10+ Sinking Funds Examples to Download

The sinking fund is a term used in business practices that refers to mean the money or revenues that are kept aside to pay the debt or bonds. Companies issue debt or bonds for their operations that need to be paid back when the maturity ends. Keeping the sinking funds aside helps in paying the lenders properly in worse situations when you might not afford it.

What are the Different Types of Sinking Fund?

Sometimes bonds are issued with a sinking fund feature attached with it, certain bond identifies the dates before the dates that the issuer might redeem the bond using sinking fund. Sinking funds can also be used sometimes to repurchase shares of outstanding bonds. The following are the ways and types of sinking funds can be operated in.

- The firm may make the decision of repurchasing or redeeming the outstanding bonds in the open market every year.

- The firm can repurchase some shares of outstanding bonds at a special price that needs to be attached to the sinking funds.

- The firms make such purchase decision whichever they get at the lower cost between the market price or the sinking fund price. The bonds are not given at a selective system to the buyers but at a random serial number basis. But the firm is limited to only repurchase the limited shares of the bonds at the sinking fund price.

- There is one more provision that is periodic payments to the trustee. The payments which have been invested can be used for retirement while at the maturity. Doing so can build a fund that may help to pay the debts on a future date.

What are the Advantages and Disadvantages of the Sinking Fund?

Advantages

1. Proper communication from any company or fir on their sinking fund can help them to get investment. Because investors are less likely to invest in companies that have a large number of debts as it is risky for them. But the idea of a sinking fund assures them that they will get their money back even if the company goes in default.

2. Companies with poor credit ratings don’t get the attraction of more investors. That is why the sinking fund works as an alternative protection to the interest of the investors and convinces them to invest.

3. The financial statement of any company or firm might not stand strong always and it might fluctuate. But with sinking funds the firm can stabilize the situation without compromising with the bonds as the repurchase it with the fund by repaying the debts. It helps the investors to get confident in the company’s bonds.

Disadvantages

- Investors might lose interest in bonds if the company, again and again, uses the siking fund to buy bonds before maturity.

- The investors might not feel to invest in the bonds if the company is seen to have less sufficient funds.

- The investors might lose interest if the company is seen to use a sinking fund to purchase discounted bonds.

10+ Sinking Funds Examples

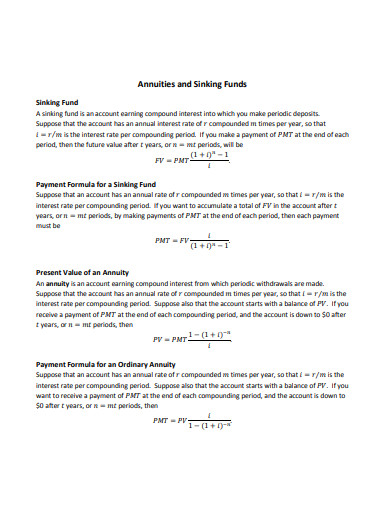

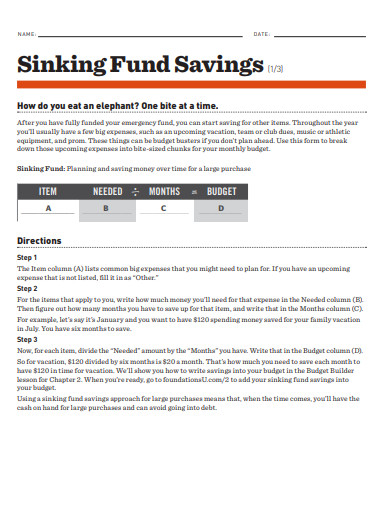

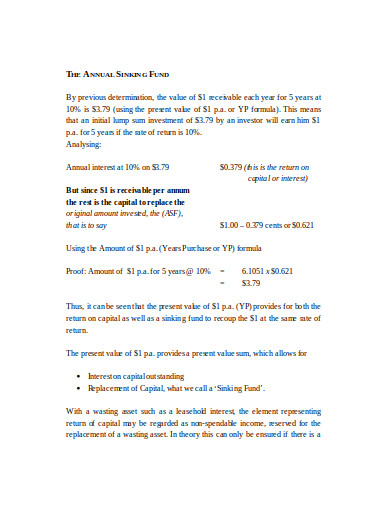

1. Annuities and Sinking Funds

Sinking funds are one of the best ways to attract investors for purchasing bonds as it gives them the security of the returns. There is certain sinking fund provision that is followed in the business to invest and utilize capital and bonds. The provision guides the way the fund is used and utilized for profit. Apart from this basic ideas sinking fund ha a lot to deal with that you can have idea of by referring to the mentioned example template. The template has focused on framing the different use of sinking fund and it also frames sinking fund formulas of different processing. So, have a look at this template today!

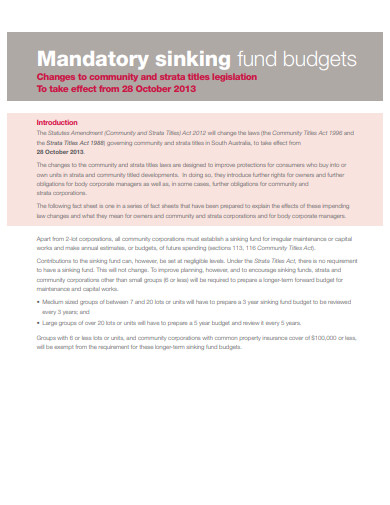

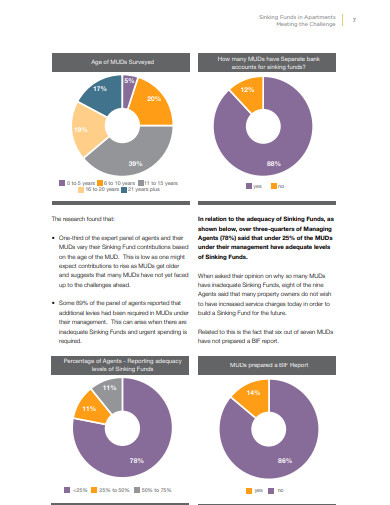

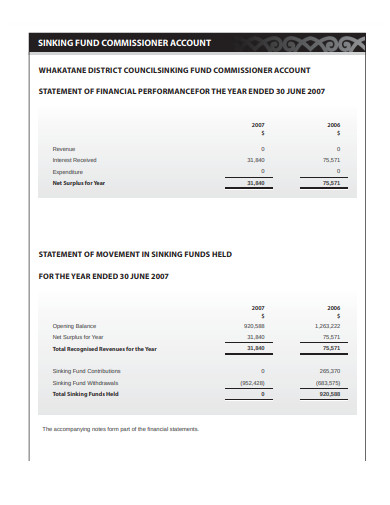

2. Mandatory Sinking Fund Budgets Example

If you are operating the business and running a company that might require investments always notify your investors that you use the sinking fund method. Letting them know about this fact they could be certain enough about their capital that it might not get wasted or loss in the market. You can strategist your business using this template too. This template frames a sinking fund budget in a way that can give you a map according to which you can take decisions in your business. So check this template out today!