10+ Income Expense Worksheet Examples to Download

Trying to keep track of your income and expenses is a must if you want to spend your finances effectively. And, as chance will have it, there is a slew of mobile apps and services designed to make this task even more manageable. In fact, you can now conveniently register, review, and pay for any penny you have spent with an expense monitoring spreadsheet. With this help, you can track your personal finances anytime. It can provide you an overview of your finances and keeps track of your main expenditures. But how can you do it?

Here are some of the example about expense and income:

10+ Income & Expense Worksheet Examples

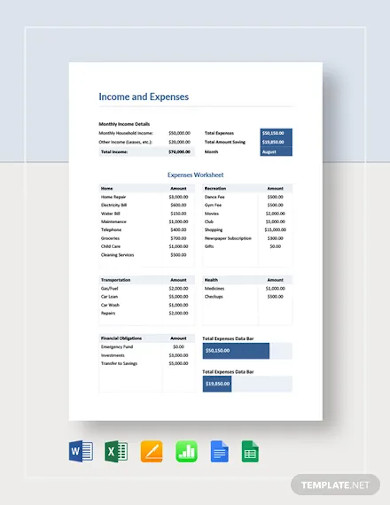

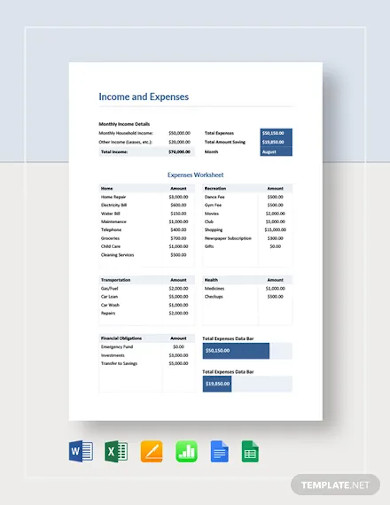

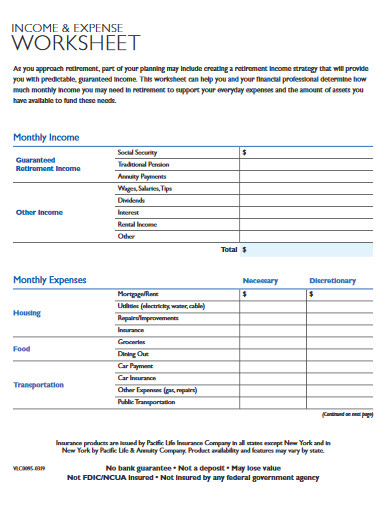

1. Income and Expense Worksheet Template

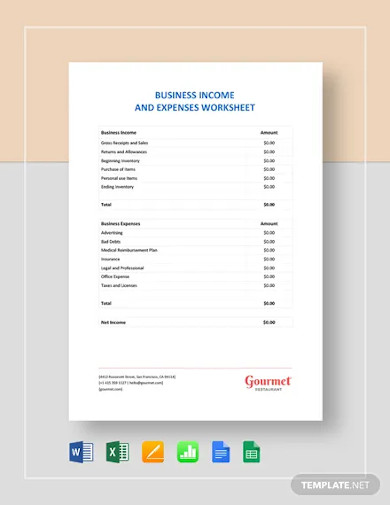

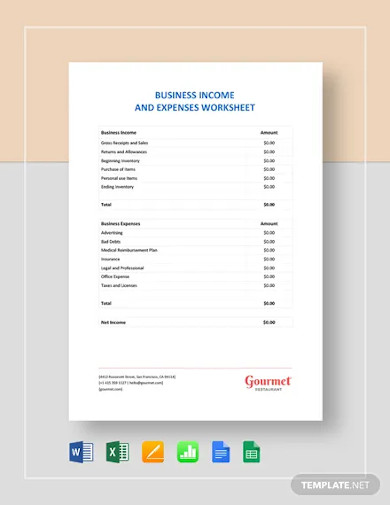

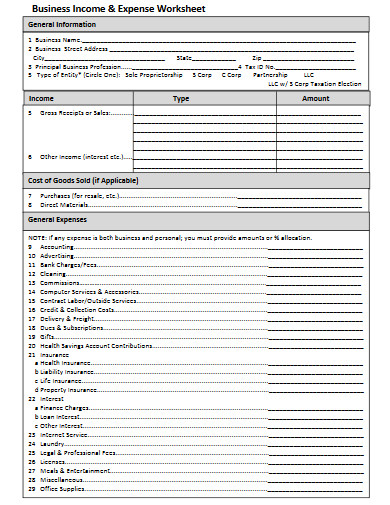

2. Business Income & Expenses Worksheet Template

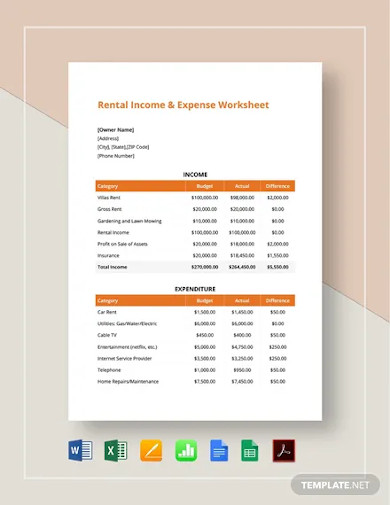

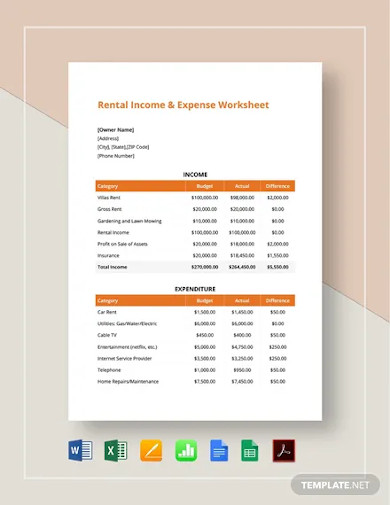

3. Rental Income & Expense Worksheet Template

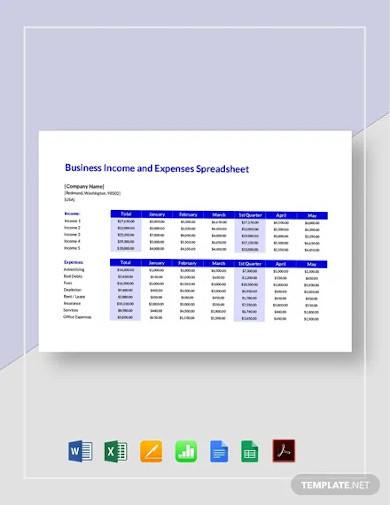

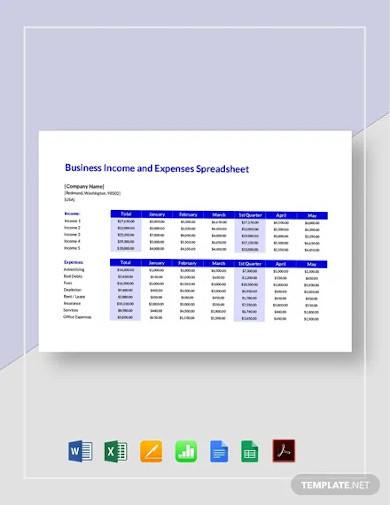

4. Small Business Income and Expenses Spreadsheet Template

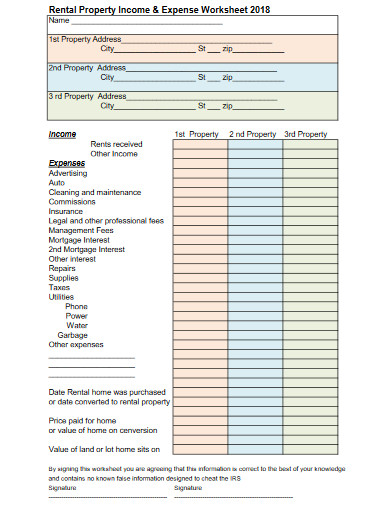

5. Rental Property Income and Expense Worksheet

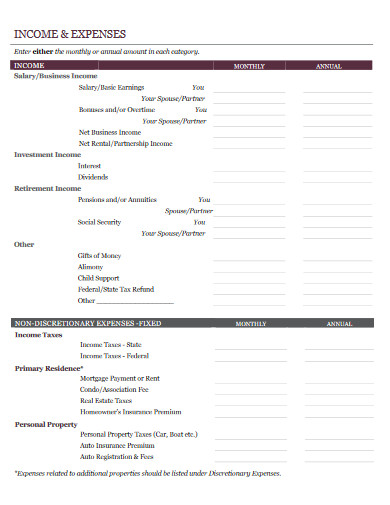

6. Income & Expenses Worksheet Example

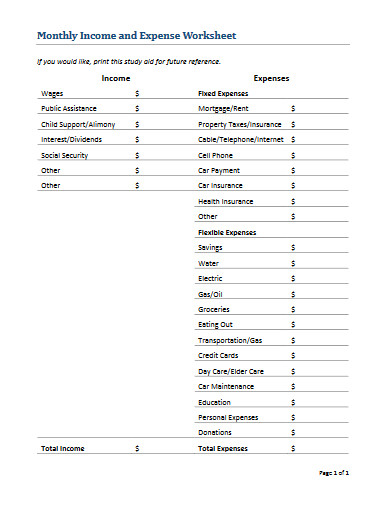

7. Monthly Income and Expense Worksheet

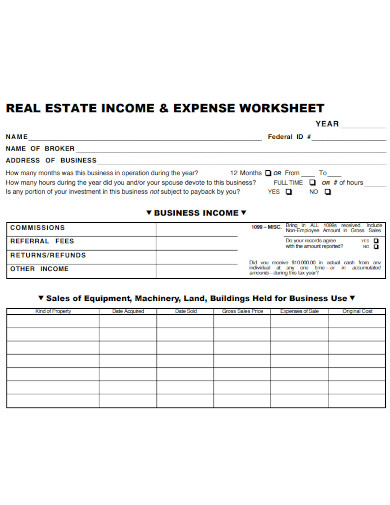

8. Real Estate Income & Expense Worksheet

9. Income and Expense Worksheet in PDF

10. Sample Business Income & Expense Worksheet

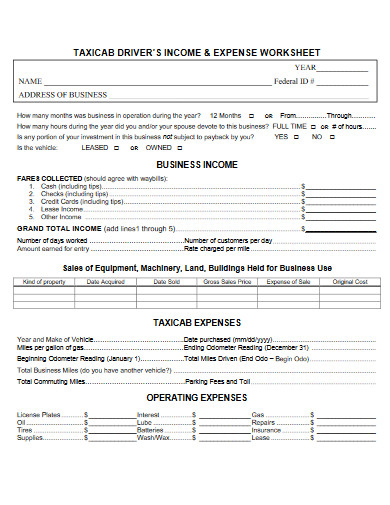

11. Drivers Income and Expense Worksheet

What Is an Income & Expense Worksheet?

An income and expense worksheet is a tool used by people to get a picture of their cash flow. If you don’t have a plan, it’s possible to overspend and overlook vital priorities, such as retirement savings. That’s you should know how to budget. Budgeting can give you a strategy for your money and make better financial decisions.

How To Track Your Income and Expense?

Many people are having problems with how they can budget their income and expense each month. That’s why they lack knowledge on where their money is really going. In this case, you might run the risk of continually establishing unrealistic budgets. And you don’t want that to happen. If you really want to succeed, here are different methods to take before you start:

Step 1: Get Yourself a Pencil and Paper

Don’t ignore the use of old methods. Many individuals are still sticking to a paper budget. Do you want to know why? Apart from not requiring access to computers, the most significant advantage is not needing access to technology. Active brains are remarkably beneficial when you are dealing with money.

Step 2: Try the Envelop System

This system of cost monitoring is a pay cash in-person method. You should set up automatic drafts for items like retirement, mortgage payments, and other utility bills. For additional charges, you should submit or pay with a debit card online. However, you must pay for your costs in cash if you pay them in person.

Step 3: Think About Computer Spreadsheets

It’s time to be serious about digital. Many people are spreadsheet enthusiasts, and they’ll go on and on about the benefits before the end of time. Spreadsheet budgets provide a range of models, the flexibility to tailor the budget, and the ease of getting the math performed for you on the computer. However, the disadvantage to spreadsheets is the time to get your machine to monitor your spending. When you avoid entering costs regularly, your budget is not a budget. It will remain a spreadsheet full of good intentions.

Step 4: Look for Budgeting Applications

Today, there are several budgeting applications available online. The convenience of a budgeting application is a great asset. That’s why you should look for the right tools. It can help you go beyond good intentions into financial victories. Try to check out helpful budgeting apps online now!

FAQs:

How can you keep track of your income and expenses?

If you want to track your income and expenses, there are appropriate steps that you need to follow. It is to make sure that you are sticking to the budget that you created. Always take note of the following.

- Create Your Budget

- Record Your Expenses

- Track Those Amounts

What are the three main budget categories?

Three main budget categories break down your after-tax monthly. These are the needs, wants, and debt, and savings payment. If you are already aware of these, don’t take them for granted. Having such in mind can help you manage the money coming in and out in your pocket.

What’s the purpose of tracking your expenses?

If you practice writing down your budget lines each month, you are not holding yourself responsible for keeping within your budget lines. It is a good idea to have an impression of what and where your money is going. So, maintain realistic budgets and meet your marvelous money goals.

If you want to keep track of how much money you pay every month, the details given above can be incredibly profitable. Spending is natural, but spending beyond your means will lead to financial difficulties. Although you only have a small amount of money in your pocket, you can still save as long as you use them wisely. Get familiar with different resources to get ahead of your budget!

10+ Income Expense Worksheet Examples to Download

Trying to keep track of your income and expenses is a must if you want to spend your finances effectively. And, as chance will have it, there is a slew of mobile apps and services designed to make this task even more manageable. In fact, you can now conveniently register, review, and pay for any penny you have spent with an expense monitoring spreadsheet. With this help, you can track your personal finances anytime. It can provide you an overview of your finances and keeps track of your main expenditures. But how can you do it?

Here are some of the example about expense and income:

10+ Income & Expense Worksheet Examples

1. Income and Expense Worksheet Template

Details

File Format

MS Word

MS excel

Pages

Charts

Google Docs

Google Sheets

Size: A4, US

2. Business Income & Expenses Worksheet Template

Details

File Format

MS Word

MS excel

Pages

Charts

Google Docs

Google Sheets

Size: A4, US

3. Rental Income & Expense Worksheet Template

Details

File Format

MS Word

MS excel

Pages

Charts

Google Docs

Google Sheets

PDF

Size: A4, US

4. Small Business Income and Expenses Spreadsheet Template

Details

File Format

MS Word

MS excel

Pages

Charts

Google Docs

Google Sheets

Size: A4, US

5. Rental Property Income and Expense Worksheet

hamptonfinancialllc.com

Details

File Format

PDF

Size: 7 KB

6. Income & Expenses Worksheet Example

hmpayson.com

Details

File Format

PDF

Size: 462 KB

7. Monthly Income and Expense Worksheet

fdic.gov

Details

File Format

PDF

Size: 71 KB

8. Real Estate Income & Expense Worksheet

1040mpls.com

Details

File Format

PDF

Size: 142 KB

9. Income and Expense Worksheet in PDF

pacificlife.com

Details

File Format

PDF

Size: 519 KB

10. Sample Business Income & Expense Worksheet

crafttax.com

Details

File Format

PDF

Size: 49 KB

11. Drivers Income and Expense Worksheet

taxpol.org

Details

File Format

PDF

Size: 228 KB

What Is an Income & Expense Worksheet?

An income and expense worksheet is a tool used by people to get a picture of their cash flow. If you don’t have a plan, it’s possible to overspend and overlook vital priorities, such as retirement savings. That’s you should know how to budget. Budgeting can give you a strategy for your money and make better financial decisions.

How To Track Your Income and Expense?

Many people are having problems with how they can budget their income and expense each month. That’s why they lack knowledge on where their money is really going. In this case, you might run the risk of continually establishing unrealistic budgets. And you don’t want that to happen. If you really want to succeed, here are different methods to take before you start:

Step 1: Get Yourself a Pencil and Paper

Don’t ignore the use of old methods. Many individuals are still sticking to a paper budget. Do you want to know why? Apart from not requiring access to computers, the most significant advantage is not needing access to technology. Active brains are remarkably beneficial when you are dealing with money.

Step 2: Try the Envelop System

This system of cost monitoring is a pay cash in-person method. You should set up automatic drafts for items like retirement, mortgage payments, and other utility bills. For additional charges, you should submit or pay with a debit card online. However, you must pay for your costs in cash if you pay them in person.

Step 3: Think About Computer Spreadsheets

It’s time to be serious about digital. Many people are spreadsheet enthusiasts, and they’ll go on and on about the benefits before the end of time. Spreadsheet budgets provide a range of models, the flexibility to tailor the budget, and the ease of getting the math performed for you on the computer. However, the disadvantage to spreadsheets is the time to get your machine to monitor your spending. When you avoid entering costs regularly, your budget is not a budget. It will remain a spreadsheet full of good intentions.

Step 4: Look for Budgeting Applications

Today, there are several budgeting applications available online. The convenience of a budgeting application is a great asset. That’s why you should look for the right tools. It can help you go beyond good intentions into financial victories. Try to check out helpful budgeting apps online now!

FAQs:

How can you keep track of your income and expenses?

If you want to track your income and expenses, there are appropriate steps that you need to follow. It is to make sure that you are sticking to the budget that you created. Always take note of the following.

Create Your Budget

Record Your Expenses

Track Those Amounts

What are the three main budget categories?

Three main budget categories break down your after-tax monthly. These are the needs, wants, and debt, and savings payment. If you are already aware of these, don’t take them for granted. Having such in mind can help you manage the money coming in and out in your pocket.

What’s the purpose of tracking your expenses?

If you practice writing down your budget lines each month, you are not holding yourself responsible for keeping within your budget lines. It is a good idea to have an impression of what and where your money is going. So, maintain realistic budgets and meet your marvelous money goals.

If you want to keep track of how much money you pay every month, the details given above can be incredibly profitable. Spending is natural, but spending beyond your means will lead to financial difficulties. Although you only have a small amount of money in your pocket, you can still save as long as you use them wisely. Get familiar with different resources to get ahead of your budget!