15+ Investment Agreement Examples to Download

Businesses need alliances. The quest for entrepreneurial success requires the power of not one but a group of people who are willing to contribute their part. This is why the industry’s biggest names rely on partnerships and business investments. Getting inventors to sign your investment agreement is a huge deal. Not only will their funding help you to expand further and pursue more projects, but investors also help you make significant decisions. Their stand will help you open up to other options that ultimately hold the best for the company. Your business might flourish with only your pair of sturdy hands, but with reliable investors, it will grow into massive heights.

15+ Simple Investment Agreement Examples

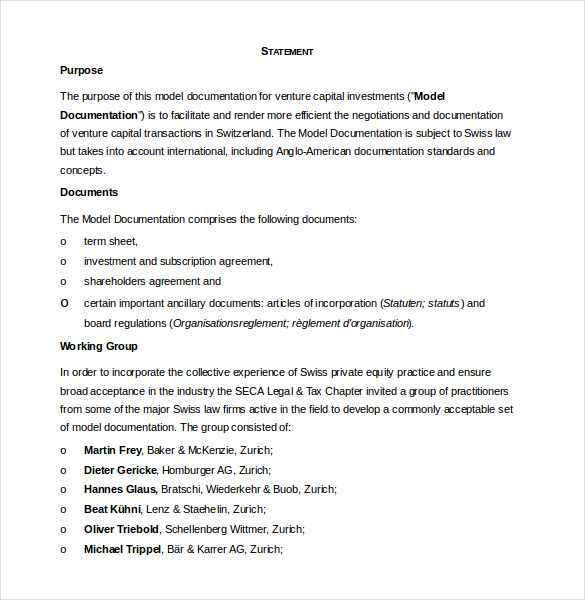

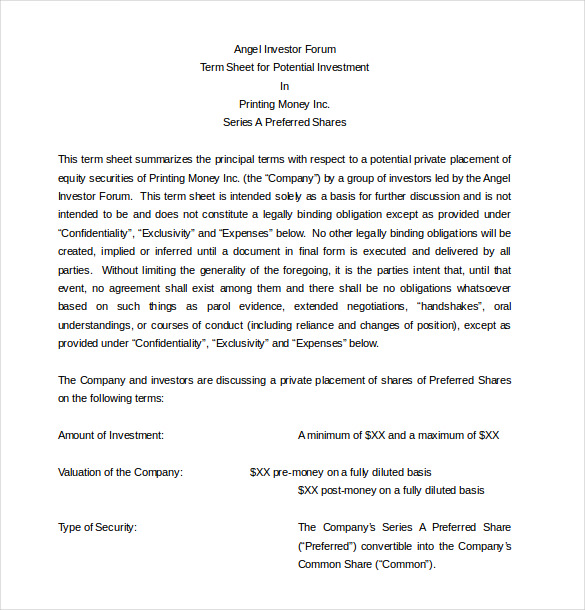

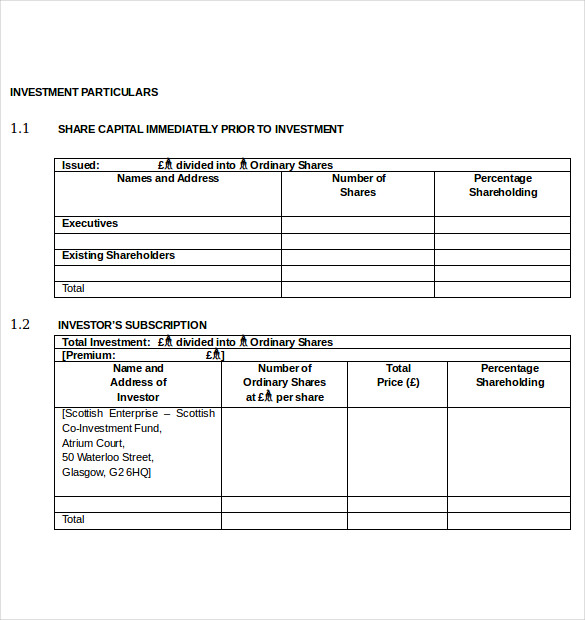

Investment Agreement Example

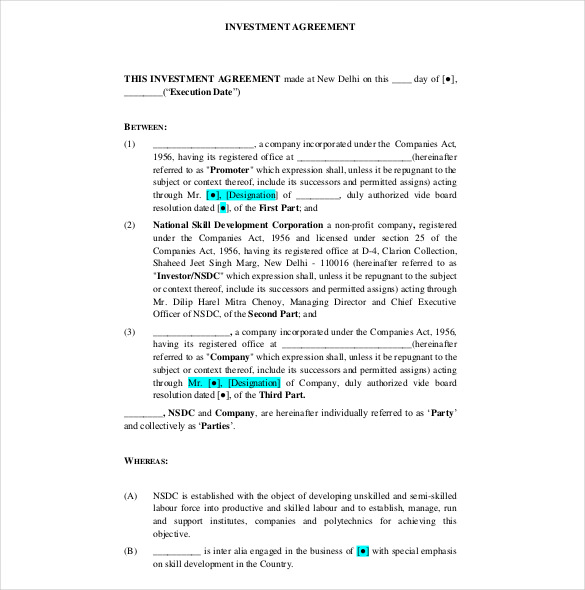

Business Investment Agreement Example

Investment Banking Agreement Example

Restaurant Investment Agreement Example

Investment Contract Agreement Template

Business Investment Agreement Template Example

Capital Investment Agreement Example

Equity Investment Agreement Example

Investment Agreement between Two Parties

Investment Agreement Letter Example

Investment Agreement Template Example

Investment Management Agreement Example

Investment Management Certificate Example

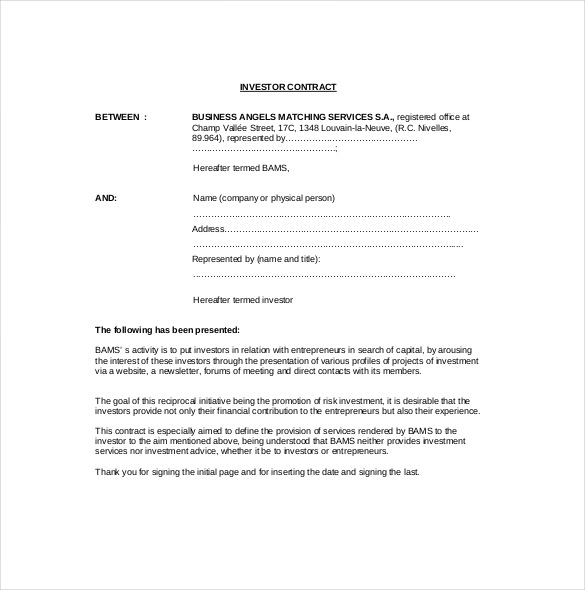

Investor Contract Agreement Template Example

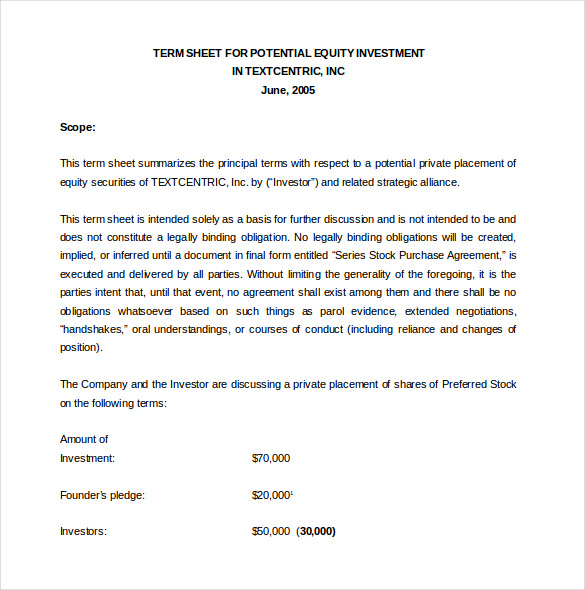

Potential Equity Investment Agreement Example

Small Business Investment Agreement Example

What Is an Investment Agreement?

An investment agreement is essentially a contract that states the duties and obligations all parties involved have on their investment. The agreement provides comprehensive terms of their investment, including payment methods and deliverables, as stipulated on the document. And because it is legally binding, it helps protect both the interest of the business and its investors from future complications.

How to Make a Simple Investment Agreement

While the term “investment” may denote a picture of large-scale businesses and the uproar of stock markets, it’s also a popular norm among small businesses. According to The Balance, an investment in small businesses is profitable because it is developing. It can be an opportunity to grow your money on a self-employed owner’s business steadily. When the brand proves to be a success, you can offer to buy the name and invite more investors until it expands further.

To help draw your investment terms more clearly, here are some ways to make a simple investment agreement:

1. Decide on Your Terms

The highlight of every basic agreement is its terms. It’s a set of responsibilities and limitation that every party involved in the papers are expected to perform at the duration of their investment. This also includes a detailed account of the agreement’s basic information. These are the names of every participating party, the dates (it may be a small detail, but it’s necessary), and the purpose of the investment. This should also determine what investment structure you’re going to follow and what the investors are going to bring to the table. While the most common investments involve monetary support, some could also be tangible assets.

2. Specify Investor Rights to Management

Your partnership agreement should have a description of whether or not the investor has a right to manage a business venture. In small-scale operations or small to medium enterprises (SME), an investor may be able to have certain managing tasks over daily operations and contribute to the decision-making process with the owner. On the other hand, large companies may allow their investors to cast their votes on significant brand deals, project plans, and business decisions. This means that they have a say on major business matters, such as choosing the best candidate for an executive position. Your investor agreement should include details on these matters so your investors can have an idea of what role he or she will play in the company.

3. Include the ROI

The return of investment (ROI) is a critical issue for every investor and will be among the first things they will promptly review on your joint agreement. State how and when the investors can expect an ROI from your business. This largely depends on the kind of investment they’re putting in your company’s hands. If it’s an equity investment agreement, their return depends on the portion their investment is going to cover. So if they’re placing $500,000 under their name on a $5,000,000,000 business, they’ll get 10% of the company. If it’s a debt security investment, the investors’ return will depend on the overall revenue, not on the profits. An equity investor gets his share when the business is actively gaining profits while a debt security investor gets his return even if the business is not making any sale. The distinction should be clear on your agreement and make sure that your terms fit the kind of investment you’re offering.

4. Highlight a Liquidation Clause

A liquidation clause indicates the investors’ payment in case the business files for bankruptcy. If it’s an equity investment, the investors can expect to get their share based on their owned percentage in the company. If an investor owns 20%, he or she will get 20% of the remaining after the credit receipts and are paid off. This is not the not liquidation clause process there is. There are other varieties that you should discuss when you begin to draft your agreement. Your equity clause should include all the details regarding this matter because this is an essential subject for any investor. It’s an exit assurance that will put them at ease when they decide to be a part of your company.

FAQ’s

Are shareholder and an investor the same?

They can be similar, but they are not the same. An investor is anyone who puts in money for a business or a venture with the aim of gaining profits. Meanwhile, a shareholder buys a share or ownership interest of a corporation through a public or private company.

What is a penny stock?

A penny stock is a small business stock that you can trade for a meager price. You can typically sell penny stock for less than $5 per share.

What are the different types of agreement?

There are numerous types of agreement in the business sphere. The most common types are partnership agreement, grant, memorandum of understanding, non-disclosure agreement, indemnity agreement, and material transfer agreement.

Investments are a great way to pursue your business aspirations with an increase in your operation’s funds. It also offers you the help of investors who can provide you with beneficial insights on challenging decision-making moments. This ensures that you don’t only have supporters, but you also have people who believe in your business goal’s success. If you’re on the lookout for the best investment agreement that you can use, take a look at our collection and download now!