9+ Simple Checkbook Register Examples to Download

Before systems in bookkeeping have been improved thanks to advancement of today’s technology, decades ago, it is hard to keep an updated record of your checkbook balance. Since there was no online account history to check, it is likely to happen that an owner of the account may spend more money than the amount he or she had in his or her account. You may also see risk register examples.

In order to prevent this to happen, the owner must document every transaction in the checkbook register to keep an accurate running balance. The bank may give you a bank statement every month which you can use to double-check your work in your checkbook register.

As of today, almost every transaction is done electronically; hence, more and more people rely on the computation of electronic transactions. However, there is no harm in balancing your checkbook nowadays; instead, this may help you be aware in your financial transactions. You may also like baby registry checklist examples.

Provided in the next section are some checkbook registers that you might find useful in balancing your accounts. Additionally, other registers can be found in the links below:

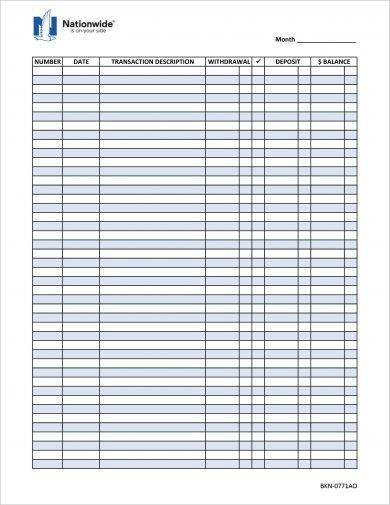

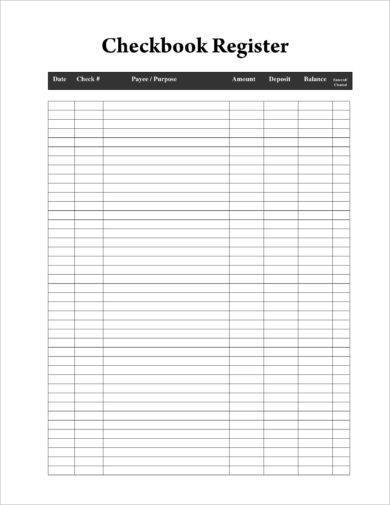

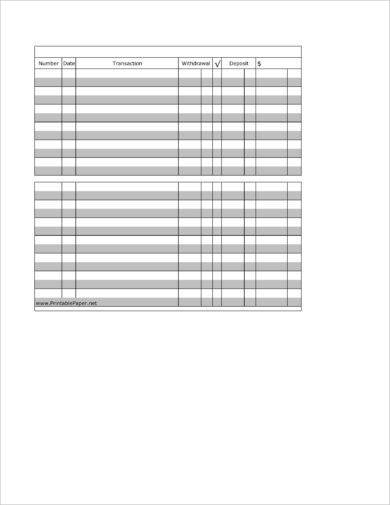

Basic Checkbook Register Example

Blank Checkbook Register Example

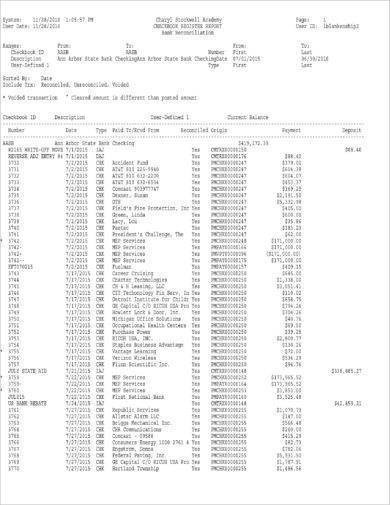

Charyl Stockwell Academy Checkbook Register Example

Reasons to Balance Your Checkbook

In today’s era where electronic transactions have been primarily used and preferred by most people because of its convenience, there are still many people who prefer to have their own checkbook register and keep them balanced as as they are doing transactions. You may also see printable attendance sheet examples.

Keeping a record on your checkbook can help you verify the transactions you have made. It is not enough that you rely on the other party recording the transaction; it is better to have your own computations in case of issues and disputes. You must be well aware of the movement of your money by constantly updating the records in your checkbook. You may also like material list examples.

No matter how huge the amount in your account is, there are still a number of reasons why you should balance your checkbook, and these are as follows:

1. To match your book balance to the bank balance

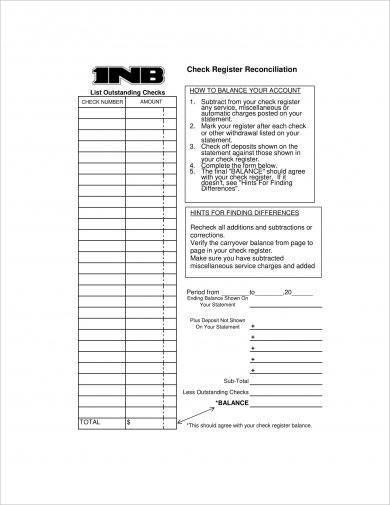

One of the biggest reasons that you must balance your checkbook is to match that balance to the bank balance. You must see to it that the end figure of your balances must be equal to each other. There are some transactions that you do not have knowledge beforehand because the bank is transacting in your behalf. You may also see list templates and examples.

On the other hand, there are also transactions that are not reflected on the records of the bank. To have a reconciliation on the differences on your book and bank balance, a bank reconciliation is usually performed. There are many ways on how you can reconcile your book and bank balance, and the commonly used methods are the bank to book reconciliation, book to bank reconciliation, and adjusted balance reconciliation. You may also like wedding guest list examples.

However, to arrive at the correct adjusted amount, the adjusted balance reconciliation method is used. In this method, the bank balance is adjusted by the deposits in transit, outstanding checks, and errors made by the bank to arrive at the adjusted balance. You may also check out contact list examples.

On the other hand, the book balance is adjusted by credit memos, fees and charges by the bank not entered into the checkbook register by the book, as well as errors made by the book in order to arrive at the adjusted balance.

Hence, it is important that you are recording your transactions in your checkbook so you will have something to check and compare to with the bank records.

2. To avoid overdraft and overdraft fees

Maintaining an updated checkbook register means that you are aware of the current balance in your account. You know how much is left in your savings or checking account as well as the amount that you are allowed to withdraw. Thus, you can avoid overdraft because you are up to date with the current balance of your account. Overdraft occurs when the balance of your account is below zero. You may also see birthday list examples.

Many banks would charge an overdraft fee and interests if this may happen. The account is said to be overdrawn, and if the negative balance exceeds the agreed terms, additional fees may be charged. However, with the help of your updated checkbook register, you can prevent this to happen. You may also like list templates in word.

3. For an easy problem-solving

There are times when a conflict or issue will arise as regards your banking transactions. When this happens, sometimes, you do not have a clue on where to start your investigation most especially if you did not balance your checkbook recently. You may also check out class list examples.

You may have a hard time knowing what went wrong in the transaction. But for those who make an effort to constantly recognize their checkbook registers, they can easily spot the error. They can simply look and check at their transaction for the months to determine the discrepancy and the cause for such issue or conflict of the balance. You might be interested in grocery list examples.

4. To verify charges by the bank

There is no question with regard to the honesty of the institutions that you are dealing transactions with. However, human as we are and since people, innately, can make mistakes, those entities may commit errors in their computations too, especially regarding the charges and fees that they have employed in your account. You may also see address list examples.

Through balancing your account in your checkbook, you can verify if the amount that the other party has charged to your account for the product or service that you availed is correct and is the same as what you have computed in your checkbook register.

5. To identify fraudulent transactions

Online transactions using debit and credit cards have been widely used today because it is convenient as you do not need to go physically to the store where you want to purchase a product or avail a service.

In cases where you need to enter your card account number, security code, and other important numbers concerning your account, there are also increased risks that someone may hack your account or steal your identity, and this is something that you must be aware of. Hence, to constantly check if your account is still secure and to identify fraudulent transactions, spend a little time in balancing your checkbook. You may also like punch list examples.

6. It can help with budgeting

When you are keeping a close eye on the transactions with regards to your account and the balance of your account, you have the greater insights on how to budget your money. It can help you control the cash flow of your account, minimize expenses, or set aside enough funds for something that you think you would be purchasing or funding in the future. You may also see packing list examples.

Through constant balancing of your checkbook, you can also have the time to analyze the flow of your income and expenses as well as your tax payments.

Checkbook Register Reconciliation Sheet Example

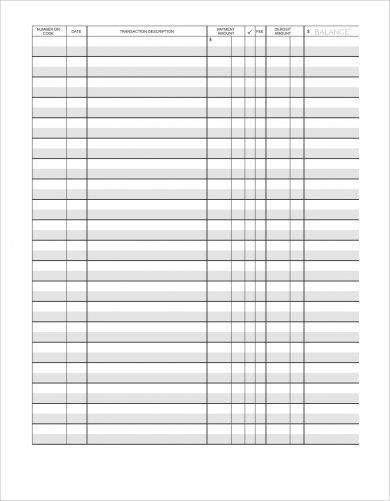

Formal Checkbook Register Example

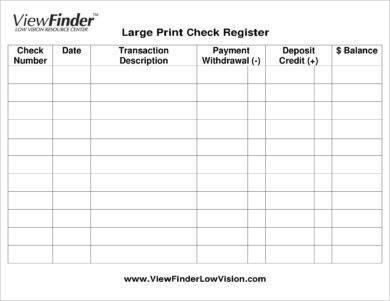

Large Print Checkbook Register Example

Ways to Make Balancing Your Checkbook Easier

Now that you have known the importance and reasons to balance your checkbook, you might be very eager to do balancing in your checkbook yourself.

While some people have enough knowledge on how to compute their balances in their checkbook, there are others who find it hard to compute and balance their accounts due to the hassle nature of the transactions of your account. Some may fail to record the transactions that the bank have made on your behalf, while others forget about the fees and charges. You may also see attendance list examples.

In order to account all those transactions involving your account, you must know the transactions that concern your account. Moreover, you can follow these ways on how to make the balancing of your checkbook easier.

1. Constantly update your checkbook register

For you to easily check the current balance in your account, make sure that your checkbook register is up to date, you have included your deposits, online purchases, withdrawals, and other transactions affecting your checkbook. Make sure that they are recorded accurately and in a timely manner. You may also like rooming list examples.

In this way, you will know more than anyone else, even the bank, of the current financial status of your account. If you have written checks, ensure to make a duplicate record so that you can verify later that the amount that is deducted from your account by the bank is correct and is the same as your records. You may also check out vendor list examples.

2. Keep track of automatic bill payments and direct deposits

You must also keep track of automatic bill payments, direct deposits, and other transactions that may be affecting the current balance of your account.

Automatic bill payments are those money transfer that are scheduled on a predetermined date. This money transfer is used to pay a recurring bill made from a banking, brokerage, or mutual fund. In this case of transaction, you must remember to include them in your checkbook register for this is among the transactions that are usually overlooked because of its recurring and automatic nature. You might be interested in bucket list templates & examples.

3. Take advantage in automatic checking account

Nowadays, many banks offer alerts that will send automatic checking account to your number, alerting you if there are possible problems with your account.

Never disregard these alerts for this will not only prompt you of the problems and issues as regards your account but also help you update your checkbook register in case there are transactions that you missed or failed to record. Take time in checking them because they can help greatly if you want to stay updated with your account. You may also see inventory list examples.

4. Consider online banking

It is indeed convenient and less hassle to review your bank statement online. In general, online banking is more convenient and less expensive, and in this way, you can easily compare your personal records to that of the records made by the other party you are transacting with.

The above are just few of the ways on how to make your balancing of your checkbook easier. You may come up with other ways, but the above are the typical ones that are used by most individuals and entities to easily compute their account balance and compare it to their banks. You may also like medication list examples.

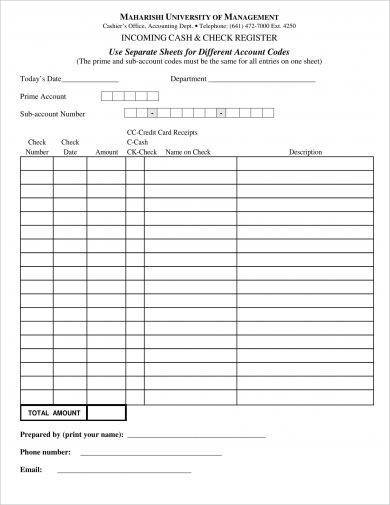

Maharishi University Checkbook Register Example

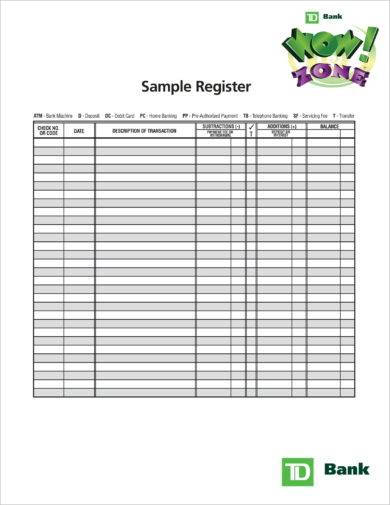

Minimalist Checkbook Register Example

Printable Checkbook Register Example

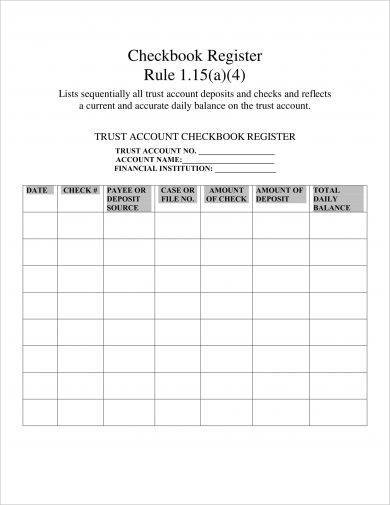

Trust Account Checkbook Register Example

Sum Up

Although most transactions today are done through electronic transactions, having an updated checkbook register can still help you in a lot of ways. If you want to personally check the movement of your accounts, you can plot your transactions in your checkbook and compare them in your bank records. You may also see price list templates and examples.

Additionally, it has been stated above that there are a lot of reasons to use a checkbook register even with the advancement of technology in terms of tracking your transactions and there are a lot of instances where a checkbook register is important, and these are as follows: they are used to match your book balance to your bank balance, to avoid overdraft and overdraft fees, for an easy problem-solving, to verify charges by the bank, to identity fraudulent transaction, and lastly, it can help with budgeting.

Although many people find checkbook register to be useful and easy to compute and balance, others find it hard to balance their checkbook registers.

In order to do so, the previous section presented the ways on how to make the balancing of your checkbooks easier. They are as follows: constantly update your checkbook register, keep track of automatic bill payments and direct deposits, be alert in automatic checking account, and consider online banking. These things can surely help you organize and be accurate in your checkbook register. You may also like management skills list and examples.

On a final note, if you need a checkbook register, feel free to browse through the examples presented above for some simple checkbook registers.