11+ Expenditure Report Examples to Download

Do you belong to the few people whose work is handling business expenditures? If you do, you’re most likely concerned about how to present your work to the higher management of the company. Well, you don’t have to worry about it anymore, because we have the right solution for you. Creating a report about business expenditures is not an easy task. It needs to be complete and precise since it contains information on the cash outflow of the business funds. To ease your concern, this article is going to help you learn more about an expenditure report.

11+ Expenditure Report Examples

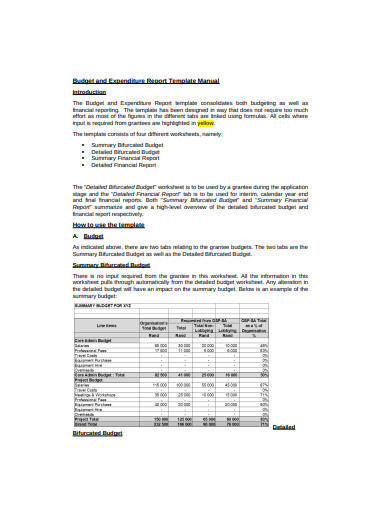

1. Budget and Expenditure Report

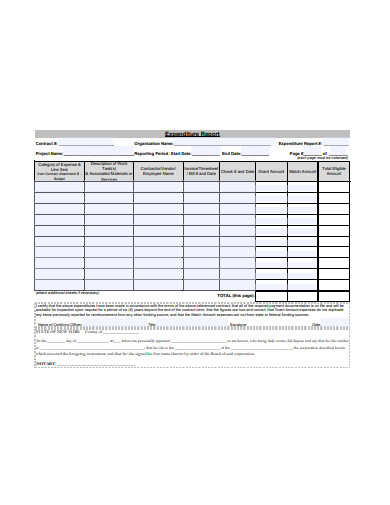

2. Expenditure Report Example

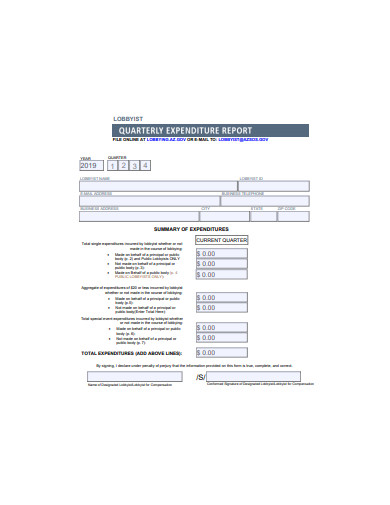

3. Quarterly Expenditure Report

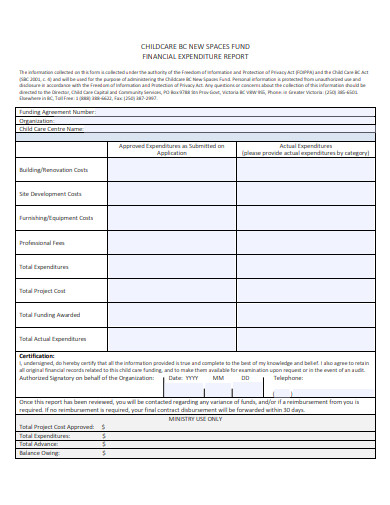

4. Financial Expenditure Report

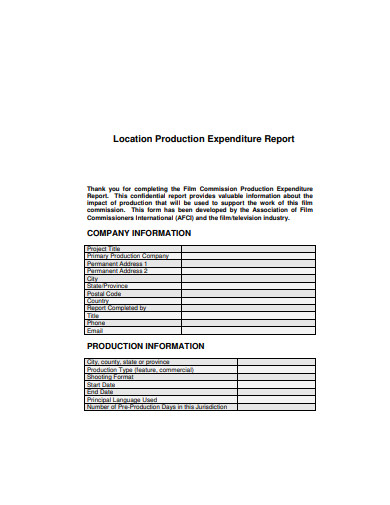

5. Location Production Expenditure Report

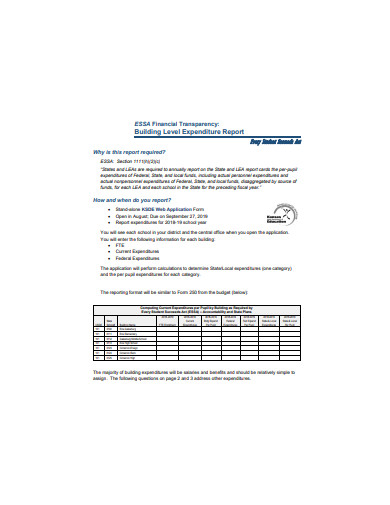

6. Building Level Expenditure Report

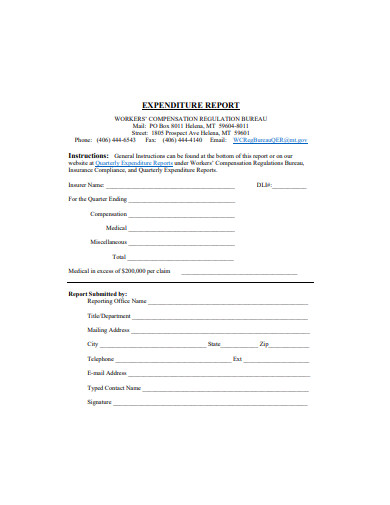

7. Expenditure Report Format

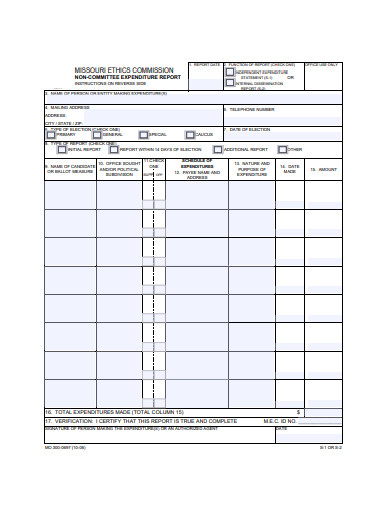

8. Non-Committee Expenditure Report

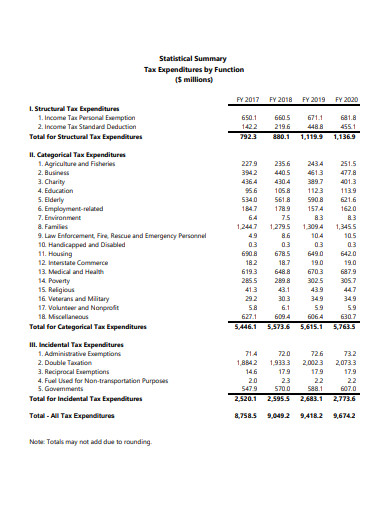

9. Tax Expenditure Report

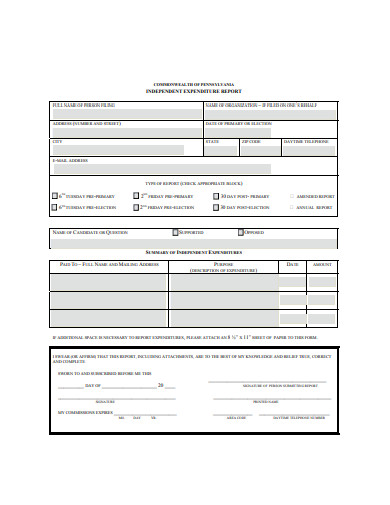

10. Independent Expenditure Report Format

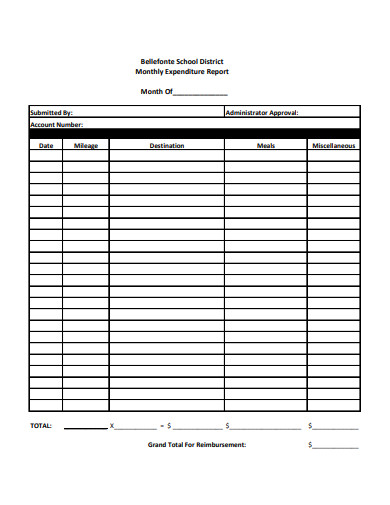

11. Monthly Expenditure Report

12. Final Expenditure Report

What Is an Expenditure Report?

In business, keeping track of the budget of a particular project is the most important work. It is how a business owner will determine if the money was accordingly spent on a project expense and not for other things. Entrepreneurs spend an enormous amount of fortune for the benefit of their company. From investing in a business project down to business travels, a tremendous amount of money is spent to ensure that the operation will have a smooth flow. A statista report revealed that back in 2017, business travel expenses reached up to $1.33 trillion in the United States. If that is how much a business owner spends his money on travel, imagine how other business expenditures would look like. In order to manage the flow of business funds, an expenditure report needs to be created.

An expenditure report contains the overall cash flow of a particular business fund. It includes detailed information on how the funds were used for specific business operations or projects. It is how business owners ensure that the funds are spent for its purpose and for the benefit of the company. There must be an expenditure report for every business fund to keep track of how it is spent, and it will also act as proof that the funds were used for business purposes. The employee who is responsible for making an expenditure report must make sure that every action where the funds are used must be included in the report. It is how the business owner monitors the funds, and if there is an unknown expense, he can immediately take action.

How To Create an Expenditure Report

Now that you know the significance of an expenditure report, this section contains the tips and guidelines that are going to help you in creating an expenditure report for the funds of a business.

1. Use the Right Format

You have to use the right format in creating your expenditure report. This type of report is usually in a table style format since it deals with the flow of business income. In your table, you have to make sure that each column and rows has specific titles to avoid any confusion and misinterpretations. You also have to ensure that your report has accurate computations, and each amount is written in complete figures. Remember that you’re dealing with the breakdown of the usage of funds, so your report must not have any errors in it.

2. Incorporate the Appropriate Title

Just like any other reports, an expenditure report also has its own title. The title of the report depends on the timeline of when the funds were used, which means it can vary from time to time. You must incorporate the right title for your expenditure report since it is going to be used by the higher management for budget discussions in particular business meetings. For example, you can have your title like “Monthly Expenditure Report for the Construction Fund” or “XYZ Company Expenditure Report for the year 2020”. Titles help an employee easily indicate which report should be submitted in a particular time, so you must not forget the title for your expenditure report.

3. Include Supporting Documents

As you know, an expenditure report contains how a business fund is used for particular expenses. So, supporting documents like invoices and receipts should also be included in your report because it serves as evidence that the funds were used to pay for a particular business expense. Employees from higher management always ask for these types of documents to confirm that the funds were used accordingly. So you must include invoices, receipts, and other payment forms in your expenditure report.

4. Always Review Your Expenditure Report

If you are finished in creating your expenditure report, It is always important to review its contents before submitting it to the higher authorities. It is a precautionary measure that ensures your report is void of any errors and mistakes because it can cause problems that might be difficult to assess. It is the last step that you have to do to ensure that everything on your expenditure report is correct before submitting it to the executive committee.

FAQs

Can I use an already made template for my expenditure report?

Yes, you can use an already made template in your expenditure report. If you want, you can use the sample documents provided in this article. The documents are convenient because they are engineered for immediate use. You can just download them into your computer, and you can quickly start creating your expenditure report.

Are there different types of expenditures?

Yes, there are different types of expenditures, such as revenue expenditure, capital expenditure, and deferred revenue expenditure. Revenue expenditure is payments during the course of the business. Capital expenditure, on the other hand, is the payment made when acquiring an asset, while a deferred revenue expenditure is the advance payment for products and services.

Is an expenditure report considered a financial report?

Yes, an expenditure report is considered a financial report because it deals with money that is spent on expenses. There are other types of financial reports, such as income statements and balance sheets, which also deals with how cash is used in business transactions.

As you can see, an expenditure report is the right solution for your concern. It is a document that contains detailed information about how business funds are used on a particular project expense. It is also the concise form of presenting financial information to the higher management of the company. Now that you know how an expenditure report can help you, you can now start creating your very own expenditure report.

11+ Expenditure Report Examples to Download

Do you belong to the few people whose work is handling business expenditures? If you do, you’re most likely concerned about how to present your work to the higher management of the company. Well, you don’t have to worry about it anymore, because we have the right solution for you. Creating a report about business expenditures is not an easy task. It needs to be complete and precise since it contains information on the cash outflow of the business funds. To ease your concern, this article is going to help you learn more about an expenditure report.

11+ Expenditure Report Examples

1. Budget and Expenditure Report

osf.org.za

Details

File Format

PDF

Size: 177 KB

2. Expenditure Report Example

dec.ny.gov

Details

File Format

PDF

Size: 46 KB

3. Quarterly Expenditure Report

azsos.gov

Details

File Format

PDF

Size: 1 MB

4. Financial Expenditure Report

gov.bc.ca

Details

File Format

PDF

Size: 89 KB

5. Location Production Expenditure Report

namibiaembassyusa.org

Details

File Format

PDF

Size: 167 KB

6. Building Level Expenditure Report

ksde.org

Details

File Format

PDF

Size: 178 KB

7. Expenditure Report Format

erd.dli.mt.gov

Details

File Format

PDF

Size: 189 KB

8. Non-Committee Expenditure Report

mec.mo.gov

Details

File Format

PDF

Size: 285 KB

9. Tax Expenditure Report

dbm.maryland.gov

Details

File Format

PDF

Size: 619 KB

10. Independent Expenditure Report Format

chesco.org

Details

File Format

PDF

Size: 222 KB

11. Monthly Expenditure Report

basd.net

Details

File Format

PDF

Size: 159 KB

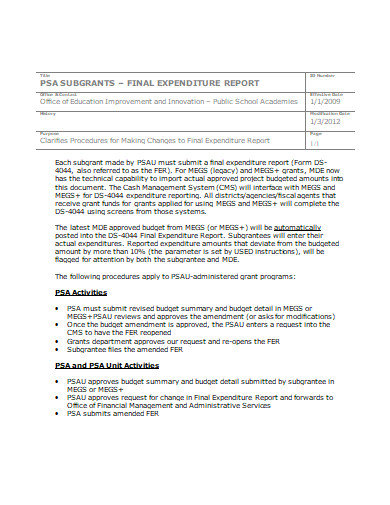

12. Final Expenditure Report

michigan.gov

Details

File Format

MS Word

Size: 144 KB

What Is an Expenditure Report?

In business, keeping track of the budget of a particular project is the most important work. It is how a business owner will determine if the money was accordingly spent on a project expense and not for other things. Entrepreneurs spend an enormous amount of fortune for the benefit of their company. From investing in a business project down to business travels, a tremendous amount of money is spent to ensure that the operation will have a smooth flow. A statista report revealed that back in 2017, business travel expenses reached up to $1.33 trillion in the United States. If that is how much a business owner spends his money on travel, imagine how other business expenditures would look like. In order to manage the flow of business funds, an expenditure report needs to be created.

An expenditure report contains the overall cash flow of a particular business fund. It includes detailed information on how the funds were used for specific business operations or projects. It is how business owners ensure that the funds are spent for its purpose and for the benefit of the company. There must be an expenditure report for every business fund to keep track of how it is spent, and it will also act as proof that the funds were used for business purposes. The employee who is responsible for making an expenditure report must make sure that every action where the funds are used must be included in the report. It is how the business owner monitors the funds, and if there is an unknown expense, he can immediately take action.

How To Create an Expenditure Report

Now that you know the significance of an expenditure report, this section contains the tips and guidelines that are going to help you in creating an expenditure report for the funds of a business.

1. Use the Right Format

You have to use the right format in creating your expenditure report. This type of report is usually in a table style format since it deals with the flow of business income. In your table, you have to make sure that each column and rows has specific titles to avoid any confusion and misinterpretations. You also have to ensure that your report has accurate computations, and each amount is written in complete figures. Remember that you’re dealing with the breakdown of the usage of funds, so your report must not have any errors in it.

2. Incorporate the Appropriate Title

Just like any other reports, an expenditure report also has its own title. The title of the report depends on the timeline of when the funds were used, which means it can vary from time to time. You must incorporate the right title for your expenditure report since it is going to be used by the higher management for budget discussions in particular business meetings. For example, you can have your title like “Monthly Expenditure Report for the Construction Fund” or “XYZ Company Expenditure Report for the year 2020”. Titles help an employee easily indicate which report should be submitted in a particular time, so you must not forget the title for your expenditure report.

3. Include Supporting Documents

As you know, an expenditure report contains how a business fund is used for particular expenses. So, supporting documents like invoices and receipts should also be included in your report because it serves as evidence that the funds were used to pay for a particular business expense. Employees from higher management always ask for these types of documents to confirm that the funds were used accordingly. So you must include invoices, receipts, and other payment forms in your expenditure report.

4. Always Review Your Expenditure Report

If you are finished in creating your expenditure report, It is always important to review its contents before submitting it to the higher authorities. It is a precautionary measure that ensures your report is void of any errors and mistakes because it can cause problems that might be difficult to assess. It is the last step that you have to do to ensure that everything on your expenditure report is correct before submitting it to the executive committee.

FAQs

Can I use an already made template for my expenditure report?

Yes, you can use an already made template in your expenditure report. If you want, you can use the sample documents provided in this article. The documents are convenient because they are engineered for immediate use. You can just download them into your computer, and you can quickly start creating your expenditure report.

Are there different types of expenditures?

Yes, there are different types of expenditures, such as revenue expenditure, capital expenditure, and deferred revenue expenditure. Revenue expenditure is payments during the course of the business. Capital expenditure, on the other hand, is the payment made when acquiring an asset, while a deferred revenue expenditure is the advance payment for products and services.

Is an expenditure report considered a financial report?

Yes, an expenditure report is considered a financial report because it deals with money that is spent on expenses. There are other types of financial reports, such as income statements and balance sheets, which also deals with how cash is used in business transactions.

As you can see, an expenditure report is the right solution for your concern. It is a document that contains detailed information about how business funds are used on a particular project expense. It is also the concise form of presenting financial information to the higher management of the company. Now that you know how an expenditure report can help you, you can now start creating your very own expenditure report.