7+ Contract Payment Schedule Examples to Download

A legal contract details a business arrangement between two parties. For service agreements, like in construction projects, these parties consist of a service provider and consumer. Among the settlements of these bodies have agreed upon is the payment breakdown or payment arrangement. The latter agreement document refers to the participants’ understanding of how the consumer will compensate the general contractor for its services. Moreover, it covers different mode payment, including the advance payment, down payment, installment payment, billing agreement, and more. If you are looking for a construction work contract with a payment schedule, then our set of examples will surely be of great help. Check them out now and discover the different kinds of residential construction and commercial construction payment plans, such as supplier payment and more!

7+ Contract Payment Schedule Examples

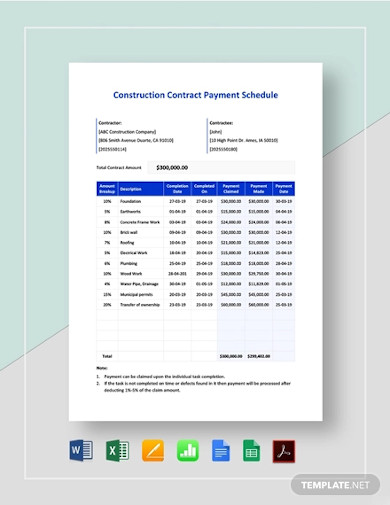

1. Construction Contract Payment Schedule

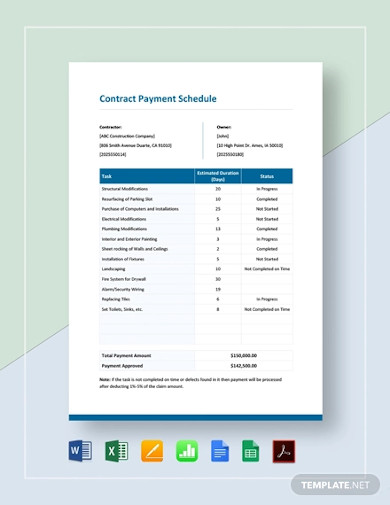

2. Contract Payment Schedule

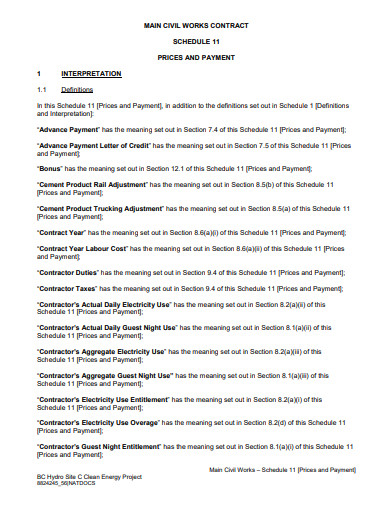

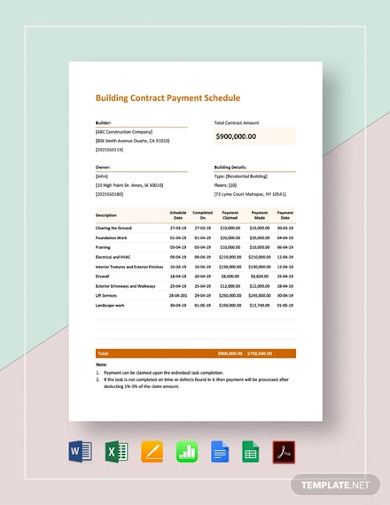

3. Building Contract Payment Schedule

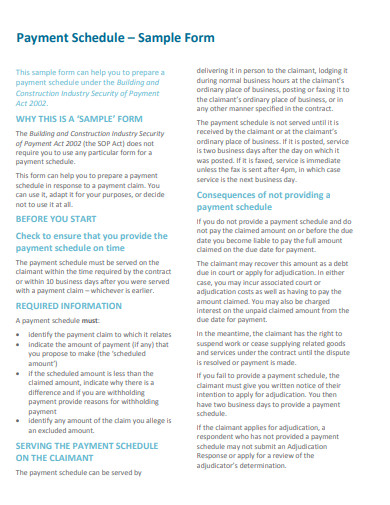

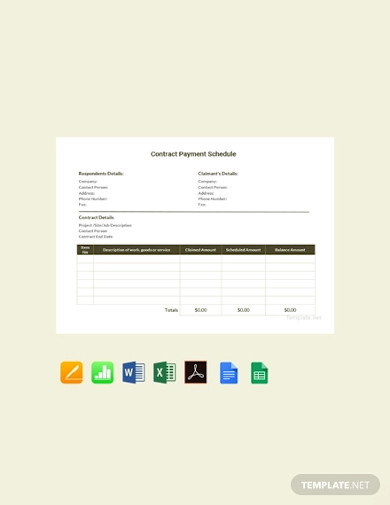

4. Sample Contract Payment Schedule

5. Contract Payment Schedule Example

6. Business Contract Payment Schedule

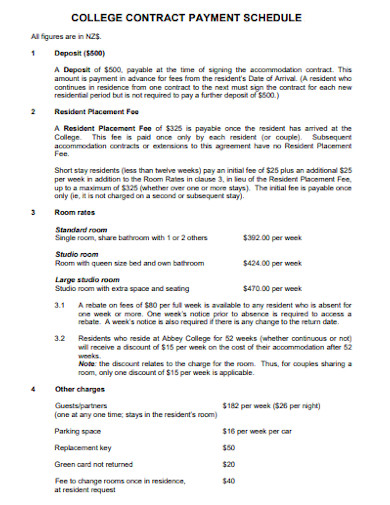

7. College Contract Payment Schedule

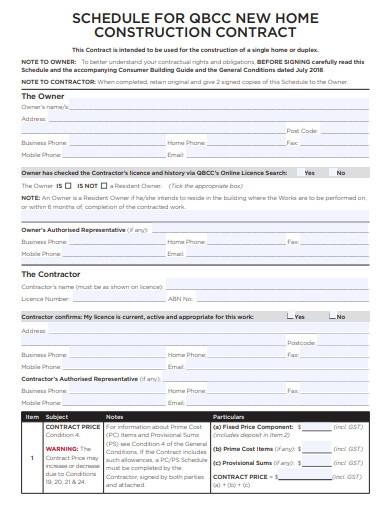

8. Construction Contract Payment Schedule Example

What Is a Contract Payment Schedule?

As the name implies, a contract payment schedule is a timetable concerning payments under the terms of a contract. Amandeep Kahlon stated in his article for the law firm, Bradley, that disputes regarding payments often arise in a business transaction. However, Kahlon added that the party who complies with the payment schedules’ specifications are more likely to secure a favorable outcome, in case of lawsuits happening. Needless to say, the schedule plays an important role in the resolution of any legal arguments. Thus, it should be included in one of the contracts’ clauses or as an adjunct.

Settling Late Payment Problems

Sad to say, many service providers suffer the effects of late payment and non-payment every once in a while. And, we all know how every business, especially a client-based company or an independent professional, heavily relies on the payments set on contracts. Below, you will be given tips on how to professionally deal with all the payment problems.

1. Always include late payment fees in your contract’s terms and conditions.

2. If the payment terms have been violated, don’t hesitate to make legal disputes. But before doing so, make sure to take some time reviewing your signed contract or your organization’s dispute resolution policies.

3. Assuming that you want to keep a healthy business relationship with your client, then a good talk with them regarding your payment concerns would be enough.

4. Create a contract payment schedule. It summarizes all the works you will be performing along with the price list and payment due dates.

How To Create a Contract Payment Schedule

Contract payment schedules or repayment schedules in recurring payment agreements or other payment contracts have to be carefully created. Since it deals with money, a minor mistake has a high chance of imposing legal actions. To walk you through in making your document the right way, you can take heed on our outline below.

1. Provide Participants’ Basic Information

First off, give out the contract participants’ basic information. This should consist of both parties’ names, addresses, and contact numbers. These details help readers verify the contract owners.

2. Enumerate Deliverables

Next is to enumerate all the services that you will be providing to your client. We know that there are a lot of services all over the world, and all of them require contracts before commencing. Good examples of these are lawn service contract, HVAC contract, roofing contract, and commercial cleaning contract. Just a reminder, you have to make all your deliverables relevant to your line of business.

3. Place Payment Amount and Timetable

Now that you have the deliverables listed, you can set both the payment amounts and due dates accordingly. In this way, you will know how much should be received and when you should be receiving it. As for your clients, they will have a clear overview of how much money they will be giving to you, and when it should be given. After all, this is an agreement between two parties for money.

4. Make Space for Payment Status

Payments also require status reports. But instead of complicating things with so many details, you can just insert a little bit of space where you can indicate whether payments are already made or not yet.

5. Set the Total of Figures

Clients may or may not have a busy schedule, leaving service providers unsure whether to take time in explaining the payment schedule or not. To play it safe, you can place the total costs of all the deliverables. Such action is also helpful if you are consequently setting up your repair estimate, roofing estimate, remodeling estimate, or other documents alike.

6. Include Terms and Conditions

As mentioned above, you have to include your stipulations on late payments or non-payments. And, this section where they can perfectly fit.

FAQs:

What is a payment frequency?

Payment frequency describes the interval of a payment for a certain good or deliverable. The different frequencies consist of on-demand, monthly, quarterly, semi-annually, annually, weekly, bi-weekly, and bi-monthly.

What are the different modern modes of payment?

People prefer to have a more secure way of bargaining. This encourages many technology developers to produce advanced machineries that do not only provide the people’s needs but also make them more convenient. In terms of payment, the latest innovations include mobile in-store payment and applications, digital currencies, mobile payment applications, and social media payments.

What does installment payment mean?

Installment is the kind of payment where the total amount of a certain product or service is divided into parts. These parts will be assigned to specific periods that a payer should comply.

A contract payment schedule is necessary for all contracts. It does not only protect your company from any payment complication but also aids your financial risk management and corporate financial management. The aforementioned complications only take form when clients violate payment terms. But, it is certain that they have reasons why they would commit such a breach. On your part, the effective thing that you can do to avoid payment problems is to keep in track with your duties and responsibilities as stated in your contract. Gene Wolfe quoted in his novel entitled Shadow & Claw, “When a gift is deserved, it is not a gift but a payment.” Then again, if things go out of hand, there are always professional resolutions you can turn to.