Preparing for the CFA Exam requires a thorough understanding of “Alternative Investment Features, Methods, and Structures,” a crucial component of portfolio diversification. Mastery of various alternative asset types, investment methods, and structural characteristics is essential. This knowledge provides insights into enhancing returns, managing risk, and achieving financial objectives, critical for a high CFA score.

Learning Objective

In studying “Alternative Investment Features, Methods, and Structures” for the CFA Exam, you should aim to understand the unique characteristics of alternative investments, including hedge funds, private equity, real estate, commodities, and infrastructure. Analyze the investment methods specific to these asset classes, such as leverage, illiquidity, and performance-based fees. Evaluate the structures of alternative investments, including limited partnerships, REITs, and private funds, and their impact on risk and return profiles. Additionally, explore the role of alternative assets in portfolio diversification, inflation protection, and return enhancement. Apply this knowledge to assess alternative investments’ suitability in various portfolio contexts, preparing for practical application on the CFA Exam.

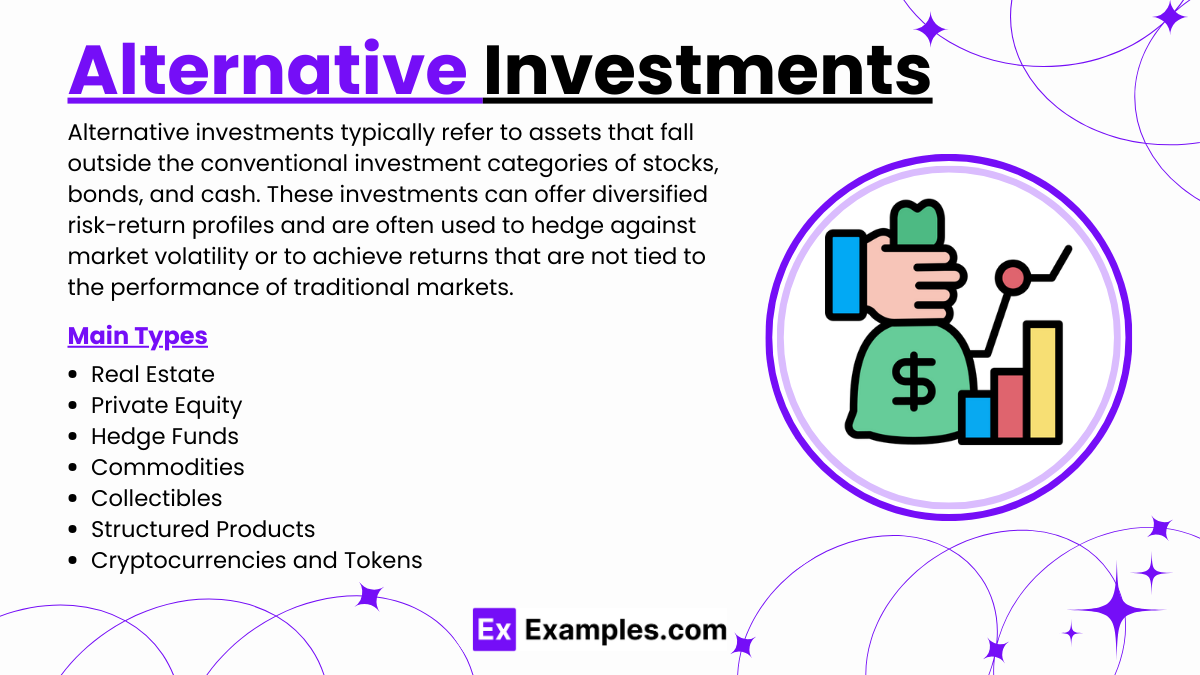

Overview of Alternative Investments

Alternative investments typically refer to assets that fall outside the conventional investment categories of stocks, bonds, and cash. These investments can offer diversified risk-return profiles and are often used to hedge against market volatility or to achieve returns that are not tied to the performance of traditional markets. Here’s an overview of the main types of alternative investments:

- Real Estate: Includes direct ownership of residential or commercial properties and investments in real estate investment trusts (REITs). Real estate can provide income through rent and potential capital appreciation but involves liquidity risks and significant capital commitment.

- Private Equity: Investments in companies that are not publicly traded on stock exchanges. Private equity can involve financing startups (venture capital), managing buyouts of established companies, or investing in turnaround situations. This requires a long investment horizon and high initial investments, and it carries high risk and high potential returns.

- Hedge Funds: Pooled investment funds that employ different strategies to earn active return, or alpha, for their investors. Hedge funds might use leverage, derivatives, and long-short strategies to achieve returns that are less correlated with mainstream markets. They are typically open only to accredited or institutional investors.

- Commodities: Physical goods like gold, oil, agricultural produce, or metals. Commodities can be a hedge against inflation and currency devaluation but are susceptible to market, regulatory, and environmental risks.

- Collectibles: Art, antiques, rare wines, coins, or stamps. While collectibles can appreciate in value over time, they require expertise for authentic valuation, are illiquid, and their returns can be highly unpredictable.

- Structured Products: Customized products that include derivatives mixed with traditional investments, designed to facilitate highly specific risk-return objectives. These are complex and often carry high fees but can be tailored to specific conditions that might not be addressable with standard investments.

- Cryptocurrencies and Tokens: Digital assets using blockchain technology. These assets have high volatility and are evolving in terms of regulation and technology. While offering high potential returns, they also carry risks of loss and fraud.

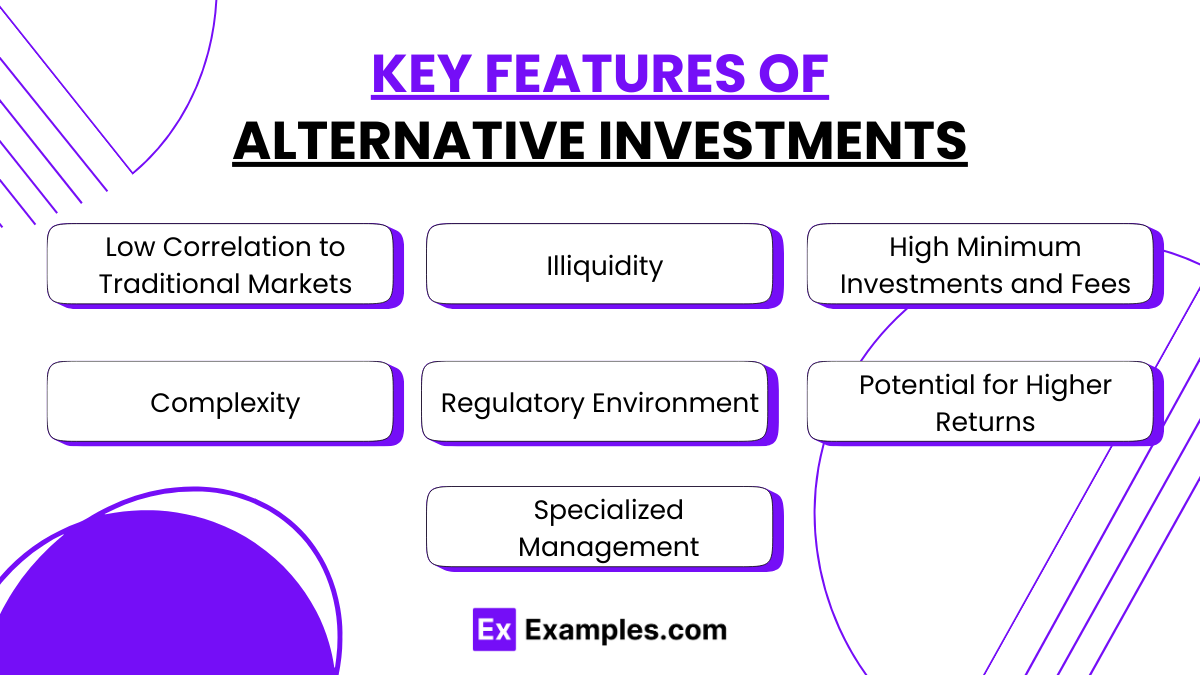

Key Features of Alternative Investments

Alternative investments offer distinct characteristics that set them apart from traditional asset classes like equities and fixed income. Here are some of the key features of alternative investments:

- Low Correlation to Traditional Markets: One of the primary appeals of alternative investments is their potential to provide returns that are not closely linked to the performance of traditional stock and bond markets. This can help in diversifying a portfolio’s risk.

- Illiquidity: Many alternative investments are characterized by lower liquidity compared to traditional investments. Real estate, private equity, and certain hedge fund strategies involve longer investment periods and can have significant entry or exit costs.

- High Minimum Investments and Fees: Alternative investments often require higher minimum investment amounts, making them less accessible to the average individual investor. Additionally, the fee structures for managing these assets, such as the “2 and 20” fee model commonly used by hedge funds (2% management fee and 20% performance fee), can be quite high.

- Complexity: The strategies and structures of alternative investments can be complex. For example, hedge funds may use advanced trading strategies that involve leverage, derivatives, and short selling. Private equity may involve intricate deal structuring and prolonged due diligence processes.

- Regulatory Environment: Alternative investments are often subject to different regulatory and disclosure requirements than traditional investments, which can be less stringent in some cases. This lack of transparency can add to the risk.

- Potential for Higher Returns: Due to their often higher risk profiles, alternative investments can offer the potential for higher returns compared to traditional investment classes. This high-reward potential attracts investors who are willing to take on more risk.

- Specialized Management: Managing alternative investments typically requires specialized expertise. Fund managers often possess specific skills in identifying opportunities, managing complex assets, and navigating different regulatory landscapes.

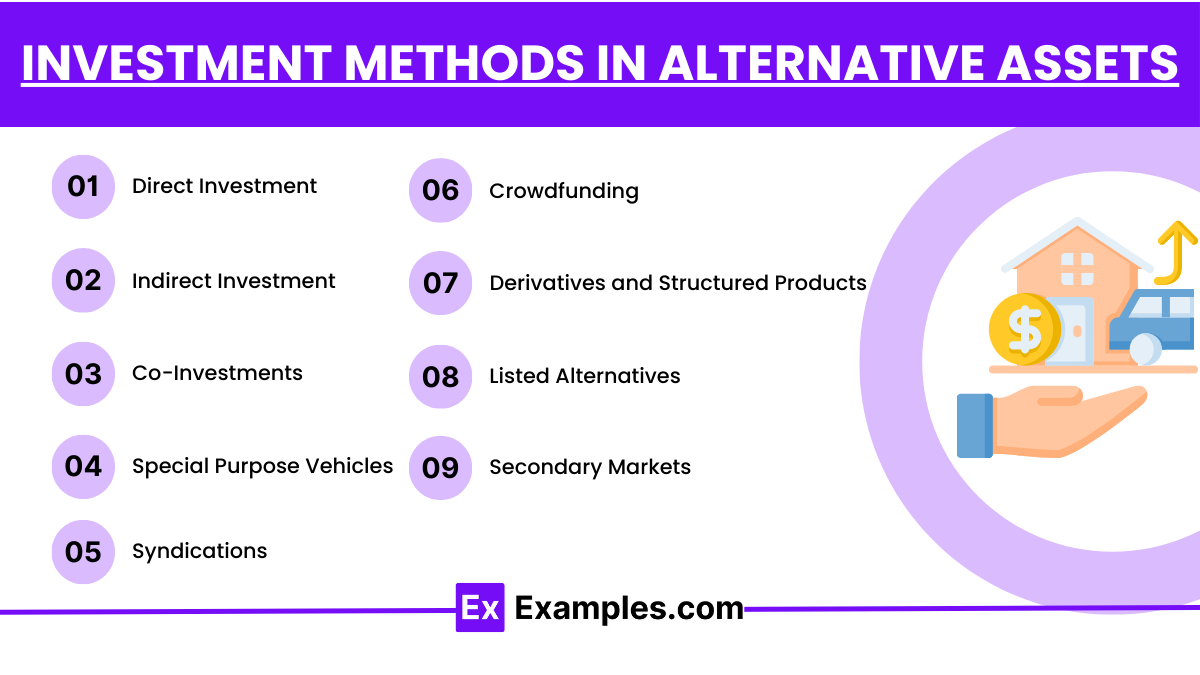

Investment Methods in Alternative Assets

Investing in alternative assets involves various methods that cater to the differing characteristics of these investments. Here’s a look at some of the common investment methods used within the realm of alternative assets:

- Direct Investment: This method involves directly purchasing an asset. In real estate, this could mean buying property outright. In private equity, it might involve directly investing in a private company. Direct investments often require substantial capital and involve hands-on management.

- Indirect Investment through Funds: Many investors access alternative assets through pooled structures like funds, including hedge funds, private equity funds, real estate funds, and venture capital funds. These funds aggregate capital from multiple investors to make larger investments managed by professional fund managers.

- Co-Investments: In co-investment, investors directly invest alongside a fund or other investors in a specific deal, rather than committing capital to a fund’s general pool. This allows investors to target specific opportunities while also benefiting from the expertise and due diligence of experienced partners.

- Special Purpose Vehicles (SPVs): SPVs are entities created for a specific, limited purpose, often a single investment project. They are commonly used in private equity and real estate to isolate financial risk due to their legal and regulatory structure.

- Syndications: Syndication involves pooling resources from multiple investors to undertake larger projects that would be too large or risky for individual investors alone. This is common in real estate investments and large-scale infrastructure projects.

- Crowdfunding: This method allows investors to commit smaller amounts of capital to various projects, typically via online platforms. It’s particularly popular in real estate, startups, and venture capital, democratizing access to these investment opportunities.

- Derivatives and Structured Products: These are financial instruments whose value is derived from the value of underlying assets, like commodities, baskets of stocks, or indexes. Investors use derivatives to hedge other investments or speculate on price movements with relatively low capital outlay.

- Listed Alternatives: Some alternative investments can be accessed through publicly traded instruments. For example, publicly traded REITs (real estate investment trusts) offer exposure to real estate markets with the liquidity of traditional equities.

- Secondary Markets: Particularly in private equity and hedge funds, investors can buy and sell interests in funds on the secondary market. This can provide liquidity in otherwise illiquid assets and opportunities to enter or exit investments based on changing market conditions or investment objectives.

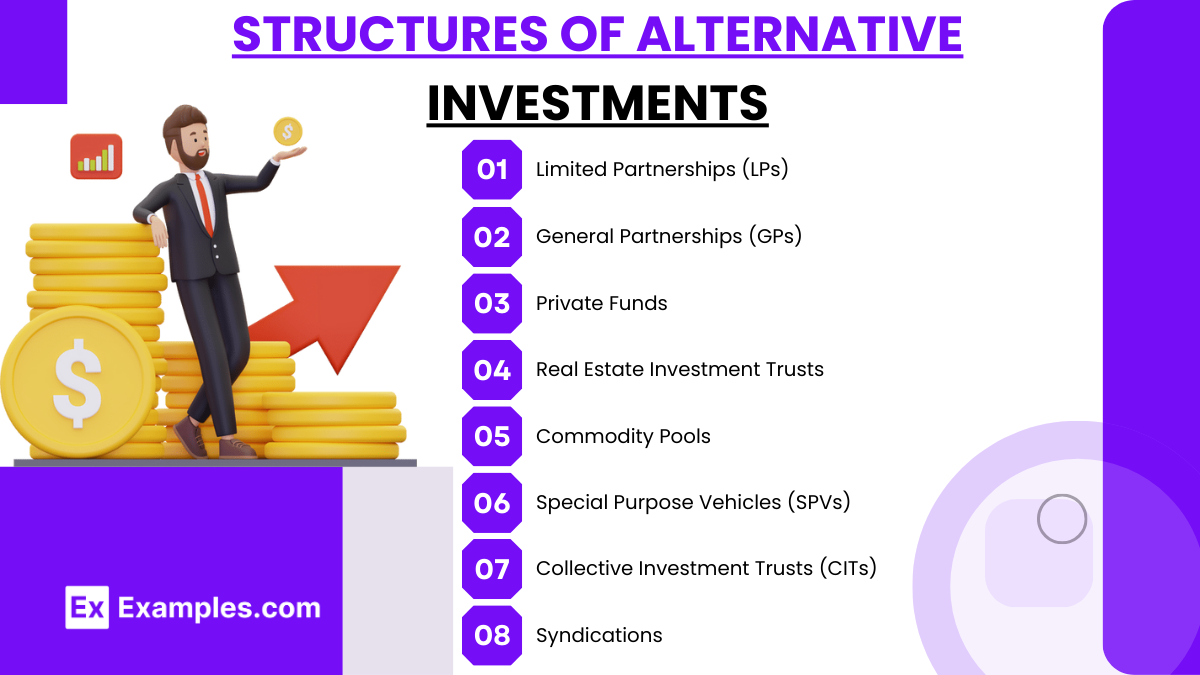

Structures of Alternative Investments

Alternative investments encompass a variety of asset classes, each with its distinct structures tailored to specific investor needs and risk profiles. Understanding these structures is crucial for investors seeking to diversify their portfolios beyond traditional stocks and bonds. Here’s an overview of common structures within alternative investments:

- Limited Partnerships (LPs):

- Common in private equity, real estate, hedge funds, and venture capital.

- Investors (limited partners) provide capital but have limited liability and are not involved in day-to-day management.

- The general partner manages the investment and has unlimited liability.

- Typically, there are commitments of capital over several years, and distributions are made as investments mature.

- General Partnerships (GPs):

- Similar to LPs but all partners have an active role in management and bear unlimited liability.

- Less common in institutional alternative investments due to higher risk for all partners involved.

- Private Funds:

- Include hedge funds, private equity funds, and real estate funds.

- Structured often as limited partnerships or limited liability companies (LLCs).

- Managed by professional investment managers who pool capital from accredited or institutional investors.

- Offer flexibility in investment strategies but have less regulatory oversight.

- Real Estate Investment Trusts (REITs):

- Corporations that own, operate, or finance income-producing real estate.

- Must distribute at least 90% of their taxable income to shareholders as dividends.

- Provide liquidity as they are often publicly traded, unlike other direct real estate investments.

- Commodity Pools:

- Operate like mutual funds for commodities and are typically organized as LPs or LLCs.

- Pool money from investors to trade in commodity futures, options on futures, and retail off-exchange forex contracts.

- Special Purpose Vehicles (SPVs)/Special Purpose Entities (SPEs):

- Created for a specific purpose, such as securitization of assets, property development, or isolating corporate assets.

- Can help protect assets from a parent company’s financial risk.

- Collective Investment Trusts (CITs):

- Exclusively for qualified retirement plans like 401(k)s and government plans.

- Operated by banks or trust companies and benefit from lower costs and regulatory requirements compared to mutual funds.

- Syndications:

- Involve pooling capital from multiple investors to invest in larger projects, particularly in real estate or large-scale venture projects.

- Each investor holds a direct or indirect proportional share of the property.

Examples

Example 1: Using Hedge Funds to Achieve Absolute Returns

Examine how hedge funds employ strategies like long-short equity, arbitrage, and global macro to generate absolute returns. Discuss the role of leverage and short-selling in enhancing returns and managing risk, as well as the impact of “2 and 20” fee structures on net returns.

Example 2: Private Equity Buyouts and Value Creation

Analyze a private equity buyout case where a firm acquires a private company, restructures operations, and eventually exits through an IPO. Discuss the illiquidity of private equity investments, typical holding periods, and the potential for high returns with effective management.

Example 3: REITs for Real Estate Exposure in a Liquid Format

Explore how Real Estate Investment Trusts (REITs) provide investors with exposure to real estate assets without the illiquidity of direct property investment. Discuss the benefits of REITs in terms of liquidity, dividend income, and the ability to diversify within the real estate sector.

Example 4: Commodities as an Inflation Hedge

Study how commodities like gold, oil, and agricultural products act as inflation hedges by maintaining value when inflation rises. Use historical examples to show how commodities can stabilize portfolios during inflationary periods, while also noting the volatility and speculative nature of commodity investments.

Example 5: Infrastructure Investments for Stable Cash Flows

Evaluate the role of infrastructure assets, such as utilities, toll roads, and airports, in providing steady, long-term cash flows. Discuss the suitability of infrastructure investments for institutional investors seeking stable income and inflation-adjusted returns, along with potential risks related to regulatory changes.

Practice Questions

Question 1

Which of the following is a primary characteristic of hedge funds that distinguishes them from traditional mutual funds?

A. Daily liquidity and lower fees

B. Strict regulatory oversight and public disclosure requirements

C. Use of leverage and performance-based fees

D. High allocation to fixed-income securities for income generation

Answer:

C. Use of leverage and performance-based fees

Explanation:

Hedge funds commonly use leverage to enhance returns and charge performance-based fees (e.g., “2 and 20” structure) that differ from traditional mutual funds, which typically charge fixed management fees and have stricter liquidity requirements. Hedge funds also tend to have more flexibility in strategies, often using derivatives, short-selling, and other non-traditional approaches.

Question 2

Which type of alternative investment structure typically involves limited partners providing capital while general partners manage the investment?

A. Real Estate Investment Trust (REIT)

B. Hedge Fund

C. Private Equity Fund

D. Closed-End Fund

Answer:

C. Private Equity Fund

Explanation:

Private equity funds are structured as limited partnerships where limited partners (LPs) provide the capital, and general partners (GPs) manage the fund and make investment decisions. This structure is common in private equity and some hedge funds, allowing professional managers to control investments while investors contribute capital but have limited liability.

Question 3

What is the primary purpose of including commodities in a diversified portfolio?

A. To provide regular income through dividends

B. To act as a hedge against inflation

C. To increase liquidity in the portfolio

D. To reduce exposure to credit risk

Answer:

B. To act as a hedge against inflation

Explanation:

Commodities, such as gold and oil, are often included in portfolios as a hedge against inflation because their prices tend to rise with increasing inflation, preserving purchasing power. Unlike fixed-income securities or stocks, commodities typically have low correlation with traditional assets, providing diversification benefits, especially during inflationary periods.