9+ Statement Analysis Examples to Download

It is a business analysis goal to gain profits rather than losses. To be able to make sure that more gains are achieved, thorough analysis and study of revenues and expenses are made on a regular basis. Financial statements help companies keep an eye on the business’s upward or downward performances.

Aside from financial statements, budget analysis are used to make sure that expenses do not incur losses for the business. A lot of statement analyses can be used to keep the company in good condition. Just take a look at the samples of different statement analyses below.

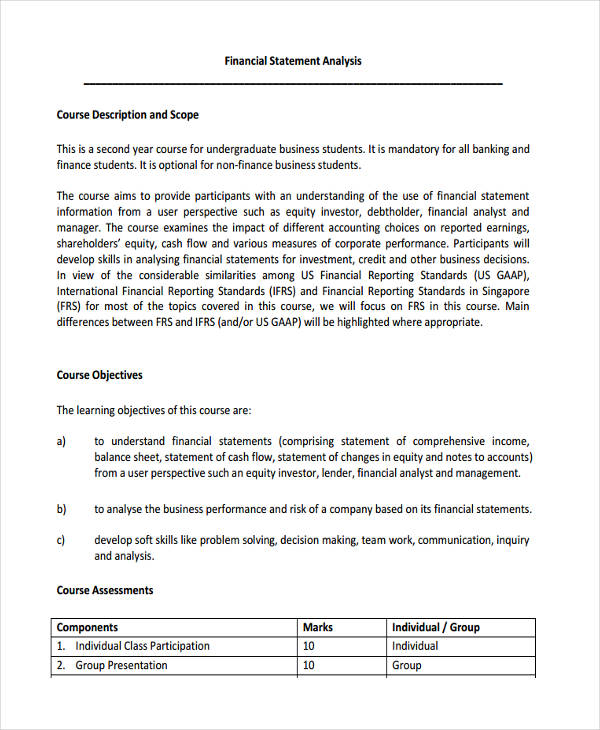

Financial Statement Analysis

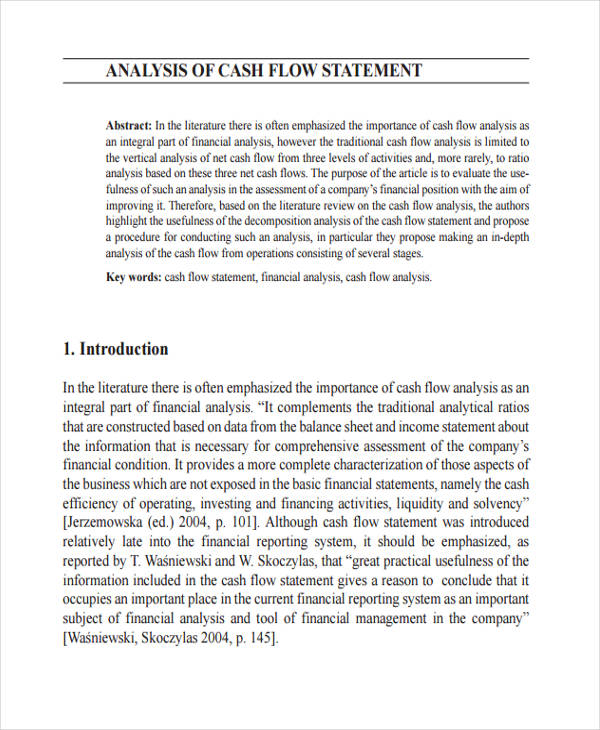

Cash Flow Statement Analysis

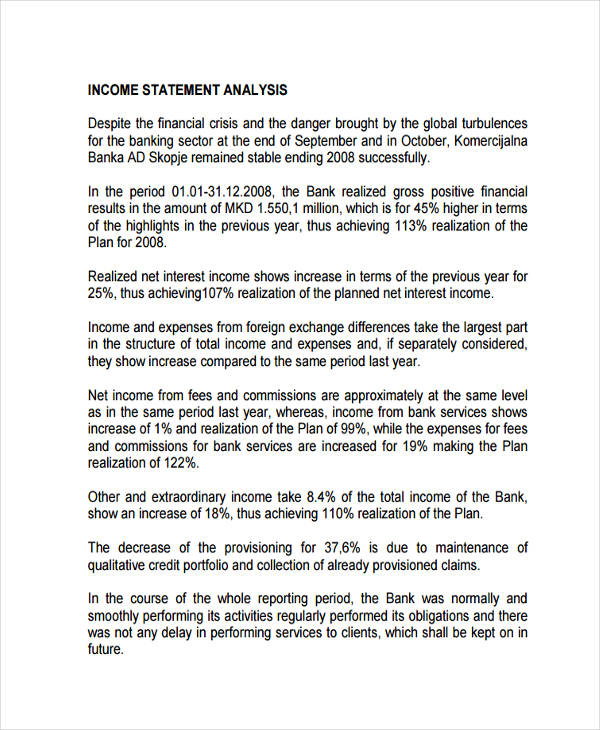

Income Statement Analysis

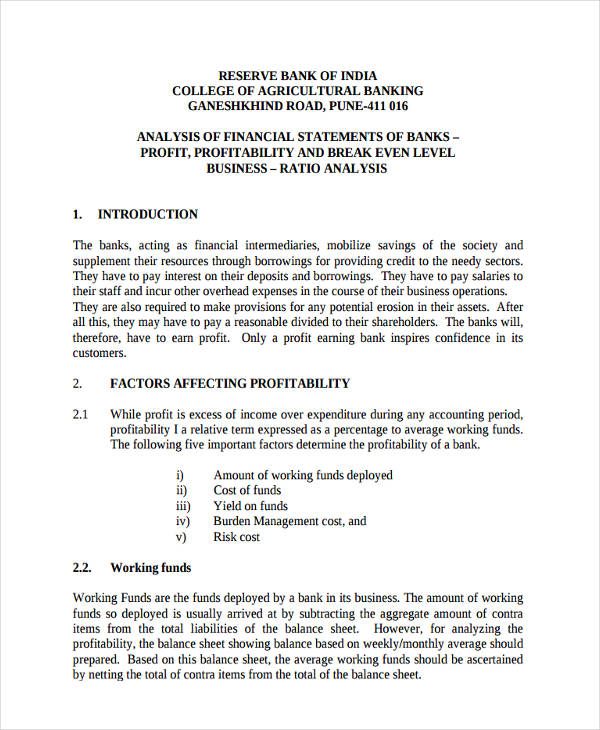

Bank Statement Analysis

Profit and Loss Statement Analysis

What Is a Statement Analysis?

Statement analysis is an evaluation process usually expressed in writing. Unlike your standard analysis example in Excel showing values and comparisons, statement analyses are presented in a different manner.

A statement analysis, particularly a financial analysis, usually shows the financial performance of the business analysis for external and internal users. By the use of these statements, users will be able to make wise decisions. Statement analysis are usually performed in a monthly basis to see the company’s operational achievements and its performances more closely. Statement analyses take on different structures or forms depending on what this statement aims to provide.

How to Write a Financial Statement

Financial statement are formal documentations of all the financial activity of a business over a period of time. Financial statements comes in four main types that shows different information:

- Income statement, reflecting the company’s revenue and expenses

- Balance sheet, reflecting the total assets, liabilities, and equities

- Statement of cash flows, presenting an inflow and outflow of cash in the business’s operational, investing, and financing activities.

- Statement of changes in equity, reflecting the purchase of shares, dividends issued, and profit or loss statement.

Statement Validity Analysis of Incident

Investigative Discourse Analysis

Statement Proof

Literary Quotation Analysis

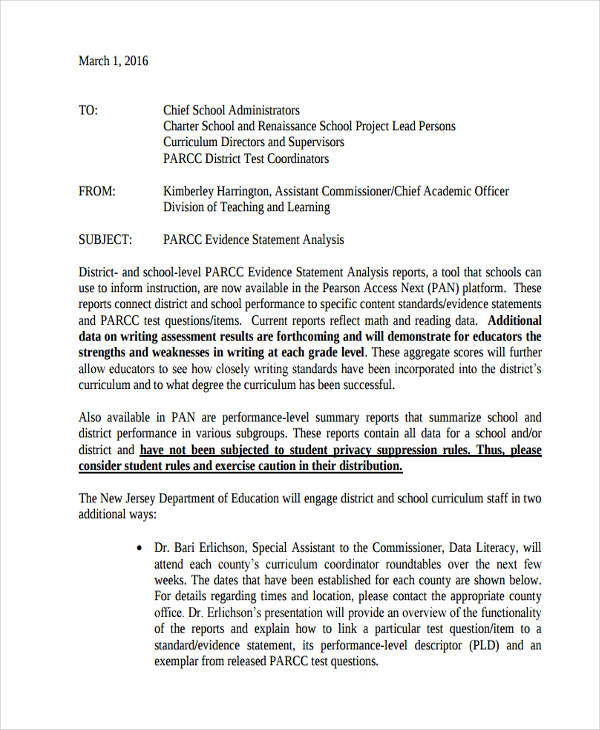

Evidence Statement Analysis

Tips for Statement Analysis Beginners

You can make use of the free analysis examples for references, but to make sure those analyses are spot-on here are tips how a statement analysis should be like:

- All information in the statement analysis should be understandable to the viewers or users of these statements.

- The statement analysis must contain reliable information, which means it is free from errors or misleading information.

- It must have relevant information that will suit the needs of the users in making decisions.

- Information must show comparability to help determine the trend of performance.

The Significance of Financial Analyses

With the use of gap analysis examples to compare actual from potential performances, financial analysis can also help evaluate if business performance is profitable and not unprofitable. It is important that financial statements analysis are used because:

- Financial statements determine the liquidity and solvency of the business.

- Financial statements help you determine the trend of profitability of the business.

- Financial statements communicate information to users of this analysis in making the best decisions.

- Financial statements give you clear, reliable, and relevant information of the operational, investing, and financing activities of a business.