10+ Payroll Worksheet Examples to Download

A company that does not pay its employees will sooner or later destroy itself. Why? Well, for one, the workforce is an essential part of any business. Without a strong and well-educated workforce, you can expect that your business won’t be able to reach higher levels. So to help you keep your workforce intact and inspired we have Payroll Worksheet Examples that you can use whenever and wherever. We also included a simple guide to help you create one fast. Check our resources now.

10+ Payroll Worksheet Examples

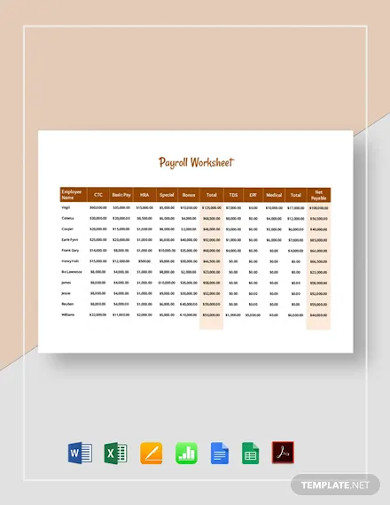

1. Payroll Worksheet Template

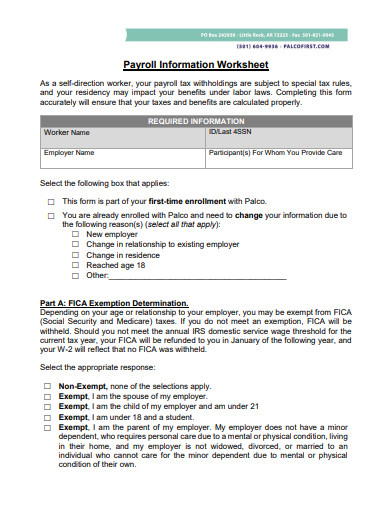

2. Payroll Information Worksheet

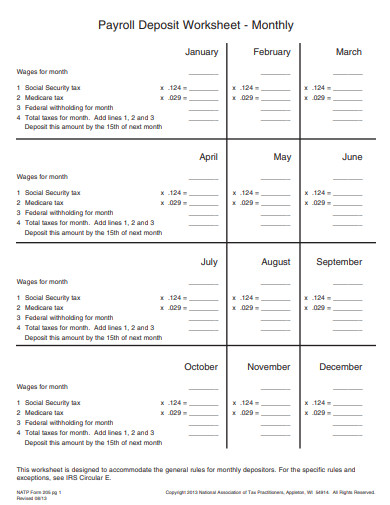

3. Monthly Payroll Deposit Worksheet

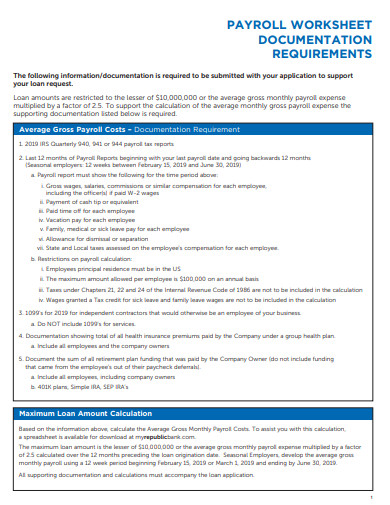

4. Payroll Worksheet Documentation

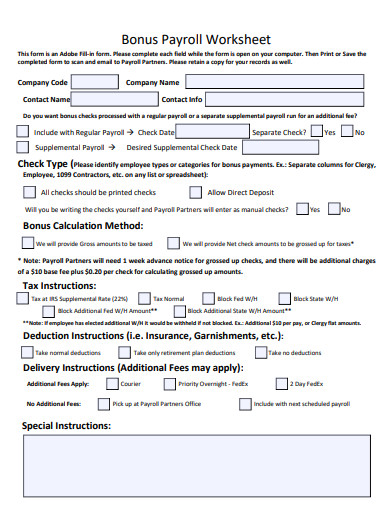

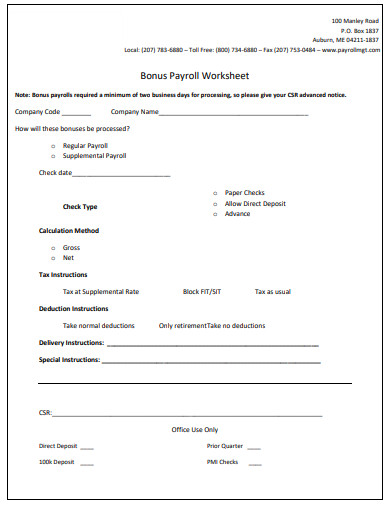

5. Bonus Payroll Worksheet

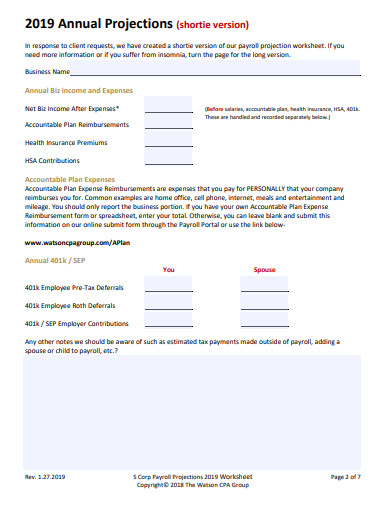

6. Corp Payroll Worksheet

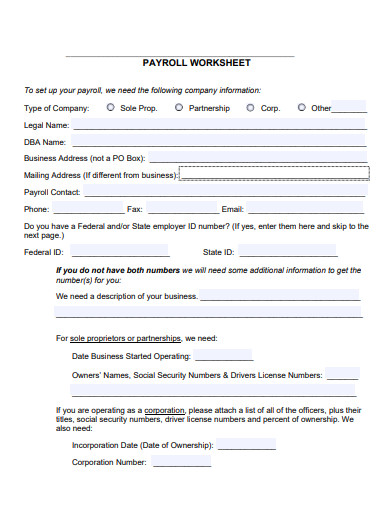

7. Business Services Payroll Worksheet

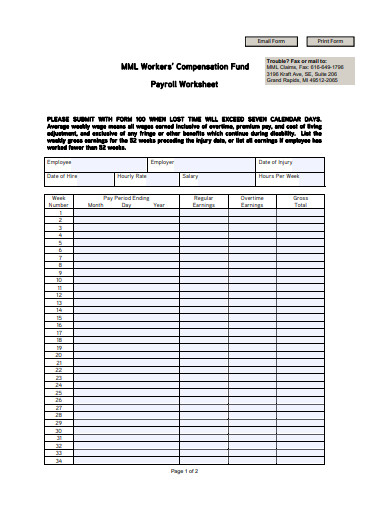

8. Workers Payroll Worksheet

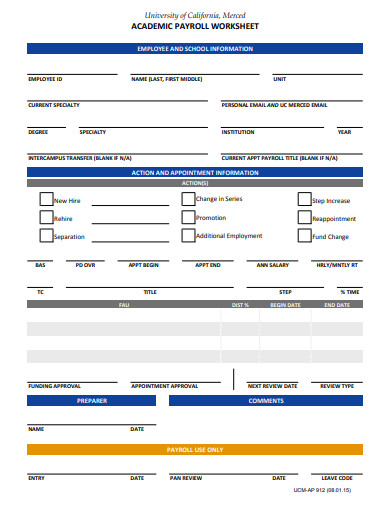

9. Academic Payroll Worksheet

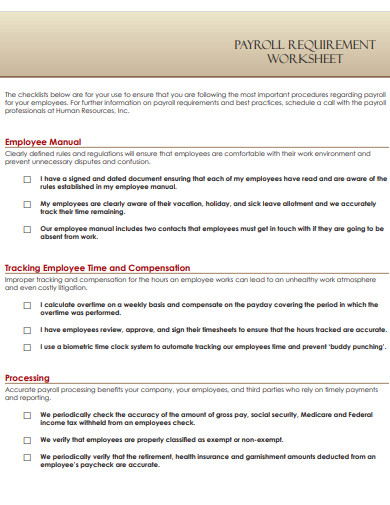

10. Payroll Requirement Worksheet

11. Bonus Payroll Worksheet Example

What is a Payroll Worksheet?

A payroll worksheet is a document that people working in human resources use to gather data about the payroll of the company’s employees. With the use of this document, they can determine the paycheck of each employee and create a corresponding payslip.

How do I manually prepare payroll?

Payroll can be much work especially if you have many employees. However, if you are a startup business with a limited number of employees you can do payroll yourself. Listed below are the steps you can take.

Step 1: Prepare the Forms and Numbers

Before you do payroll, you need to make sure that you have Employer Identification Numbers, and Form W-4s of your business. These are government-mandated requirements so you should gather them.

Step 2: Set a Schedule

Creating a payroll schedule comes next. This is important to ensure that you can pay the tax and other withholdings and can provide your employees with a consistent paycheck or salary release date.

Step 3: Calculate Salary

The next thing you need to do is the bread and butter of payroll which is calculation. You need to do this to ensure that you’re paying your employees right.

Step 4: Pay Taxes

Always remember that taxes are part of the government’s requirements. So make sure that you can pay taxes to the government. Not paying your taxes to your company and your employees may result in a lawsuit, so make sure that you fulfill this requirement.

How to Create a Payroll Worksheet

A worksheet is easy to make. You can even format them in a way that is printable and flexible. However, if you are still adamant about creating one, we’ve listed steps below that you can use to make one. Check them out!

Step 1: Decide on the Format

The format of your worksheet may increase or decrease efficiency, so make sure that you decide on something you can work with easily. Applications such as Microsoft Word are not good for these types of documents.

Step 2: Create a Structure

After determining the proper application to use, you can then create a structure. The more detailed the worksheet, the better, so creating a monthly worksheet with weekly details can be a good choice.

Step 3: Input Formulas

If you are working with Google Sheets or Microsoft Excel, using formulas is a better choice as they help you automate your systems and help you expedite the process. You can also ensure that your formulas complement each other to heighten your budget and help you see your income better.

Step 4: Make it Digital

In today’s world, it is easier to manage a worksheet of various blank fields over a child’s height of papers. That’s why, if possible make sure that you have a soft copy of your document. In this way, you can be flexible and can work on it anywhere you are.

FAQs

What is CTC salary?

A CTC Salary or Cost to Company salary is the gross salary that you can get from the company. This means that this money is the full salary without any deduction and addition. You usually see this in construction and other labor-intensive companies as their main source of income.

What is the purpose of a payroll spreadsheet?

The purpose of a payroll worksheet is to ensure that you or your human resource team can calculate the payroll of your employees in the shortest possible time. Many samples are available on the internet for this type of document.

Is it better to be paid weekly or monthly?

Depending on the amount of salary you are getting, weekly or monthly could be better. However, the advantage of monthly or bi-monthly salary over weekly is that you get to easily pay big bills such as rent, car, etc. Nonetheless, you need adequate budgeting to sustain yourself.

Payroll is necessary to a company as it ensures whether the company can still provide the right quality to the services they offered. It allows hotel personnel to give out their best in making decisions or the construction engineer to guide the people in the right direction. That’s why, if possible provide adequate payroll to your employees as not only do you help your business but you ensure a prosperous venture, as well.