11+ Value Portfolio Examples to Download

A value portfolio is an investment philosophy that aims to have value investment and a diversified portfolio. It is also a technique to add value to the high potential stocks that are quoted at discounted rates against their intrinsic value. Value portfolio professionals employ several fundamental concepts to manage and succeed in adding value to the portfolio.

What are the fundamental concepts for a Successful Value Portfolio?

Time is Important

The timing of investment is essential in the exponential growth of the investment. The sooner you engage in investment, the better the chances you might get for more choices. Because of the interest rate and returns, the investment made earlier by you would roll up to grater value when its closer to retirement.

Generate more Expend Low

You should focus on how much you can cut your expenses in the business to take the maximum produced value home. The difference between the ratio of expenses and revenue generation should stand on the opposite ends on the chart. If it comes to be similar or somewhat similar to your total earnings, there will not be any chances of profit or benefit.

Asset Allocation

Asset allocation determines the level of profit and returns you might get with your investment. Planning this step strategically and adequately is essential to get better returns than you deserve. Studies say that most investors face loss in returns due to their wrong allocation of the assets at the wrong time.

Correct Diversification

The investments should never be made on any single asset or stocks for the safety of the capital. If you diversify your capital properly on different stocks, you might face a little loss than making all your capital sink with the economic trends fall and rise.

Follow the Less Followed

John Templeton, if someone wants to have better investment performance as compared to the crowd, they must plan and act differently. Thus never follow the path crowd is developing as it might make you face poor returns.

Keep Margin of Safety

The margin of safety is the level of difference between the intrinsic value and market price of the investment. The investors assess and analyze the inherent value of an asset and determine the margin of safety before buying it. The difference that occurs between the asset’s intrinsic value and the amount the investor is willing to pay is the margin of safety.

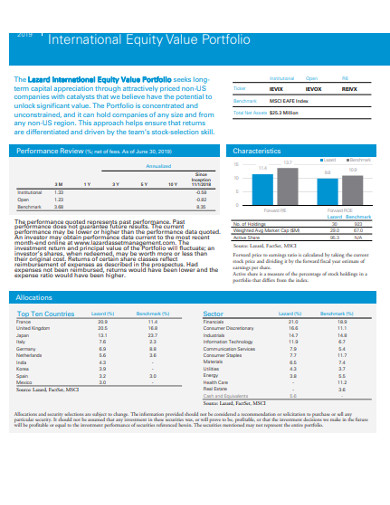

11+ Value Portfolio Examples

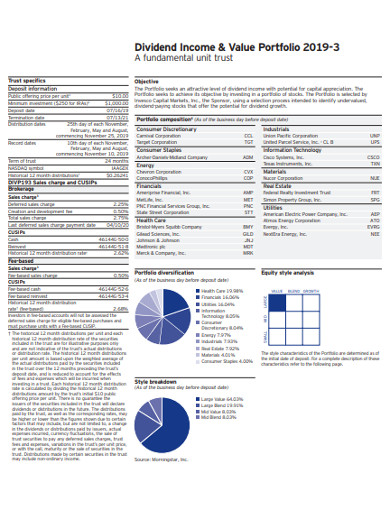

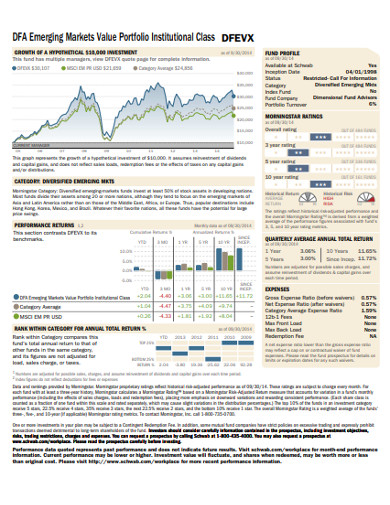

1. Dividend Income and Value Portfolio Example

Value portfolio is the strategic investment that is designed taking different other small steps and strategies of investment techniques. It requires to follow certain important fundamental aspects to make the value portfolio successful. You can have a look at those fundamental steps by looking at this template that presents a model portfolio sample. The template communicates well with its specifically defined content and pie chart representation of the facts. Have a look at this template and grab it if you find it useful for you.

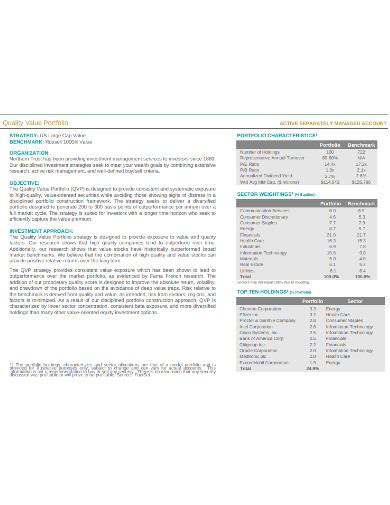

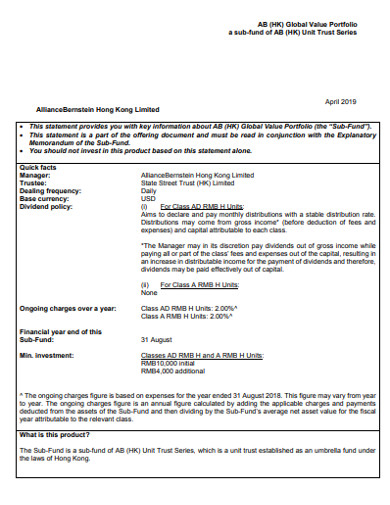

2. Quality Value Portfolio Example

Designing a quality added and perfectly shaped value portfolio for your investment might simplify many of your tasks of investment. Or you can relax and have a look at this finely crafted template on quality value portfolio example. Referring to the template you might get a better and fine structure for your investment and you might end up getting an attractive portfolio design. So, have a look at this template today!

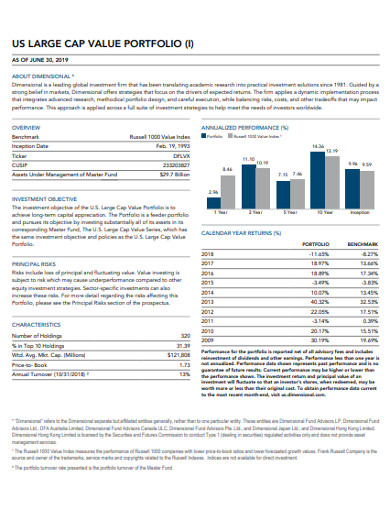

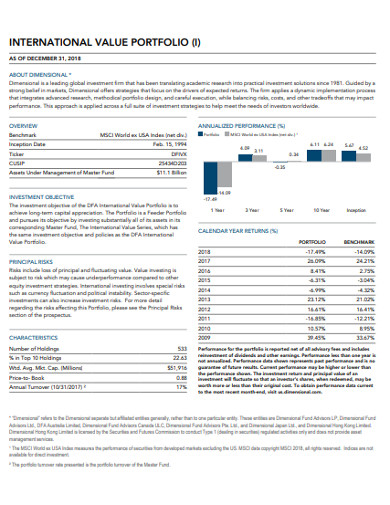

3. Large Cap Value Portfolio Example

value portfolios can be decided and shaped by your proper planning and decisions. If you are focusing your business in the market of the US having this template might let you know about the different aspects and systems of the value portfolio. You can also do a portfolio selection from the market where people offer certainly designed content. Or, try the template and download it if it looks useful to you.

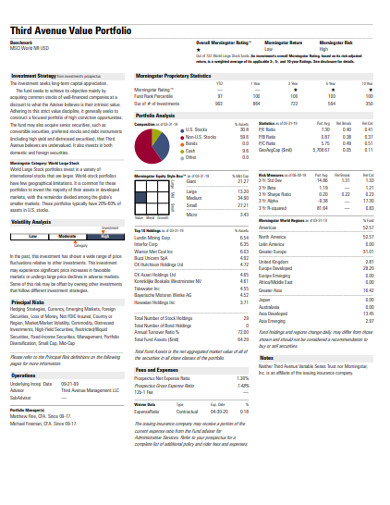

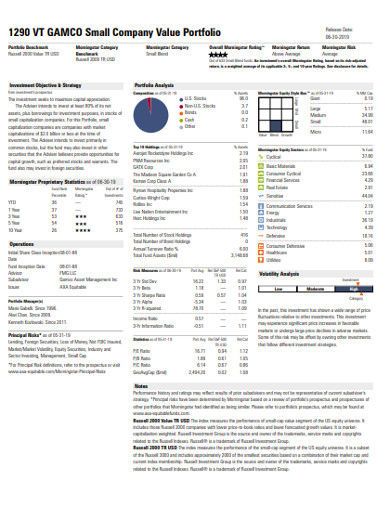

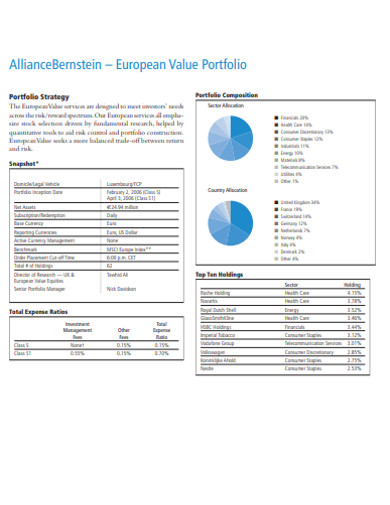

4. Third Avenue Value Portfolio Example

Before indulging in any business process understanding it properly is important. Hence, we suggest you should have a look at this template. The frame is prepared explaining several aspects that are important in value portfolio framing. If you understand the facts, even preparing a digital portfolio won’t be tough. So get the template today!