5+ Rental Ledger Examples to Download

When talking about ledger, a lot of people would often imagine those thick books containing books of account used by entities to record their business transactions. A ledger is only one of those books of account. In general, a ledger contains all the entity’s accounts, providing a summary of the transaction for each type of asset, liability, equity, revenue, and expense.

In a rental business, a ledger is specifically used to record every rent payment made by the tenant as well as the date that the rent covers. It is also a sheet and a useful form of documentation in case of any disputes regarding rent payment. As a renter, it is important that you ask one from your landlord, and as a landlord, it is your responsibility to keep a ledger and provide it to your tenant especially at the end of the tenancy period.

Rental Ledger Examples and Templates

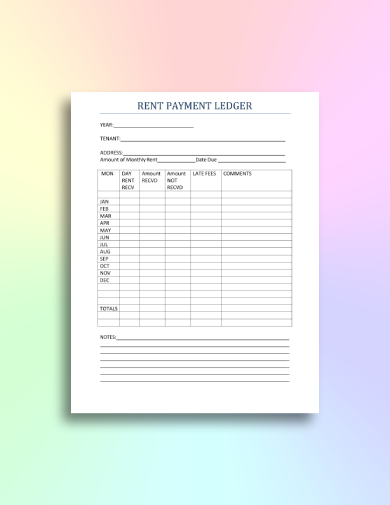

1. Basic Rental Ledger

While the traditional or manual style of recording can still be useful today, recording rental transactions, especially rent payments, with the use of a computer system provides an efficient and fast way to complete the records. So, when you intend to create your own rental ledger for your tenant, make sure to have an online record that you can edit or modify anytime. This would help you easily record the transaction and keep that record without worrying that it might get lost or damaged due to wear and tear or fortuitous events. Moreover, in case your tenant would move out, you can immediately provide him or her a ledger that summarizes his or her rental payments and other related transactions. You can refer to the format of this basic rental ledger to create one with ease.

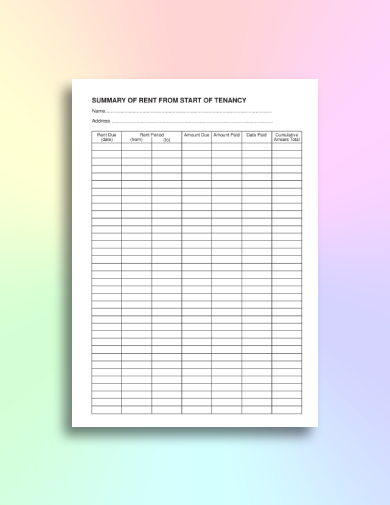

2. Generic Rental Ledger

Maintaining an up-to-date rental ledger is important for the landlord in order to record the previous payments of the tenant and to determine if the tenant has defaulted or is late in his or her current payments or if he has payment in arrears. On the other hand, this can also be advantageous for the tenants since it can also be used when they apply as a tenant in a new property as evidence that they pay their rent on time or that they are good and credible tenants. Knowing this, it is vital that you carefully create a rental ledger by referring to this generic rental ledger. You can also include your company details, especially your contact information in case of some inquiries, suggestions, feedback, and other related concerns.

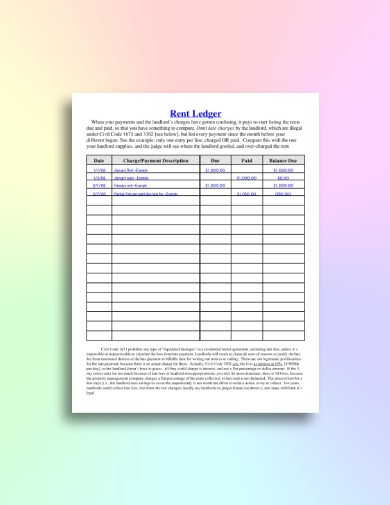

3. Detailed Rental Ledger

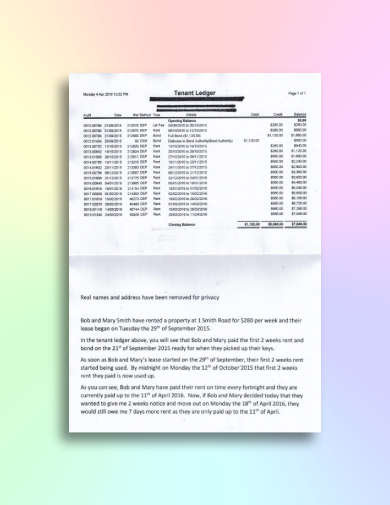

As can be seen from this detailed rental ledger example, the specific date when the rent payment is made is listed on the first column; the charge or payment description is listed on the second column; the amount due and amount paid is listed on the third and fourth columns, respectively; and the balance due is listed on the last column. After the table, the provisions from related and applicable tenant laws are also presented in order for the tenant to know his or her rights, especially when it comes to paying late fees or charges as this is prohibited and illegal under Civil Code 1671 and 3302. You may also check your state laws regarding other stipulations related to a rental contract. This is also something that the landlord must know and be concerned about.

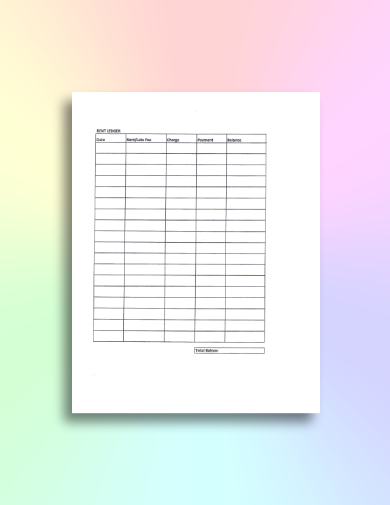

4. Plain Rental Ledger

In this plain rental ledger example, the details that must be recorded by the landlord are as follows: the date of payment, amount of rent, fees and charges, amount paid, and the balance due. However, in general, there are four types of transactions that you can find in a rental ledger: rent, payment invoice, bond, and deposit. Rent refers to the payments made to the rent, as well as any refunds or adjustments. Payment invoice is the payment made to your invoice and any refunds and adjustments. Bonds are payments to your residential tenancies authority bond. Lastly, deposits pertain to those payments that you made in advance or before the due date. Hence, if you are planning to create a rental ledger, make sure to include these items on your document.

5. Comprehensive Rental Ledger

This comprehensive rental ledger example presents the following essential elements: audit, date, ref, type, details, debit, credit, and balance. Audit pertains to the transaction or identification number that is used as a tracking mechanism for the rental transactions. Date refers to when the rent payment or transaction was made or the issuance of the rent receipt. Ref, also known as the receipt number, is the reference number for the rental transaction. Type is what the payment is made for, for example, rent invoice, bond, or deposit. Details are the description of the transaction. Debit refers to the amount taken from the tenant’s account, while debit refers to the amount paid to the tenant’s account. Finally, balance is the total and current amount of money in the tenant’s account.

6. Standard Rental Ledger

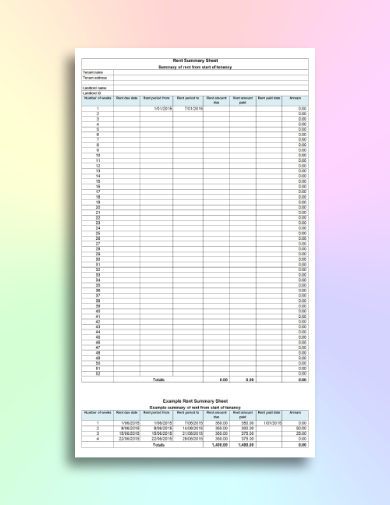

Basically, the landlord is responsible for recording in a ledger a summary of the rental payments and other related transactions made by the tenant or renter. As a landlord, you can make a personalized ledger as long as it contains the information that the tenant needs to know, similar to the example presented above. From this standard rental ledger example, we can see that the details are organized in the following column headings: number of weeks, rent due date, rent period from, rent period to, rent amount due, rent amount paid, date the rent is paid, and rent in arrears. Do not forget to include the tenant’s and landlord’s name, address, and contact details. The contact details are important in order for the parties to communicate in case of disputes, misunderstandings, and other rent-related issues.