10+ Banking Resume Examples to Download

If you work in banking, you are a trustworthy professional who knows your way through the financial sector. You provide your customers with investment counseling and recommendations. However, when it comes to writing a job-winning resume, you are the one who needs assistance. What exactly does a decent banking resume look like? With thousands of people competing for the top banking jobs, you can not afford to leave any questions unanswered. But don’t be bothered! The banking resume and tips will help you get your foot in the door of a job.

10+ Banking Resume Examples

1. Business Banking Relationship Manager Resume

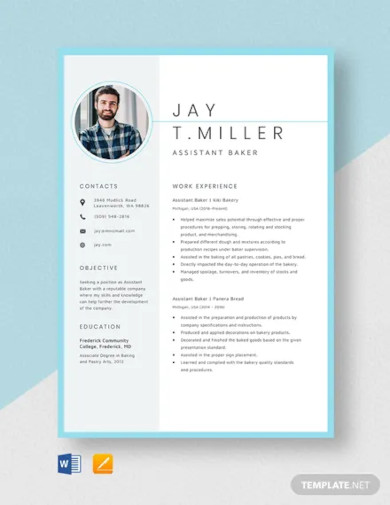

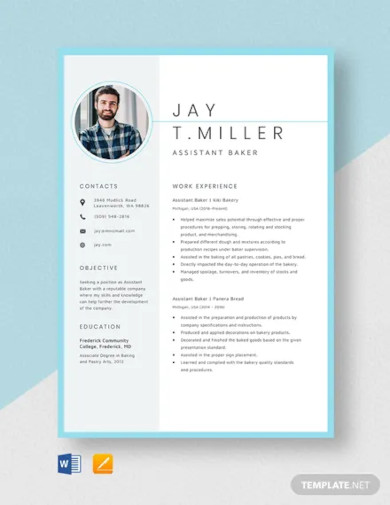

2. Assistant Banker Resume Template

3. Free Banking Resume for Freshers Template

4. Free Banking Resume for Experienced Template

5. Free Professional Banking Resume Template

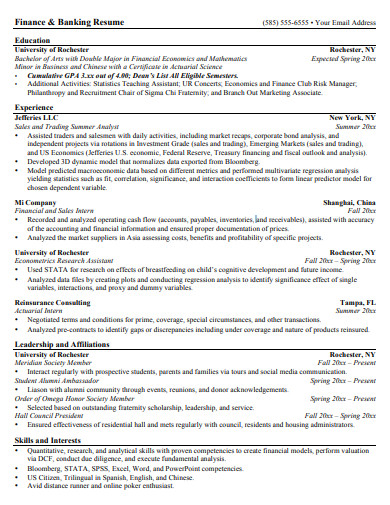

6. Finance & Banking Resume Example

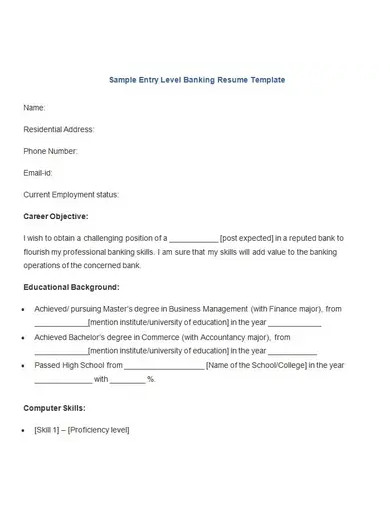

7. Sample Entry Level Banking Resume

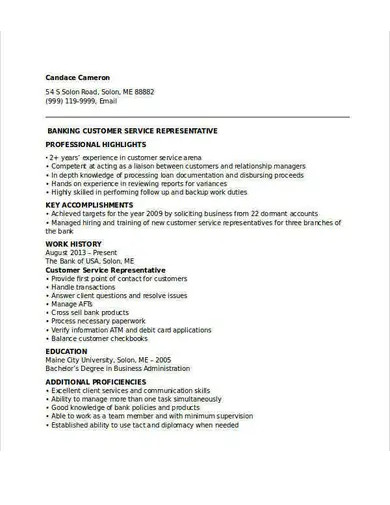

8. Banking Customer Service Retail Resume

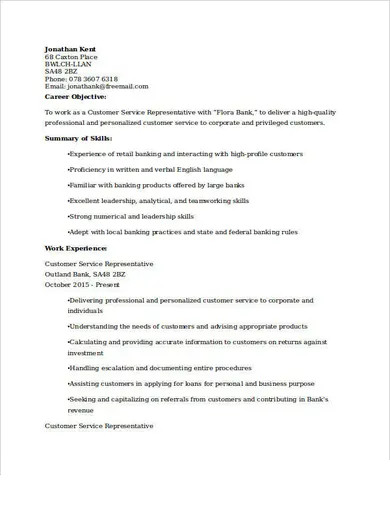

9. Customer Service Representative Resume

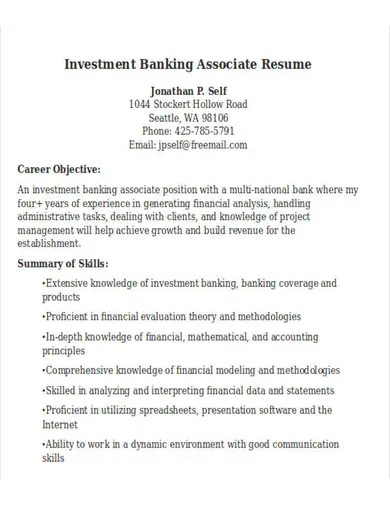

10. Investment Banking Associate Resume

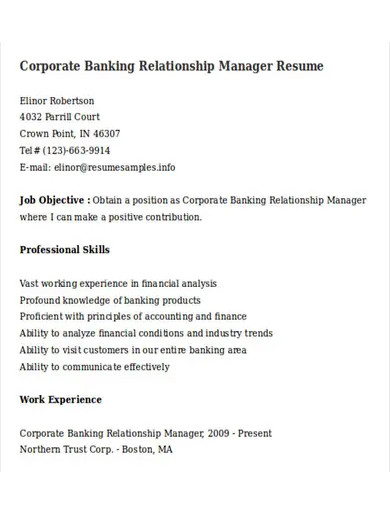

11. Corporate Banking Relationship Manager Resume

What Is a Banking Resume?

To prospective employers, a banking resume highlights your career objectives. Employers examine your resume objective to see how your aims match theirs. A well-written resume will convince them that you’re the most suitable candidate for the job. Since your resume is likely to be one of the first things a recruiting manager reads from your submission, you must write detailed proof to ensure a positive first impression.

How to Write an Outstanding Bank Resume?

When you start looking for jobs, make sure you have a specific target in mind. Think about what sort of job you’d like to do. After that, consider the advantages and disadvantages of each. And imagine how the profession could progress in the long run. Do you want to become a bank teller? If yes, explore the potential of the individual resume section below.

Step 1: Resume Summary

The majority of candidates begin their resumes with a specific segment, such as qualifications or job experience. However, nothing beats a well-written resume description at the top of your resume when it comes to selling yourself. To be transparent, the overview of your profile is your resume. It’s a short resume for those who aren’t sure whether they want to read the rest of it for more details.

Step 2: Work Experience

You certainly have a lot to say about your previous employment. And it’s at this point that formatting comes in handy. It will make it easy for the reader to follow the file. Make sure your job history is well-organized and follows a reverse chronological, with dates. It’s to make it easier for recruiters to see your career path by including the most current and essential stuff at the top.

Step 3: Educational Background

Whether you’re a fresh graduate or it’s been a long time since you graduated, don’t just skim the surface. You can always provide detailed information about your studies. Let your academic accomplishments speak for you by stressing your contribution and hard work.

Step 4: Skills in Banking

Since you’re applying for a banking position, bear in mind that this type of work necessitates is a mix of hard and soft skills. Each work description must contain unique keywords, which need to express in the thesis. Customizing your resume for each place you apply for is a vital aspect of the career hunting process.

Step 5: Certifications

If you’re an experienced practitioner, including any certifications you’ve received throughout your career is a plus. However, if you still find there are holes in your skills, look at online qualifications. With the advent of high-quality online education, earning a solid finance degree can now be a matter within a few months with a little spare time.

Step 6: References

To succeed in the banking business, you must have a high degree of secrecy and confidence. That is why, to succeed in your profession, you must have reliable references. You might ask your past bosses, coworkers, and other business insiders if they’d be able to put in a good word for you with your next employer.

FAQs:

What are the skills you should list on your resume?

There is an essential type of skills to cover on your resume. Some of such includes:

Active Listening

- Communication

- Customer Service

- Computer Skills

- Leadership

- Interpersonal Skills

- Management Skills

How can you write a resume for a bank teller with no experience?

When you have less experience, keep track of your education and relevant extras. Include a list of bank teller skills and financial abilities found in the job. Also, attach additional sections on your bank resume that are relevant to the job.

What’s a good objective for a bank resume?

Obtaining a challenging place in a prestigious company will enable you to expand your education, experience, and skills. Find a responsible job that allows you to put your training and experience to good use while still contributing to the company’s success.

If you are creating your resume, take note of the given information above. Also, feel free to download the banking resume templates available. They are convenient to use. Use them now!

10+ Banking Resume Examples to Download

If you work in banking, you are a trustworthy professional who knows your way through the financial sector. You provide your customers with investment counseling and recommendations. However, when it comes to writing a job-winning resume, you are the one who needs assistance. What exactly does a decent banking resume look like? With thousands of people competing for the top banking jobs, you can not afford to leave any questions unanswered. But don’t be bothered! The banking resume and tips will help you get your foot in the door of a job.

10+ Banking Resume Examples

1. Business Banking Relationship Manager Resume

Details

File Format

MS Word

Pages

Size: A4 & US

2. Assistant Banker Resume Template

Details

File Format

MS Word

Pages

Size: A4 & US

3. Free Banking Resume for Freshers Template

Details

File Format

MS Word

PSD

AI

Publisher

Pages

Indesign

Size: US

4. Free Banking Resume for Experienced Template

Details

File Format

MS Word

AI

Publisher

Pages

Indesign

Size: US

5. Free Professional Banking Resume Template

Details

File Format

MS Word

PSD

AI

Publisher

Pages

Indesign

Size: US

6. Finance & Banking Resume Example

rochester.edu

Details

File Format

PDF

Size: 104 KB

7. Sample Entry Level Banking Resume

brs.com

Details

File Format

MS Word

Size: 10 KB

8. Banking Customer Service Retail Resume

bestsampleresume.com

Details

File Format

MS Word

Size: 6 KB

9. Customer Service Representative Resume

coverlettersandresume.com

Details

File Format

MS Word

Size: 5 KB

10. Investment Banking Associate Resume

bestsampleresume.com

Details

File Format

MS Word

Size: 45 KB

11. Corporate Banking Relationship Manager Resume

resumesamples.info

Details

File Format

MS Word

Size: 44 KB

What Is a Banking Resume?

To prospective employers, a banking resume highlights your career objectives. Employers examine your resume objective to see how your aims match theirs. A well-written resume will convince them that you’re the most suitable candidate for the job. Since your resume is likely to be one of the first things a recruiting manager reads from your submission, you must write detailed proof to ensure a positive first impression.

How to Write an Outstanding Bank Resume?

When you start looking for jobs, make sure you have a specific target in mind. Think about what sort of job you’d like to do. After that, consider the advantages and disadvantages of each. And imagine how the profession could progress in the long run. Do you want to become a bank teller? If yes, explore the potential of the individual resume section below.

Step 1: Resume Summary

The majority of candidates begin their resumes with a specific segment, such as qualifications or job experience. However, nothing beats a well-written resume description at the top of your resume when it comes to selling yourself. To be transparent, the overview of your profile is your resume. It’s a short resume for those who aren’t sure whether they want to read the rest of it for more details.

Step 2: Work Experience

You certainly have a lot to say about your previous employment. And it’s at this point that formatting comes in handy. It will make it easy for the reader to follow the file. Make sure your job history is well-organized and follows a reverse chronological, with dates. It’s to make it easier for recruiters to see your career path by including the most current and essential stuff at the top.

Step 3: Educational Background

Whether you’re a fresh graduate or it’s been a long time since you graduated, don’t just skim the surface. You can always provide detailed information about your studies. Let your academic accomplishments speak for you by stressing your contribution and hard work.

Step 4: Skills in Banking

Since you’re applying for a banking position, bear in mind that this type of work necessitates is a mix of hard and soft skills. Each work description must contain unique keywords, which need to express in the thesis. Customizing your resume for each place you apply for is a vital aspect of the career hunting process.

Step 5: Certifications

If you’re an experienced practitioner, including any certifications you’ve received throughout your career is a plus. However, if you still find there are holes in your skills, look at online qualifications. With the advent of high-quality online education, earning a solid finance degree can now be a matter within a few months with a little spare time.

Step 6: References

To succeed in the banking business, you must have a high degree of secrecy and confidence. That is why, to succeed in your profession, you must have reliable references. You might ask your past bosses, coworkers, and other business insiders if they’d be able to put in a good word for you with your next employer.

FAQs:

What are the skills you should list on your resume?

There is an essential type of skills to cover on your resume. Some of such includes:

Active Listening

Communication

Customer Service

Computer Skills

Leadership

Interpersonal Skills

Management Skills

How can you write a resume for a bank teller with no experience?

When you have less experience, keep track of your education and relevant extras. Include a list of bank teller skills and financial abilities found in the job. Also, attach additional sections on your bank resume that are relevant to the job.

What’s a good objective for a bank resume?

Obtaining a challenging place in a prestigious company will enable you to expand your education, experience, and skills. Find a responsible job that allows you to put your training and experience to good use while still contributing to the company’s success.

If you are creating your resume, take note of the given information above. Also, feel free to download the banking resume templates available. They are convenient to use. Use them now!