10+ Mortgage Statement Examples to Download

How much do you know about mortgage statements? Do you have the responsibility of paying your personal loans? It is quite not easy to engage in responsibilities such as paying a mortgage. But for you to be able to understand its nature, we provided specific details and information about mortgage statements.

10+ Mortgage Statement Examples

1. Mortgage Statement Template

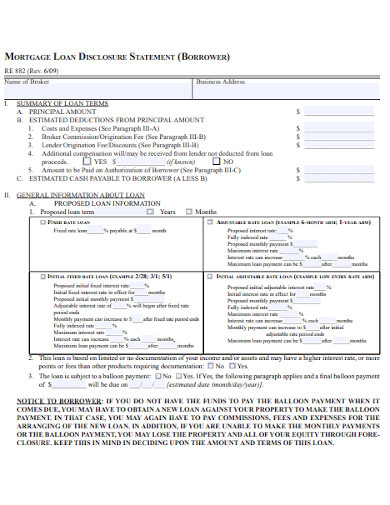

2. Mortgage Loan Disclosure Statement

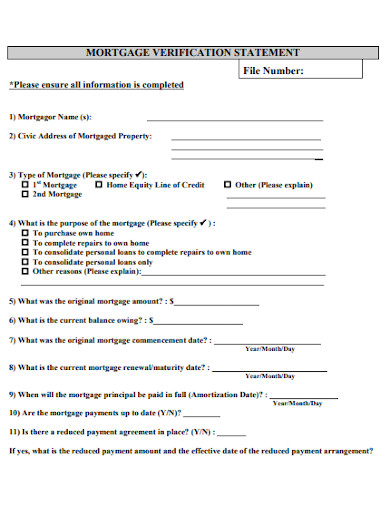

3. Mortgage Verification Statement

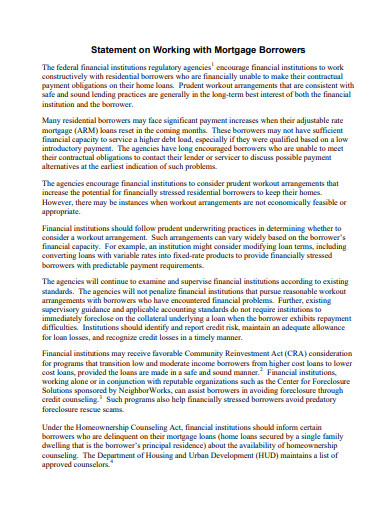

4. Statement on Working with Mortgage Borrowers

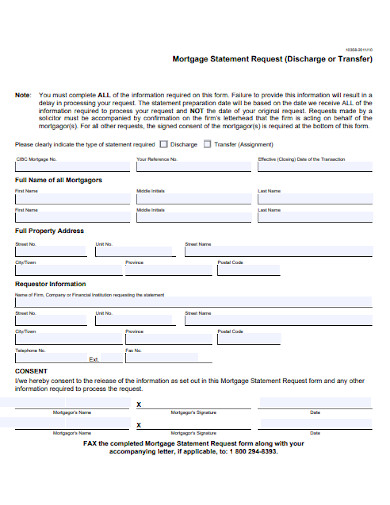

5. Mortgage Statement Request in PDF

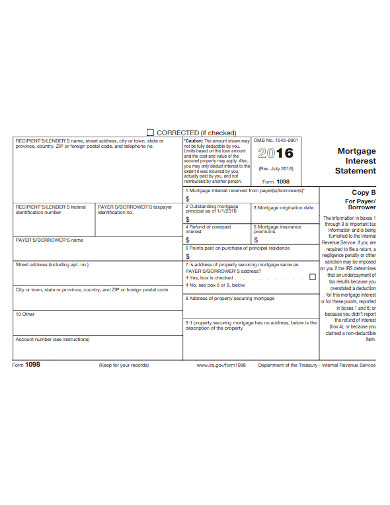

6. Mortgage Interest Statement

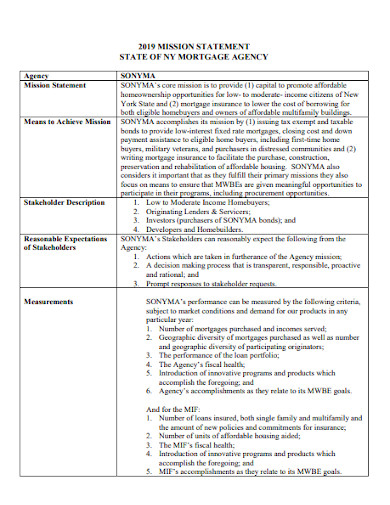

7. Mission Statement of Mortgage Agency Template

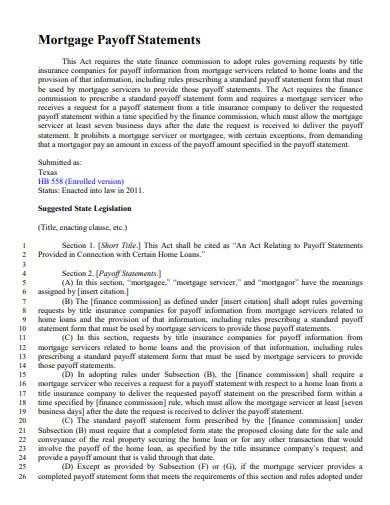

8. Mortgage Payoff Statements

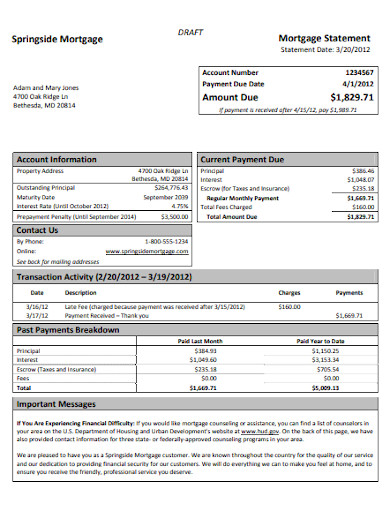

9. Sample Mortgage Statement

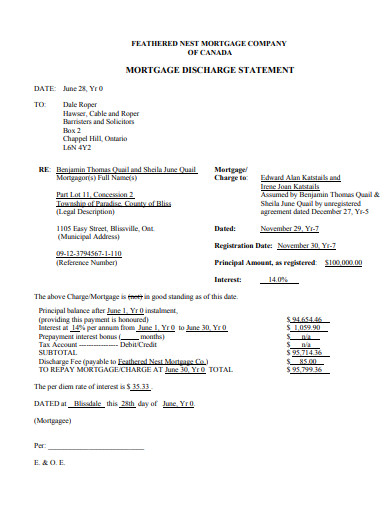

10. Mortgage Discharge Statement

11. Formal Mortgage Statement

What is a Mortgage Statement?

A mortgage statement provides information about your current balance, interest rate, amortization and the history of payment from the last issuance date. It is a type of document that is sent to you on a monthly basis – may it be in a form of electronic mail or a hand copy of the document itself. It is always updated provided with a breakdown of your payment.

What are the Different Sections of a Mortgage Statement?

- Account Information

This contains the following information:

– Account number – this helps your company easily identify your loan.

– Statement date – the date of the mortgage statement has been issued

– Due date of the payment – this indicates the due date of your next payment

– Amount due – indicates the amount that you should be paying. If you have paid late, it will also be indicated here.

– Type of mortgage – it will be either fixed rate or adjustable rate

– Interest rate – indicates the total interest that you should pay in your current bill.

– Customer service information – includes the information of the customer service line and the mailing address of your payment.

- Previous Payment

This includes the breakdown of your entire payment made in the current year and how much was being placed into the interest, principal and escrow account.

- Explanation of the amount due

- Principal payment – remaining loan balance of the current month

- Interest payment – applied on the interest of the remaining loan balance for the current month

- Escrow payment – this includes your insurance

- Total payment for the month – sum of principal, interest and escrow payment

- Other fees – includes charges for late fees

- Past due amount – indicates if you still have a balance payment from your previous transaction

- History of transaction

This includes all the specific details of your transaction including the amount paid, the date of payment and the description.

- Other important information

This refers to the statement that indicates the process if you can’t pay on your mortgage.

- Delinquency notice

This indicates a notice that when you failed to pay on the date provided. It would result in termination of the one you are paying for.

Reason why you should keep your Mortgage Documents:

- Documentation

– You might be asked for a proof of income, deductions and other necessary files for backup. In case you missed to pay your tax, you may want to consider keeping the documents of your loan and properties.

- For maintenance

– You can use your mortgage documents for scheduled maintenance to see what needs to be replaced.

- Accuracy of payments

– You must be knowledgeable about how much is your balance and how much have you paid on your mortgage. Try to see if all the payments stated were accurate.

Importance of a Mortgage Statement

Your mortgage statement would let you be aware of the changes that were made in your entire payment. This includes the possible problem in the computation of your previous and current payment or any other charges. In case of any discrepancies, you can contact the authorized person in charge immediately. Usually, you are only allowed to provide a dispute letter within 30 days.

How do you make a mortgage payment?

It can be via online transaction, through mail or to the location where you can transact with the payments.

Is it okay to pay your mortgage early?

There are some who would charge you for an early payment of your mortgage. This is usually done when you pay all of the amount ranging from a maximum of five years.

Are you already marked late if you cannot pay on the due date?

There is what we call the two-week grace period, which means that you are given an extended time for you to make up on your payment in a span of two weeks.

Just like a credit statement, it is provided for you to be aware of your current month payment and the possible discrepancies in your statement that needs to be checked at. Always remember that your mortgage statement is a financial document that is considered confidential so you don’t have to disclose to anyone else.