12+ Tax Deduction Examples to Download

A lot of money gets taken away by the government when it applies a standard deduction to a person’s income. One of the best ways to reduce this deduction is through one’s application for a tax deduction.

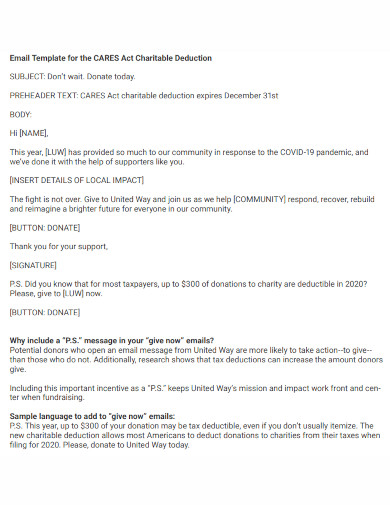

1. Charitable Tax Deduction Email Template

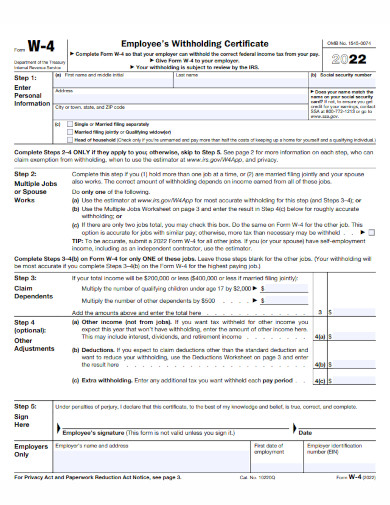

2. Internal Tax Deduction Revenue Service

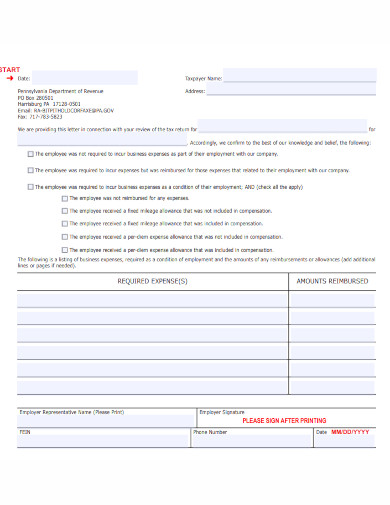

3. Employer Tax Deduction Letter Template

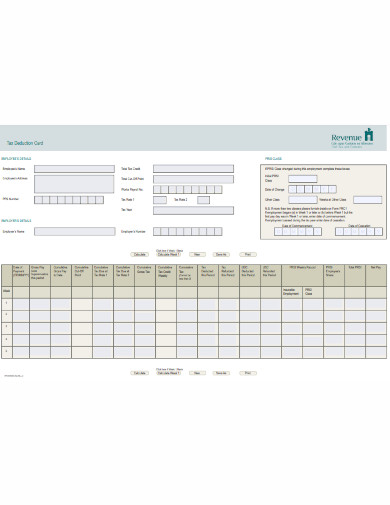

4. Tax Deduction Card

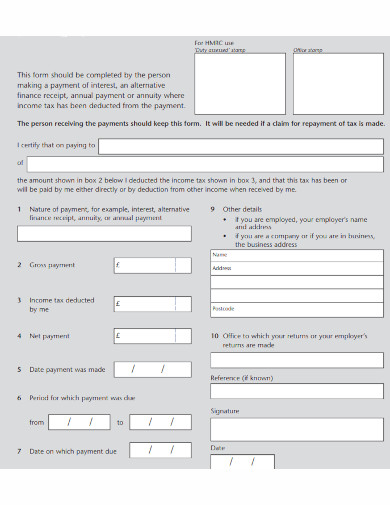

5. Income Tax Deduction Certificate

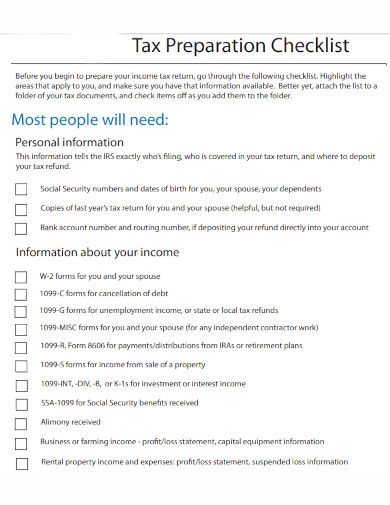

6. Tax Deduction Preparation Checklist

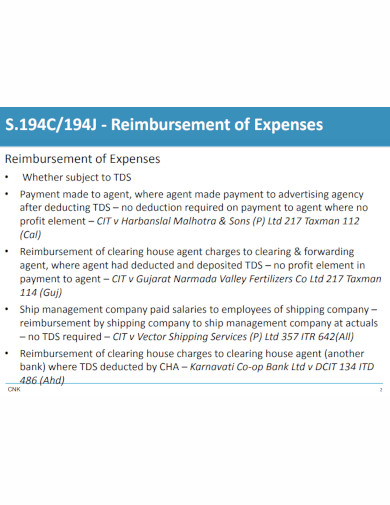

7. Tax Deduction at Source

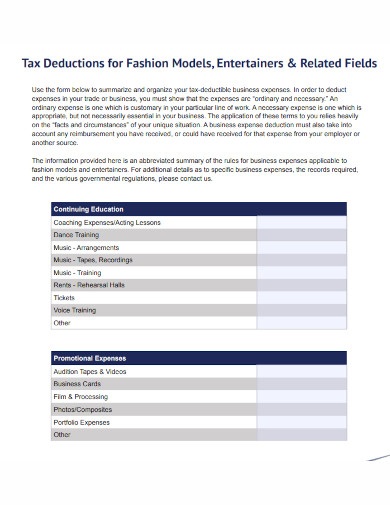

8. Tax Deductions for Fashion Models

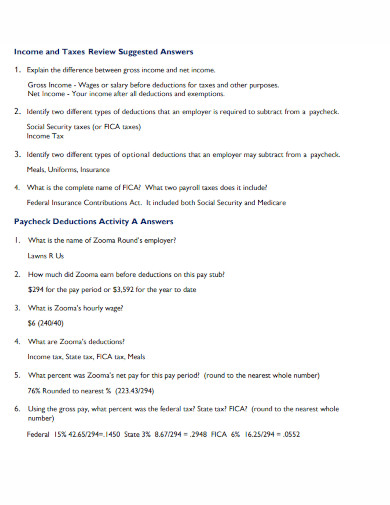

9. Tax Deduction Education Lesson Plan

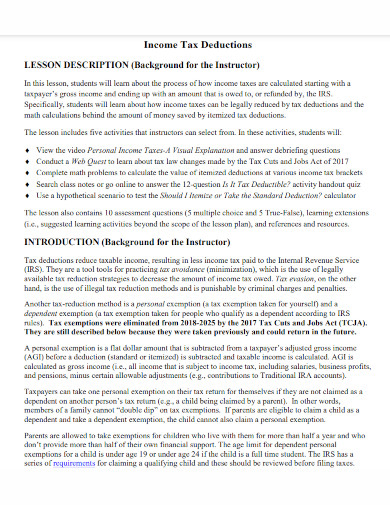

10. Income Tax Deductions

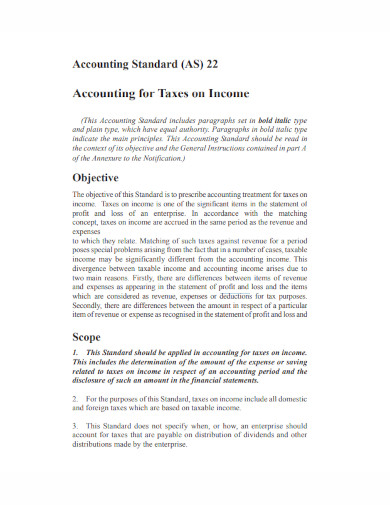

11. Accounting Income Tax Deduction

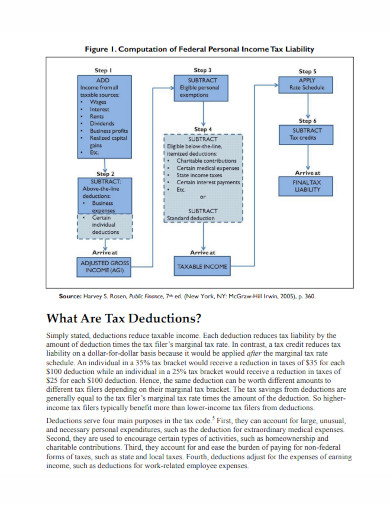

12. Tax Deductions for Individuals

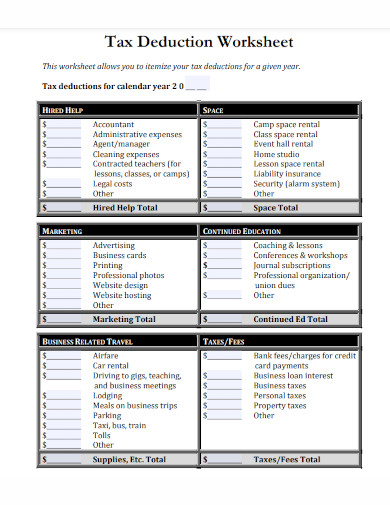

13. Tax Deduction Worksheet

What Is Tax Deduction?

A tax deduction is a perk that a person can avail of through various means. This perk reduces the tax received by the individual at a flat rate, which means it can reduce a person’s income tax to a flat zero. If you are looking for references, tax deduction checklist outlines, outline formats, and templates, you may use any of the links above.

How To Avail of Tax Deduction

The government taxes the incomes of most people in the working population. The amount of tax deduction one obtains is highly dependent on specific contexts, tones, and themes surrounding one’s position or occupation. Other tax deduction elements one should keep track of are culture, preference for ethnicity or ethnic group, and the economy of the country. One of the best ways to reduce that tax and obtain more of your income is to avail yourself of a tax deduction.

Step 1: Pay or Avail of Health Insurance

One of the ways to obtain a tax deduction is by paying one’s health insurance and using that to deduct your taxes. Not only will you be able to have extra funds when you get sick or are in danger, but you will also be able to reduce your income tax to obtain more money.

Step 2: Contribute or Donate To a Charity or Other Government Affiliated Organizations

One of the best ways to obtain a tax deduction is to contribute or donate to government-affiliated or government-verified charities or organizations. This will not only allow you to obtain a tax deduction, but it will also help out specific causes or advocacies aligned with your core values.

Step 3: Check or Research The Tax Bracket You Are On

Income tax is applied to the person based on the tax bracket they are located in. Being able to know the ins and outs of the tax bracket you are in, will help you see if there are any extra ways to reduce your income tax.

Step 4: Invest in An Equity Saving Scheme

Another way to reduce taxable income is to invest in a bank’s equity saving scheme. This will not only reduce your taxes but will also provide you with extra funds along the line.

FAQs

Is a tax deduction good?

Yes, a tax deduction is good as it allows you to obtain more money from your income. This is because a tax deduction reduces the amount of tax imposed on your income. Not only that but this means you can also invest the extra money either into extra luxury or into a UITF and/or trust fund. Overall a tax deduction is good because it reduces the overall amount of tax you will need to pay or be imposed upon you.

Is a tax deduction a refund?

Technically a tax deduction is not a refund, as the deduction is a flat rate that will be used to reduce the current taxation on one’s income. A refund on one’s taxed income is considered a tax credit and refunds a percentage of one’s income tax. The major difference between a tax deduction and a tax credit is the way the income tax is reduced as a tax deduction is a flat rate, whilst a tax credit is based on a percentage of one’s tax. This means that a tax credit is overall one that gives more money back to the taxpayer.

Is income tax deductible what you get back?

A tax deduction can reduce one’s income tax to a specific amount that may even reach a value of 0. But these deductibles are not considered a flat refund and are not a value you can get back as physical money. Instead, this just flat-out reduces the amount of tax you will be forced to pay when you get your income. If you wish for a tax refund you can refer to a tax credit instead, as this will allow you to get your money back.

A tax deduction is a perk one can get that will reduce the amount of income tax that will be imposed on them at a specific period. This perk is something an individual can earn in their lifetime by investing in certain avenues, contributing to charities, and more. Therefore if one wants to earn more money, one must try and avail of a tax deduction.