8+ Payroll Report Examples to Download

Any small business owner serves in more than one capacity with his or her organization. Completing payroll is one of the most critical activities in running a small company. Employees must be able to count on getting paid on a regular and timely basis. Payroll affects every area of a small business, from staff productivity to the company’s financial health.

Managing accounts and keeping accurate track of all employees’ time and attendance in preparing payroll is a complex and time-consuming operation. To calculate employee’s salary quickly and accurately, here are sample templates and tips to consider:

9+ Payroll Report Examples

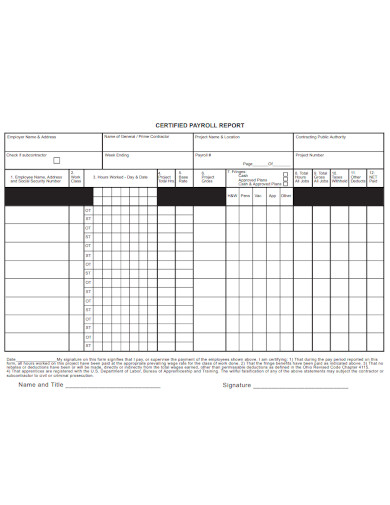

1. Payroll Report Example

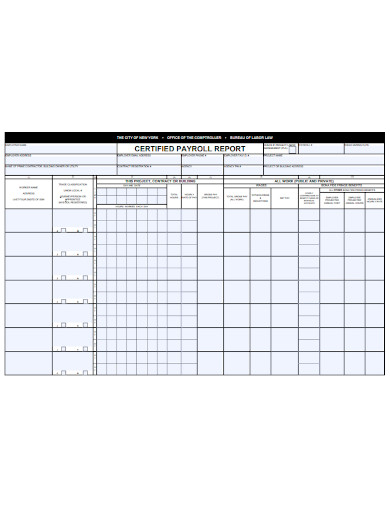

2. Certified Payroll Report

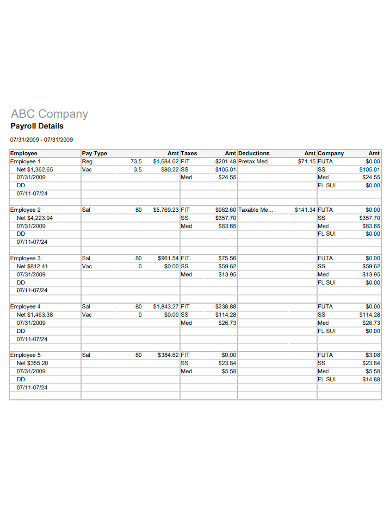

3. Company Payroll Report

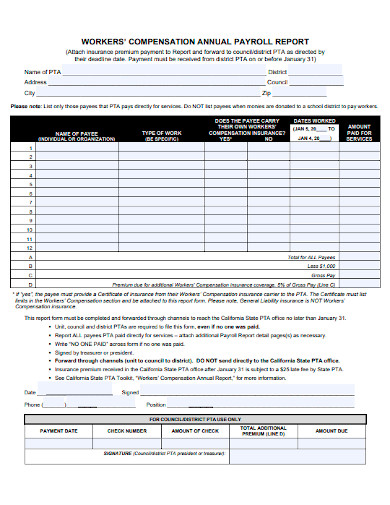

4. Annual Payroll Report

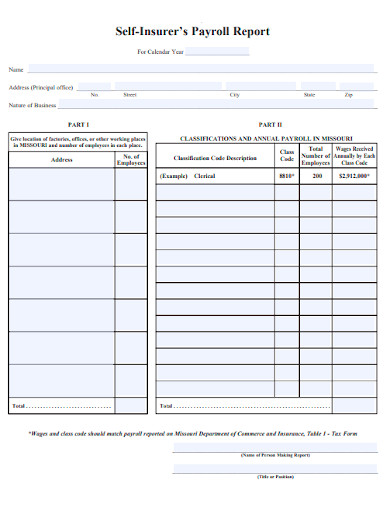

5. Self Insurer’s Payroll Report

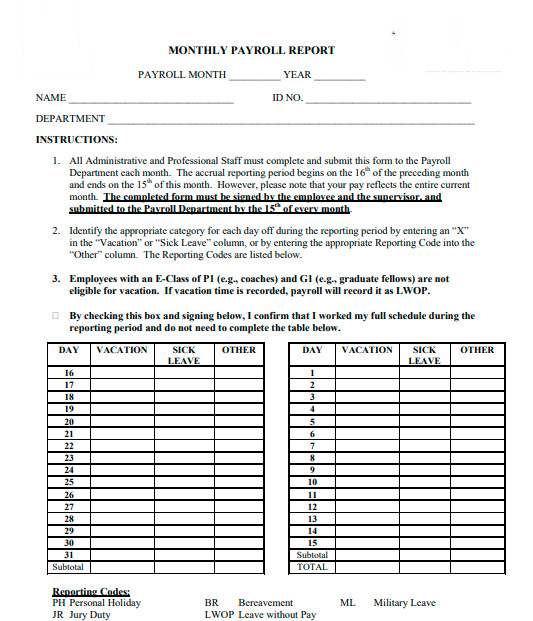

6. Monthly Payroll Report

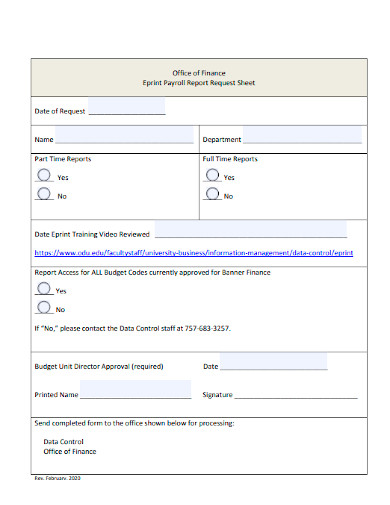

7. Payroll Request Report

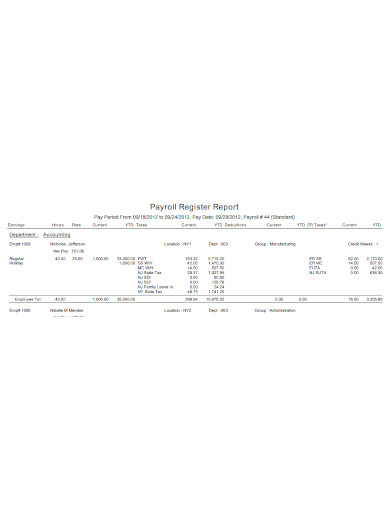

8. Payroll Register Report

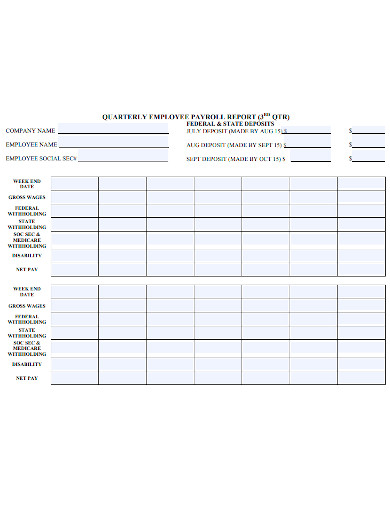

9. Employee Payroll Report

What Is a Payroll Report?

Payroll records are forms that provide a summary of payroll data. Payroll reports of various forms assist company owners, lenders, and policymakers in analyzing payroll expenses.

Here are common payroll report types:

- Company-wide Payroll Report

- Employee Time Reports

- Employee-Specific Reports

- Cash Requirements Reports

- Payroll Tax Reports

- Paycheck Protection Program Reports

- Certified Payroll Reports

How to Create a Payroll Report?

Payroll reports can come in a variety of sizes and shapes. Here’s how to arrange the payroll report, regardless of the format.

Step 1: Determine the Information Needed

Begin by defining the data that you need to share with a third party or analyzed internally. In reporting to third parties, you don’t want to provide more detail than they have requested.

Assume you’re applying for a company loan and must have a payroll sheet detailing the payroll expenses for the past four quarters. You wouldn’t want to file an entire payroll ledger because it would include employee identities, donations to retirement benefits, and a slew of other unnecessary information. You’d be best off with a concise report that details job salaries, employer taxes, and employer-paid fringe benefits.

Step 2: Choose a Time Frame.

If you’re using IRS forms to create a payroll tax filing, you get to pick the reporting date. For instance, it might be preferable to generate 12 monthly payroll reports for your lender rather than four quarterly reports. It allows you more leeway in explaining increases in payroll expenses.

Step 3: Enter Payment Details.

Now that you are making the payroll report, it’s time to know the accountant’s best mate, Microsoft Excel. Look at the Excel models floating across the web for anything that vaguely resembles what you’re trying to create. After that, modify it to suit your needs. Once you have completed the prototype, enter the data from your payroll method. If you are manually entering data, be careful not to make a transposition mistake.

Step 4: Analyze the Results

If you’ve done writing the paper, go through it again for mistakes and see what ideas you can glean. Were your payroll costs higher or smaller than expected? Why is this the case?

If you’re writing a report about a third party, consider what story the statement is saying. If a lender or creditor asks you a probing question about your company’s financial documents, you must be an expert on it.

FAQs:

What is the purpose of a payroll report?

Payroll is one of the most critical facets of any company. It affects employee productivity and represents a company’s financial health and prestige. Employees depend on their paychecks, so mistakes or late payments will lead to a loss of confidence.

What qualifications do you require to work on the payroll?

Here are six qualities that many employers ask for when recruiting payroll leaders:

- Payroll Systems Experience

- Business Acumen Leadership

- Qualities Compliance Knowledge

- Other Technical Expertise

What exactly are the duties of a payroll clerk?

The principal duties of a payroll clerk are to collect, calculate, and record details. These are to keep payroll records up to date.

Creating payroll can be a time-consuming and tricky process, but if you have the proper knowledge and templates, you can make it easier and less time-consuming. As a result, be aware of the critical information that you would use in your calculations.