10+ Startup Financial Modeling Examples to Download

Before you start off with any project or anything, you go for planning. You make an exact copy of the planned project so that it works like a blueprint for you. That can be referred to and look up to, while you are actually implementing the plan. Such is also the financial model. These are the representation of real-world financial situations.

Similarly, when you plan for a startup business, you need a startup financial modeling. A startup financial modeling helps you to understand the business and make the predictions regarding the company’s customers, revenue, employees, etc. into the future to check and analyze the viability of the business. It also helps in financial risk management, which is defined by the practice of economic value by using the financial tools and therefore get rid of the various kinds of risks.

10+ Startup Financial Modeling Examples in PDF | DOC

1. Venture for Startup Finance Example

2. Finance Modelling for Business Owners and Entrepreneur

3. Pattern for Startup Finance Model

4. Finance Modelling Fundamentals

5. Finance Modelling for Startups

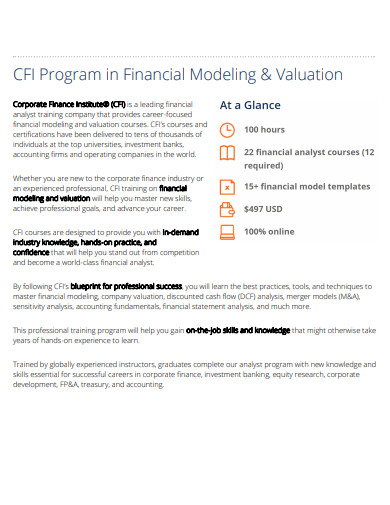

6. Program in Finance Modelling and Valuation

7. Business Plan for Startup Business

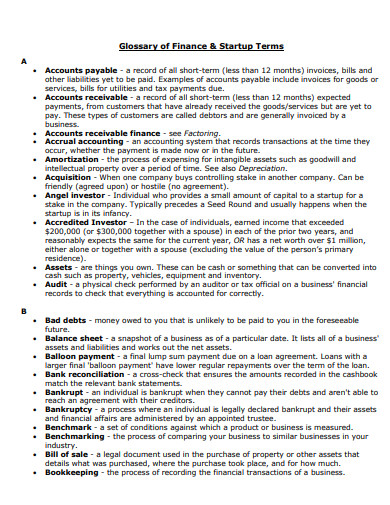

8. Glossary of Finance and Startup Terms

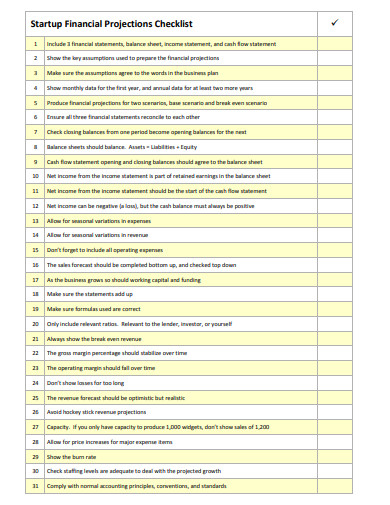

9. Startup Financial Projections Checklist

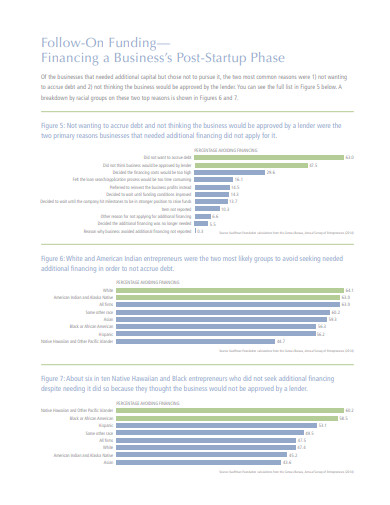

10. Startup Finance Trades by Race

11. Factors Affecting Startup Innovations and Growth

How to Create an Effective Financial Model?

Step 1: Historical Results

Every business or company’s financial model making should include a picture of the historical results of it. Make an attempt at pulling in the financial scenarios of the company for a minimum of three years. Then try to know the assumptions of the historical period by calculating the revenue growth rate, fixed costs, variable costs, gross margins, etc. From there, you can also predict the assumptions of the future period.

Step 2: Create the Income Statement

With the predictions of assumptions, you will be able to calculate the income statement with revenue, gross profit, etc.

Step 3: Make the Balance Sheet

After you have fulfilled the requirement of having a top income statement, you can now finally start to fill in the balance sheet. A balance sheet is a statement that consists of the assets the liabilities of any business at a particular point in time. So make sure you make this balance sheet properly taking into account the essentials.

Step 4: Create Supporting Schedules

Then you need to create a supporting schedule like the schedule of Property, Plant, and Equipment(PP&E). This includes the company’s tangible fixed assets of the long term. You will be able to know the PP&E schedule from the historical results.

Step 5: Design the Cash Flow Statement

After you have made the income statement and the balance sheet, you can now go on to design the cash flow statement with the reconciliation method. The reconciliation method is an accounting method in which two sets of records are taken to confirm whether the figures are correct and matches with one another.

Step 6: Perform the DCF Analysis

The DCF analysis is the Discounted Cash Flow Analysis. This refers to a valuation method that estimates the value of an investment on the basis of its future cash flows. Through this analysis, you will be able to know the present value of the company, depending on the future projections about the amount of money it will generate tomorrow.

Types of Startup Financial Modeling

A Bottoms-Up Startup Financial Model

The bottom-up analysis is the one that is based on the product or the service from which an estimate is made based on what you need to have to make the way of your offering to the market. The bottom-up forecast, usually examine factors like the capacity of the production, the expenses of the specific departments and a proper approachable market so that proper estimation of the sales can be done.

A Top-Down Startup Financial Model

It starts when a business starts to assess the market as a whole. At first, you need to know and determine the market size of the market that is available for you. Then you will come to know about the percentage or the size of the market that will purchase your products and the services. This way you will know the strengths and the weaknesses of your company and accordingly will be able to find ways to work on the weaknesses and boost the strengths more.

Benefits of Financial Modeling

The financial scenario of a company keeps fluctuating. It totally depends on the major decisions taken for the progress and the attainment of the profit. While making financial reporting and analysis, you need to have appropriate knowledge about the financial scene of the company. Financial modeling helps in this. At each and every step, the model can guide you regarding the number of risks associated with every decision made. The plans can also be helpful in giving birth to an effective financial statement that perfectly speaks for the finances of the company.

Who uses Financial Modelling?

Financial modeling is used by every company to properly plan out the finances and the operations of the company. There is no such category or section that especially uses financial modeling. It is rather a prerequisite to attain advanced financial management that all businesses should have. Moreover, startup companies need to make a financial plan. It is much more than a necessity for those. Just like a corporate financial management works, the same way a startup financial model is also an essential tool for the startups.

Problems Solved by Startup Financial Model

1: Proper Planning

Any startup when is in the budding stage often forgets to make a proper plan. A plan works like a guide that navigates the way while making various decisions. So this problem of lack of planning gets solved if you have a financial model. It will help you to touch all the topics and form a proper layout of the entire financial scenario.

2: Time Management

There is no investment like that of time. Though it is known how important time is, yet the proper utilization is rarely seen doing. A startup too usually lacks proper time management. But if there is the presence of a financial model then that problem gets solved.

3: Poor Management

It can be any project, but if the management is dysfunctional then the entire attempt goes in vain. So to make sure that the management is properly planned, everyone has distributed with responsibilities and the management is tight too, then the financial model can be a rescue. The model will help you in managing all the departments and the activities properly.

4: Dealing with Competitors

Then comes the problem of competitors. Apparently, it seems that it is a big challenge in the way of the success of a startup. But then if you have a well planned financial model designed, it will help you to tackle and sort that problem too. You can make the model by taking into consideration the problem or the challenge faced by the competitors by the startup.

5: Loose Finances

Then comes the biggest problem that is the finding or the money issue. You might have great ideas, yet you may fail to use it because of the lack of the required amount of money. To make sure that you don’t get stuck in this problem, you can make a proper financial model that will help you to manage that part well.

10+ Startup Financial Modeling Examples to Download

Before you start off with any project or anything, you go for planning. You make an exact copy of the planned project so that it works like a blueprint for you. That can be referred to and look up to, while you are actually implementing the plan. Such is also the financial model. These are the representation of real-world financial situations.

Similarly, when you plan for a startup business, you need a startup financial modeling. A startup financial modeling helps you to understand the business and make the predictions regarding the company’s customers, revenue, employees, etc. into the future to check and analyze the viability of the business. It also helps in financial risk management, which is defined by the practice of economic value by using the financial tools and therefore get rid of the various kinds of risks.

10+ Startup Financial Modeling Examples in PDF | DOC

1. Venture for Startup Finance Example

www8.gsb.columbia.edu

Details

File Format

PDF

Size: 571 KB

2. Finance Modelling for Business Owners and Entrepreneur

springer.com

Details

File Format

PDF

Size: 179 KB

3. Pattern for Startup Finance Model

researchgate.net

Details

File Format

PDF

Size: 653 KB

4. Finance Modelling Fundamentals

bpmglobal.com

Details

File Format

PDF

Size: 1 MB

5. Finance Modelling for Startups

fundingpost.com

Details

File Format

PDF

Size: 174 KB

6. Program in Finance Modelling and Valuation

corporatefinanceinstitute.com

Details

File Format

PDF

Size: 649 KB

7. Business Plan for Startup Business

opportunity.nebraska.gov

Details

File Format

DOC

Size: 27 KB

8. Glossary of Finance and Startup Terms

nawbo.org

Details

File Format

PDF

Size: 290 KB

9. Startup Financial Projections Checklist

planprojections.com

Details

File Format

PDF

Size: 192 KB

10. Startup Finance Trades by Race

kauffman.org

Details

File Format

PDF

Size: 822 KB

11. Factors Affecting Startup Innovations and Growth

ripublication.com

Details

File Format

PDF

Size: 298 KB

How to Create an Effective Financial Model?

Step 1: Historical Results

Every business or company’s financial model making should include a picture of the historical results of it. Make an attempt at pulling in the financial scenarios of the company for a minimum of three years. Then try to know the assumptions of the historical period by calculating the revenue growth rate, fixed costs, variable costs, gross margins, etc. From there, you can also predict the assumptions of the future period.

Step 2: Create the Income Statement

With the predictions of assumptions, you will be able to calculate the income statement with revenue, gross profit, etc.

Step 3: Make the Balance Sheet

After you have fulfilled the requirement of having a top income statement, you can now finally start to fill in the balance sheet. A balance sheet is a statement that consists of the assets the liabilities of any business at a particular point in time. So make sure you make this balance sheet properly taking into account the essentials.

Step 4: Create Supporting Schedules

Then you need to create a supporting schedule like the schedule of Property, Plant, and Equipment(PP&E). This includes the company’s tangible fixed assets of the long term. You will be able to know the PP&E schedule from the historical results.

Step 5: Design the Cash Flow Statement

After you have made the income statement and the balance sheet, you can now go on to design the cash flow statement with the reconciliation method. The reconciliation method is an accounting method in which two sets of records are taken to confirm whether the figures are correct and matches with one another.

Step 6: Perform the DCF Analysis

The DCF analysis is the Discounted Cash Flow Analysis. This refers to a valuation method that estimates the value of an investment on the basis of its future cash flows. Through this analysis, you will be able to know the present value of the company, depending on the future projections about the amount of money it will generate tomorrow.

Types of Startup Financial Modeling

A Bottoms-Up Startup Financial Model

The bottom-up analysis is the one that is based on the product or the service from which an estimate is made based on what you need to have to make the way of your offering to the market. The bottom-up forecast, usually examine factors like the capacity of the production, the expenses of the specific departments and a proper approachable market so that proper estimation of the sales can be done.

A Top-Down Startup Financial Model

It starts when a business starts to assess the market as a whole. At first, you need to know and determine the market size of the market that is available for you. Then you will come to know about the percentage or the size of the market that will purchase your products and the services. This way you will know the strengths and the weaknesses of your company and accordingly will be able to find ways to work on the weaknesses and boost the strengths more.

Benefits of Financial Modeling

The financial scenario of a company keeps fluctuating. It totally depends on the major decisions taken for the progress and the attainment of the profit. While making financial reporting and analysis, you need to have appropriate knowledge about the financial scene of the company. Financial modeling helps in this. At each and every step, the model can guide you regarding the number of risks associated with every decision made. The plans can also be helpful in giving birth to an effective financial statement that perfectly speaks for the finances of the company.

Who uses Financial Modelling?

Financial modeling is used by every company to properly plan out the finances and the operations of the company. There is no such category or section that especially uses financial modeling. It is rather a prerequisite to attain advanced financial management that all businesses should have. Moreover, startup companies need to make a financial plan. It is much more than a necessity for those. Just like a corporate financial management works, the same way a startup financial model is also an essential tool for the startups.

Problems Solved by Startup Financial Model

1: Proper Planning

Any startup when is in the budding stage often forgets to make a proper plan. A plan works like a guide that navigates the way while making various decisions. So this problem of lack of planning gets solved if you have a financial model. It will help you to touch all the topics and form a proper layout of the entire financial scenario.

2: Time Management

There is no investment like that of time. Though it is known how important time is, yet the proper utilization is rarely seen doing. A startup too usually lacks proper time management. But if there is the presence of a financial model then that problem gets solved.

3: Poor Management

It can be any project, but if the management is dysfunctional then the entire attempt goes in vain. So to make sure that the management is properly planned, everyone has distributed with responsibilities and the management is tight too, then the financial model can be a rescue. The model will help you in managing all the departments and the activities properly.

4: Dealing with Competitors

Then comes the problem of competitors. Apparently, it seems that it is a big challenge in the way of the success of a startup. But then if you have a well planned financial model designed, it will help you to tackle and sort that problem too. You can make the model by taking into consideration the problem or the challenge faced by the competitors by the startup.

5: Loose Finances

Then comes the biggest problem that is the finding or the money issue. You might have great ideas, yet you may fail to use it because of the lack of the required amount of money. To make sure that you don’t get stuck in this problem, you can make a proper financial model that will help you to manage that part well.