10+ Financial Audit Report Examples to Download

A business’s financial status reflects the rate of its success. The higher its gains, the better its performance. On the other hand, if it’s bombarded with losses, it’s heading towards a critical state. It goes without saying that ensuring that your financial reports are accurate and dependable is a top priority. This is why financial audit reports are important in measuring the validity of an entity’s financial statements. Its results help them see what’s wrong and provides them with a thorough recommendation of practical solutions that they can use. If you’re on the lookout for a high-quality financial audit report that you can use, refer to our various displays below.

10+ Financial Audit Report Examples

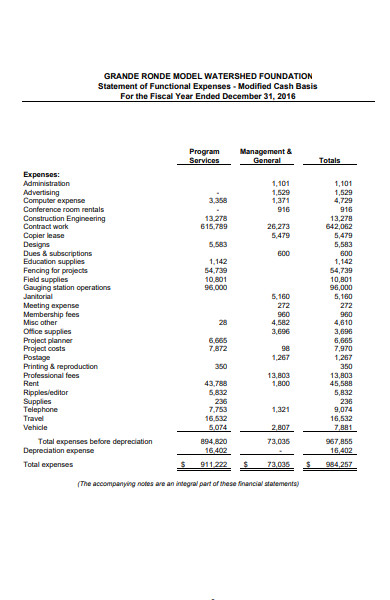

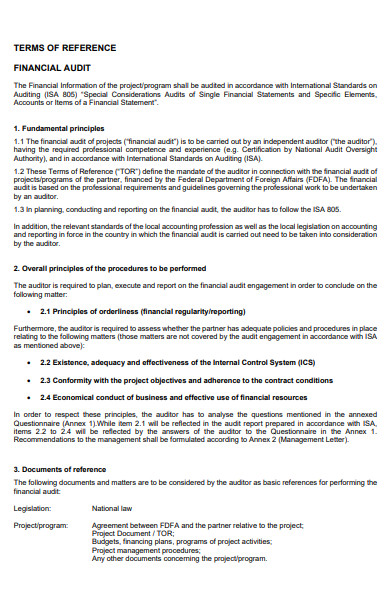

1. Financial Audit Report Template

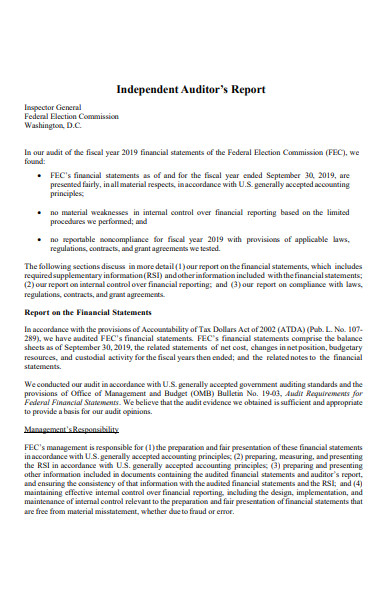

2. Independent Financial Audit Report

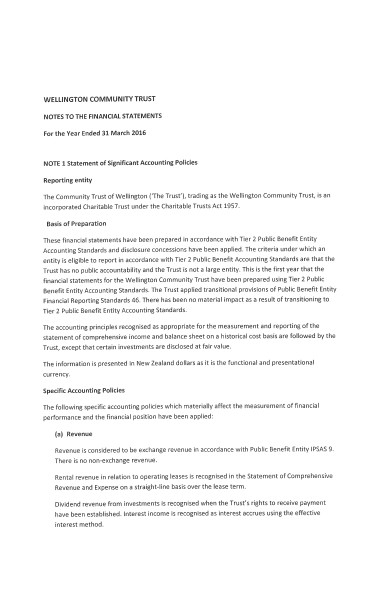

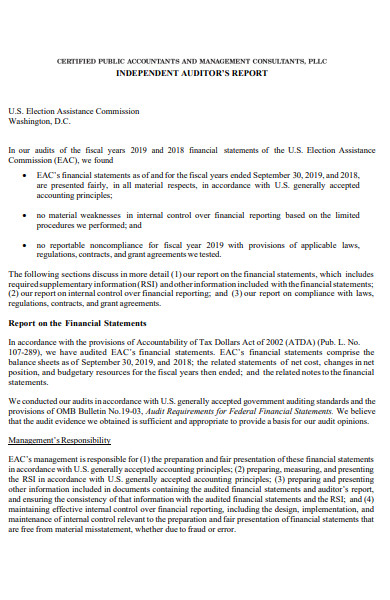

3. Audit Report and Financial Statement

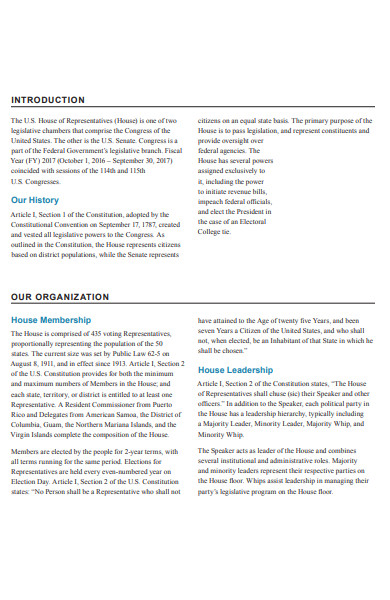

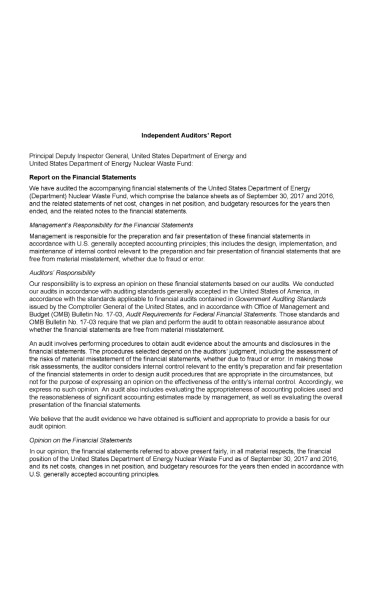

4. Representatives Financial Audit Report

5. Financial Statement Audit Report

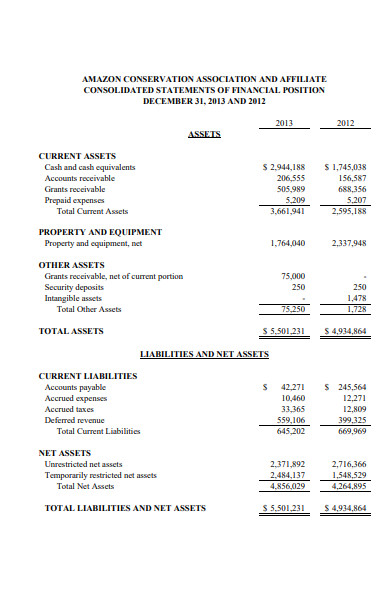

6. Sample Financial Audit Report

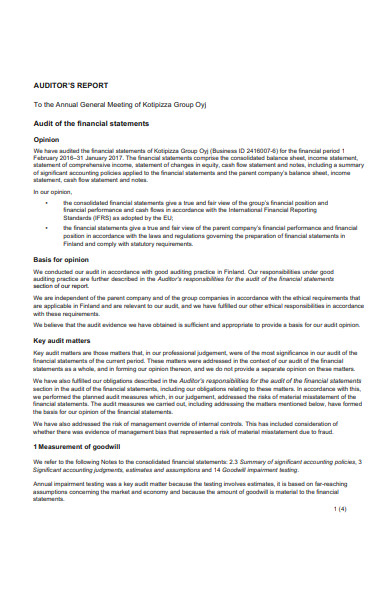

7. University Financial Audit Report

8. Company Financial Audit Report

9. Financial Audit Report Example

10. Financial Audit Report in PDF

11. Annual Financial Audit Report

What Is a Financial Audit Report?

A financial audit report is the result of a close examination of an entity’s financial statements. This provides a list of findings and recommendations that an individual, group, or company can use to determine the financial status, identify system gaps, and declare the credibility of their standing financially. This also helps them point out the deficiency in their finances and demand accountability to whoever’s responsible for it.

According to PwC, an auditing’s primary purpose is to assure a company owner that its management shows a credible display of its financial status. It establishes the trust the owner has for its stakeholders. This is especially true for entities that hire external auditors to examine their reports. Along with that, it helps them improve the quality of their system by abiding with an expert’s perspective and opinion.

Different Types of Audit

The term “audit” is relative to terms such as inspect, assess, analyze, and evaluate. While this may seem common to examining a company’s financial statements, this applies to many areas in an organization. Financial auditing is only one of its numerous varieties. Here are the different types of auditing:

1. Internal audit. This takes place within the organization. This means that a company has its own auditor that inspects the status of their systems.

2. External audit. External auditing is done by an independent auditor or someone that’s outside the organization.

3. Operational audit. This analyzes a company’s procedures and daily operations to ensure that there are no errors in the process or if there are things that need improvement.

4. Information system audit. This is usually conducted in IT companies. Information systems auditing ensures that there are no errors in their cyber-security, and software systems, among others.

5. Compliance audit. This ensures that an organization’s rules and policies work according to the standard designated by law.

How to Write a Financial Audit Report

Financial auditing may seem tricky (and yes, it undoubtedly is) but if you’re looking for a way to how to make one, here are some tips that can help you:

1. Identify Your Audience

It’s important to consider who’ll be reading your report in the beginning stage of the process. This helps you customize what document you’ll be submitting according to their level of understanding. This helps them comprehend what the content of your report is all about. For example, if you’re writing the financial audit report to a company’s executives or department managers, using technical jargon and incorporating detailed figures may not be a problem. However, if you’re auditing for a supplier, manufacturer, or marketing company, they may prefer the report as a narrative rather than numerical. They may want to learn more about the results rather than on the process. This helps you construct a financial report that suits their preference.

2. Provide Comprehensive Findings Outline

This might be among the highlights of your audit report as this will provide what the auditor found out about a business or companies financial statements. This will determine if there are gaps or loopholes in the financial records or if it shows a positive result or not. If there’s a glitch in the system, the findings should efficiently specify these deficiencies to help a client understand the problem and brainstorm solutions. Avoid using lengthy and jargon-infested statements when making your results outline, even if you’re addressing it to financial experts. Use simple language and keep it brief.

3. Keep It Brief and Simple

It’s not just your finding that should be brief and simple; apply this to your entire report. A lengthy report may prove to be a burden rather than a valuable input because it takes longer to go through the entire document. Employ familiar language and lay everything in a concise piece. Be sure to review every statement, and if some words or phrases may seem ambiguous, don’t hesitate to cut it. The simple and the shorter the auditor’s report is, the better.

4. Make Effective Recommendations

Besides providing a complete list of findings, it’s also important for a standard audit report to give recommendations based on their findings. This is what organizations and companies look forward to reading when receiving audit reports. While reading the findings helps them get a glimpse of what fixes and adjustments they can do to improve their financial status, they trust the audit committee’s recommendations of solutions because it’s within the scope of their expertise. This helps them know what to precisely and how they’ll execute it.

FAQs

What are the five Cs of internal auditing?

The five Cs of auditing are condition, criteria, cause, consequence, and corrective action.

What are the different audit opinions?

There are four types of audit opinions: unqualified opinion, qualified opinion, adverse opinion, and disclaimer of opinion.

What are the different stages of auditing?

There are three main stages of processing. They are:

- Planning and identifying risks

- Testing internal controls

- Executing substantive procedures

Financial auditing contributes significantly to ensuring that your financial documents show an accurate result of figures and statements. This doesn’t only keep you updated on your records, but this also diminishes the risk of underground anomalies in your system. However, the process can be arduous, so you’ll need all the help you can get. Get yours from our financial audit report template and download now!

10+ Financial Audit Report Examples to Download

A business’s financial status reflects the rate of its success. The higher its gains, the better its performance. On the other hand, if it’s bombarded with losses, it’s heading towards a critical state. It goes without saying that ensuring that your financial reports are accurate and dependable is a top priority. This is why financial audit reports are important in measuring the validity of an entity’s financial statements. Its results help them see what’s wrong and provides them with a thorough recommendation of practical solutions that they can use. If you’re on the lookout for a high-quality financial audit report that you can use, refer to our various displays below.

10+ Financial Audit Report Examples

1. Financial Audit Report Template

Details

File Format

MS Word

Pages

Google Docs

Size: A4, US

2. Independent Financial Audit Report

fec.gov

Details

File Format

PDF

Size: 937 KB

3. Audit Report and Financial Statement

wct.org.nz

Details

File Format

PDF

Size: 2 MB

4. Representatives Financial Audit Report

house.gov

Details

File Format

PDF

Size: 5 MB

5. Financial Statement Audit Report

eac.gov

Details

File Format

PDF

Size: 964 KB

6. Sample Financial Audit Report

energy.gov

Details

File Format

PDF

Size: 2 MB

7. University Financial Audit Report

adminfinance.umw.edu

Details

File Format

PDF

Size: 1 MB

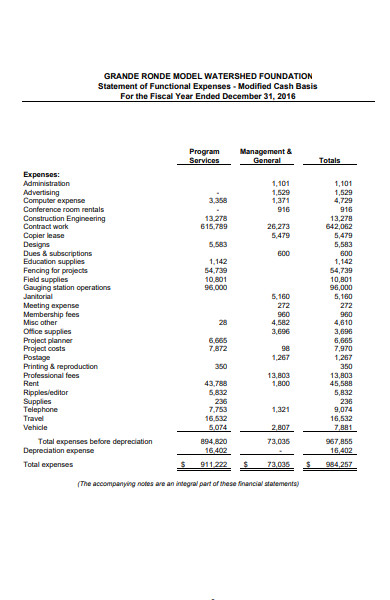

8. Company Financial Audit Report

amazonconservation.org

Details

File Format

PDF

Size: 143 KB

9. Financial Audit Report Example

kotipizzagroup.com

Details

File Format

PDF

Size: 72 KB

10. Financial Audit Report in PDF

ifes.org

Details

File Format

PDF

Size: 208 KB

11. Annual Financial Audit Report

Details

File Format

PDF

Size: 2 MB

What Is a Financial Audit Report?

A financial audit report is the result of a close examination of an entity’s financial statements. This provides a list of findings and recommendations that an individual, group, or company can use to determine the financial status, identify system gaps, and declare the credibility of their standing financially. This also helps them point out the deficiency in their finances and demand accountability to whoever’s responsible for it.

According to PwC, an auditing’s primary purpose is to assure a company owner that its management shows a credible display of its financial status. It establishes the trust the owner has for its stakeholders. This is especially true for entities that hire external auditors to examine their reports. Along with that, it helps them improve the quality of their system by abiding with an expert’s perspective and opinion.

Different Types of Audit

The term “audit” is relative to terms such as inspect, assess, analyze, and evaluate. While this may seem common to examining a company’s financial statements, this applies to many areas in an organization. Financial auditing is only one of its numerous varieties. Here are the different types of auditing:

1. Internal audit. This takes place within the organization. This means that a company has its own auditor that inspects the status of their systems.

2. External audit. External auditing is done by an independent auditor or someone that’s outside the organization.

3. Operational audit. This analyzes a company’s procedures and daily operations to ensure that there are no errors in the process or if there are things that need improvement.

4. Information system audit. This is usually conducted in IT companies. Information systems auditing ensures that there are no errors in their cyber-security, and software systems, among others.

5. Compliance audit. This ensures that an organization’s rules and policies work according to the standard designated by law.

How to Write a Financial Audit Report

Financial auditing may seem tricky (and yes, it undoubtedly is) but if you’re looking for a way to how to make one, here are some tips that can help you:

1. Identify Your Audience

It’s important to consider who’ll be reading your report in the beginning stage of the process. This helps you customize what document you’ll be submitting according to their level of understanding. This helps them comprehend what the content of your report is all about. For example, if you’re writing the financial audit report to a company’s executives or department managers, using technical jargon and incorporating detailed figures may not be a problem. However, if you’re auditing for a supplier, manufacturer, or marketing company, they may prefer the report as a narrative rather than numerical. They may want to learn more about the results rather than on the process. This helps you construct a financial report that suits their preference.

2. Provide Comprehensive Findings Outline

This might be among the highlights of your audit report as this will provide what the auditor found out about a business or companies financial statements. This will determine if there are gaps or loopholes in the financial records or if it shows a positive result or not. If there’s a glitch in the system, the findings should efficiently specify these deficiencies to help a client understand the problem and brainstorm solutions. Avoid using lengthy and jargon-infested statements when making your results outline, even if you’re addressing it to financial experts. Use simple language and keep it brief.

3. Keep It Brief and Simple

It’s not just your finding that should be brief and simple; apply this to your entire report. A lengthy report may prove to be a burden rather than a valuable input because it takes longer to go through the entire document. Employ familiar language and lay everything in a concise piece. Be sure to review every statement, and if some words or phrases may seem ambiguous, don’t hesitate to cut it. The simple and the shorter the auditor’s report is, the better.

4. Make Effective Recommendations

Besides providing a complete list of findings, it’s also important for a standard audit report to give recommendations based on their findings. This is what organizations and companies look forward to reading when receiving audit reports. While reading the findings helps them get a glimpse of what fixes and adjustments they can do to improve their financial status, they trust the audit committee’s recommendations of solutions because it’s within the scope of their expertise. This helps them know what to precisely and how they’ll execute it.

FAQs

What are the five Cs of internal auditing?

The five Cs of auditing are condition, criteria, cause, consequence, and corrective action.

What are the different audit opinions?

There are four types of audit opinions: unqualified opinion, qualified opinion, adverse opinion, and disclaimer of opinion.

What are the different stages of auditing?

There are three main stages of processing. They are:

Planning and identifying risks

Testing internal controls

Executing substantive procedures

Financial auditing contributes significantly to ensuring that your financial documents show an accurate result of figures and statements. This doesn’t only keep you updated on your records, but this also diminishes the risk of underground anomalies in your system. However, the process can be arduous, so you’ll need all the help you can get. Get yours from our financial audit report template and download now!