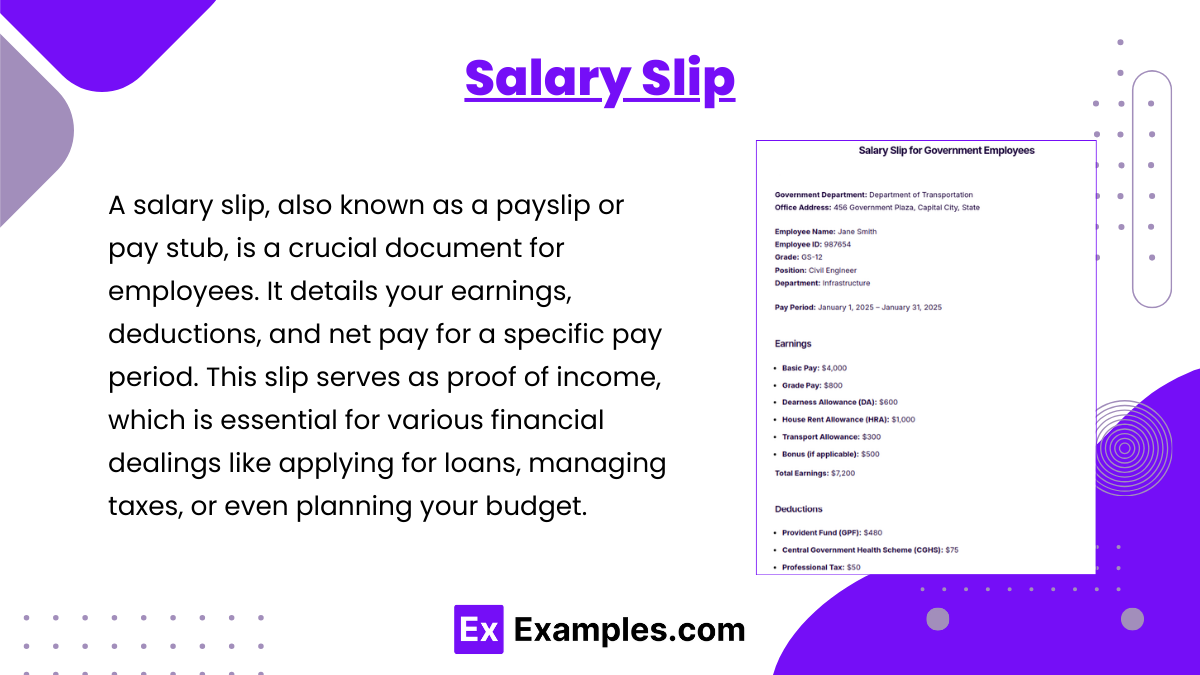

15+ Salary Slip Examples to Download

A salary slip, also known as a payslip or pay stub, is a crucial document for employees. It details your earnings, deductions, and net pay for a specific pay period. This slip serves as proof of income, which is essential for various financial dealings like applying for loans, managing taxes, or even planning your budget. To make things simpler, many employers provide a salary slip template, which helps maintain consistency in documenting the vital information every pay period.

What is Salary Slip?

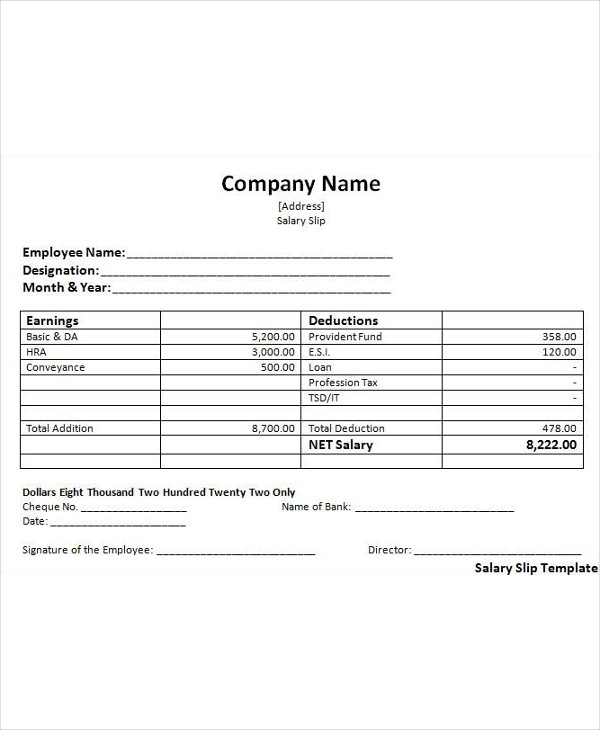

Salary Slip Format

Employee and Employer Details

This section includes the name, employee ID, designation, department, and details of the employer like the company name and address.

Pay Period

The specific period, usually a month, for which the salary is being paid.

Earnings

Details of the gross salary including basic pay, allowances such as house rent, medical, transport, special allowance, and any bonuses or incentives.

Deductions

Lists all deductions like provident fund contributions, professional tax, income tax (TDS), and any other statutory or voluntary deductions.

Net Pay

The total amount received by the employee after all deductions have been subtracted from the gross earnings.

Company Declarations

Often includes additional information like bank account details where the salary is deposited, tax declaration, and employer’s signature.

Salary Slip Example

Company Name: ABC Corporation

Address: 123 Business Rd., Commerce City, CO 80022Employee Name: John Doe

Employee ID: 567890

Position: Marketing Manager

Department: MarketingPay Period: January 1, 2025 – January 31, 2025

Earnings

- Basic Pay: $3,000

- House Rent Allowance (HRA): $900

- Medical Allowance: $300

- Transport Allowance: $200

- Special Allowance: $600

- Bonus: $500

Total Earnings: $5,500

Deductions

- Provident Fund: $360

- Professional Tax: $50

- Income Tax (TDS): $400

- Other Deductions: $90

Total Deductions: $900

Net Pay

Net Amount Payable: $4,600

Bank Details:

Bank Name: First Bank

Account Number: 123456789Signature of Employer: [Signature Space]

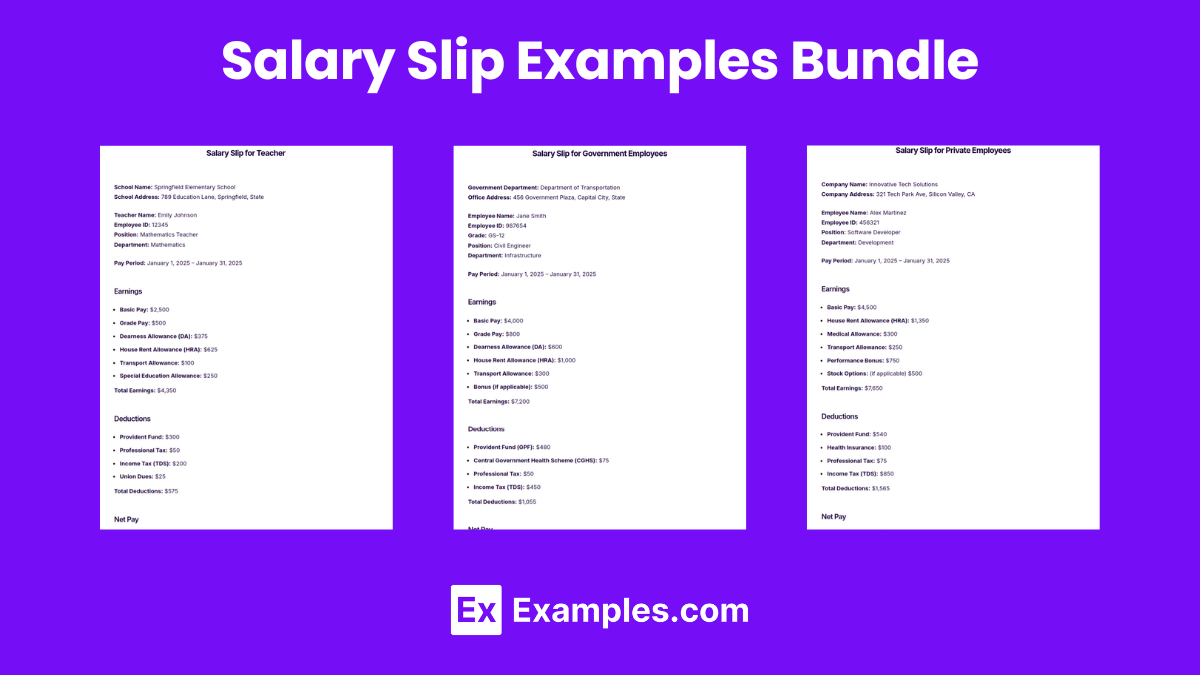

Salary Slip Examples

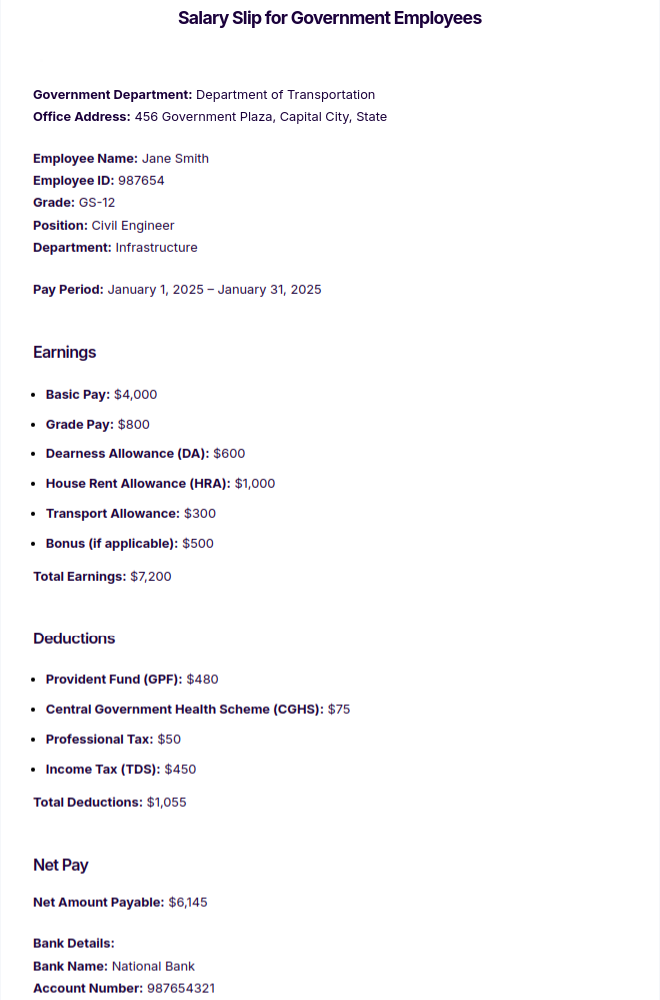

Salary Slip for Government Employees

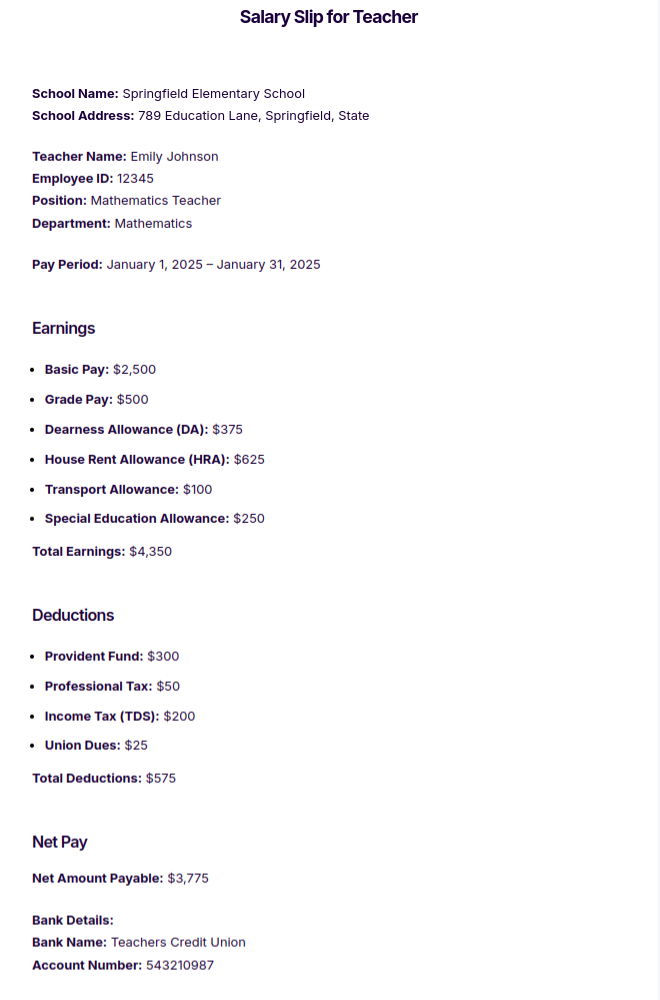

Salary Slip for Teacher

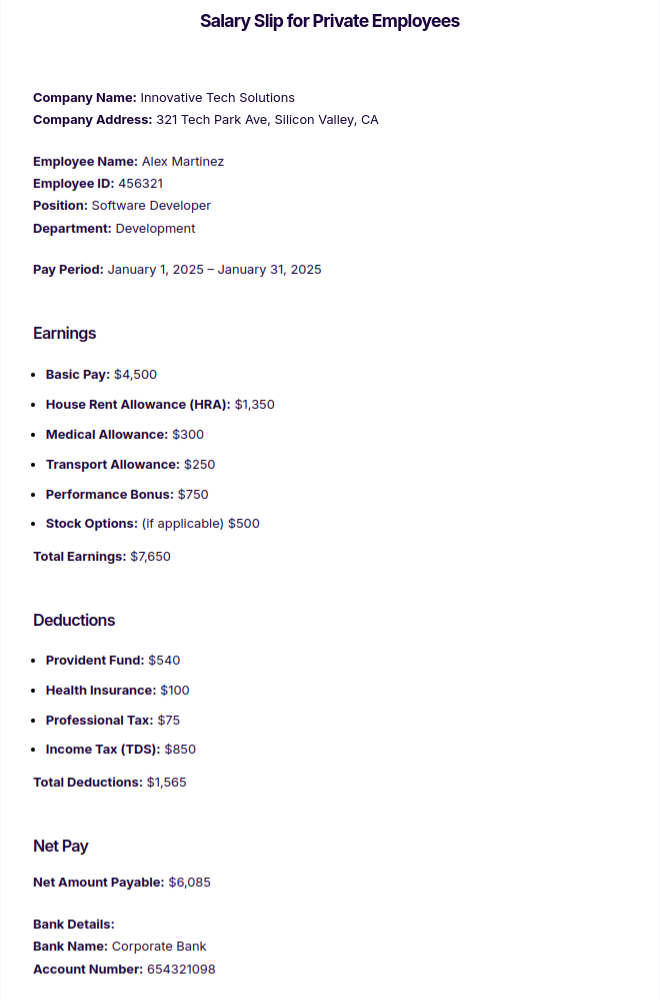

Salary Slip for Private Employees

More Examples on Salary Slip

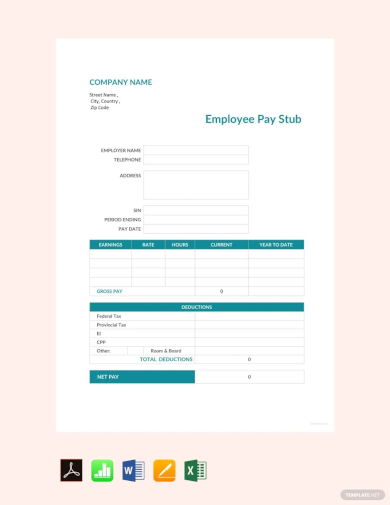

Free Employee Pay Slip Record Template

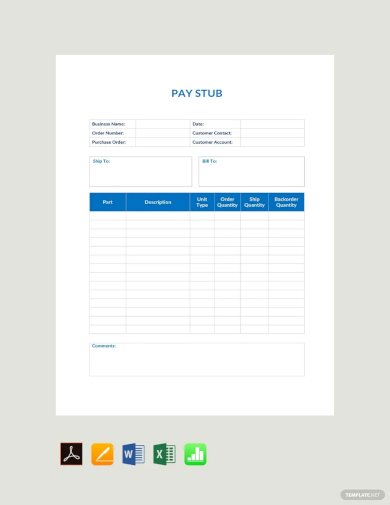

Salary Slip Pay Stub Example

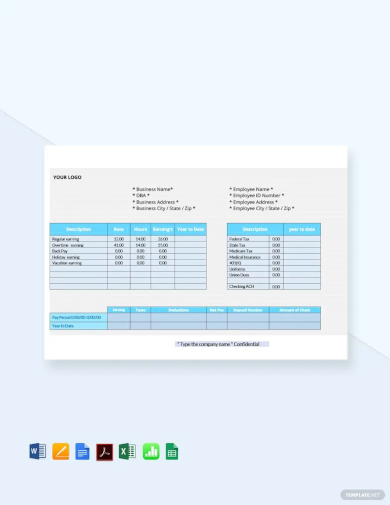

Sample Employee Pay Stub Example

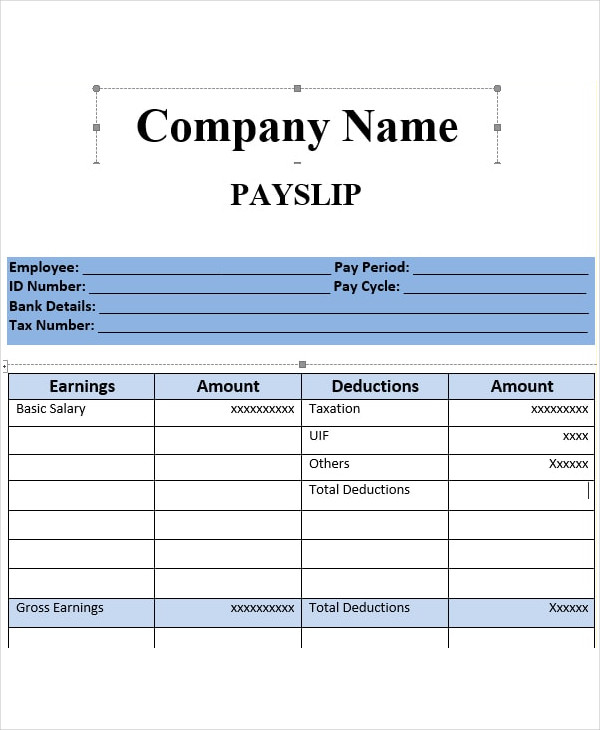

Free Employee Salary Slip Example

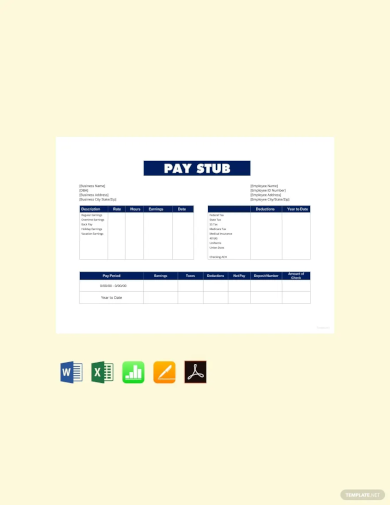

Sample Pay Stub Example

Basic Pay Stub Example

Company Salary Pay Stub Example

Basic Pay Stub Example

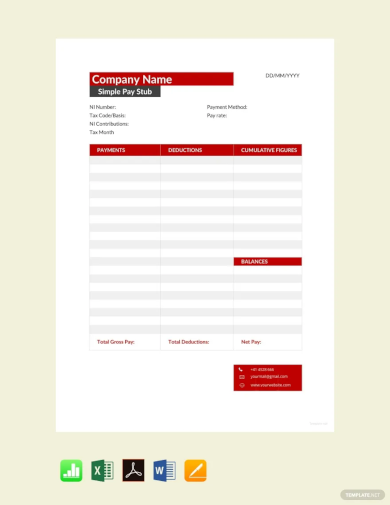

Simple Pay Stub Example

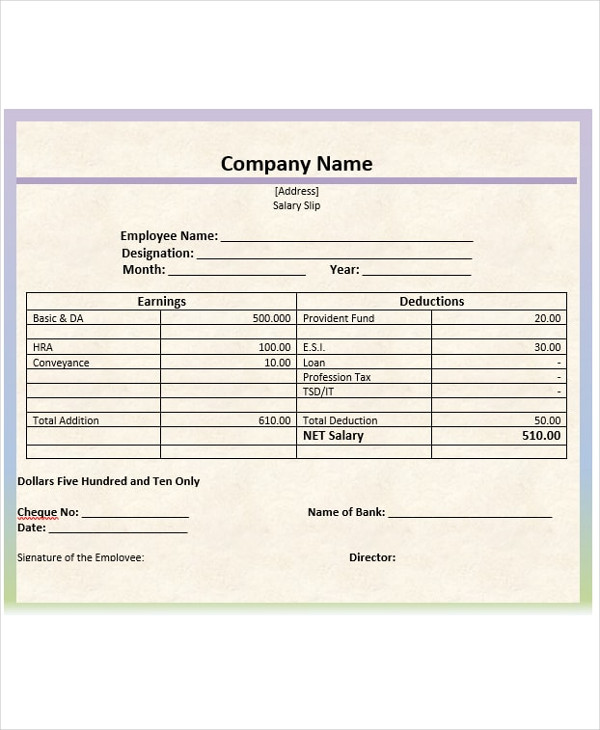

Basic Salary Slip Example

Fully Editable Sample Salary Slip Example

Simple Salary Slip Example

Components of a Salary Slip

- Employee and Employer Details: Includes the name, employee ID, designation, department, and details of the employer like the company name and address.

- Pay Period: The specific time period for which the salary is being paid.

- Gross Salary: The total earnings of the employee before any deductions are made. This includes basic salary, allowances, overtime, bonuses, etc.

- Deductions: All amounts deducted from the gross salary, which may include taxes, provident fund contributions, insurance, and other deductions.

- Net Salary: The actual amount payable to the employee after all deductions have been made.

- Year-to-Date Totals: Cumulative totals of what the employee has earned and what has been deducted over the year.

- Company Contributions: Details any contributions the employer might make on behalf of the employee, such as retirement fund contributions or health insurance.

- Leave Details: Information on the balance and usage of leaves such as annual leave, sick leave, etc.

7 Essential Elements to Include on a Payslip

- Employee Information

Includes the employee’s name, employee ID, designation, department, and sometimes their contact information. - Employer Information

Details about the employer such as company name, address, and tax identification number. - Pay Period

Specifies the time frame for which the salary is being paid (e.g., monthly, bi-weekly). - Gross Salary

The total earnings of the employee before any deductions, including the basic salary, allowances, bonuses, and overtime pay. - Deductions

A breakdown of all deductions made from the gross salary, such as income tax, provident fund, insurance premiums, and loan repayments. - Net Salary

The actual take-home pay after all deductions have been subtracted from the gross salary. - Additional Information

Includes year-to-date totals, leave balances, employer contributions (e.g., to retirement funds), and statutory compliance details.

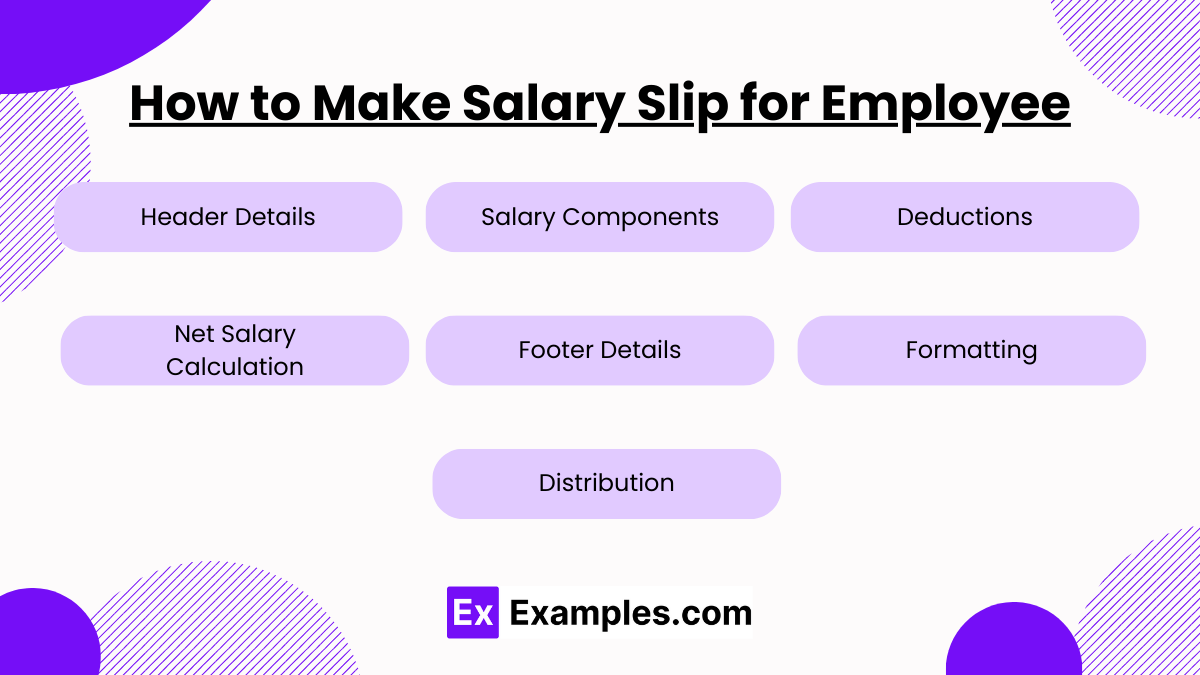

How to Make Salary Slip for Employee

Creating a salary slip for employees involves organizing all essential details regarding earnings, deductions, and other relevant information. Follow these steps:

- Header Details

- Include the company name, logo, and address.

- Add the employee’s name, ID, department, designation, and contact information.

- Specify the pay period (e.g., month and year).

- Salary Components

- Basic Salary: The fixed base pay.

- Allowances: Mention housing, travel, medical, or other applicable allowances.

- Bonuses: Include any additional performance-based earnings.

- Overtime: Add compensation for extra working hours if applicable.

- Deductions

- Income Tax (TDS): Deducted as per tax slabs.

- Provident Fund: Employer and employee contributions for retirement benefits.

- Insurance Premiums: Deduct health or other insurance amounts.

- Loan Repayments: Deduct any loan installments.

- Include any other statutory or company-specific deductions.

- Net Salary Calculation

- Calculate the net salary as:

- Ensure the final amount reflects the employee’s take-home pay.

- Calculate the net salary as:

- Footer Details

- Provide a breakdown of leave balances or year-to-date earnings if required.

- Add any statutory disclaimers or compliance notes.

- Include authorized signatory details or digital approval if necessary.

- Formatting

- Use a structured template in software like MS Excel, Google Sheets, or payroll software.

- Ensure clarity and professional design with all key details well-organized.

- Distribution

- Generate the payslip in PDF format and deliver it securely to the employee via email or through the payroll management system.

Importance of Salary Slips

- Proof of Income

Acts as official evidence of an employee’s earnings, which is essential for loan applications, credit card approvals, and financial transactions. - Legal Compliance

Ensures that employers comply with labor laws and statutory requirements, providing transparency in salary payments and deductions. - Financial Planning

Helps employees track their income, deductions, and savings, enabling better budgeting and financial management. - Tax Filing

Provides a detailed breakdown of taxable income and deductions, simplifying income tax filing and compliance. - Employment Record

Serves as a historical record of salary payments, which can be useful for resolving disputes or for future employment references. - Transparency and Trust

Builds trust between employers and employees by providing a clear breakdown of earnings and deductions. - Leave and Benefits Tracking

Often includes leave balances and details about benefits, helping employees stay informed about their entitlements.

FAQs

What are common components of a salary slip?

Components include basic pay, allowances, deductions, net pay, and employee details.

How can I get my salary slip?

Employers typically distribute salary slips digitally or in print at each pay cycle.

Can I use a salary slip for a loan application?

Yes, salary slips are crucial for validating income during loan applications.

What if there are errors on my salary slip?

Report any discrepancies to your HR department immediately for corrections.

Is a salary slip confidential?

Yes, salary slips are confidential documents and should only be shared with authorized parties like financial institutions or tax authorities.