Voided Check Examples to Download to Download

A voided check is a check that has been canceled and cannot be used for transactions. It often contains the word “VOID” written across it. Voided checks are essential for setting up direct deposits or automatic bill payments, providing a way to share banking information securely. Unlike a check register, which tracks all transactions, a voided check ensures no funds are withdrawn. Safety observation of voided checks helps prevent fraud and unauthorized use of banking details.

What Is a Voided?

A voided check is a check marked Void across it, rendering it unusable for transactions. It’s often used to provide banking information for direct deposits or payments. Unlike a pay stub sheet, a voided check doesn’t record transactions or earnings.

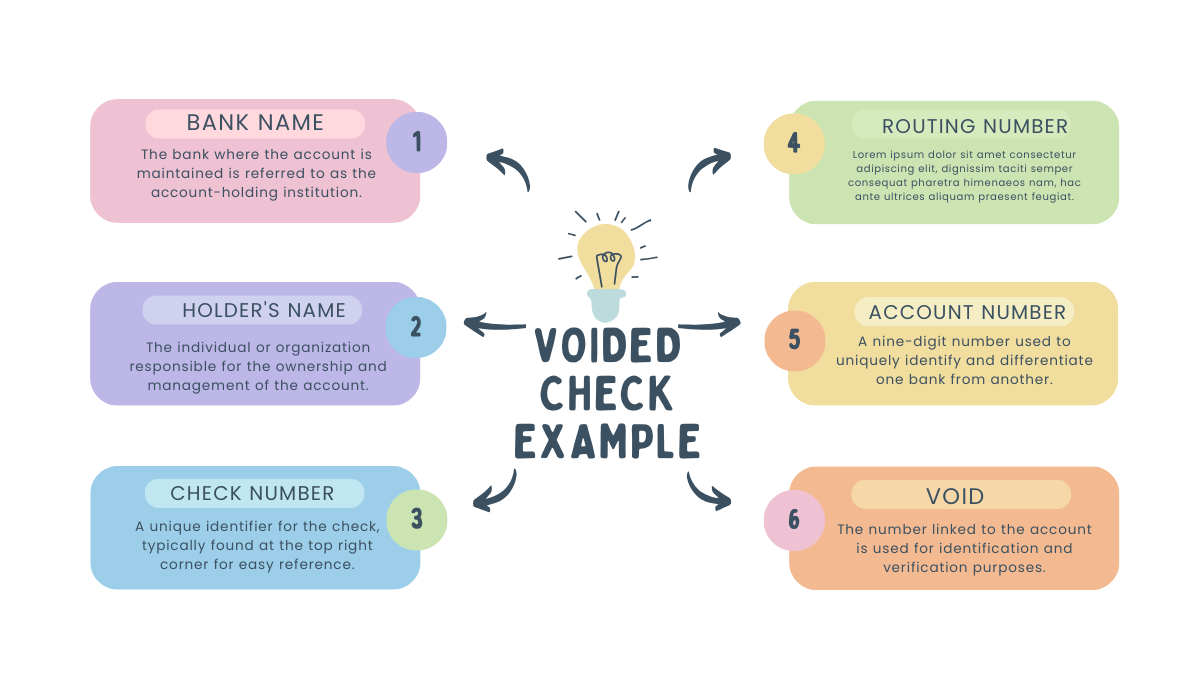

Voided Check Example

- Bank Name: The name of the bank where the account is held.

- Account Holder’s Name: The name of the person or entity that owns the account.

- Check Number: A unique identifier for the check, usually located at the top right corner.

- Routing Number: A nine-digit number that identifies the bank.

- Account Number: The number associated with the account.

- VOID: Written across the check in large letters.

Example layout

| Element | Description |

|---|---|

| Bank Name | ABC Bank |

| Account Holder’s Name | John Doe |

| Check Number | 1234 |

| Routing Number | 012345678 |

| Account Number | 987654321 |

| VOID | Written across the entire check |

Voided Check Example For direct deposit

- Bank Name: ABC Bank

- Account Holder’s Name: John Doe

- Check Number: 1234

- Routing Number: 012345678

- Account Number: 987654321

- VOID: Written in large letters across the entire check

Sample Image Layout

- Bank Name: ABC Bank

- Account Holder: John Doe

- Check Number: 1234

- Routing Number: 012345678

- Account Number: 987654321

- VOID written prominently across the check

What to do if you need a voided check but don’t have a checkbook

- Bank Letter: Request a letter from your bank that includes your routing and account numbers. This can often be used for a direct deposit agreement.

- Counter Check: Ask your bank for a counter check, which can be voided similarly.

- Print a Check: Use online banking services to print a check, then write “VOID” across it.

- Authorization Form: Provide a signed background check authorization form or direct deposit form that includes your banking details.

How to Write a Void Check?

- Take a Check: Use a blank check from your checkbook.

- Write “VOID”: Write “VOID” in large, bold letters across the front of the check. This prevents it from being used for transactions.

- Do Not Sign: There’s no need to sign the check.

- Complete Information: Optionally, fill in the routing and account numbers if needed for the deposit agreement.

When to Use Voided Checks?

- Direct Deposit Setup: Provide voided checks to employers to set up direct deposit for your salary.

- Automatic Bill Payments: Use voided checks to authorize automatic payments for utilities, loans, and other recurring bills.

- Linking Accounts: Use a voided check to link your checking account with online banking services or investment accounts.

- Expense Reimbursement: Some companies require a voided check to reimburse expenses directly into your bank account.

- Safety Security Plan: Incorporate voided checks into your financial safety security plan to ensure secure handling of banking information.

- Record Keeping: Maintain voided checks in your book journal for accurate financial record-keeping and future reference.

What does it mean when a check has been voided?

- Cancellation: The check is marked “VOID,” rendering it unusable for any financial transaction.

- Security: Voiding a check ensures that it cannot be fraudulently cashed or deposited.

- Information Sharing: It allows you to share banking details securely for setting up direct deposits or automatic payments.

- Record Keeping: Voided checks can be kept as part of your financial records for tracking and verification purposes.

Voided Check for Capital One

- Log In: Access your Capital One online banking account.

- Checkbook: If you have a checkbook, take a blank check.

- Write “VOID”: Write “VOID” in large, bold letters across the front of the check. Make sure it covers the entire face of the check.

- Details: Ensure the check shows your name, account number, and the bank’s routing number.

- No Checkbook?: If you don’t have a checkbook, you can:

- Bank Letter: Request a direct deposit authorization form from Capital One. This form includes your routing and account numbers.

- Print Check: Use Capital One’s online banking to print a check with your account details, then void it.

Other Important Details About Check Writing

- Date: Always write the current date on the check. This helps keep accurate records and ensures the check is valid.

- Payee: Clearly write the name of the person or entity to whom the check is being issued. This prevents the check from being cashed by someone else.

- Amount in Numbers: Write the exact amount in the box provided. Ensure the numbers are clear and precise to avoid any confusion or alteration.

- Amount in Words: Write the amount in words on the line provided. This serves as a double-check against the numeric amount and helps prevent fraud.

- Signature: Sign the check in the bottom right corner. Without your signature, the check is not valid.

- Memo Line: Use the memo line to note the purpose of the check. This is helpful for both personal records and for informing the recipient of the payment’s purpose.

- Check Register: Record each check you write in your check register. This helps track your spending, manage your account balance, and avoid overdrafts.

- Avoid Blank Spaces: Fill in all fields completely to prevent unauthorized alterations. Draw a line through any unused space in the amount fields.

- Void Incorrect Checks: If you make a mistake, write “VOID” across the check and start a new one. Keep the voided check for your records.

- Safety Observation: Always store checks in a safe place and monitor your account regularly for unauthorized transactions.

Uses for a Voided Check

- Direct Deposit Setup : Employers use voided checks to obtain your banking details for depositing your salary directly into your account.

- Automatic Bill Payments : Utility companies, lenders, and other service providers may require a voided check to set up automatic monthly payments from your bank account.

- Electronic Funds Transfers (EFT) : Banks and financial institutions use the information from voided checks to enable electronic transfers between accounts.

- Setting Up Online Banking : When linking your checking account to online banking services or apps, a voided check can verify your account information.

- Expense Reimbursements : Companies and organizations may request a voided check to process expense reimbursements directly into your account.

- Safety Security Plan : Including voided checks in your safety security plan helps prevent unauthorized use while allowing secure sharing of banking details.

- Financial Record Keeping : Keeping voided checks in your book journal helps maintain accurate financial records and provides a reference for account information.

Why would I need a voided check?

To provide banking information for direct deposit or automatic payments.

How do I void a check?

Write “VOID” in large letters across the front of the check.

Can a voided check be used for fraud?

No, a voided check cannot be cashed or deposited.

What information does a voided check provide?

It provides the bank’s routing number and your account number.

Can I void a check after writing it?

Yes, as long as you write “VOID” clearly across it.

Is it safe to give someone a voided check?

Yes, it is safe for setting up payments and deposits.

What if I don’t have a checkbook?

Request a counter check or a bank letter with your account details.

Where do I write “VOID” on a check?

Across the front of the check, covering the entire face.

Can I use a voided check for proof of account?

Yes, it can serve as proof of your banking information.

Do I sign a voided check?

No, there is no need to sign a voided check.