15+ Sole Proprietorship Examples to Download

Starting and maintaining a business is one of the best ways to increase one’s income and overall net worth. There are many types of businesses one can choose from; each of these types of businesses has its contexts, objectives, themes, tones, and regulations. The sole proprietorship is one of the most basic types of business, which allows the owner to have sole power over the business.

1. Sole Proprietorship Concern

2. Sole Proprietorship Example

3. Characteristics of Sole Proprietorship

4. Sole Proprietorship as Business Structure for Startups

5. Sole Proprietorship Returns Template

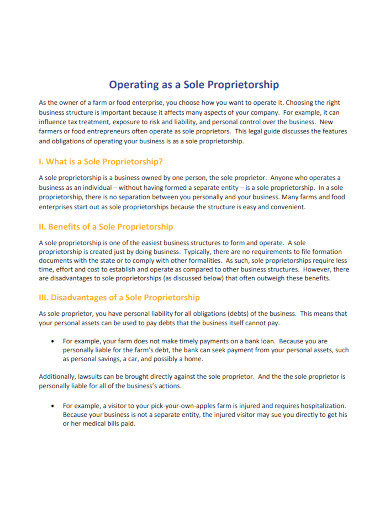

6. Operating as a Sole Proprietorship

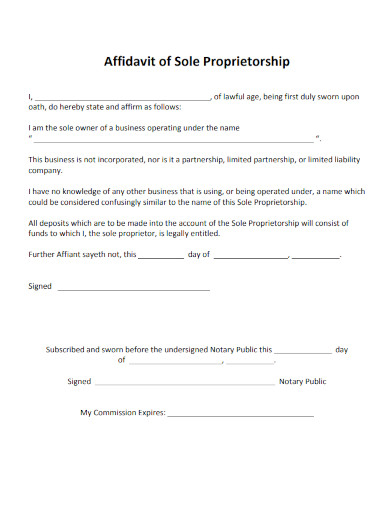

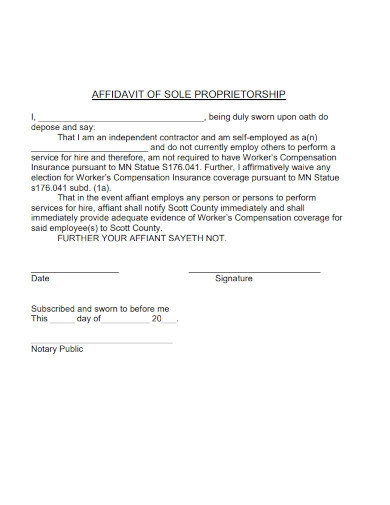

7. Affidavit of Sole Proprietorship Example

8. Sole Proprietorship Financial Report

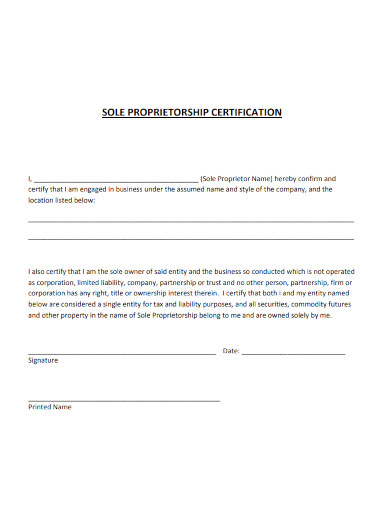

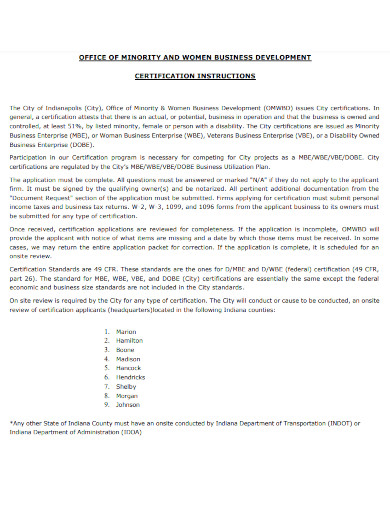

9. Sole Proprietorship Certification

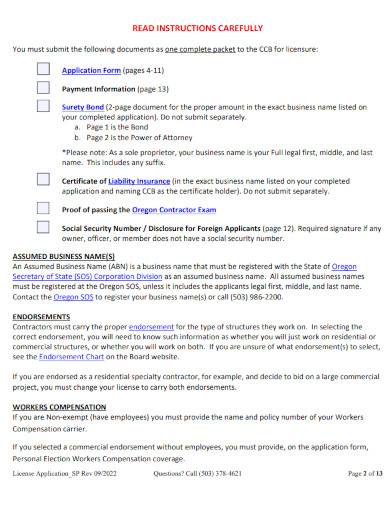

10. Sole Proprietorship License Application

11. Sole Proprietorship Application

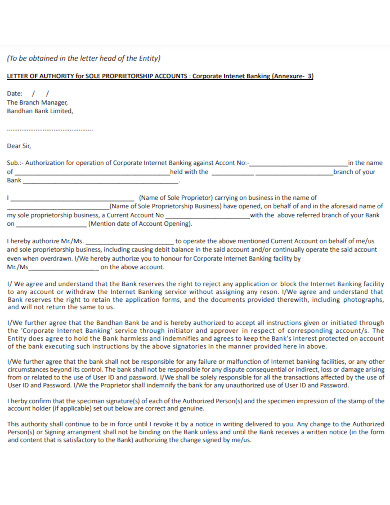

12. Letter of Authority for Sole Proprietorship Accounts

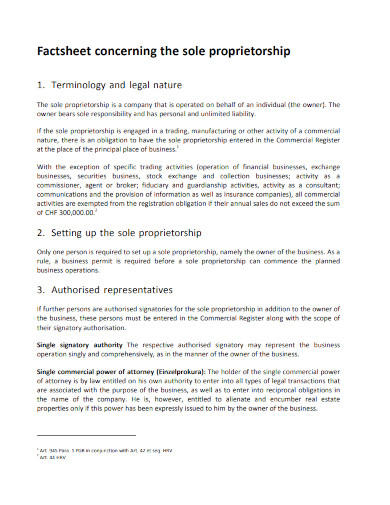

13. Factsheet Concerning the Sole Proprietorship

14. Sample Affidavit of Sole Proprietorship

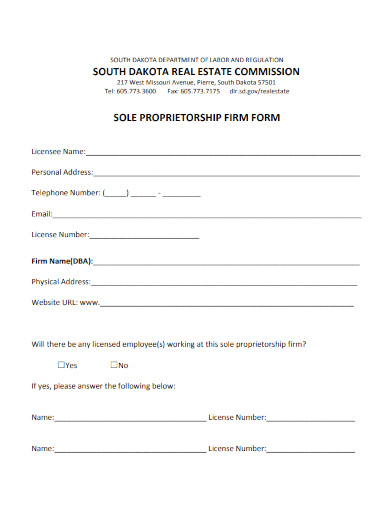

15. Sole Proprietorship Firm Form

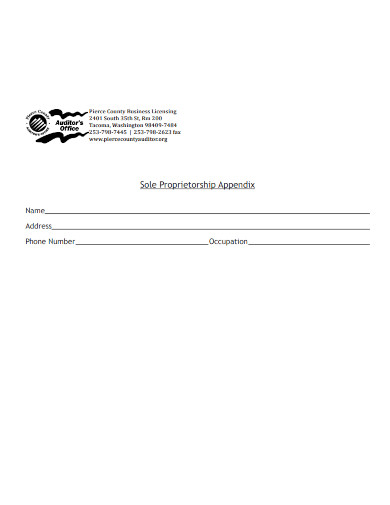

16. Sole Proprietorship Appendix

What Is Sole Proprietorship?

The sole proprietorship is a type of business wherein an individual owns the business or company and has all the power to regulate the flow of their business. Not only that, but the owner will also shoulder all the responsibilities that owning a business will outline for the person.

How to Identify Sole Proprietorship From Other Types of Businesses

A sole proprietorship business is no outward different from other types of businesses or service businesses, as they will still produce products, services, or commodities. One can easily identify the major differences between a sole proprietorship and other forms of business by looking over the internal elements of the business and the amount of power the owner has over various regulations, etc.

Step 1: Determine if There are No Partners in the Ownership of the Business

One of the elements of a sole proprietorship is that the owner is a single individual. Determine if the owner of the business is a single entity. The only exception to this element is if the owners are a couple who owns the business together.

Step 2: Identify if There is No Separation Between the Owner and the Business

The owner in the scope of a sole proprietorship will be the primary representative of the business. This means that the business and the owner are not separate entities. Identify if there is no separation between the owner and the business. If there is a separation, then the business is not a sole proprietorship.

Step 3: Check if the Owner Assumes All the Power and Control in the Business

In a sole proprietorship, the owner will assume all the power and control over the various elements of the business or company. If there is a split of decisional powers over the heads of the business, then the business is not a sole proprietorship.

Step 4: Ascertain if the Owner Assumes All the Monetary Obligations and Responsibilities Of the Business

The owner of the sole proprietorship will need to assume all the monetary obligations and responsibilities of the business, which means they will primarily be the source of salary, payments of bills, and other monetary responsibilities the business will incur. You must ascertain if the owner of the business will assume all of the monetary obligations of the business, if they don’t then the business is not a sole proprietorship.

FAQs

Partnership vs. sole proprietorship; what is the difference between partnership and sole proprietorship?

A partnership is a type of business ownership wherein two people co-own a specific company or business, based on the agreed percentages. This means that two people are responsible for the payment of all the monetary responsibilities the business incurs. This is a juxtaposition of a sole proprietorship where the sole owner of the business is the sole person responsible for the monetary responsibilities the business will incur.

What is the biggest disadvantage of a sole proprietorship?

There are many disadvantages of sole proprietorship due to the nature of owning this type of business. Not only is it hard to increase the investment of the business but the owner is wholly liable and responsible for all the monetary responsibilities of the business. This presents itself as the biggest disadvantage of a sole proprietorship.

What is the biggest advantage of a sole proprietorship?

A sole proprietorship allows the owner to have maximum control and privacy over their business and executive decisions. Not only that, but the start-up business will require very little monetary input or investment.

The sole proprietorship is a type of business ownership wherein an individual entity will solely act as the business owner. It is important to know what type of business ownership a specific company or business is.