10+ Value Investing Principles Examples to Download

Value investing is a type of strategic step taken by the businessmen to uplift some stocks or demands which are required in the market but haven’t met the deserving value. Such investment is done by recognizing and separating the underestimated stocks and working on them by adopting effective marketing techniques. Thus value investing is nothing but a balanced investment strategic approach in trade.

What are the Principles of Value Investing?

Step 1: Recognize the Real Value

The first and utmost thing you need to do is to recognize and identify the real value of the stocks. Because the pricing of the stocks may go up and down according to the time and demand in the market.

Step 2: Intrinsic Value

The analysis of the value and price of the stocks at which they are available in a financial year can help you to invest in it at the best time. Do your homework and invest in it during the time they are available at the cheapest cost.

Step 3: Safety Margins

Value investing is all about some calculated speculations that might take place at some point. That is why you should always keep some space for accommodating the failures of speculations of the value hike in the market. This is called the Margin of Safety that can save you from different types of loss or undesired consequences.

Step 4: False market Hypothesis

A common belief and feature of the value investors are that they oppose the common market notion that the price of a stock represents its value. So following this contrarian rule you can make your investments.

Step 5: Stay Patient

Value investing is all about research and detail study of the market, the demand and supply, and the stocks of different companies. So after the speculations and probable planning, it is your time to stay patient to observe how the intrinsic value fluctuates due to high demand in the market.

10+ Value Investing Principles Example

1. Eight Principles of Value Investing Example

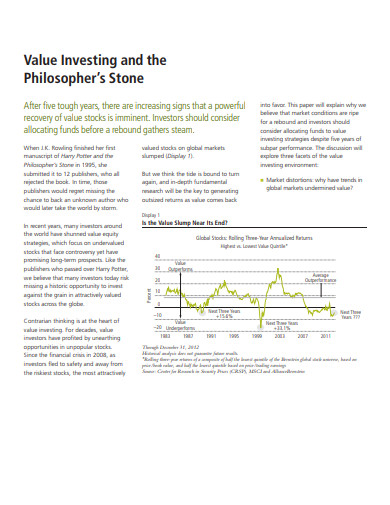

2. Value Investing and Philosopher’s Stone

3. Getting Started in Value Investing

4. 3D Value Investing Example

5. Applying Value Investing Principles in Indian Context

6. Methodology for Value Ideas Investing

7. Value Investing and Behaviour Finance

8. Tailored Approach to Value Investing

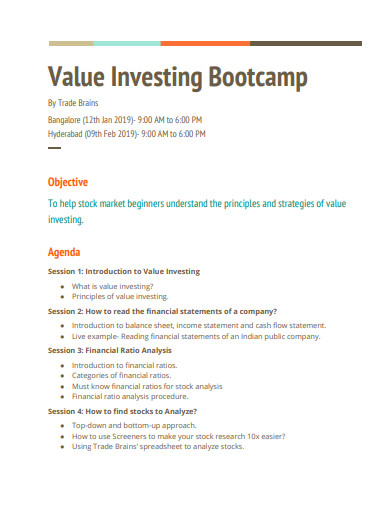

9. Value Investing Boot Camp Example

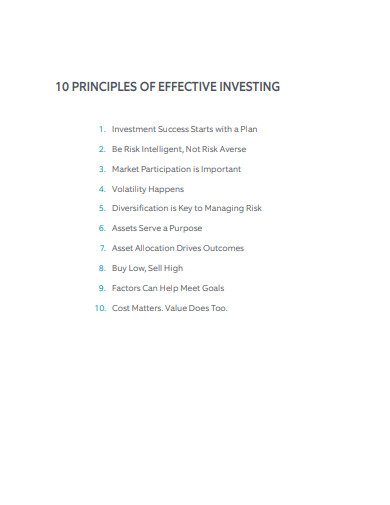

10. 10 Principles of Effective Investing

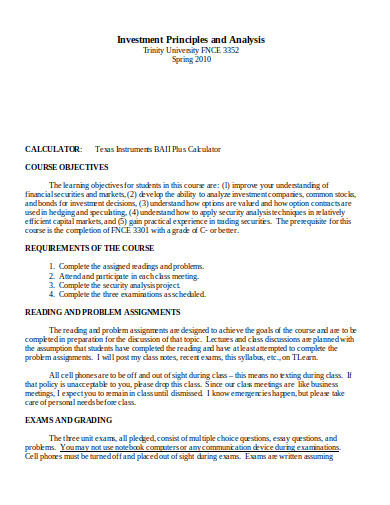

11. Investing Principal and Analysis

What is Value Investing Strategies?

Though the type of investment itself is a strategic process one needs to plan and strategize seriously how and when the stocks would be unveiled in the market. This planning might include some strategic steps like

- Thorough and proper research of the market and accordingly select the average products. Till the time you need to leave it in the market, the stock should be introduced with a new look without removing the company identity to which it reflects.

- The speculation you would make should not be based on emotions or gut feeling but the research results and logic.

- You should have proper homework done before buying any stock. Sometimes a little wait can get you greater profit because you would get the stock at its cheapest price. You should again wait for its sale till its book value is exalted in the market.

- You should be critical about the company’s records and history from where you are buying the stocks.

Some Tips for Value Investing

1.Research, Research, and Research

Value investing, as interpreted by Graham, is different from speculations but requires speculations at points to read the future probable scenario of the stocks. The basis of that speculation is your market research so stress on it before investing.

2. Take Risks

Sometimes neither the research nor the study can give a visible book value ratio, so at a certain point, you need to take the risk and make strong speculation for investments.

3. Risk Management

No investment is risk proof and thus requires some tactics to be managed while a crisis arises. Such risk management in business is known as the Margin of Safety.

4. Prefer Long Term Investments

If you have understood the concept of value investing you know it is a time taking process and you need to be patient for this. So whenever you are doing such business prefer the long-term investment for greater profit.

5. Don’t Overemphasize

Nothing should be overemphasized in the value investing process, particularly the P/E ratio or Price-to-Earning Ratio.

When to Process Value Investing?

Different times in the market can get you the opportunities for value investing. And most of the time certain opportunities come for the stocks are undervalued for several reasons like-

- Every investor invests according to his sense of good and bad, profitable and liable stocks. Sometimes some amateur investors to refer the greater ones end up following the investment decisions and this marginalizes other potential stocks.

- Sometimes market crashes and bubbles also give ways to the undervaluation of some stocks due to the over investment on some particular stocks. This also contributes to negative stock trading and investing.

- Sometimes stocks are undervalued because they are not properly advertised and get lost in the sea of the huge number of stocks. Small companies do not invest much in glamourizing the stock which underrates it and helps value investors to choose their path.

- Some bad or negative article in news about a company can lower down the prestige of the company in the public’s eyes and their reliability on their stocks also decreases.