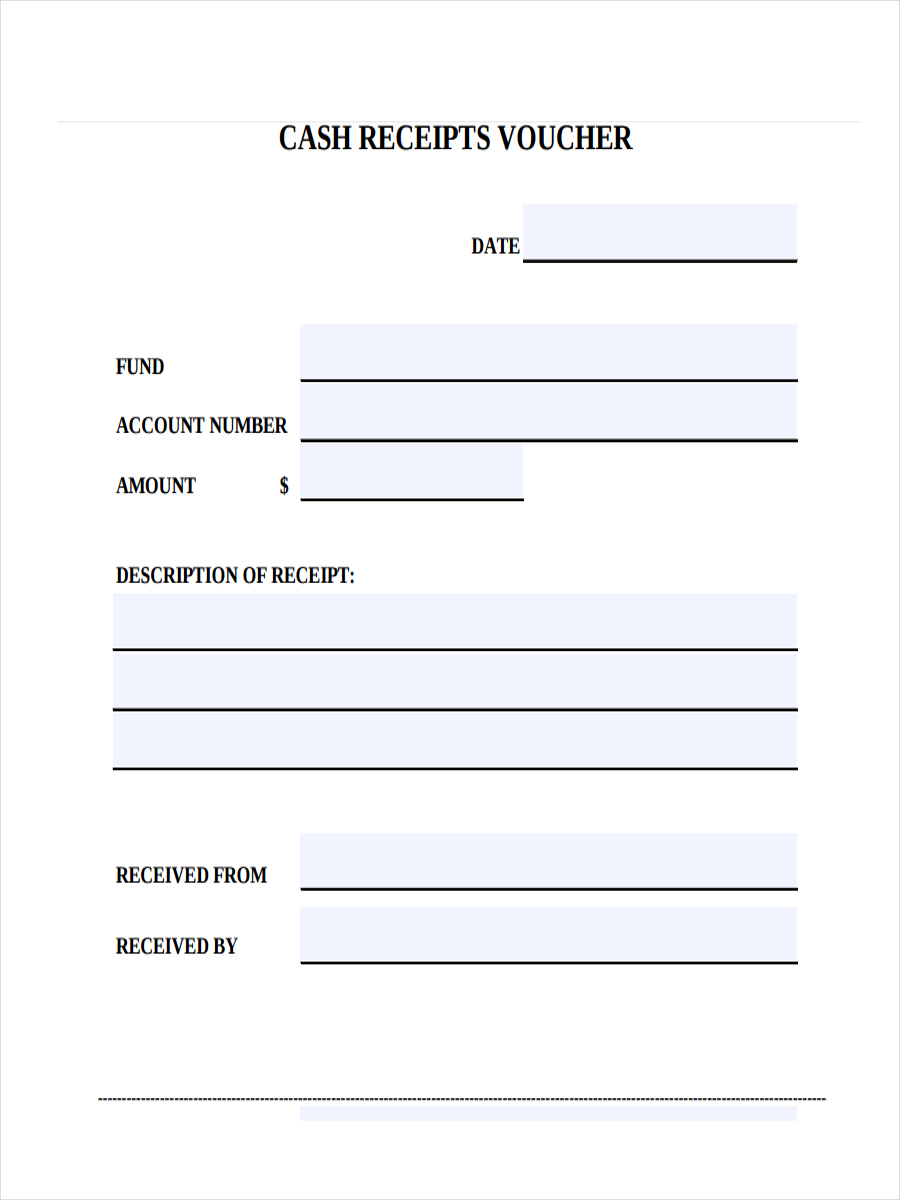

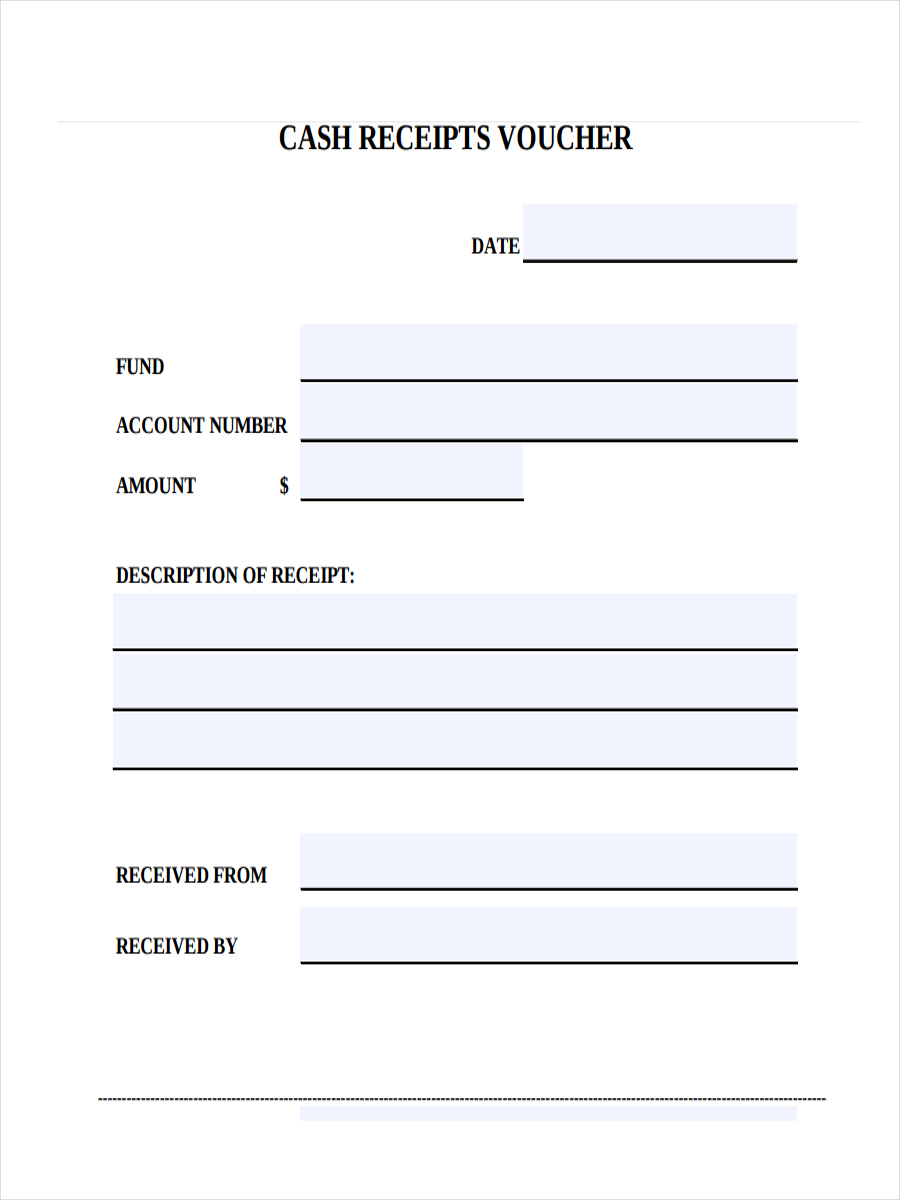

Cash Receipt Voucher

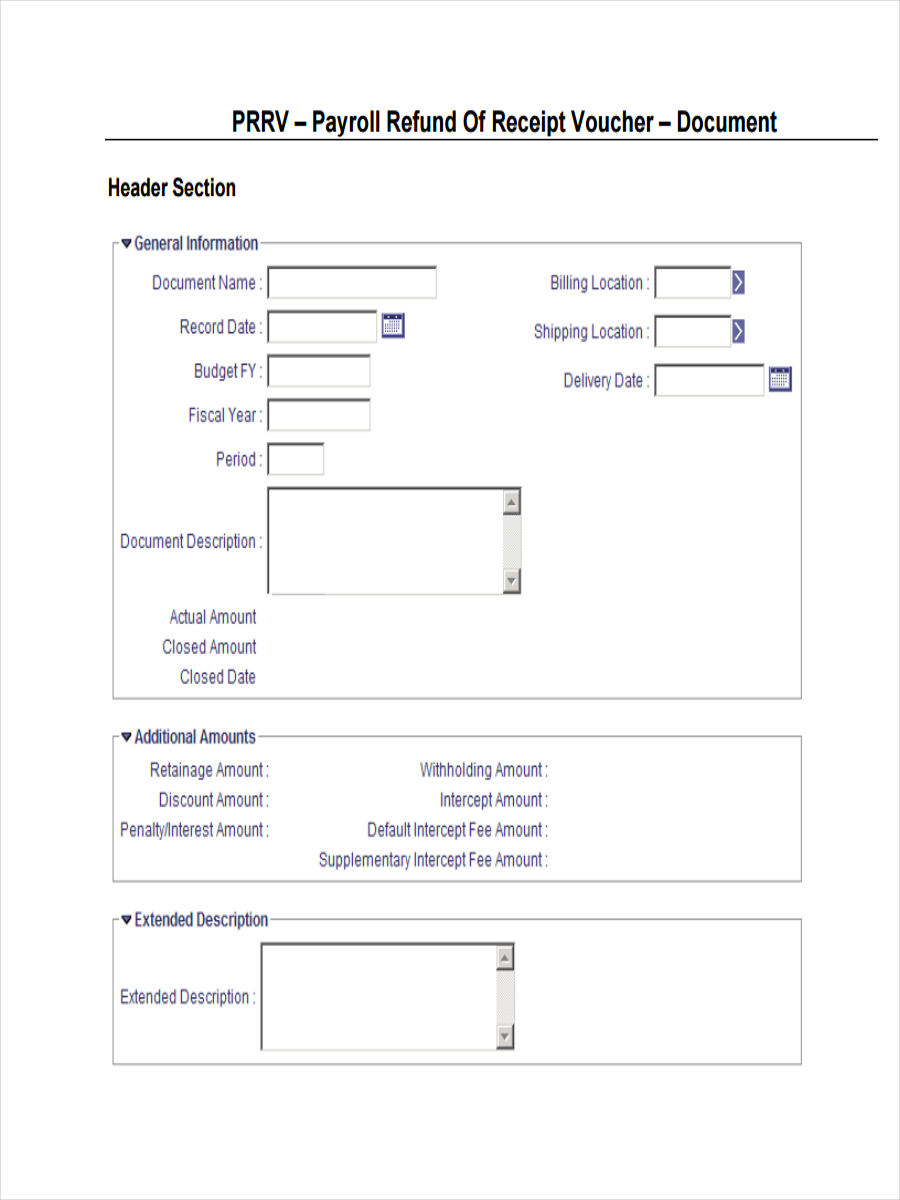

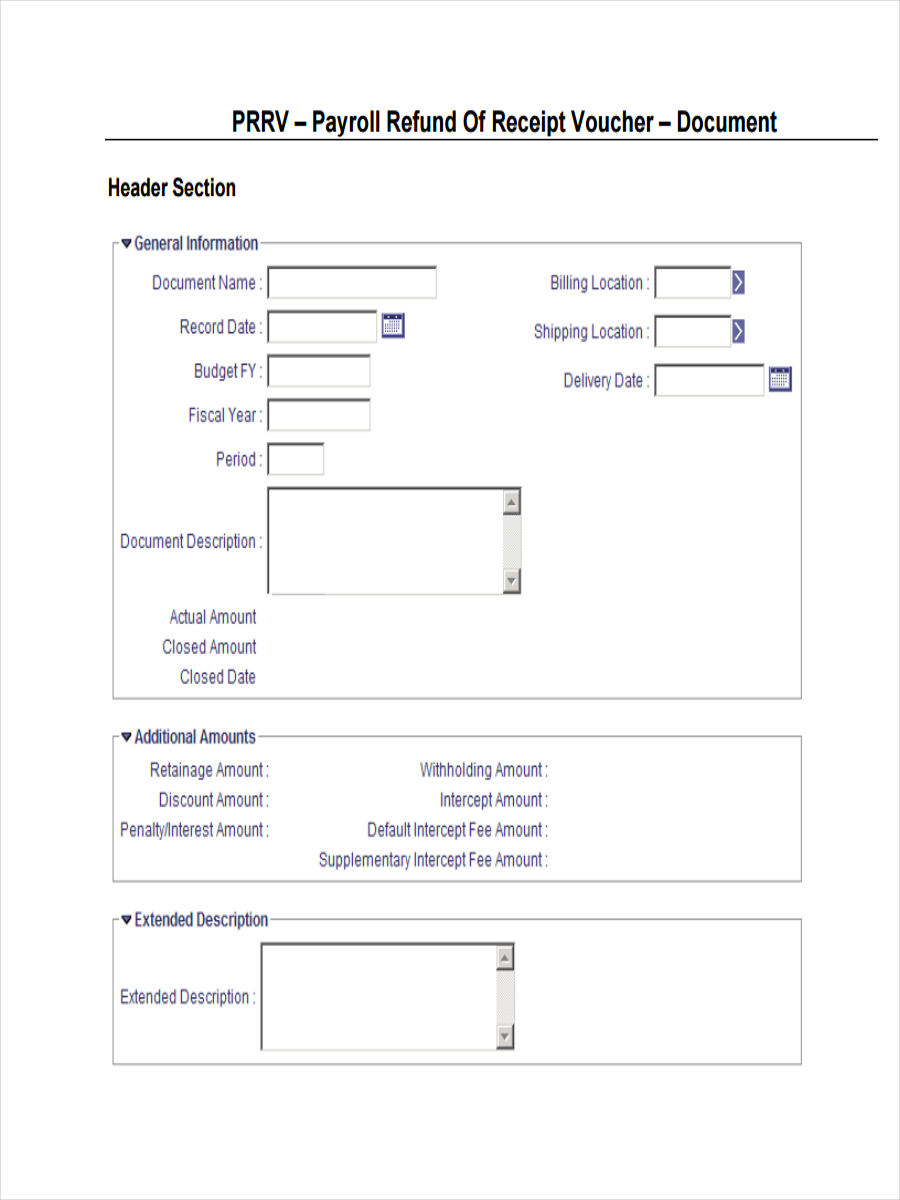

Payroll Refund Receipt Voucher

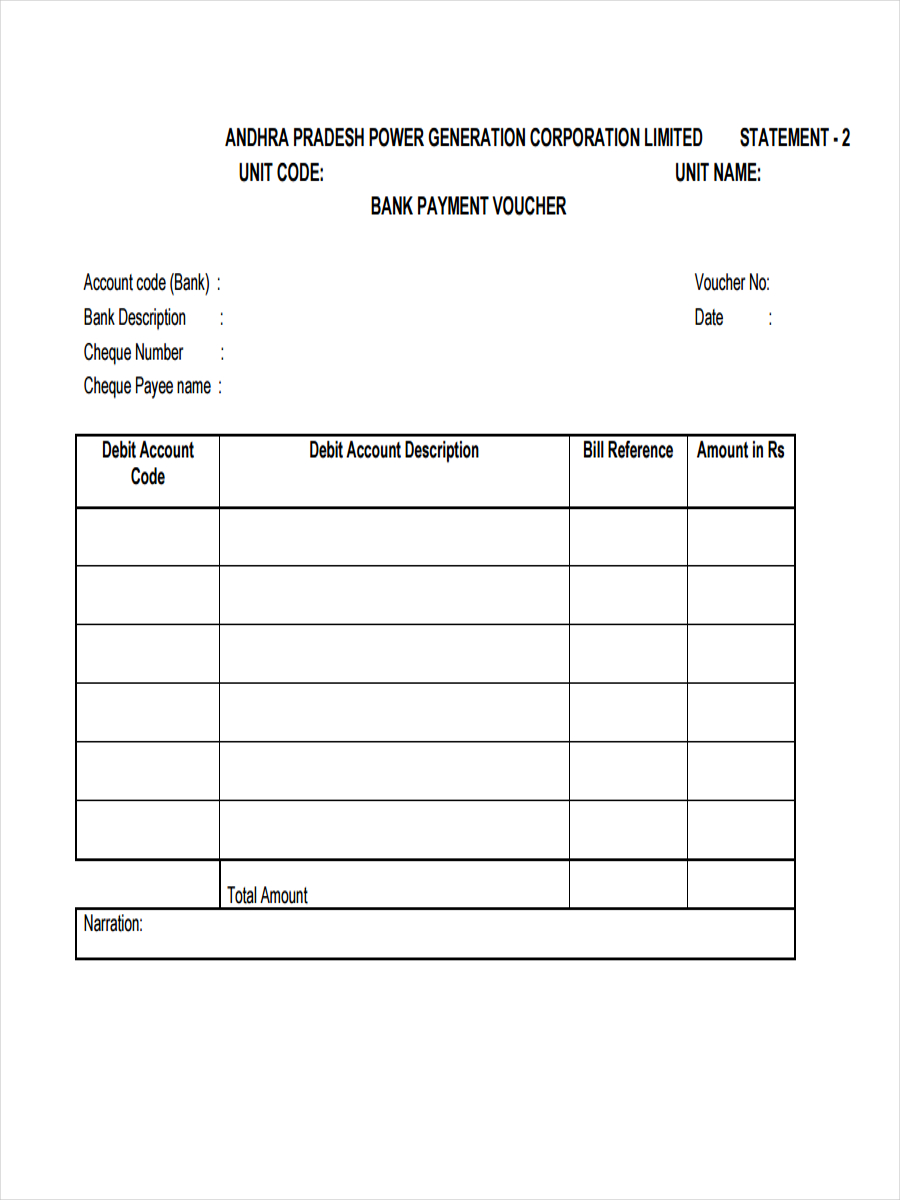

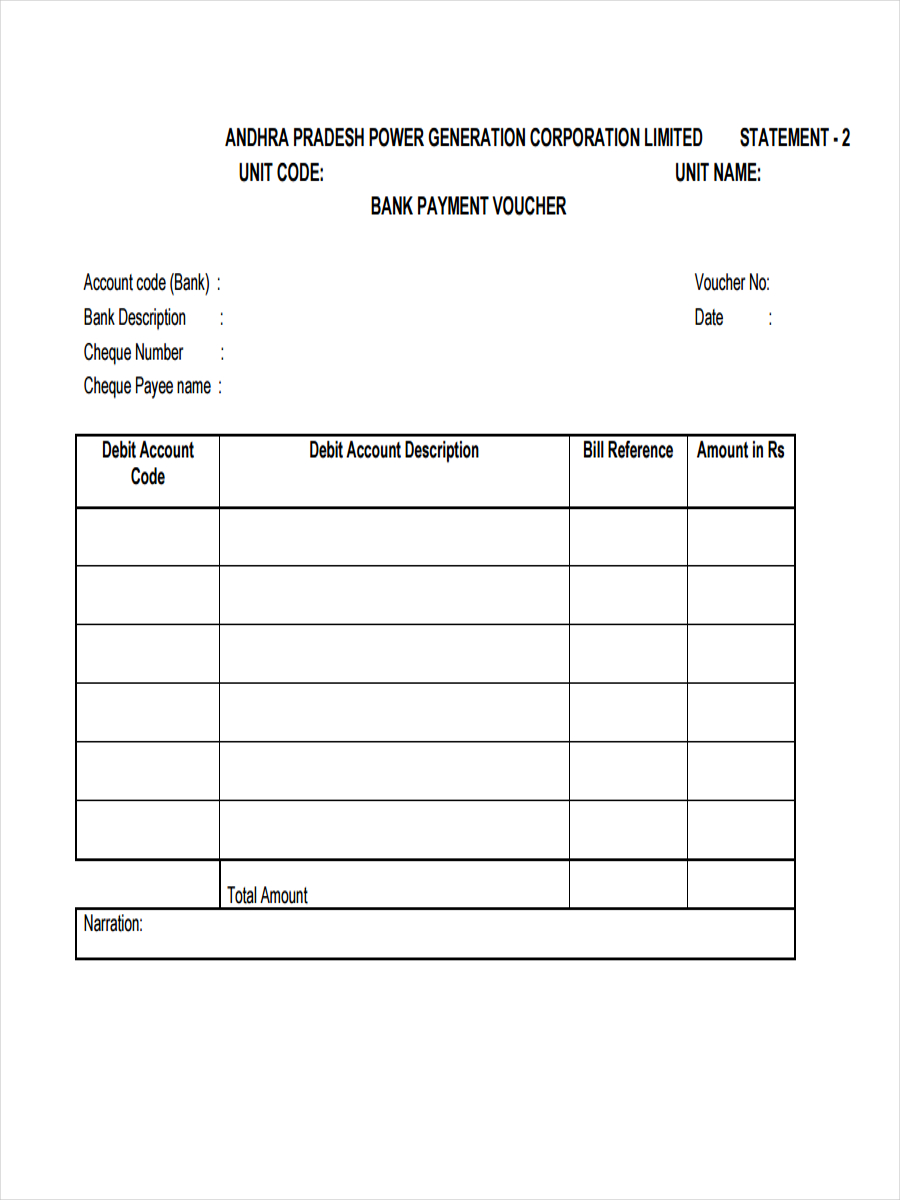

Receipt Voucher for Bank

Free Receipt Voucher

Cheque Receipt Voucher

Payment Receipt Sample Voucher

Simple Receipt Voucher

Purpose of a Receipt Voucher

A receipt voucher serves several essential purposes in business and financial transactions. Here is a list of the main purposes:

- Records Cash Inflows

Receipt vouchers record each instance of cash received, helping businesses maintain accurate records of all inflows. This ensures that no received funds go untracked, which is essential for clear and organized financial documentation. - Confirms Payment Receipt

By issuing a receipt voucher, a business provides customers with written confirmation that their payment has been received. This serves as formal proof of payment, building trust between the business and the customer and reducing the risk of payment disputes. - Enhances Transparency

Receipt vouchers increase financial transparency by clearly documenting every transaction. This transparency helps establish a business’s credibility and reassures stakeholders, such as investors and auditors, about the accuracy of the company’s financial records. - Facilitates Audit and Verification

During audits, receipt vouchers allow auditors to easily verify that the cash reported aligns with actual transactions. These vouchers provide detailed documentation that auditors can cross-check to confirm the integrity of financial data. - Supports Financial Reporting

By systematically recording all received payments, receipt vouchers contribute to accurate financial statements. This aids in reporting net income accurately and helps businesses make informed decisions based on reliable financial data.

Types of Receipt Vouchers

Here is a list with explanations for each type of receipt voucher:

- Cash Receipt Voucher records any cash received by a business, whether from customers, investors, or other sources. This type of voucher is specifically used for transactions where payment is made directly in cash. For example, it might be used when a company receives immediate cash for a retail sale, petty cash income, or other cash payments from customers.

- Bank Receipt Voucher is used to record funds received directly into the company’s bank account. This type is essential for transactions where payments are made via bank transfer, check deposits, or online payment gateways. Common examples include client payments, loan proceeds from banks, or investment funds that are deposited directly into the company’s bank account.

- Non-Cash Receipt Voucher is used for non-cash transactions where the business receives an asset or service instead of cash. These are often used in barter transactions or when receiving goods or services in exchange for another asset. For example, a company might use a non-cash receipt voucher when it receives office supplies in exchange for providing advertising services or when it receives donated equipment.

- Credit Receipt Voucher tracks amounts received on credit terms, where a customer agrees to pay at a later date but receives goods or services upfront. This type of voucher is commonly used for regular customers who have established credit terms with the business. For instance, a company may issue a credit receipt voucher when it sells products to a customer who will pay in the future according to an agreed-upon payment schedule.

- Adjusting Receipt Voucher is used to record adjustments made in accounts when there is an error or a change needed in the recorded amount. This type of voucher is particularly useful for making corrections, such as adjusting for overpayment or underpayment. For example, if an amount was recorded incorrectly on a previous receipt voucher or if a partial payment is received after the initial transaction, an adjusting receipt voucher is issued to reflect the accurate amount.

Difference between a Voucher and an Invoice

| Aspect | Invoice | Voucher |

|---|---|---|

| Definition | A document issued by a seller to request payment for goods or services provided. | An internal document used by the accounting department to authorize and record a payment. |

| Issued By | Seller or service provider | Accounting department within a business |

| Purpose | Requests payment from the buyer for goods or services. | Authorizes and records a payment based on a received invoice. |

| Content | Includes quantity, price, description, payment terms, and due date. | Includes invoice details, payment terms, dates, and account codes for authorization. |

| Timing | Created before payment, often at the time of sale or service delivery. | Created after receiving an invoice, during the payment authorization process. |

| Use | Maintains record of sales and amount owed by customers. | Confirms all necessary checks before payment, maintains internal financial records. |

| Function in Process | Signals a specific amount owed to the seller by the buyer. | Acts as proof that a transaction has been approved for payment, aligning with recorded invoices. |

| Type of Document | External (sent to customers) | Internal (used within the business only) |

How to Prepare a Receipt Voucher

- Collect Necessary Payment Information

- Confirm the total payment amount, the payer’s name, and contact details.

- Verify the purpose of the payment to ensure it’s documented accurately.

- Use a Standard Receipt Voucher Template

- Choose a template that includes key sections: Voucher Number, Date, Payer Information, Payment Details, Amount Received, and Purpose of Payment.

- A consistent format improves clarity and tracking.

- Assign a Voucher Number

- Assign a unique, sequential number to each voucher for tracking.

- This number is essential for organized filing and later retrieval.

- Record the Date

- Enter the exact date when the payment was received. This date will be critical for accounting and tracking cash flow.

- Fill Out Payer Information

- Include the payer’s full name, company (if applicable), and contact information such as address, email, or phone number.

- If the payment was made by a representative, include both the company and representative’s name.

- Enter Payment Method and Details

- Specify the payment method: cash, cheque, bank transfer, credit card, etc.

- If it’s a cheque or bank transfer, add details like the cheque number, transaction ID, and bank name for reference.

- Indicate the Currency and Total Amount Received

- Clearly state the amount in both figures and words to avoid errors or misinterpretation.

- Mention the currency type (e.g., USD, EUR) if dealing with multiple currencies.

- Specify the Purpose of Payment

- Write a concise description of the purpose of payment, such as “Payment for Invoice #12345” or “Consulting Services for October.”

- This section is essential for tracking income sources.

- Add Description of Transaction (if needed)

- Include any additional details, such as a breakdown of services provided or specific products purchased, if relevant.

- Provide Authorized Recipient Details

- Include the name and title of the person authorized to receive the payment on behalf of the company.

- Obtain their signature and add a space for the date to validate the voucher.

FAQ’s

How is a receipt voucher different from an invoice?

An invoice is a request for payment issued before a payment is made, detailing amounts owed for goods or services provided. A receipt voucher, on the other hand, is issued after receiving payment as proof that the payment has been received. While invoices prompt payment, receipt vouchers confirm it.

Are receipt vouchers necessary for cash payments?

Yes, receipt vouchers are important for cash payments as they act as proof of the transaction. Cash transactions are harder to trace without documentation, so a receipt voucher helps keep accurate records, preventing potential discrepancies and making cash management easier.

Who should sign a receipt voucher?

A receipt voucher should be signed by the person authorized to receive the payment on behalf of the organization. This signature confirms the authenticity of the receipt and that the payment was properly received and recorded. In most businesses, this may be an accountant, cashier, or financial officer.

Can a receipt voucher be used as proof of payment in legal situations?

Yes, a receipt voucher can serve as proof of payment in legal situations as it documents that funds were received by a specific party for a stated purpose. It includes essential details such as the payer’s name, amount received, and date, making it an official record that can support financial claims if disputes arise.

Is it necessary to issue a receipt voucher for online payments?

Yes, issuing a receipt voucher for online payments is recommended to maintain a complete financial record. Even though digital payment platforms provide transaction records, a receipt voucher consolidates the transaction details in the company’s accounting records, which simplifies bookkeeping and auditing.

5+ Receipt Voucher Examples to Download

A receipt voucher is a documented acknowledgment confirming a transaction where cash or goods have been received. It can be issued as a cash receipt, simple receipt, or payment receipt, depending on the context and the type of transaction. Receipt vouchers are commonly used by businesses, financial institutions, and individuals to record the details of a financial transaction. Typically, they include essential information such as the date, amount received, names of the payer and receiver, and a brief description of the transaction. These vouchers support accurate financial records, ensure transparency, and simplify audits or references by serving as verifiable proof of payment.

What is a Receipt Voucher?

A Receipt Voucher is a financial document that serves as proof of receiving payment or funds, often used in business transactions to confirm that money has been received by a company or individual. It includes details such as the date, amount, payer’s name, payment method, and purpose of the payment. Commonly used in accounting, receipt vouchers help ensure accurate financial records, simplify auditing, and prevent discrepancies in cash management. They are essential for tracking income and maintaining transparent, organized financial records for businesses.

Receipt Voucher Format

Voucher Details

Voucher Number: [Unique Number]

Date: [DD/MM/YYYY]

Payer Information

Received From: [Name of the Payer or Customer]

Address: [Address of the Payer, optional]

Contact: [Phone or Email of the Payer, optional]

Payment Information

Payment Method: [Cash, Cheque, Bank Transfer, etc.]

Cheque/Transaction Number: [Number, if applicable]

Bank Name: [Bank, if payment by cheque or transfer]

Amount Received

Currency: [Currency, e.g., USD]

Total Amount: $[Exact Amount Received]

Purpose of Payment

[Brief Description of Purpose, e.g., “Payment for Invoice #12345” or “Consulting Fees”]

Description of Transaction

[Further details about the transaction if needed, e.g., services provided or product details]

Authorized Recipient Details

Name of Authorized Recipient: [Name]

Signature: [Space for Signature]

Date of Receipt: [Date]

Additional Notes

[Any special instructions or remarks]

Receipt Voucher Example

Voucher Details

Voucher Number: 1023

Date: 11/14/2024

Payer Information

Received From: John Doe

Address: 123 Main Street, Springfield, IL

Payment Information

Payment Method: Bank Transfer

Transaction Number: 7859301

Bank Name: First National Bank

Amount Received

Currency: USD

Total Amount: $1,500.00

Purpose of Payment

Payment for Invoice #56789 (Consulting Services)

Description of Transaction

Consulting services provided for business development strategies during October 2024.

Authorized Recipient Details

Name of Authorized Recipient: Sarah Johnson

Signature: _____________________

Date of Receipt: 11/14/2024

Additional Notes

Payment includes all taxes and service charges.

Credit Receipt Voucher Example

Voucher Details

Voucher Number: CRV-2045

Date: 11/14/2024

Customer Information

Customer Name: Michael Lee

Address: 789 Oak Avenue, Springfield, IL

Contact: mlee@example.com

Transaction Details

Credit Amount: $850.00

Purpose of Credit: Return of goods (Order #78956)

Description of Goods/Services:

Product Return – Office Chairs (5 units)

Reason for Credit: Customer returned goods due to damage during shipping.

Credit Method

Credit Account: Customer Account with XYZ Office Supplies

Transaction Reference Number: REF-112233

Authorized By

Authorized Person: Emily Davis

Signature: ____________________

Date of Authorization: 11/14/2024

Additional Notes

Credit will be applied to the customer’s next purchase.

Customer notified of the credit adjustment via email.

Sales Receipt Voucher Example

Voucher Details

Voucher Number: 2054

Date: 11/14/2024

Customer Information

Customer Name: Jane Smith

Address: 456 Elm Street, Springfield, IL

Contact: janesmith@example.com

Sales Details

Invoice Number: INV-7834

Description of Goods/Services:

Product A: 5 units @ $50 each, Total: $250

Product B: 10 units @ $30 each, Total: $300

Product C: 2 units @ $100 each, Total: $200

Payment Information

Total Amount: $750

Payment Method: Credit Card

Transaction Number: 9823746

Bank Name: Springfield Bank

Purpose of Sale

Sale of office equipment and supplies.

Received By

Name of Authorized Recipient: Robert Green

Signature: _____________________

Date of Receipt: 11/14/2024

Additional Notes

Payment completed in full. No outstanding balance.

Receipt Voucher for Advance Payment

Voucher Details

Voucher Number: 2024-AP-109

Date: 11/14/2024

Payer Information

Received From: ABC Constructions Ltd.

Address: 456 Elm Street, Springfield, IL

Contact: contact@abcconstructions.com

Payment Information

Payment Method: Bank Transfer

Transaction Number: 8429137

Bank Name: Global Finance Bank

Amount Received

Currency: USD

Total Amount (Advance Payment): $10,000.00

Purpose of Payment

Advance Payment for Construction Project at Maple Avenue (Project ID: MAPLE-2024)

Description of Transaction

Initial advance payment for the construction project per agreement terms. Total project value is $50,000. Balance due upon project milestones completion.

Authorized Recipient Details

Name of Authorized Recipient: Michael Stewart

Signature: _____________________

Date of Receipt: 11/14/2024

Additional Notes

The advance payment is non-refundable and will be deducted from the final project invoice. Any adjustments or additional charges will be detailed in subsequent invoices.

Receipt Voucher Samples & Templates in PDF

Cash Receipt Voucher

Payroll Refund Receipt Voucher

Receipt Voucher for Bank

Free Receipt Voucher

Cheque Receipt Voucher

Payment Receipt Sample Voucher

Simple Receipt Voucher

Purpose of a Receipt Voucher

A receipt voucher serves several essential purposes in business and financial transactions. Here is a list of the main purposes:

Records Cash Inflows

Receipt vouchers record each instance of cash received, helping businesses maintain accurate records of all inflows. This ensures that no received funds go untracked, which is essential for clear and organized financial documentation.Confirms Payment Receipt

By issuing a receipt voucher, a business provides customers with written confirmation that their payment has been received. This serves as formal proof of payment, building trust between the business and the customer and reducing the risk of payment disputes.Enhances Transparency

Receipt vouchers increase financial transparency by clearly documenting every transaction. This transparency helps establish a business’s credibility and reassures stakeholders, such as investors and auditors, about the accuracy of the company’s financial records.Facilitates Audit and Verification

During audits, receipt vouchers allow auditors to easily verify that the cash reported aligns with actual transactions. These vouchers provide detailed documentation that auditors can cross-check to confirm the integrity of financial data.Supports Financial Reporting

By systematically recording all received payments, receipt vouchers contribute to accurate financial statements. This aids in reporting net income accurately and helps businesses make informed decisions based on reliable financial data.

Types of Receipt Vouchers

Here is a list with explanations for each type of receipt voucher:

Cash Receipt Voucher records any cash received by a business, whether from customers, investors, or other sources. This type of voucher is specifically used for transactions where payment is made directly in cash. For example, it might be used when a company receives immediate cash for a retail sale, petty cash income, or other cash payments from customers.

Bank Receipt Voucher is used to record funds received directly into the company’s bank account. This type is essential for transactions where payments are made via bank transfer, check deposits, or online payment gateways. Common examples include client payments, loan proceeds from banks, or investment funds that are deposited directly into the company’s bank account.

Non-Cash Receipt Voucher is used for non-cash transactions where the business receives an asset or service instead of cash. These are often used in barter transactions or when receiving goods or services in exchange for another asset. For example, a company might use a non-cash receipt voucher when it receives office supplies in exchange for providing advertising services or when it receives donated equipment.

Credit Receipt Voucher tracks amounts received on credit terms, where a customer agrees to pay at a later date but receives goods or services upfront. This type of voucher is commonly used for regular customers who have established credit terms with the business. For instance, a company may issue a credit receipt voucher when it sells products to a customer who will pay in the future according to an agreed-upon payment schedule.

Adjusting Receipt Voucher is used to record adjustments made in accounts when there is an error or a change needed in the recorded amount. This type of voucher is particularly useful for making corrections, such as adjusting for overpayment or underpayment. For example, if an amount was recorded incorrectly on a previous receipt voucher or if a partial payment is received after the initial transaction, an adjusting receipt voucher is issued to reflect the accurate amount.

Difference between a Voucher and an Invoice

Aspect | Invoice | Voucher |

|---|---|---|

Definition | A document issued by a seller to request payment for goods or services provided. | An internal document used by the accounting department to authorize and record a payment. |

Issued By | Seller or service provider | Accounting department within a business |

Purpose | Requests payment from the buyer for goods or services. | Authorizes and records a payment based on a received invoice. |

Content | Includes quantity, price, description, payment terms, and due date. | Includes invoice details, payment terms, dates, and account codes for authorization. |

Timing | Created before payment, often at the time of sale or service delivery. | Created after receiving an invoice, during the payment authorization process. |

Use | Maintains record of sales and amount owed by customers. | Confirms all necessary checks before payment, maintains internal financial records. |

Function in Process | Signals a specific amount owed to the seller by the buyer. | Acts as proof that a transaction has been approved for payment, aligning with recorded invoices. |

Type of Document | External (sent to customers) | Internal (used within the business only) |

How to Prepare a Receipt Voucher

Collect Necessary Payment Information

Confirm the total payment amount, the payer’s name, and contact details.

Verify the purpose of the payment to ensure it’s documented accurately.

Use a Standard Receipt Voucher Template

Choose a template that includes key sections: Voucher Number, Date, Payer Information, Payment Details, Amount Received, and Purpose of Payment.

A consistent format improves clarity and tracking.

Assign a Voucher Number

Assign a unique, sequential number to each voucher for tracking.

This number is essential for organized filing and later retrieval.

Record the Date

Enter the exact date when the payment was received. This date will be critical for accounting and tracking cash flow.

Fill Out Payer Information

Include the payer’s full name, company (if applicable), and contact information such as address, email, or phone number.

If the payment was made by a representative, include both the company and representative’s name.

Enter Payment Method and Details

Specify the payment method: cash, cheque, bank transfer, credit card, etc.

If it’s a cheque or bank transfer, add details like the cheque number, transaction ID, and bank name for reference.

Indicate the Currency and Total Amount Received

Clearly state the amount in both figures and words to avoid errors or misinterpretation.

Mention the currency type (e.g., USD, EUR) if dealing with multiple currencies.

Specify the Purpose of Payment

Write a concise description of the purpose of payment, such as “Payment for Invoice #12345” or “Consulting Services for October.”

This section is essential for tracking income sources.

Add Description of Transaction (if needed)

Include any additional details, such as a breakdown of services provided or specific products purchased, if relevant.

Provide Authorized Recipient Details

Include the name and title of the person authorized to receive the payment on behalf of the company.

Obtain their signature and add a space for the date to validate the voucher.

FAQ’s

How is a receipt voucher different from an invoice?

An invoice is a request for payment issued before a payment is made, detailing amounts owed for goods or services provided. A receipt voucher, on the other hand, is issued after receiving payment as proof that the payment has been received. While invoices prompt payment, receipt vouchers confirm it.

Are receipt vouchers necessary for cash payments?

Yes, receipt vouchers are important for cash payments as they act as proof of the transaction. Cash transactions are harder to trace without documentation, so a receipt voucher helps keep accurate records, preventing potential discrepancies and making cash management easier.

Who should sign a receipt voucher?

A receipt voucher should be signed by the person authorized to receive the payment on behalf of the organization. This signature confirms the authenticity of the receipt and that the payment was properly received and recorded. In most businesses, this may be an accountant, cashier, or financial officer.

Can a receipt voucher be used as proof of payment in legal situations?

Yes, a receipt voucher can serve as proof of payment in legal situations as it documents that funds were received by a specific party for a stated purpose. It includes essential details such as the payer’s name, amount received, and date, making it an official record that can support financial claims if disputes arise.

Is it necessary to issue a receipt voucher for online payments?

Yes, issuing a receipt voucher for online payments is recommended to maintain a complete financial record. Even though digital payment platforms provide transaction records, a receipt voucher consolidates the transaction details in the company’s accounting records, which simplifies bookkeeping and auditing.