10+ Compliance Report Examples to Download

In a workplace, there are certain laws, regulations, ethics, and standards that need to be complied by all of its employees. These legal requirements are imposed in all aspects of a business, including both internal and external projects or operations. In fact, nearly all companies’ regulatory boards or other executives conduct audits in their safety, security, product, financial, and other areas on a monthly, quarterly, or annual basis. These audits are required to put into writing the full details, in a form of a report, every department’s compliance in its duties. With that being said, we encourage you to learn more about such a report through our examples and article below.

10+ Compliance Report Examples

1. Compliance Report Template

2. Board Compliance Report Template

3. Compliance Investigation Report Template

4. Annual Compliance Report

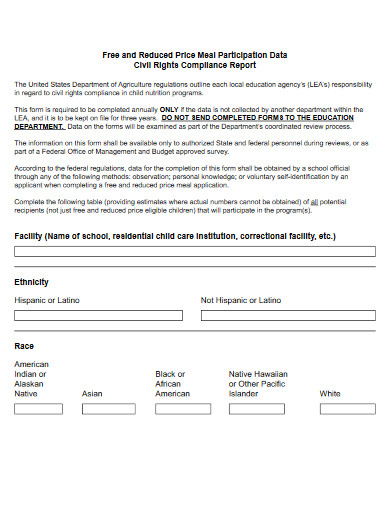

5. Civil Rights Compliance Report

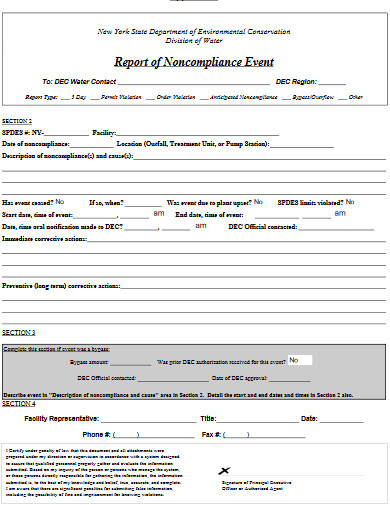

6. Report of Noncompliance Event

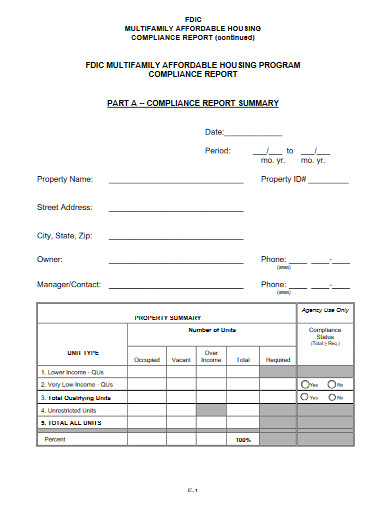

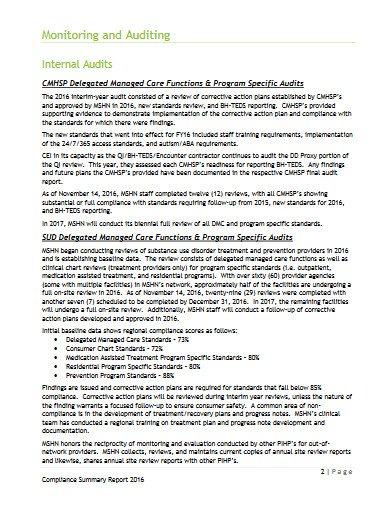

7. Compliance Report Summary Form

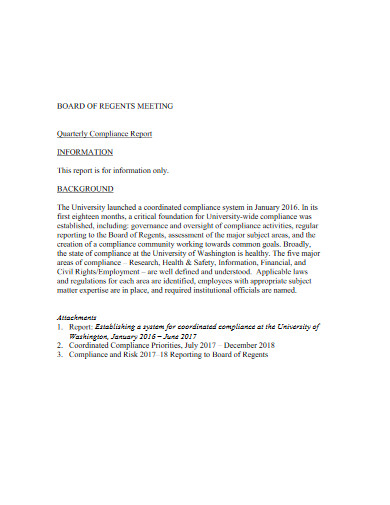

8. Quarterly Compliance Report

9. Compliance Reporting Form

10. Corporate Compliance Reporting Form

11. Compliance Summary Report

What Is a Compliance Report?

A compliance report is a document that holds the complete information about a company’s conformity with the law, regulations, ethical practices, and industry standards. It is produced right after the successful implementation of activities of a compliance strategic plan and audit strategic plan. According to Kerie Kerstetter of Diligent Insights, the documentation procedure enables business executives in setting the right decision criteria for their company. This helps them to properly allocate resources, as well as organize risk management plans and strategic plans. Because of these facts, compliance reporting is, without a doubt, important for businesses and should never be taken for granted.

Who Reads a Compliance Report?

A compliance report’s audience may vary on what it covers. So, who are the audiences for this kind of report, and why do they need them? Our list below can answer that question.

1. Regulators – They are organizations that formulate directives and grant sanctions. One of their functions is to enforce these directives while making sure that they incur liabilities.

2. Board Members – Compliance is a good selling point of a business, and knowledge on this is necessary for these trustees to perform their obligations.

3. Counsel – The legal department, as their title implies, needs to make sure that the company they are working for meets all legal requirements. This is why the compliance report is necessary for them.

4. Employees – The workforce of a company must be aware of the legalities and appropriateness of their operations.

5. Clients, Investors, and Retailers – Companies need to maintain good relationships with their affiliations, and sharing the status of their compliance is one way to do so.

How To Create a Compliance Report

In writing a compliance report, it is important to make sure of the thoroughness and preciseness of every detail. Not only that, but each of them also has to be relevant to certain company policy, regulations, and standard procedures. To help you get the aforementioned qualities instilled in your report, take heed on our list of steps below.

1. Write Down Basic Details

Commence your report by writing down its details. This must include the proponents, submission date, name of the author, name of the company or department that’s being audited, and title of the report. In report writing, the title usually goes first. Then, it will be followed by the audit subject’s names, the author’s name, the list of proponents, and the date of submission, respectively. Most professionals prefer putting these elements in a different page, which is commonly known as the cover page.

2. Establish the Purpose

After providing the basic information, firmly establish what the report is about other than being a part of program documentation. In doing so, you must not forget to indicate the type of report that you will be making. This is to help readers have initial ideas on the proceeding details. A good example of this is to provide the department stakeholders with knowledge about a new state regulation that must be complied with by all businesses.

3. State the Findings

As mentioned above, a compliance report is a document that has to be produced, succeeding in the successful execution of a strategic audit plan. And because it is so, it is obvious enough that various company analyses with their corresponding results are involved. The outcomes of these analyses have to be detailed to let the target audience become aware of the compliance status of the company.

4. Provide Recommendations

Once you have all the findings enumerated, mention all the recommendations that the auditor has provided in their assessments. This must be taken into account in your company’s data inventory for the reference of other compliance auditors in the near future. Another reason why this section has to be included is that a report must expound every important detail of a process, like auditing.

FAQs:

What is a compliance risk?

Compliance risk is the probability of an individual or organization to get penalties because of an un-conformity with the laws, regulations, and standard practices.

What are the different types of compliance risks?

Compliance risks have many forms. They include the following:

1. Environmental Risk – the damages to living beings due to corporate activities

2. Workplace Health and Safety – the physical damages to employees caused by business undertakings

3. Corrupt Practices – the unlawful activities that harm the business financial health and corporate reputation

4. Social Responsibility – the damages done by business activities to employees or communities

5. Quality – the failure of products and services to meet quality standards

6. Process Risk – failure to meet legal obligations with business partners and clients

What is the importance of compliance?

Compliance with the law, regulations, policies, and procedures is a way to avoid violations. In other words, conforming to the aforementioned factors helps an organization protect itself from fines and lawsuits, which can greatly damage its financial health and reputation.

Almost everywhere we step into, there are rules that we need to comply with. Many of us think that these are limiting us to do whatever we fancy. To be fair, it does in some ways. However, the main purpose of having them carried out is to protect us in various manners. If you put it in a business context, they simply act as guidelines to make the best out of every company’s undertakings to ensure its success and sustainability.