11+ Venture Capital Investment Agreement Examples to Download

A venture capital investment is a professional relationship between an investor and a booming company. The agreement usually comes from venture capital firms who specialize in building high risk financial portfolios. They willingly give funding to start-up companies in exchange for equity. This type of relationship is most common in technology industries. You may also see business investment agreement examples.

The person who deals with venture capitals is known as a venture capitalist. These people usually work for a venture capital firm.

Venture Capitals vs. Loans

Although venture capital may sound similar to loans, they are actually very different except for the fact that they are both common methods of funding a business. With loans, a lender gives a company money, and that company will have an obligation to pay the lender back the amount he gave, plus the agreed interest that will accumulate the longer the debt is unpaid. You may also like small business investment agreement examples.

Sometimes the loan is even backed with assets, such as equipment or property, and other receivables to be surrendered should the company be unable to pay back the loan. However, for smaller companies with considerably smaller loans, the loan is simply backed up by a personal guarantee from the business owner. This “backing” of some sort allows the lender to recover even if the borrower fails to make payments. You may also check out equity investment agreement examples.

Venture capitals, on the other hand, gives the start-up business a chance to issue private shares in exchange for money. This means that the money that the venture capitalist gives to the owner of the start-up becomes a partial owner of the business. This type of “money lending” is only used with high growth industries where there are more risks associated with the general agreement.

For venture capitals, there will be no assets to back up the loan, which means that, to avoid monetary default and create a higher chance of investment success, both parties must agree to higher payouts to result in higher success rate for the business. You may also see restaurant investment agreement examples.

Share Subscription Agreement for Venture Capital Example

Venture Capital Investment Agreement Example

Venture Capital Investment Term Sheet Sample

Preparing to Look for a Venture Capitalist

Of course, investors would only want to invest their money into businesses with potential, those they can see succeeding. To identify which businesses have the ability to grow, investors are burdened with the difficult task of having to predict the future of that venture. Will it succeed or fail? Will they get back their money’s worth (and more) if they invest in it or not? You might be interested in partnership investment agreement examples.

Investors, aside from looking at a company’s future success, also looks at the business’s risk of failing. The lower the risks, the higher chance of investors crowding in to give their money to that specific trade. Businesses can lower their risk of failing and increasing their chances of success if they develop business strategies and create strong relationships with relevant individuals and business entities.

So if you want to make your start-up business attractive to potential investors, you must show them that you have already achieved small yet important milestones, and overcame risks that are common to newbies in the industry. You don’t even have to show them profits, sales, or even revenue yet. You just need to show them that you have a well-founded start and that you are on your way. You may also see co-investment agreement examples.

Venture Capital Investment for Technology and Ecommerce Companies

Sample Venture Investment Management Agreement

Finding and Meeting Investors

Once you’ve decided that your business is ready, you can begin to look for investors with whom you can connect. Since venture capitalists aren’t exactly loitering around public highways holding a sign, you can try looking for them in these places:

1. Ask for help from service providers.

These people are bound to know someone who knows someone who knows a venture capital investor. Talk to bankers, lawyers, and accountants since these people often know local venture capital firms they can hook you up with. You may also check out mutual confidentiality agreement examples.

2. Go back to networking.

When all else fails, network. You can attend pitch events (which are just a formalized conference) designed to connect start-up business owners with investors.

3. Talk to business incubators.

Business incubators are groups of people who gather resources in one place and often provide discounted services and free advice to young business. And by young, they mean rookies in the business world.

These people have been where you currently are, and they want to help you improve the way they have. These groups will help you find the right investors for your company. If you want to talk to one, go to National Business Incubator Association. This is a global nonprofit who support organizations in over 60 countries. You may also see management services agreement.

4. Find venture capitalists through their websites.

If you really can’t find a person who can serve as your bridge toward a venture capitalist, contact one yourself. Visit the National Venture Capital Association to find investors online. Don’t hesitate to send one a formal email if you find a capitalist you think is perfect for your job. They exist to accommodate you.

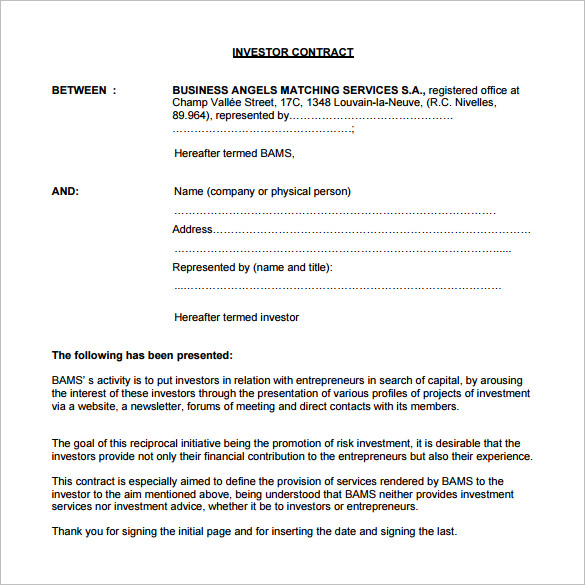

Venture Capital Investment Agreement Investor Contract

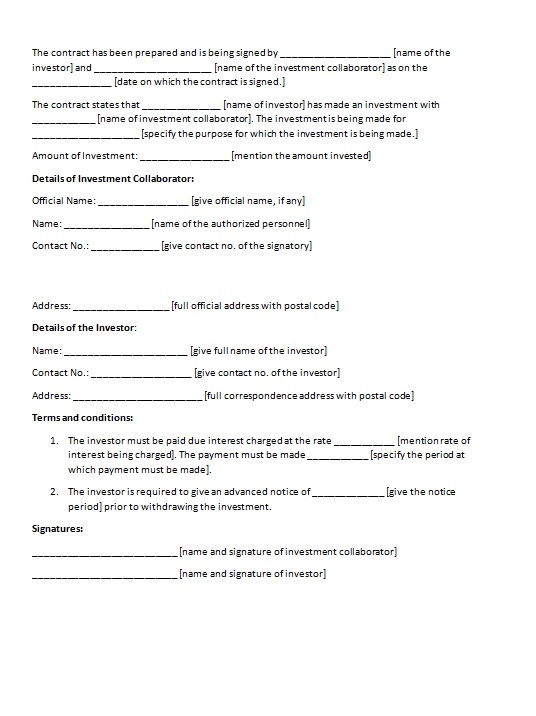

Simple Investment Agreement Template

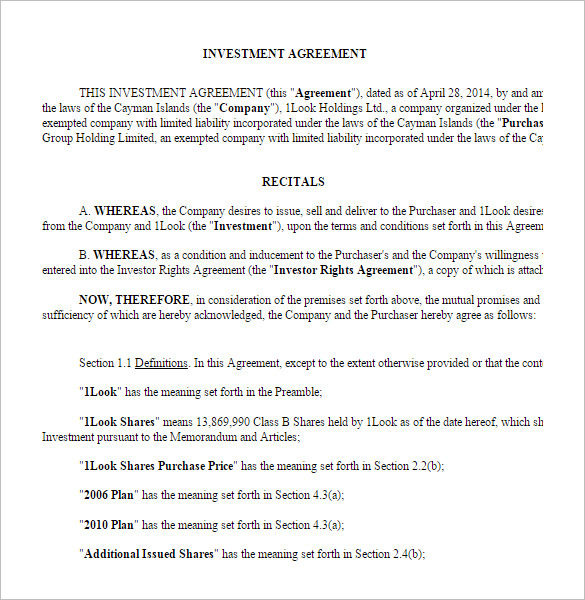

Venture Capital Investment Agreement Format

Creating a Venture Capital Investment Agreement

Both parties involved in the must strive to have a productive relationship that can support both of their interests. The relationship must be good and beneficial to everybody involved. Once you have chosen your investors, the next thing for you to do is to create a solid agreement by which you can both refer to for the responsibilities that you both have to perform.

It will give a detailing of the principal obligations of the company and the investor at the time the commercial agreement has been issued, and until it is nullified. An investment agreement, as with all legally issued document, will also serve as a legal framework for the professional relationship.

Venture Capital Investment Agreement Template

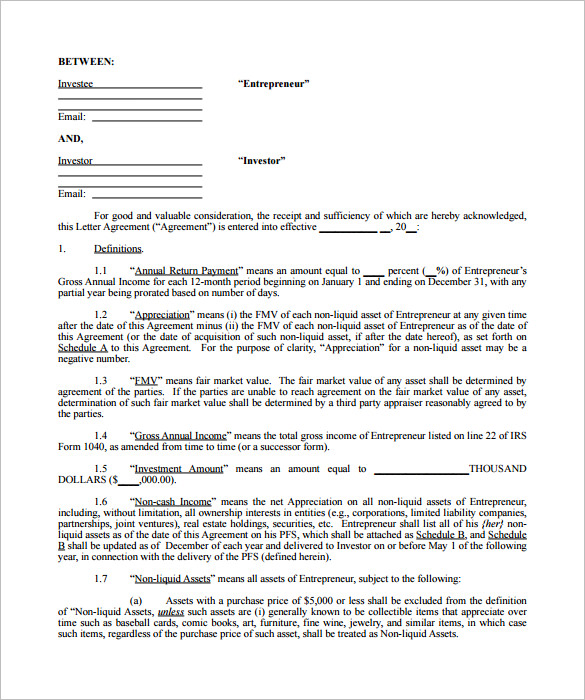

Joint Venture Capital Investment Agreement Example

Top Issues to Consider in the Agreement

1. Due Diligence

The investor will start an investigation regarding all of the affairs of the company that may directly affect them. Oftentimes, the investor will also insist that the problems their inspection has discovered will be rectified before they invest. Issues on intellectual property is often the root of difficulties in these situations. You may also see business agreement examples.

2.Fail-safe Conditions

The technicalities of the agreement must first be ironed out before both parties sign any contract to avoid complications in the future.

One of the things that the business must first settle is the basic agreement that the investor’s equity will not be subscribed until the business has settled all its financial and managerial issues. This is to ensure that the investor will not be in the position where he expects to start receiving what he’s due, and the business finding himself incapable of providing funds for it because of some unexpected hitch.

3. Rights to Information

One of the most important detail that will be discussed in the agreement is the way the business is expected to conduct its operations. Of course, once the agreement has been settled and completed, the investor will monitor his investment to make sure that he will not end up losing his money. However, he will not directly interfere with the business’s day-to-day affairs. You may also like stock agreement examples.

The investment agreement will contain the investor’s right to appoint an observer who will also be tasked with attending board meetings. Aside from that, it must also be clear on the agreement that a monthly management account be prepared within 21 days each month. This document will be circulated to the investor and, along with his representative, is his way of monitoring the business. You may also check out management agreement examples.

4. Restrictions on Management

Since the investor is basically now a partial owner of the business, it will seem only right that the management cannot undertake certain actions without his consent, since any bad decision can already directly affect him. This aspect of the relationship must be discussed ahead by both parties. You might be interested in subscription agreement examples.

Some of the restrictions may include issuing further company sales, borrowing more than a specified amount, acquiring major capital expenditure, expanding into new business areas, amending the management’s service agreements, or entering into transactions that are outside the ordinary course of business.

5. Warranties by Shareholders

This is actually the aspect of the standard agreement that causes so much debate in the making of the agreement. The warranties exist to encourage a disclosure of any issue before the investment has been completed, and to serve as an escape plan should things not turn out the way they were warranted.

The investor will want to ensure that these disclosures are fairly made, and the shareholders must do their part in avoiding overwhelming the investor with extensive disclosures whose implications may not be readily perceived. You may also see shareholders agreement examples.

Shareholders often find a way to decrease their liabilities through warranties. But, of course, that will not be ideal for the other parties. Hence, everyone must reach a compromise that is deemed favorable to all.

6. Underperformance of the Management

We’ve already talked about how a business makes itself attractive in the eyes of capitalists so that they will choose to invest in it. Well, to do that, businesses have to show a business plan that contains their projection of how their business will do in the future. Although the investors will rely heavily on these projections for their investment, the business can’t fully promise that they will be able to perform as expected.

An underperformance clause can be inserted into the agreement which will give the investor the right to serve an underperformance notice on the company so that he can take certain things under his control if things go wrong. This is a very important tool that the investor can use should the management fail to do their job. You may also like free partnership agreement examples.

Venture Capital Equity Investment Agreement

Venture Capital Investment Agreement Sample

Final Thoughts

Every investment is a risk, and everyone who enters into one knows that. Although the prospect of having a third party providing you with monetary support may be tempting, you must first be aware of the consequences associated with being involved into one. However, if you really have decided to take in an investor, make sure that you have created and solidified the terms of this partnership in a way that will benefit the two of you. You may also see financial confidentiality agreement examples.

A sound partnership agreement is an effective tool for both parties to minimize the risks that are surely present in the partnership. It’s also a trusted way of increasing your chances of creating and maintaining a harmonious relationship with your investor, which, since you will both be working together for a length of time, is important for the further success of your professional relationship.