10+ Financial Feasibility Report Examples to Download

Many companies and businesses rely on the consistent improvement of their products and services to stay competitive in the marketplace. This means that said companies and businesses will require projects that will improve the whole structure of the company or business and their products and services. To know whether or not the project is viable, one must conduct and create a financial feasibility report.

10+ Financial Feasibility Report Examples

1. Financial Feasibility Report Template

2. Standard Financial Feasibility Report

3. Professional Financial Feasibility Report

4. Financial Feasibility Study Report

5. Financial Feasibility Assessment Report

6. Financial Operations Feasibility Report

7. Financial Feasibility Report Services

8. Market and Financial Feasibility Report

9. School Financial Feasibility Report

10. Financial Feasibility Report in PDF

11. General Financial Feasibility Report

What Is a Financial Feasibility Report

A financial feasibility report is a document that will outline the financial availability and viability of a specific project. This report will succinctly detail the projected financial outcomes and costs the project might incur on the business or company conducting said project.

How to Write a Financial Feasibility Report

A standard financial feasibility report is a very long and important document that will take some time to finish writing. A well-written financial feasibility report will allow the upper management to have more confidence in the outcome and feasibility of the project. If you need to have a financial feasibility report template or an example, you may refer to any of the samples named Professional Financial Feasibility Report, Financial Feasibility Study Report, Financial Feasibility Assessment Report, and Financial Operations Feasibility Report.

Step 1: Conduct the Financial Feasibility Study

Begin by conducting the financial feasibility study as this will provide you with the initial data that you will write down in your report. If you do not know how to conduct a financial feasibility study, you may opt to have an expert conduct the study for you.

Step 2: Create The Cover Page, The Table of Contents, and the Introduction

The report must begin with a title page or a cover page that will preface all the contents of the financial feasibility report. The next page that will follow the cover page is the table of contents, which must indicate and label the location of each element of the feasibility report. Lastly, the introduction should come after the table of contents to set the stage and introduce the whole financial feasibility report.

Step 3: Write the Financial Feasibility

After you finish the first few pages, you must now write the financial feasibility of the project. This should include the projected income and expenses, which should be compared and juxtaposed against the resources available in the business or company.

Step 4: List Out the Details of The Market Survey

Another part that must be added to the financial feasibility report is the market study. This will determine if the market is ready for the results of the project, which will directly affect the projected ratio between income and expenses.

Step 5: Analyze the Data

You must analyze the data of both the financial feasibility and deduce the effects they will have on the likelihood of success of the said project. Not only that, but the data will also determine if the business can support the project’s lifespan.

Step 6: Write the Conclusion

The final portion of the financial feasibility report is to have a conclusive statement. This statement will close the whole report and indicate the future decision and actions one may take.

FAQs

What is the purpose of the financial feasibility study?

Every project has stakeholders and shareholders that will provide the manpower, commodities, and resources needed to ensure a successful project. Like most things, these projects will cost a lot of money to sustain which will be pivotal for the success and longevity of the said project. The financial feasibility study is a research effort that experts do to determine whether or not the project has enough financial resources (money and assets) to sustain the lifespan of the entire project. This research effort is very important as it will dictate whether or not the business or company can undertake the efforts the project requires from them without the risk of bankruptcy or longstanding issues that will cripple the project or the business conducting the said project. For example, if a storage business wants to conduct a project to increase the number of its warehouses, it must determine if they have enough materials and money to fund the project they want to do. Therefore if one wants to conduct a project that will increase one’s sales, quality of product and/or service, or sales, then the business or company should conduct a financial feasibility study for their project.

What is the main objective of a financial feasibility study?

The main objective or goal of the financially feasible study is to determine or check the viability of the project when it is compared to the financial resources the business or company has available for the project. Not only will the financial feasibility study generate a report for one to use as a reference, but the upper management will also be able to make informed decisions. Therefore, it is very important for the upper management to either conduct or requests a financial feasibility study for their future projects.

How do you analyze financial feasibility reports?

The financial feasibility study generates a report that will have various data points the financial experts will use to determine the viability of the project. The first thing one should do is to analyze the projected income and expenditure, that the financial feasibility study will generate. After analyzing the data, one must check if there is a customer or consumer demand for the outcome of the project, or if the project will appease a specific customer demand. Afterward, you must determine if any person or outside labor is needed for the project, and whether or not the business or company can allocate said resources to the project. The last step of the analysis of one’s financial feasibility report is to create or brainstorm an informed decision for the future of the project.

A financial feasibility report is a type of report that contains data people will use to determine the financial viability of the project. When a person creates a well-made financial feasibility report the people involved can create good decisions that will not jeopardize any element or aspect of a specific business or company. Therefore it is important to know how to create a financial feasibility report when proposing a project for a company.

10+ Financial Feasibility Report Examples to Download

Many companies and businesses rely on the consistent improvement of their products and services to stay competitive in the marketplace. This means that said companies and businesses will require projects that will improve the whole structure of the company or business and their products and services. To know whether or not the project is viable, one must conduct and create a financial feasibility report.

10+ Financial Feasibility Report Examples

1. Financial Feasibility Report Template

ignitecda.org

Details

File Format

PDF

Size: 4 MB

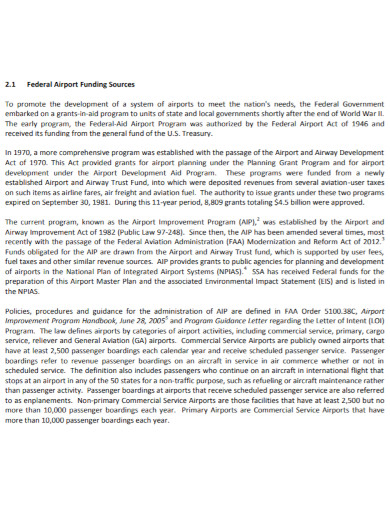

2. Standard Financial Feasibility Report

southsuburbanairport.com

Details

File Format

PDF

Size: 3 MB

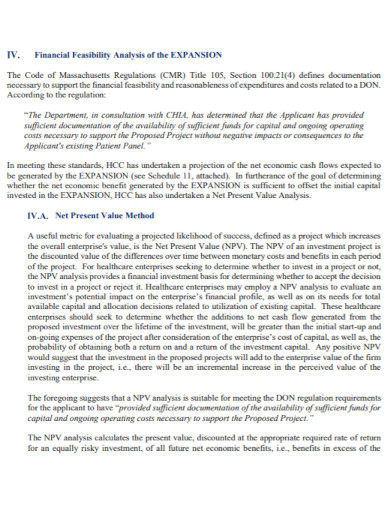

3. Professional Financial Feasibility Report

mass.gov

Details

File Format

PDF

Size: 3 MB

4. Financial Feasibility Study Report

portofguam.com

Details

File Format

PDF

Size: 3 MB

5. Financial Feasibility Assessment Report

sites.jla.us.com

Details

File Format

PDF

Size: 557 KB

6. Financial Operations Feasibility Report

cranberryisles-me.gov

Details

File Format

PDF

Size: 11 MB

7. Financial Feasibility Report Services

uog.edu

Details

File Format

PDF

Size: 118 KB

8. Market and Financial Feasibility Report

mylongview.com

Details

File Format

PDF

Size: 6 MB

9. School Financial Feasibility Report

choicemedia.tv

Details

File Format

PDF

Size: 288 KB

10. Financial Feasibility Report in PDF

phoenix.gov

Details

File Format

PDF

Size: 6 MB

11. General Financial Feasibility Report

beg.utexas.edu

Details

File Format

PDF

Size: 2 MB

What Is a Financial Feasibility Report

A financial feasibility report is a document that will outline the financial availability and viability of a specific project. This report will succinctly detail the projected financial outcomes and costs the project might incur on the business or company conducting said project.

How to Write a Financial Feasibility Report

A standard financial feasibility report is a very long and important document that will take some time to finish writing. A well-written financial feasibility report will allow the upper management to have more confidence in the outcome and feasibility of the project. If you need to have a financial feasibility report template or an example, you may refer to any of the samples named Professional Financial Feasibility Report, Financial Feasibility Study Report, Financial Feasibility Assessment Report, and Financial Operations Feasibility Report.

Step 1: Conduct the Financial Feasibility Study

Begin by conducting the financial feasibility study as this will provide you with the initial data that you will write down in your report. If you do not know how to conduct a financial feasibility study, you may opt to have an expert conduct the study for you.

Step 2: Create The Cover Page, The Table of Contents, and the Introduction

The report must begin with a title page or a cover page that will preface all the contents of the financial feasibility report. The next page that will follow the cover page is the table of contents, which must indicate and label the location of each element of the feasibility report. Lastly, the introduction should come after the table of contents to set the stage and introduce the whole financial feasibility report.

Step 3: Write the Financial Feasibility

After you finish the first few pages, you must now write the financial feasibility of the project. This should include the projected income and expenses, which should be compared and juxtaposed against the resources available in the business or company.

Step 4: List Out the Details of The Market Survey

Another part that must be added to the financial feasibility report is the market study. This will determine if the market is ready for the results of the project, which will directly affect the projected ratio between income and expenses.

Step 5: Analyze the Data

You must analyze the data of both the financial feasibility and deduce the effects they will have on the likelihood of success of the said project. Not only that, but the data will also determine if the business can support the project’s lifespan.

Step 6: Write the Conclusion

The final portion of the financial feasibility report is to have a conclusive statement. This statement will close the whole report and indicate the future decision and actions one may take.

FAQs

What is the purpose of the financial feasibility study?

Every project has stakeholders and shareholders that will provide the manpower, commodities, and resources needed to ensure a successful project. Like most things, these projects will cost a lot of money to sustain which will be pivotal for the success and longevity of the said project. The financial feasibility study is a research effort that experts do to determine whether or not the project has enough financial resources (money and assets) to sustain the lifespan of the entire project. This research effort is very important as it will dictate whether or not the business or company can undertake the efforts the project requires from them without the risk of bankruptcy or longstanding issues that will cripple the project or the business conducting the said project. For example, if a storage business wants to conduct a project to increase the number of its warehouses, it must determine if they have enough materials and money to fund the project they want to do. Therefore if one wants to conduct a project that will increase one’s sales, quality of product and/or service, or sales, then the business or company should conduct a financial feasibility study for their project.

What is the main objective of a financial feasibility study?

The main objective or goal of the financially feasible study is to determine or check the viability of the project when it is compared to the financial resources the business or company has available for the project. Not only will the financial feasibility study generate a report for one to use as a reference, but the upper management will also be able to make informed decisions. Therefore, it is very important for the upper management to either conduct or requests a financial feasibility study for their future projects.

How do you analyze financial feasibility reports?

The financial feasibility study generates a report that will have various data points the financial experts will use to determine the viability of the project. The first thing one should do is to analyze the projected income and expenditure, that the financial feasibility study will generate. After analyzing the data, one must check if there is a customer or consumer demand for the outcome of the project, or if the project will appease a specific customer demand. Afterward, you must determine if any person or outside labor is needed for the project, and whether or not the business or company can allocate said resources to the project. The last step of the analysis of one’s financial feasibility report is to create or brainstorm an informed decision for the future of the project.

A financial feasibility report is a type of report that contains data people will use to determine the financial viability of the project. When a person creates a well-made financial feasibility report the people involved can create good decisions that will not jeopardize any element or aspect of a specific business or company. Therefore it is important to know how to create a financial feasibility report when proposing a project for a company.