Variable Costs – Meaning, Defination, & Examples

Variable costs are expenses that change in proportion to the production volume. In cost analysis, these costs fluctuate with output levels, making them crucial for accurate product cost analysis. Understanding variable costs is essential for break-even analysis, as it helps determine the sales volume needed to cover both fixed and variable expenses. Key examples include raw materials, direct labor, and utility costs. Effective management of variable costs enhances profitability and aids in strategic financial planning.

What Is a Variable Cost?

A variable cost is an expense that varies directly with the level of production or sales volume. Unlike fixed costs, variable costs increase as production rises and decrease when production falls. Common examples include raw materials, direct labor, and production supplies.

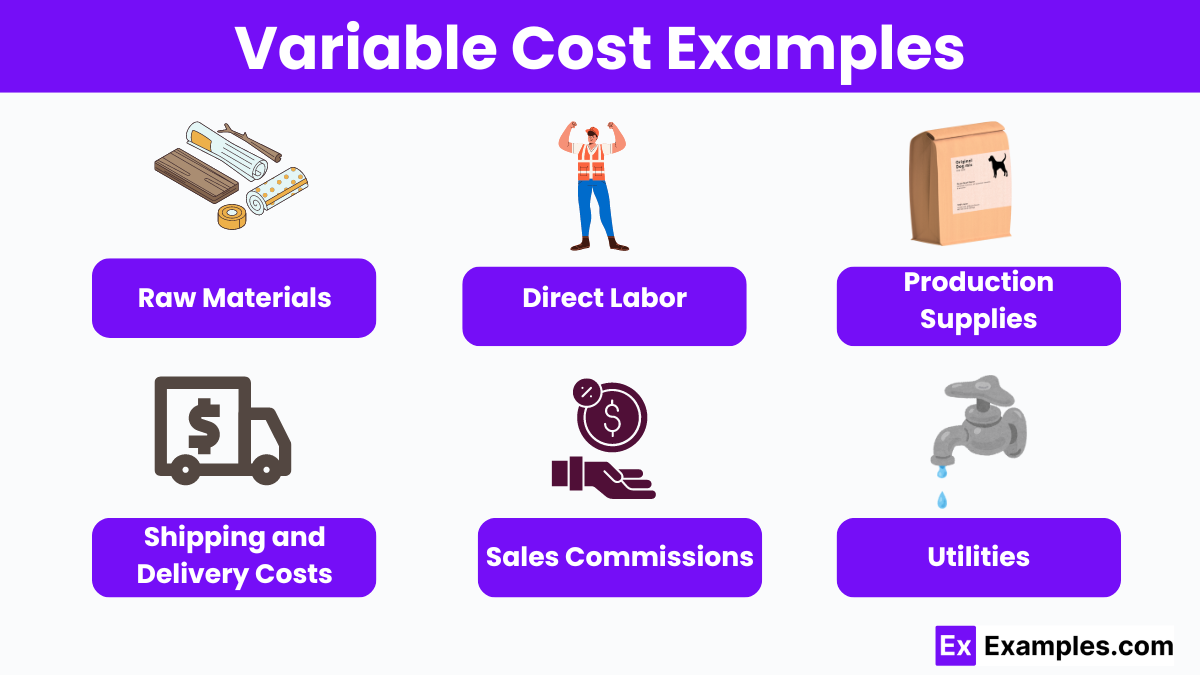

Variable Cost Examples

Raw Materials: Raw materials are the primary components used in manufacturing products. The cost of raw materials increases with higher production volumes and decreases when production slows down. This variability makes raw material costs a significant factor in managing overall production expenses.

Direct Labor: Direct labor costs refer to wages paid to employees directly involved in the production process. These costs fluctuate with the number of units produced or hours worked. Managing direct labor costs is crucial for maintaining profitability, especially in labor-intensive industries.

Production Supplies: Production supplies include items like packaging materials, machinery lubricants, and other consumables used during manufacturing. These costs vary based on production levels. Effective management of production supplies helps in controlling overall manufacturing expenses and maintaining product quality.

Shipping and Delivery Costs: Shipping and delivery costs are expenses incurred when transporting finished products to customers. These costs vary depending on the volume of goods shipped. Efficient logistics and transportation management can reduce shipping and delivery expenses, improving overall cost efficiency.

Sales Commissions: Sales commissions are payments made to sales personnel based on the volume or value of sales they generate. These costs increase with higher sales and decrease with lower sales. Properly structured sales commissions can motivate sales teams and drive revenue growth.

Understanding Variable Costs

Understanding variable costs is essential for effective cost analysis and maintaining an efficient operating budget. These costs fluctuate with production levels, impacting the basic budget. By analyzing variable costs, businesses can better forecast expenses, optimize resource allocation, and ensure financial stability. Proper management of variable costs is crucial for maintaining a balanced and responsive operating budget.

Formula and Calculation of Variable Costs

Variable Costs = Cost Per Unit x Total Number of Units Produced

To calculate variable costs, multiply the cost per unit by the total number of units produced. For example, if the cost per unit is $5 and 1,000 units are produced, the total variable cost is $5 x 1,000 = $5,000. This straightforward calculation helps businesses manage expenses and maintain an efficient operating budget.

Importance of Variable Cost Analysis

- Accurate Event Budget Planning:

Variable cost analysis helps forecast and manage event expenses like catering, venue rental, and promotional materials. This ensures a realistic event budget, covering all costs and meeting financial goals. - Efficient Manufacturing Budget Management:

Analyzing variable costs like raw materials and direct labor enables businesses to adjust the manufacturing budget based on production levels, optimize resources, and maintain profitability. - Improved Profit Margins:

By identifying and controlling variable costs, businesses can enhance profit margins. Cost analysis highlights areas for expense reduction without compromising quality, leading to better financial performance. - Strategic Pricing Decisions:

Understanding variable costs allows businesses to set competitive and profitable prices. Knowing the cost per unit helps determine the minimum price needed to cover expenses and achieve desired profit margins. - Break-Even Analysis:

Variable cost analysis is essential for break-even analysis. It helps calculate the sales volume needed to cover all costs, aiding in strategic planning and ensuring financial stability. - Flexibility and Scalability:

Variable cost analysis provides insights into cost changes with production volume. This information is vital for businesses looking to scale operations or adjust production in response to market demand, ensuring cost-efficiency.

Variable Cost vs. Average Variable Cost

| Aspect | Variable Cost | Average Variable Cost |

|---|---|---|

| Definition | Total costs that vary with the level of production. | Variable cost per unit of output, calculated by dividing total variable costs by the number of units produced. |

| Calculation Formula | Variable Cost = Cost Per Unit x Total Number of Units Produced | Average Variable Cost (AVC) = Total Variable Cost / Total Units Produced |

| Purpose | To determine the total expenses that fluctuate with production levels. | To understand the cost of producing each unit on average. |

| Usage | Used in budgeting, cost control, and financial planning. | Used in pricing decisions, break-even analysis, and evaluating production efficiency. |

| Example | If producing 1,000 units with a cost per unit of $5, the total variable cost is $5,000. | If the total variable cost is $5,000 for 1,000 units, the average variable cost is $5 per unit. |

| Impact on Profitability | Directly affects total production costs and, consequently, overall profitability. | Helps in understanding the per-unit cost and its impact on pricing and profit margins. |

| Flexibility | Changes directly with the production volume. | Provides a per-unit measure that remains consistent as long as production efficiency is stable. |

Variable Costs vs. Fixed Costs

| Aspect | Variable Costs | Fixed Costs |

|---|---|---|

| Definition | Costs that vary directly with the level of production or sales volume. | Costs that remain constant regardless of production or sales volume. |

| Examples | Raw materials, direct labor, production supplies, shipping costs, sales commissions. | Rent, salaries, insurance, depreciation, property taxes. |

| Calculation Formula | Variable Cost = Cost Per Unit x Total Number of Units Produced | Fixed Cost = Total Fixed Expenses |

| Behavior | Increases with higher production and decreases with lower production. | Remains unchanged regardless of production levels. |

| Impact on Break-Even Analysis | Essential for calculating the break-even point; impacts variable cost per unit. | Impacts the overall break-even point; does not change per unit produced. |

| Flexibility | Changes with production volume, providing flexibility in managing costs. | Remains inflexible, necessitating coverage through sales to achieve profitability. |

| Management Focus | Requires careful monitoring to control costs and maintain profit margins. | Needs to be covered by revenue to avoid losses, often managed through budgeting. |

| Examples in Practice | Cost of raw materials rises with more units produced. | Monthly rent of a factory remains the same regardless of the number of units produced. |

| Impact on Profitability | Directly affects total production costs and overall profitability. | Needs to be covered by sales revenue for a business to be profitable. |

| Adaptability | Can be adjusted more easily in response to changes in production demand. | Less adaptable to short-term changes in production demand. |

Benefits of Variable Cost

1. Flexibility in Budgeting:

Variable costs allow for more flexible budgeting since they adjust with production levels. This adaptability helps businesses manage expenses more effectively during periods of fluctuating demand.

2. Improved Cost Control:

Businesses can closely monitor and control variable costs, such as raw materials and direct labor. This control enables better management of production expenses and helps maintain profit margins.

3. Enhanced Profit Margins:

By managing variable costs efficiently, companies can improve their profit margins. Lowering variable costs without compromising quality increases overall profitability.

4. Scalable Operations:

Variable costs provide scalability. As production increases, costs rise proportionally, allowing businesses to expand operations without a significant increase in fixed expenses.

5. Strategic Pricing Decisions:

Understanding variable costs helps in setting competitive and profitable prices. Businesses can ensure that pricing covers all variable costs and contributes to fixed costs and profits.

6. Better Decision-Making:

Variable cost analysis aids in informed decision-making. Managers can evaluate the impact of changes in production volume on overall costs, helping in strategic planning and resource allocation.

7. Break-Even Analysis:

Variable costs are crucial for calculating the break-even point. Knowing these costs helps businesses determine the sales volume needed to cover all expenses and achieve profitability.

8. Resource Optimization:

Effective management of variable costs ensures optimal use of resources. Businesses can allocate resources efficiently, reducing waste and enhancing operational efficiency.

9. Cost Allocation Accuracy:

Variable costs provide accurate cost allocation per unit of production. This accuracy is essential for product costing, inventory valuation, and financial reporting.

10. Adaptability to Market Changes:

Variable costs allow businesses to adapt quickly to market changes. During periods of lower demand, reducing production can lower variable costs, minimizing financial impact.

How do variable costs differ from fixed costs?

Variable costs fluctuate with production levels, while fixed costs remain constant regardless of production volume.

Why are variable costs important in cost analysis?

Variable costs are crucial for understanding total production expenses and making informed budgeting and pricing decisions.

What are some examples of variable costs?

Examples include raw materials, direct labor, production supplies, shipping costs, and sales commissions.

How do you calculate variable costs?

Variable costs are calculated by multiplying the cost per unit by the total number of units produced.

How do variable costs impact profit margins?

Efficient management of variable costs can improve profit margins by reducing overall production expenses.

What role do variable costs play in break-even analysis?

Variable costs are essential for calculating the break-even point, helping businesses determine the sales volume needed to cover all expenses.

Can variable costs be controlled?

Yes, businesses can monitor and control variable costs through effective resource management and cost-reduction strategies.

How do variable costs affect pricing decisions?

Understanding variable costs helps businesses set competitive and profitable prices that cover all expenses and contribute to profits.

Are utilities considered variable costs?

Yes, utilities used in production processes, like electricity and water, are variable costs as they change with production volume.

What is the relationship between variable costs and production levels?

Variable costs increase with higher production levels and decrease with lower production levels.